OSE Derivatives

Japan’s Single Stock Options Markets Primed for Revitalization after Regulatory Improvements

The recent upturn in Japanese stock markets has drawn attention from domestic and overseas investors to Single Stock Options (SSO) . Originally listed in 1997 on both the Osaka Exchange (OSE) and the Tokyo Stock Exchange (TSE), SSO became part of OSE products after the 2014 merger to JPX. Together with Nikkei 225 and TOPIX derivatives, SSO has become one of the most significant equity derivatives in Japan.

INCREASING TRADING VOLUME

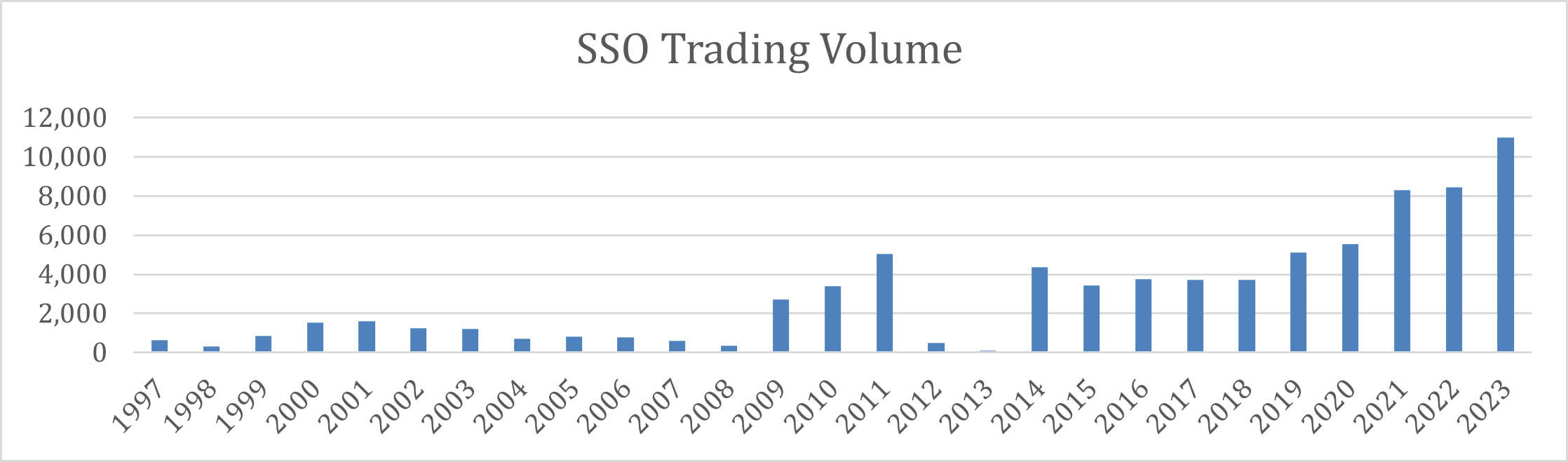

Chart 1 below shows the annual ADV (average daily volume) of SSO since 1997, with 2023 being the highest on record.

< chart 1 >SSO Trading Volume

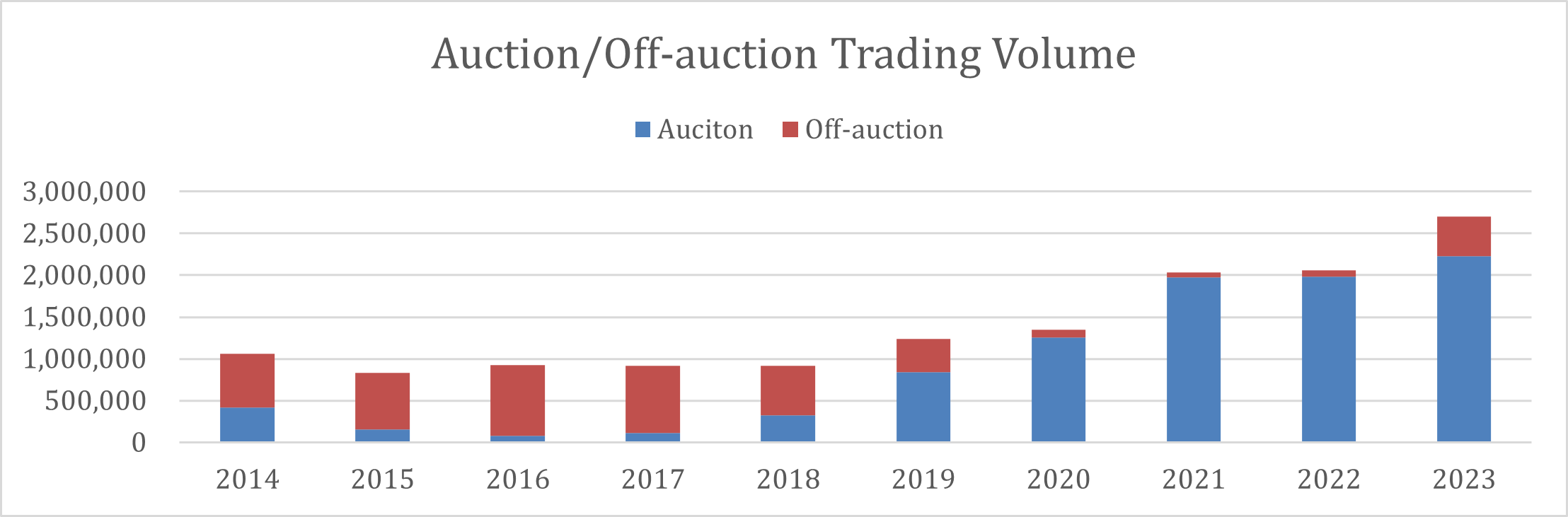

Chart 2 identifies trends in SSO transactions over the last 10 years. Off-auction transactions accounted for the majority of transactions 10 years ago, while auction transactions have dominated since 2019.

< chart 2 >Auction/Off-auction Trading Volume

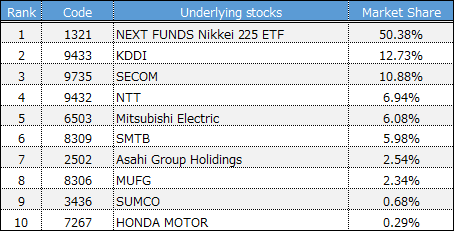

Active trading in SSOs was buoyed by the entry of market makers in 2019 and the availability of quotes for SSO issues, mainly for ETFs, especially among certain individual/retail investors (see the table below).

< chart 3 >Trading Notional Value Ranking over 2023

For more information on SSO trading by investment category and the OSE’s major initiatives through 2023, see “Updated Development Plan for Japan’s Single Stock Options Market.”

REGULATORY IMPROVEMENTS IN 2024

OSE has implemented several regulatory improvements this year in an effort to further boost the SSO market.

1. Margin Rules were revised, dedicated SSO accounts were implemented.

In SSO trades, covered call * and target buying ** transactions generally do not trigger default of debt settlement when the options transaction and the collateral are tied. However, under the Japanese margin rules, additional margin-related charges may be incurred even if the position is based on a covered call or target buying, due to factors such as price fluctuation in the asset underlying the SSO and interest rate conditions.

In the U.S., where individual/retail investors actively trade SSO, additional margin is not required for covered calls and target buying tied to collateral. In June 2024, OSE partially revised the margin rules for SSO between trading participants and customers, implementing dedicated SSO accounts, aiming to eliminate additional margin under certain conditions for SSO transactions involving covered call or target buying.

*Covered call: holding the stock + selling call options

**Target buying: selling put options + cash for purchasing the stock

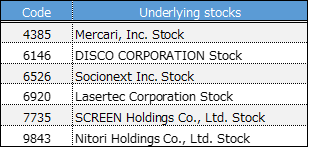

2. Underlying assets covered has increased in number.

Among TSE-listed stocks, ETFs, and REITs, approximately 220 assets are currently eligible for SSO. In July 2024, six stocks (Chart 4) favored by retail investors were added to the list of eligible underlying stocks, enhancing the market’s appeal.

< chart 4 >Newly Added Underlying Stocks

3. A market making environment for SSO issues targeting individual stocks was created.

As previously noted, market makers have participated in the SSO market since 2019. Until this year, however, SSO trading was mostly limited to quotes for ETF options. As a result, investors who preferred to order book trading (on the board) could practically only trade ETF options, when they were really seeking quotes for SSO on individual stocks.

Following years of discussions with both market makers and securities firms that primarily serve retail investors, OSE developed an environment in which quotes are presented for SSO issues covering individual stocks. In September 2024, OSE revised Mmarket Maker Program, targeting the following table of 12 SSOs eligible for market making.

< chart 5 >Underlyings for Continuous Quotes as of November 2024

Find more information on the Market Maker Program.

Since then, for both puts and calls in the latest two contract months, quotes for specific spread conditions and volumes have been observed for 11 key issues around ATM (at-the-money) range, resulting in increased trading.

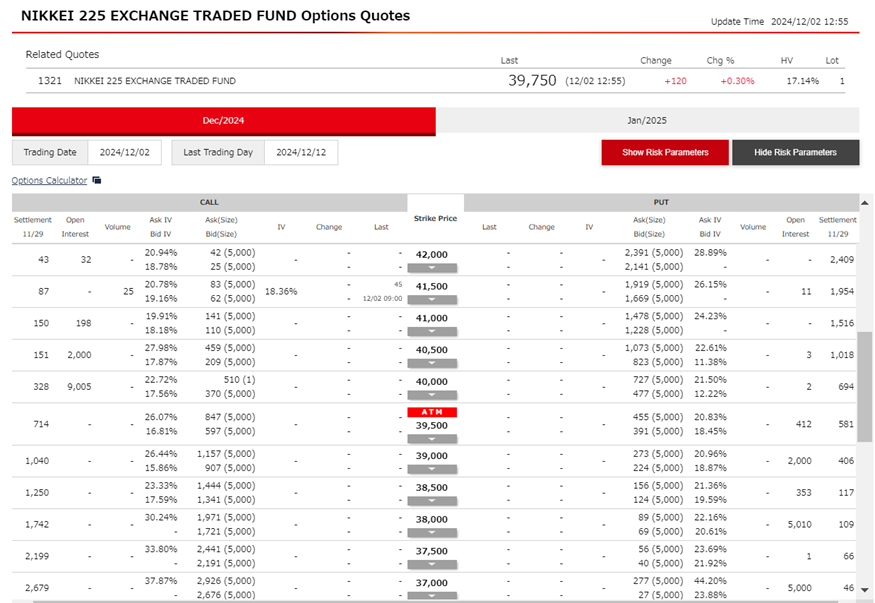

< chart 6-1 >Example:1321 as of Dec 2

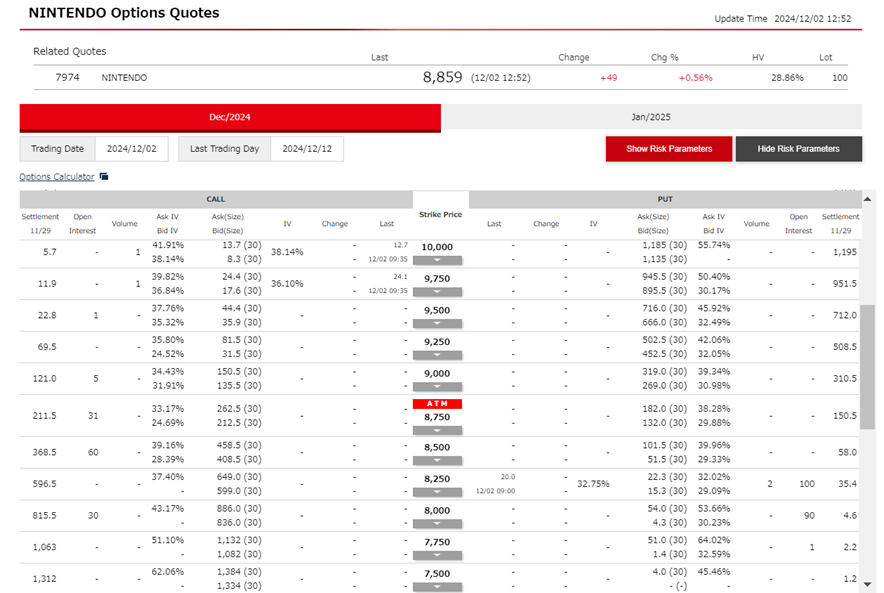

< chart 6-2 >Example:7974 as of Dec 2

To check SSO quotes, etc., find derivatives quotes.

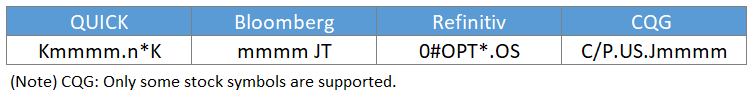

For venders codes:

Nippei Yasuoka, Head of Institutional Sales Japan at Optiver, a global liquidity provider, stated, “The growth potential of Japan’s single stock options market is highly significant, given the current trading conditions in the Japanese stock market. Optiver is fully committed to supporting the development of the Japan SSO market and plans to expand the number of stocks we market make to approximately 30 in the near future.”

4. Rules for strike prices were reviewed.

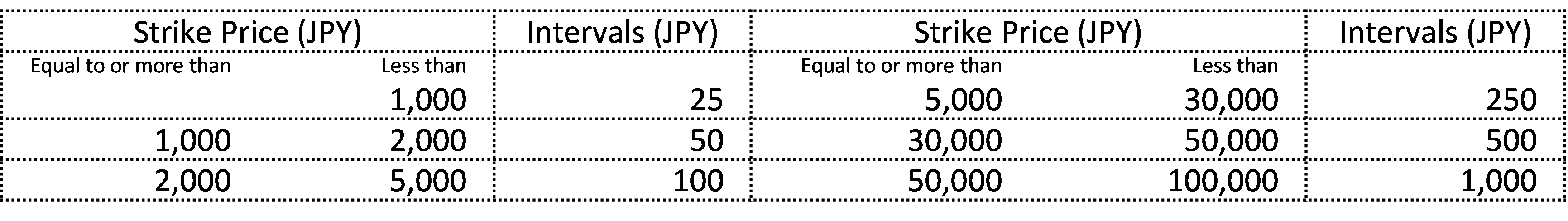

Investors have long called for improvements in setting strike prices, particularly for ATM options. In response, OSE revised the rules for setting strike prices for the aforementioned 12 underlying assets subject to market making, as shown in the table below.

< chart 8 >

MORE BROKERAGE FIRMS TO HANDLE SSO

In the United States, individual investors commonly use SSO trading as a standard method of stock investment. A significant factor contributing to this is the ease with which SSO trading can be conducted through major online brokerage firms in the U.S.

In Japan, SSO trading on behalf of individual investors is primarily transacted through Interactive Brokers Securities Japan and The Kosei Securities. Both firms attract mainly affluent retail investors who are already aware of the benefits and value of SSO.

Since November 2024, Moomoo Securities Japan has also embarked on handling SSO trading. The firm’s parent company, Futu Holdings Ltd., is listed on NASDAQ in the U.S. Its trading application is highly regarded for its depth of information and ease of use. Shortly after its launch in Japanese stock trading, the application surpassed 1 million downloads in May 2024. With its expertise in developing applications in the U.S. where SSO trading by retail investors is thriving, Moomoo can be a catalyst for market revitalization in Japan.

Japan’s SSO market is expected to continue growing, particularly with increased participation from retail investors and the rising number of securities firms offering SSOs, as well as OSE’s wide-ranging system improvements. OSE is committed to further revitalizing the SSO market, encouraging investors in Japanese equities to pay attention to the SSO market and capitalize on its emerging investment opportunities.

Related links