OSE Derivatives

Did Bank of Japan Governor Ueda do a 360 on the yen?

Written by Harry Ishihara, Macro Strategist

Shifting around:

This post explores the Bank of Japan’s recent shifts in monetary policy as Governor Ueda hints, (seemingly) retracts, then hints again at potentially hiking to support the yen.

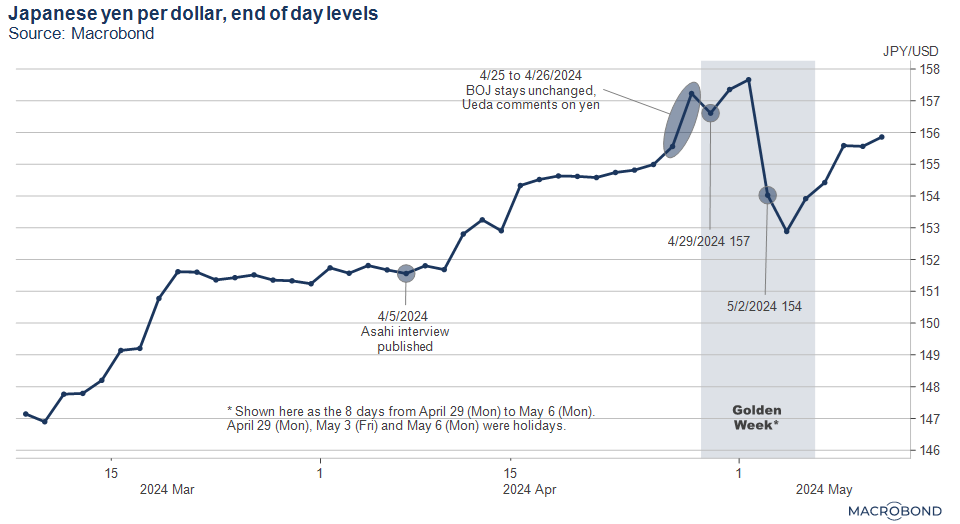

In March, the Bank of Japan (BOJ) raised interest rates for the first time in 17 years. In an early April interview, Governor Ueda suggested that further weakness in the yen could trigger another rate hike, a statement that surprised the markets. However, no action was taken at the BOJ’s April 25-26 meeting, and one of Governor Ueda’s remarks was interpreted as meaning the yen’s weakness could be dismissed – worsening its slide. This sentiment prevailed until April 29, when the yen weakened to 160 against the dollar—the lowest in 34 years. Then, during Japan’s Golden Week, the yen experienced two sudden rebounds on April 29 and May 2, suggesting possible interventions that pushed it back to around 152 against the dollar. Governor Ueda’s subsequent comments are being seen as retractions of his post meeting comment that accelerated the slide towards 160.

A retracted sword?

As mentioned in my previous post, Governor Ueda’s early April interview with the Asahi News took the markets by surprise. The markets were eager to understand his policy direction after the March rate hike amid the yen’s continued decline. In the interview, he hinted that the weakening yen might prompt another hike if it significantly influenced the wage-price spiral.

However, as illustrated in the graph below, the yen continued to slide, surpassing 155 against the dollar. This led to speculation about potential BOJ support at the April 25-26 meeting. Nonetheless, when asked during the April 26 post-meeting press conference whether the effects of the weak yen on underlying , Governor Ueda answered affirmatively.

This response dashed hopes for immediate BOJ support, and the yen briefly fell to 160 against the dollar on April 29 during the Golden Week holiday, the weakest level in 34 years.

FX intervention?

The level of 160 yen is often regarded as a significant long-term chart point. Its breach could have triggered uncontrolled depreciation towards 200 yen, some chartists say. After reaching 160, the yen strengthened notably on April 29 and May 2, actions widely attributed to unconfirmed market interventions by the Ministry of Finance (MOF).

Vice Minister Kanda’s brilliant timing?

At present, Vice Minister of International Affairs Masato Kanda, sometimes referred to as “Japan’s currency chief” by the Japan Times, has neither confirmed nor denied these interventions. Nonetheless, if the MOF did intervene, the timing during Golden Week appears particularly opportune, considering the traditionally thin market conditions. Interventions are rare, and if confirmed, they would be the first since autumn 2022. Note that the large May 2 move appears to have been brilliantly timed 30 minutes after an FOMC press conference – taking advantage of a dovish comment by Chair Powell. (US-Japan interest rate differentials drive the yen)

Reviewing the press conference

In hindsight, the April 26 Ueda reply about the yen looks like it was taken out of context. To repeat, the question was about the yen’s effect on UNDERLYING inflation, and his subsequent comments – even during the conference – imply that the weakness cannot be ignored.

Ueda often differentiates between transitory inflation factors (“the first force”) and more persistent, demand- or wage-driven factors (“the second force”). He repeatedly noted that while the inflationary effects of a weak yen are usually transient, they are impacting the first force. Importantly, he also indicated that a sustained weak yen could eventually bolster the second force, particularly if it influences fiscal 2023 inflation figures, which would then impact wage negotiations for fiscal 2024.

Hawkish moments

The press conference also had its share of hawkish moments. Governor Ueda frequently stated or implied that underlying inflation is already close to the 2 percent target, which is expected to be “generally” achieved during the latter half of the forecast period (late FY2025 or later). However, it is difficult to gauge how close it is. Complicating the discussion further, government energy subsidies that had been dampening inflation are being phased out from June.

He also seemed to hint that policy rates could go much higher – explaining that it could approximately be equal to the neutral rate when the target is achieved. Although no range was given during the conference, a graph on page 62 of the BOJ’s Outlook Report, “Estimates of the Natural Rate of Interest for Japan” shows the estimated real natural rate is between -1.0% to +0.5%. As “natural rate” and “neutral rate” are usually synonymous, adding the 2% inflation target implies a nominal “neutral rate” of +1.0% to +2.5% vs the current policy rate target of 0% to 0.1%.

Post Golden Week reflections

Since the Golden Week excitement, Governor Ueda’s remarks are perceived as more supportive of the yen, with a May 9 Nikkei headline reading, “Comments on the weak yen – changing course”. This is a shift from April 29’s definitive “Yes” – in response to whether the weak yen’s impact on underlying inflation could be dismissed – to a more cautious stance on May 7 when he said, “As part of monetary policy management, we are watching the weak yen carefully”.

Conclusion – was 160 too much of a good thing?

The potential MOF interventions at around 160 yen during Golden Week, and the perceived 360 by Ueda in support of the yen since then, signal a proactive approach by policymakers to curb further yen depreciation, which is unusual. As an exporting nation, a weak yen has almost always been seen as being good for the economy and for the stock market.

However, at 160 and above, it could have become too much of a good thing, possibly sparking a cost-push inflation spiral via energy and food imports, for example. As Japan imports over 80 percent of its energy and 70 percent of its calories, a weak yen could bump economy-wide costs significantly.

Ueda’s perceived 360 and the possible MOF interventions highlight the delicate balance policymakers face between economic growth and inflation, and the interaction between monetary policy and currency policy.

Related links