Insights

BOJ Governor Ueda hints of more hikes

By Harry Ishihara, Macro Strategist

Decision possible this summer through autumn, according to Asahi News

Intro:

A detailed interview of BOJ Governor Ueda by Asahi News[i] [ii] included multiple hints of the possibility of additional hikes. Importantly, Ueda noted that recent wage hike announcements will be reflected in wages this summer through autumn, and push up prices. Yen weakness could also become a trigger, he noted.

Takeaways

The Asahi interview was conducted on April 3, with multiple articles published on April 5 including one titled, “BOJ might mull rate hike from summer to autumn”[iii]. Some of the main takeaways appear to be:

1) In March, negative rates, yield curve control and ETF purchases were all discontinued as attainment of the 2% inflation target felt closer,

2) Rates could be hiked again as their confidence grows and as wage growth feeds through to prices from this summer through autumn,

3) Yen weakness could also become a trigger if it appears to be affecting the wage/price spiral significantly,

4) The 2% inflation target is more of an AVERAGE target based on Ueda’s description

5) Ueda describes Japan’s inflation situation as “…What is happening now is that the likelihood of returning to the 0% norm is gradually diminishing”, but stated that the degree of accomodation can be reduced

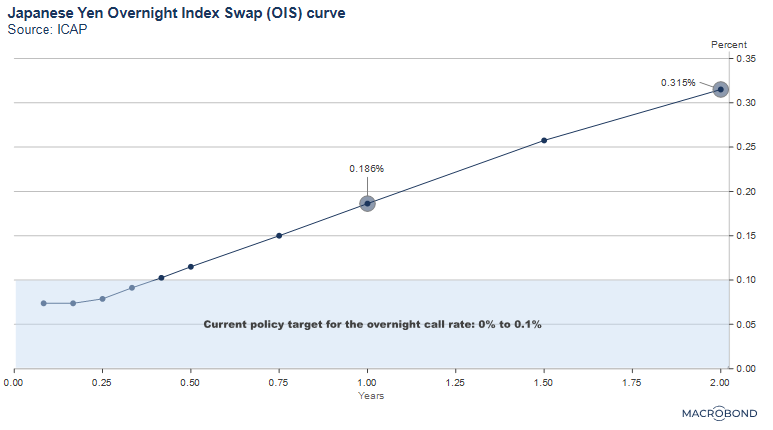

Meanwhile, the Japanese yen OIS (Overnight Index Swap[iv]) market appears to be pricing in hikes over the next year and beyond as the next graph implies.

We hope that this summary is useful. Please note that the graphs were not part of the interview and are for illustration purposes only.

The March meeting:

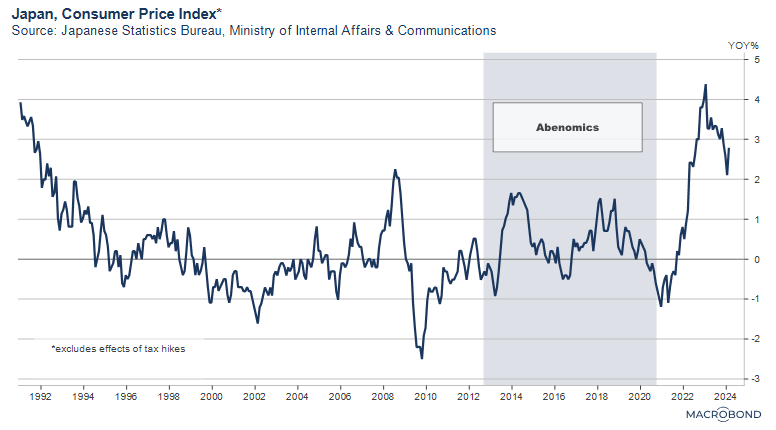

At the historic March meeting (detailed in our posts here and here), the three pillars of BOJ’s extraordinary monetary easing, namely negative interest rates (NIRP), yield curve control (YCC) and ETF purchases, were discontinued in one go. The “improvement in price movements” (Ueda) – probably meaning the upward move out of a deflationary environment – had allowed them to do so.

Wages and inflation:

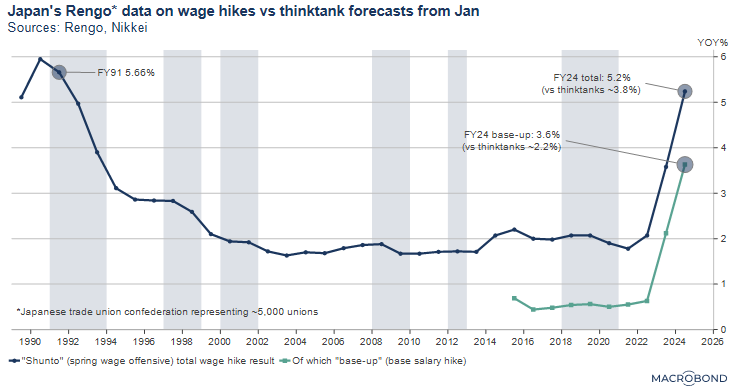

Based on this spring’s labor negotiations, known as “Shunto”, wage growth (graph below) might reach a 33-year high, according to surveys of major unions. Small and medium-sized enterprises are expected to follow.

Importantly, Ueda expects these strong Shunto results to gradually be reflected in wages from this summer through autumn, and then gradually push up prices. Thus – although not attained yet – Ueda notes they “foresee a sustained and stable achievement of the 2% inflation target” and that “the likelihood of this happening is increasing.”

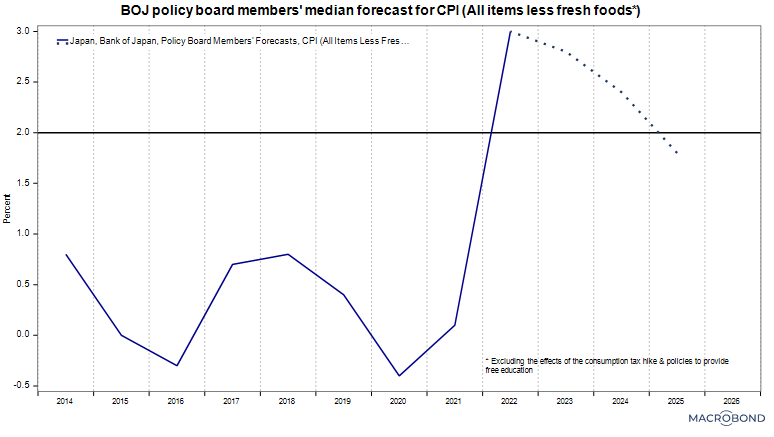

Meanwhile, the BOJ expects inflation to significantly slow (next graph). And rather than showing concern about inflation rising above 2% again, Ueda explained the trend as: “What is happening now is that the likelihood of returning to the 0% norm is gradually diminishing…”.

With wages growing and inflation slowing, real wage growth is expected to turn positive soon. Upcoming tax cuts from June will also provide support to consumption, combating recent signs of weakness.

The yen:

The highlight of the March meeting was Japan’s first rate hike in 17 years, but the yen has stayed very weak since then. Although the yen is officially the purview of the Ministry of Finance and not the BOJ, Ueda seemed to open the door to a yen related hike by saying,

“If the exchange rate’s trend is likely to have a significant impact on the wage price spiral, it becomes a reason to respond with monetary policy.”

Underlying inflation and the outlook for hikes:

During the interview, Ueda referred to “underlying inflation” several times. This refers to a rate of inflation that excludes transitory items, such as import price effects. Although accurately expressing it in percent terms is “nearly impossible”, he admitted that the BOJ is monitoring “a variety of data” without disclosing details.

Importantly, Ueda’s view is that underlying inflation remains below 2%, which also means “an accommodative environment” continues to be “necessary”. But that view does not prevent additional hikes, as he clearly noted he would “anticipate a reduced degree of accommodation”.

His thoughts on unconventional monetary easing:

A comprehensive review of the past 25 years of monetary policy is ongoing. However, Ueda noted that the unconventional policies “made the transition to a non-deflationary environment possible” while adding “…we have to admit that there were side effects, especially to bank profitability and market functioning”. The consumer price index since the early 90’s looks as follows.

The inflation target:

Ueda’s explanation of the inflation target made it sound like an average inflation target rather than a rigid one:

“The 2% target…implies movement above and below it while not allowing it to massively deviate from it over prolonged periods…”

Apparently there are no plans to change it, although some market participants think that 2% is too high for Japan.

Balance sheet reduction?

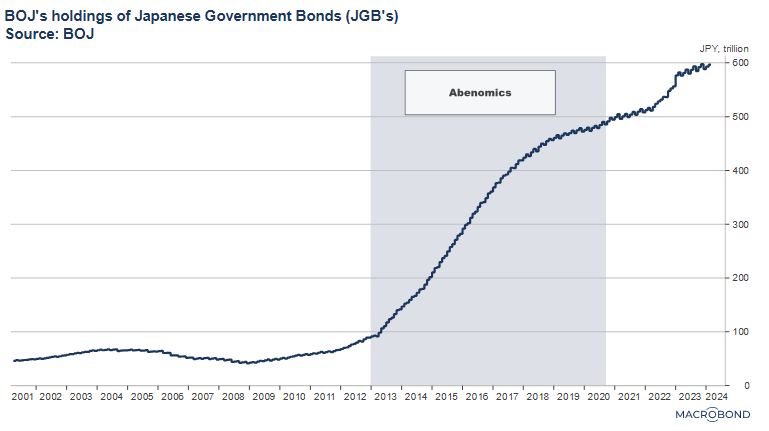

No details were given, but due to the size of their holdings, reduction will be tricky and decisions will be carefully made. The JGB holdings of close to 600 trillion yen are shown in the following graph, while the ETF’s have a market value of 70 trillion yen or so at the end of Feb, according to Nikkei News.

Market reaction:

On April 5, the day the Asahi interview was published, the yen strengthened and Japanese stock prices sold off significantly at one point. Ueda’s comment about the yen (possibly) becoming a reason to tighten was probably the biggest surprise. Meanwhile, the 1 year OIS market is currently implying only about 1 hike over the next year, implying a slow hiking cycle, in line with Ueda’s comment that an accomodative environment is still necessary.

[i] https://www.asahi.com/articles/ASS447D1FS43ULFA007.html (Japanese)

[ii] https://digital.asahi.com/articles/ASS444CMBS44ULFA01YM.html?iref=pc_rellink_01 (Japanese)

[iii] https://www.asahi.com/ajw/articles/15220141

[iv] The Japanese yen OIS is a swap agreement that involves the exchange of a floating rate – the unsecured overnight call rate – and the fixed interest rate shown in the graph. Thus OIS can be used to determine market expectations for policy rates.

Related links