OSE Derivatives

Updated Development Plan for Japan’s Single Stock Options Market

Current State of Japan’s SSO Market

Securities Options (Single stock options, SSO) stand as the exclusive listed derivatives tied to individual stocks in Japan. Introduced in 1997 with a modest selection of 20 underlying securities, this market has since expanded to encompass over 200 underlying assets, including stocks, ETFs, and REITs, all readily available for trading.

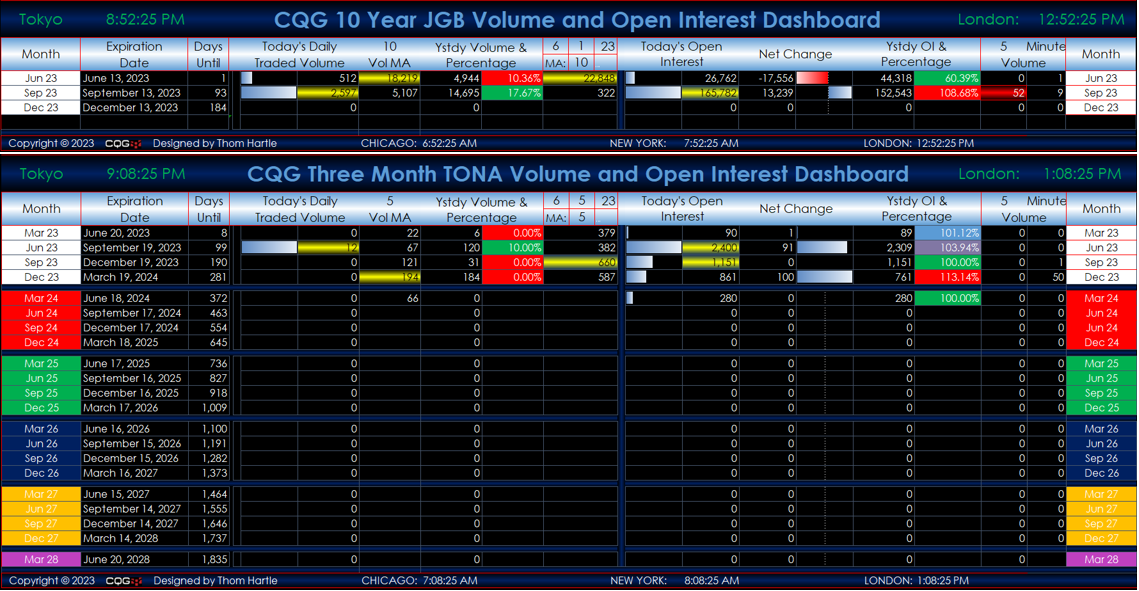

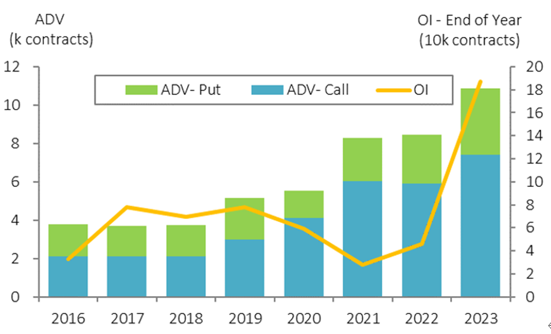

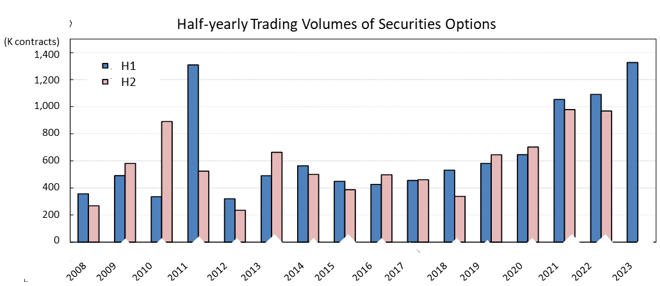

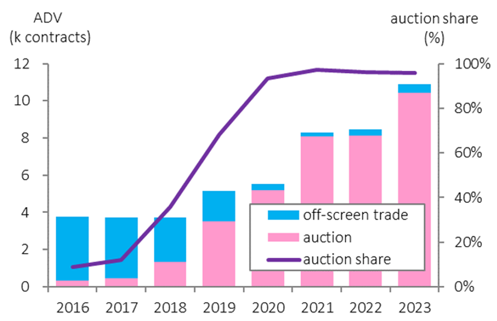

The SSO trading volume has witnessed consistent growth over the years, culminating in a record high in the calendar year 2022 and surpassing the previous year’s performance in 2023, boasting an impressive average daily turnover of approximately 10,000 contracts. Notably, call options dominate the trading landscape, primarily due to the prevalence of covered calls—a strategy where traders receive a premium for the option while sacrificing potential gains above a certain level of the underlying asset’s price.

In the first half of 2023, the trading volume of Japanese securities options achieved an all-time high for a semiannual period, as foreign investors returned to the Japanese market. With a focus on bolstering market liquidity and investor convenience, Japanese securities options are poised for further growth once comparable levels of liquidity and ease of access to overseas markets are attained.

The dominance of off-auction (off-screen) trading persisted until around 2017 but has since witnessed a gradual decline in favor of in-auction trading, which now constitutes over 90% of all transactions.

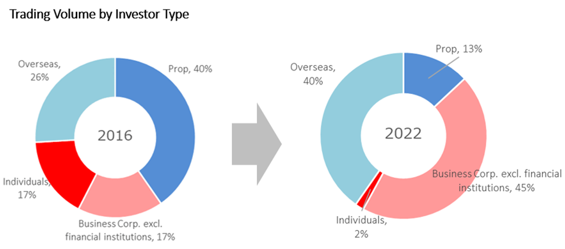

Additionally, by investor type, the proportion of proprietary trading by securities firms has contracted from 40% in 2016 to 13% in 2022, while foreign investors and business corporations have taken up a more substantial share.

The investment landscape has also experienced notable shifts, with the top ETFs commanding around 80% of options trading volume and 40% of transaction value, a significant change from 2016 when the most heavily traded securities only accounted for less than 10% of the total market.

Enhancing Liquidity and Convenience

The Osaka Exchange (OSE) has undertaken the following three key measures to enhance liquidity and convenience in Japan’s securities options market.

1. Introduction of flexible options trading

In the aftermath of the global financial crisis and following an international agreement, there was a tightening of regulations for over-the-counter (OTC) derivatives. This led to a notable shift from OTC to exchange-traded derivatives. In response to the demand for inter-dealer trading in the OTC market, OSE introduced an exchange-traded product in June 2018, offering flexible trading conditions that encompassed strike date, strike price, final settlement method, and the ability to offset margins with other futures and options contracts.

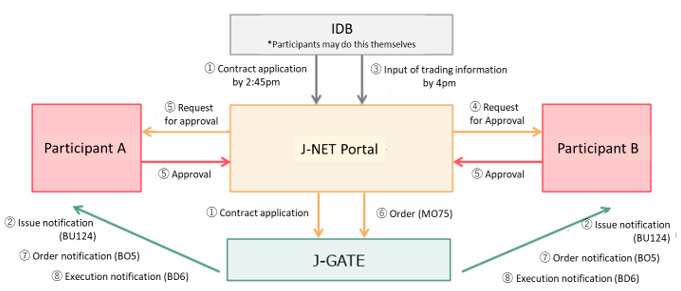

The introduction of these flexible options significantly improved the transaction flow, particularly with the support of J-GATE 3.0, a derivatives matching system launched in September 2021, and the assistance of the J-NET portal*. With these enhancements, investors now have a smoother trading experience, enabling them to apply for contracts between 8:00 am to 2:45 pm and 4:15 pm to 11:00 pm (5:00 pm for securities options).

*J-NET portal allows trading participants to place J-NET trade orders (off-auction trading of derivatives) through a web-based system. It is available free of charge to all trading participants who wish to use it. Investors should contact their broker.

| Specifications | Index options: • Contract months: Exercise dates can be set on a per day basis for a maximum 5-year period. • Strike price: Can be set to two decimal places. • Final settlement method: Can be selected either via cash settlement by SQ or index closing price. Securities options: • Contract months: Exercise dates can be set on a per day basis for a maximum 3-year period. • Strike price: Can be set to two decimal places. • Final settlement method: Can be selected either via physical delivery or cash settlement by closing price. |

| Underlying | Index options: • Nikkei 225, TOPIX, JPX-Nikkei Index 400 • TSE REIT Index, TOPIX Banks Index – flexible options trading only Securities options: • Single stocks, ETFs (total 226) |

| Trading Methods | • Trading possible on the day of application • J-NET (off-auction) only • Contract setups via J-NET Portal • Order submission and execution via J-NET Portal and J-GATE 3.0 |

2. Attracting market makers

At least one market maker has been attracted to the securities options market since 2019, offering quotes for the follow two specific issues at all times.

– NEXT FUNDS TOPIX Exchange Traded Fund (1306)

– NEXT FUNDS Nikkei 225 Exchange Traded Fund (1321)

The OSE is actively exploring the possibility of augmenting the number of issues/stocks presenting quotes by engaging multiple market makers, with the aim of further enhancing liquidity.

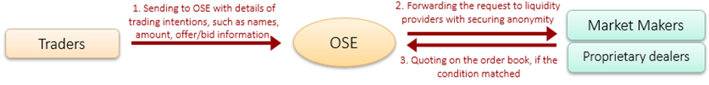

3. Developing RFQ (Request for Quotes) e-mails

Since 2014, a simultaneous e-mail response system has been in place to request market makers and others to provide quotes for issues lacking them, thereby improving market convenience. OSE intends to expand the number of responsive market makers and securities (proprietary sector) to RFQ requests.

Currently, the strong performance of Japanese equities has garnered significant attention, with foreign investors exhibiting sustained interest, as evidenced by being overbought for 12 consecutive weeks in the first quarter of 2023. One contributing factor to this sustained interest with Japanese equities is the implementation of the TSE’s corporate value enhancement measures, among other catalysts. Capitalizing on this momentum, JPX (Japan Exchange Group), the parent company of OSE and TSE, is actively collaborating to revitalize the securities options market, projecting a continued surge in trading volumes. As market participants, it is crucial to closely monitor this thriving market with substantial growth potential.

Related links