OSE Derivatives

JAPANESE DERIVATIVE MARKET OPENS FOR HOLIDAY TRADING

[Updated: 2023.12.17]

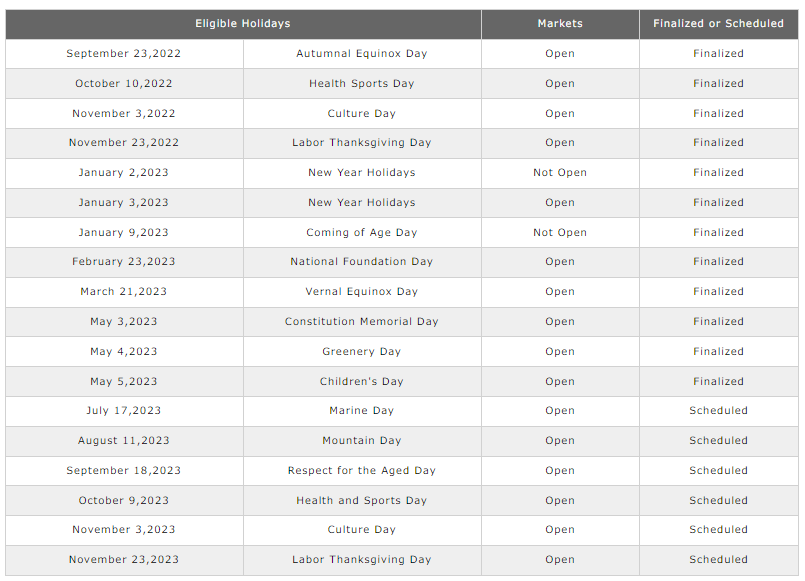

Osaka Exchange, Inc. (OSE) and Tokyo Commodity Exchange, Inc. (TOCOM) announce the derivatives holiday trading days (finalized) for the Second half of 2024 as follow website.

https://www.jpx.co.jp/english/news/2040/20231204-01.html

Beginning September 23, 2022, Autumnal Equinox Day, Osaka Exchange (OSE) and Tokyo Commodity Exchange (TOCOM) now offer derivatives holiday trading. Products such as Nikkei 225 futures and Platts Dubai crude oil futures can be traded even on holidays.

The new trading comes in response to requests from market participants who pointed out the disadvantage of fewer trading days on Japanese markets, which observe 16 holidays. The additional trading days are expected to increase the volume of derivatives trading in Japan and the initial results are promising. Volume on the first day of holiday trading exceeded expectations, reaching 49% of weekday volume (Nikkei 225 Large 31%, Nikkei 225 mini 57%). Night Session trading was unaffected, maintaining 90% (Nikkei 225 Large 87%, Nikkei mini 94%) of weekday volume.

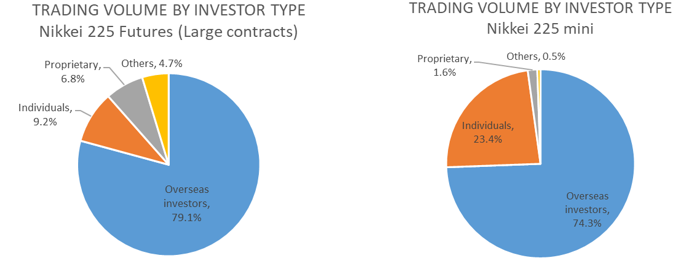

Nikkei 225 Futures attract overseas investors

As shown below, foreign investors comprise the majority of trading in Nikkei 225 futures. Since the introduction of the Evening Session (later Night Session), the time-zone difference has made it easier for overseas investors to participate in Japanese derivative markets. Overseas investors are the most active traders on the Nikkei 225 Futures (Large Contracts) and the Nikkei 225 mini, followed by domestic individuals. The notional value of a Nikkei 225 mini contract is one-tenth of a Nikkei 225 Large and is the most liquid futures contracts in Asia. On the combined Nikkei 225 Large and Nikkei 225 mini, more than three-quarters of the trading volume derives from overseas investors.

Trading hours considerably extended

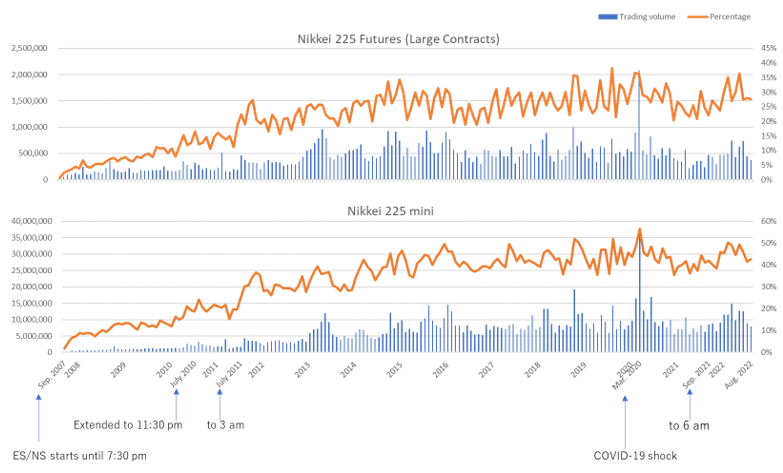

In addition to new products like the Nikkei 225 mini, longer trading hours have contributed to growth of Japanese derivative market.

Demand for equity index futures trading on OSE has increased after-hours due to the market share expansion of overseas investors and the increase in over-the-counter (OTC) trading. OSE introduced the Evening Session in 2007 both for investor convenience and to create a more efficient market. Now called the Night Session, it is open for trading all night until 6 am Japan Time. Trading volume in the Night Session has increased yearly, satisfying the trading and hedging needs of overseas investors and domestic traders.

TRADING VOLUME AND TRADING SHARE OF NIGHT SESSION

Like the Night Session, holiday trading aims to further enhance investor convenience by providing opportunities for hedge trading. Opening the Japanese derivatives market to a broader range of investors in the future will strengthen competitiveness.

Related links