OSE Derivatives

A Quick Guide to Nikkei 225 Futures; Introducing New Smaller Investment Products

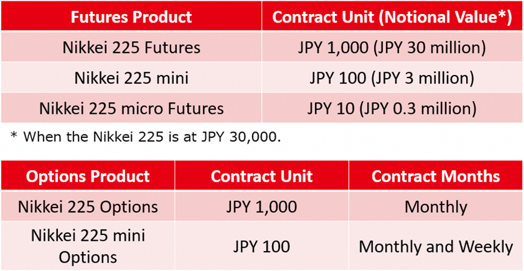

On May 29, 2023, Osaka Exchange (OSE), a part of Japan Exchange Group, will launch “Nikkei 225 micro Futures” and “Nikkei 225 mini Options”, both linked to the Nikkei Stock Average. A contract unit of Nikkei 225 micro Futures will equal 1/10th of a Nikkei 225 mini contract. Nikkei 225 mini Options will be a transformed Nikkei 225 Weekly Options by reducing the contract unit to 1/10th of its current size and setting regular contract months in addition to the current weekly contract months.

In advance of these new product launches, we review Nikkei 225 futures and options below, which have proven particularly attractive to overseas investors.

What Are the Nikkei 225 Futures Products?

The Nikkei Stock Average (Nikkei 225) is a calculation by Nikkei Inc. based on the prices of 225 high liquidity stocks of some 2,000 stocks listed on the Tokyo Stock Exchange (TSE) Prime Market. The 225 constituent stocks are reviewed once a year (in principle, in early October), considering market liquidity and balance among sectors.

“Nikkei 225 Futures (Large Contract)” are futures contracts on the Nikkei 225, with a minimum trading unit (1 lot) of 1,000 times the Nikkei 225. The minimum trading unit (1 contract) on “Nikkei 225 mini” is 100 times the Nikkei 225. To facilitate entry by individual investors, the minimum trading unit on the mini was set at ?100 times the Nikkei 225.

Several considerations led to the creation of the Nikkei 225 mini. First, arbitrage opportunities with Nikkei 225 Futures contract would result in enhanced liquidity. Second, small investment units would facilitate closings by investors new to futures trading. Third, declining volatility in the Japanese stock market revealed a great need for ?5 investment increments.

History of Nikkei 225 Futures Products

In the late 1980s, prices on the Japanese stock market rose in tandem with an increase in trading, and by the end of 1987, market capitalization of the TSE surpassed that of the New York Stock Exchange to become the world’s largest.

Meanwhile, institutional investors began to demand hedges against price fluctuations in their stock holdings. In response, Osaka Stock Exchange (now Osaka Exchange), launched Nikkei 225 Futures in September 1988 and Nikkei 225 Option in 1989. In its first three years, Nikkei 225 Futures surpassed the Chicago Mercantile Exchange S&P 500 Futures to become the world’s largest futures contract.

Nikkei 225 mini, launched in July 2006, ranked No. 1 in Asia Pacific region and the fourth largest trading volume in stock index futures worldwide as of 2021.

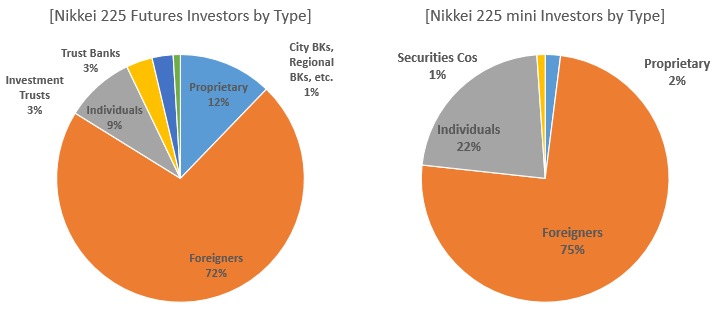

Overseas Investors and Arbitrage Trading

As shown in the pie charts above, foreign investors account for more than 70% of trading volume in Nikkei 225 futures, both large and mini. Nikkei 225 futures are also listed on overseas markets and are often used for arbitrage trading between ETFs and futures linked to the Nikkei 225. Some arbitrage and other transactions take advantage of the difference in ticks on Nikkei 225 Futures (10 yen) and Nikkei 225 mini (5 yen). Some overseas HFTs (high frequency traders) that trade futures on the OSE are considering entering the TSE ETF market via arbitrage trading in Nikkei 225 futures.

Nikkei 225 mini Gaining Popularity

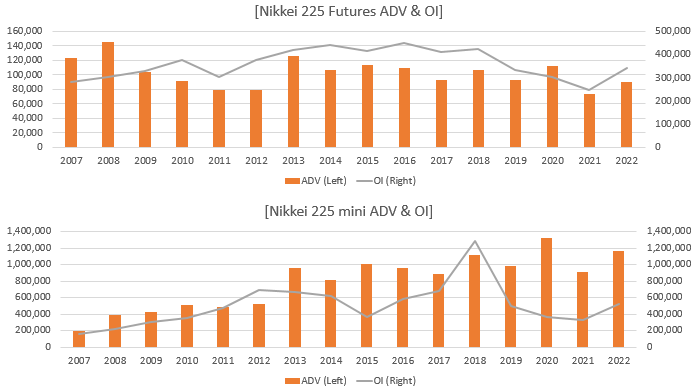

The graphs above tell trading volume of Nikkei 225 mini is increasing compared to the Nikkei 225 Futures (large).

Orders from individual investors through online securities brokers and other channels continue to increase steadily. The ratio of domestic individual investors in the mini contract (20%) is higher than that of the large contract (9%). Compared to individual stocks, investments can be made with relatively small margins, making the mini market easy for individual investors to access due to its high capital efficiency and high liquidity.

At the same time, proprietary traders of domestic financial institutions have also embraced the market. Many domestic institutions hold positions based on the Nikkei 225 Index, and some use the Nikkei 225 mini market as a hedging tool, while others use it to capitalize on investment opportunities.

Based on the track records of domestic investors over several months since its launch, overseas hedge funds and proprietary investors evaluate the liquidity of Nikkei 225 mini market, and entered the market one after another. The percentage of overseas investors rose very much and has since become the largest trading entity so far.

Another contribution to the expansion of Nikkei 225 futures market is the fact that trading hours were greatly extended, including Night Session, which was also desirable for foreign investors, the largest force in the market. (See “Trading hours considerably extended” in https://market-news-insights-jpx.com/ose/article002566/)

Introducing Nikkei 225 micro Futures and Nikkei 225 mini Options

In recent years, the need for more precise risk management tools has been increasing against the trend toward smaller investment units in the cash equity market, etc., and the launch of futures and options with smaller trading notional amounts than before has also been called for. Comments from investors include “I have no choice but to trade CFDs (Contract for Difference) now, which can be traded at 1/10th of the price”, “It will be easier to trade with more detailed position adjustment”, and “It can meet the detailed needs of institutional investors as well as individual investors”, which are mostly positive towards products with the smaller trading notional amounts.

In light of these trends, OSE will list “Nikkei 225 micro Futures”, with a contract unit of 1/10th of Nikkei 225 mini, as well as transform Nikkei 225 Weekly Options (weekly contract months) into “Nikkei 225 mini Options” by reducing the contract unit to 1/10th of its current size and setting regular contract months in addition to the current weekly contract months. Through these measures, OSE aims to revitalize the futures and options markets by widening the investor base.

Nikkei 225 Futures & Options Product Line-up

Futures and option products linked to the Nikkei 225 are eligible for holiday trading. (see https://market-news-insights-jpx.com/ose/article002566/)