Insights

Japanese foreign bond flows – an update

Written by Harry Ishihara, Macro Strategist

Since 2020, Japanese institutional bond investors have generally been repatriating into domestic bonds at the expense of foreign bonds. Fed and ECB rate cuts have lowered both hedge costs and repo funding costs, but risk appetite has been held back somewhat by a continued rise in domestic yields. Another highlight in 24H2 was heavy net-selling of European governments, triggered by political concerns. However, new foreign bond products and other signs suggest underlying demand is intact –and just waiting for the right timing.

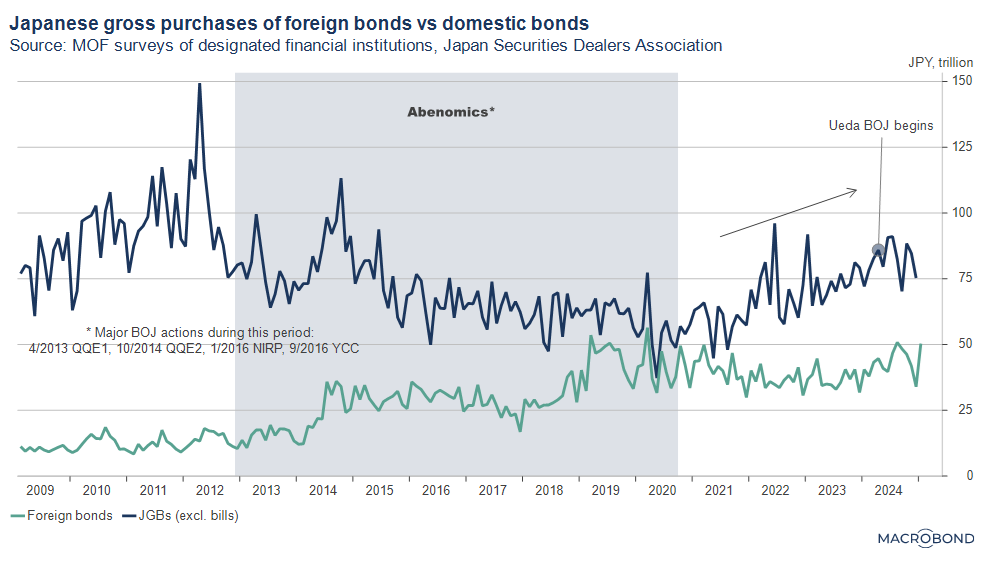

Gross purchases

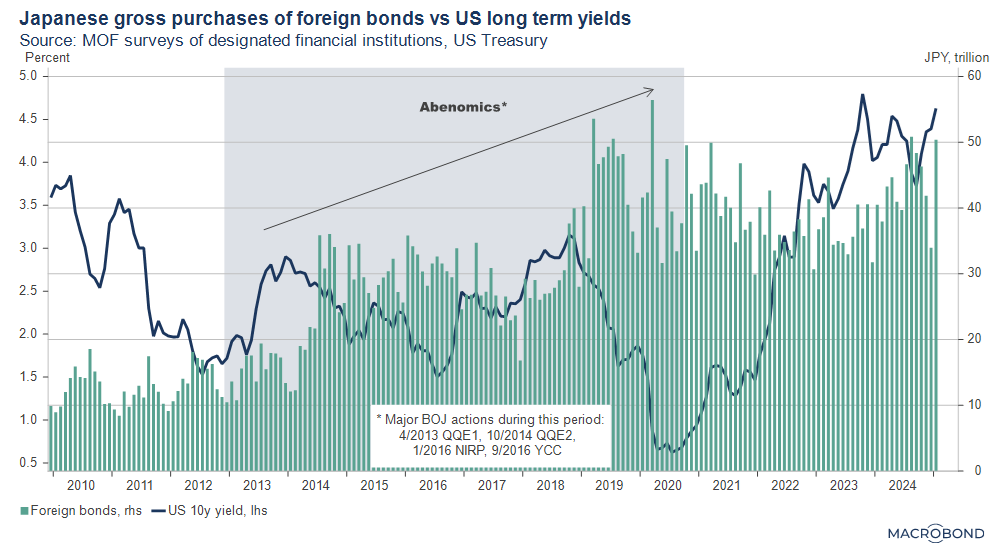

Gross purchases by Japanese institutional investors of foreign bonds[i] have stopped surging but remain near their post Abenomics peaks[ii]. Rising US yields had caused gross purchasing activity to taper off to around 30 to 40 trillion yen per month in late 2023 before recovering somewhat in late 2024. A headline in August 2024 summed up sentiment at the time: “Japanese money to buy the rate-cutting countries – targeting US and China while avoiding Europe’s fiscal woes” (Nikkei, Aug 24).

US sovereign bonds still favored

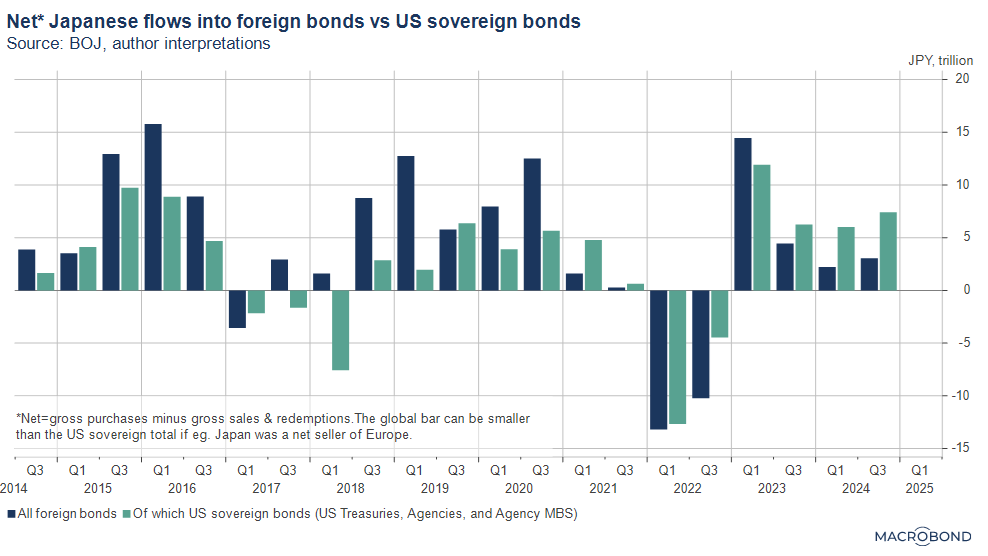

As the next graph of net[iii] flows implies, most foreign bond flows involve US sovereign bonds, which include US treasuries, agencies and agency MBS. Most Japanese investors are shy about taking foreign credit risk and seek bonds that are highly rated and liquid. As we wrote in January 2024, they often get special attention by government treasury departments and government bond traders, due to the size of their flows. Pre-corona, it was not uncommon for Japanese flows in US treasuries to be larger than the Fed’s for example.

“Yen-toh” versus dollar-based or euro-based

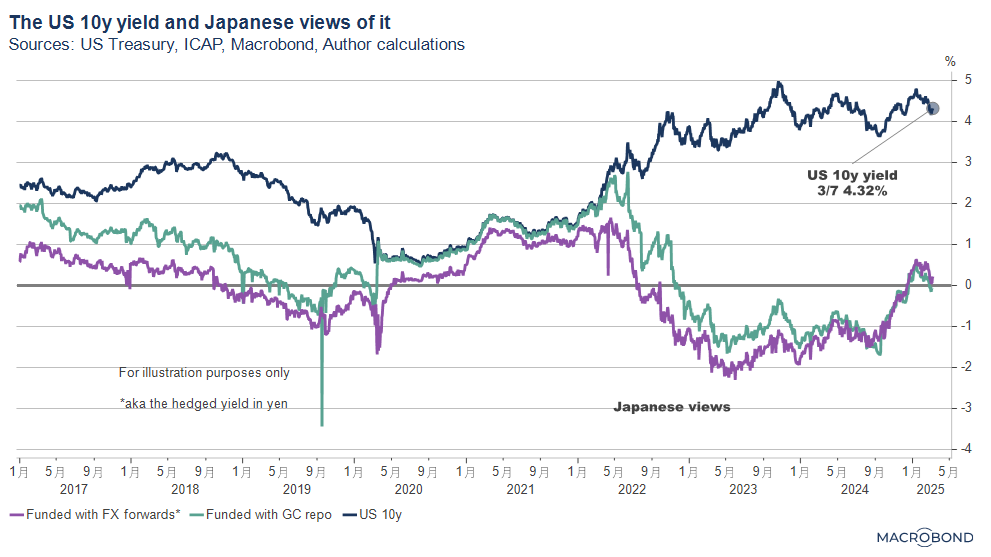

The bulk of Japanese investor flows into foreign bonds are hedged for currency fluctuations. This usually involves selling FX forwards every 3 months and rolling them for the holding period. These investments/investors are often called “Yen-toh” (pronounced En-toe), short for yen-based investing/investors. Other investments/investors can fund in the foreign currency, eg. with GC repos[iv], and are sometimes called dollar-based or euro-based. Many investors can do both.

Importantly, the hedge cost and repo costs are both a function of overseas short term rates. For example, the cost of a 3m USD rolling hedge would mostly reflect the difference between US and Japan 3m rates, while GC repo rates closely follow Fed Funds. Since late 2022 through most of 2024, US 10-year yields probably looked negative for both “Yen-toh” and dollar-based investors as the next graph shows.

Rising domestic yields is the other hurdle

Along with hedge costs, participants also mention rising domestic yields as holding back (global) bond risk appetite, for 2 reasons:

1) They hurt their large domestic bond holdings.

2) They make foreign bonds look less attractive, especially when FX hedged.

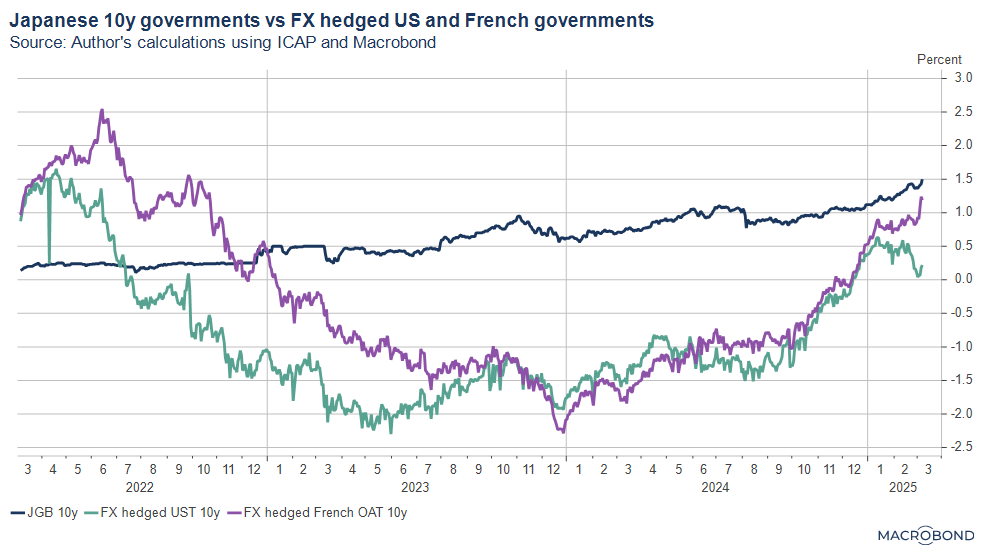

The next graph illustrates both #1 and #2. The steady rise in JGB yields was initially triggered by higher inflation abroad but is now driven more by BOJ rate hike expectations. It also shows JGB yields as still being higher than the 2 popular FX hedged foreign government bonds – US and French.

Repatration continuing?

With the hurdles above, residual flows into foreign bonds had probably reflected two types: 1) short term trading and 2) “Yen-toh” into FX hedged US Agency MBS for their spread over JGB’s. In general, however, a “repatriation” from foreign bonds into JGB’s has looked like the underlying trend, as the next graph shows.

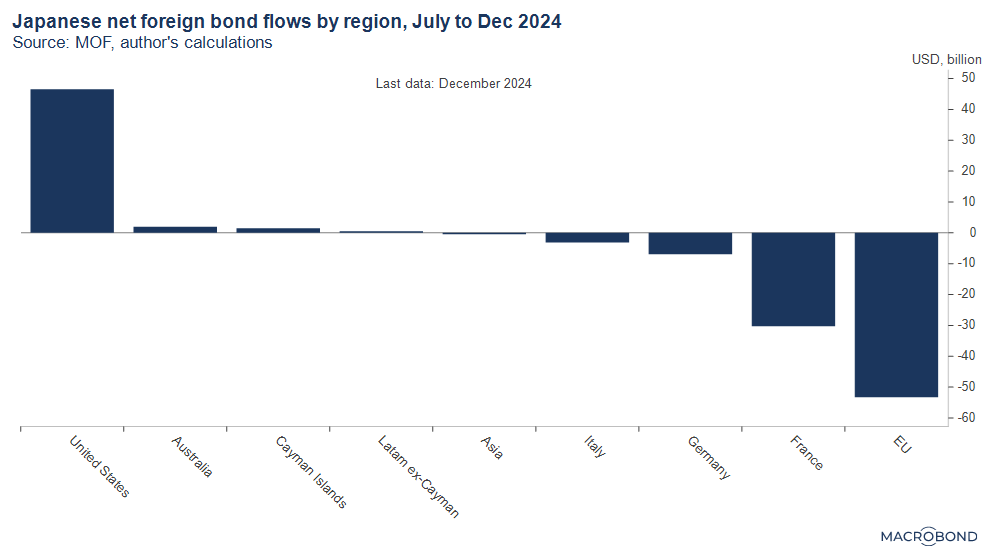

Selling Europe

As the next graph shows, in late 2024, Japanese investors sold some of their European foreign bond holdings, at “the highest pace in over 10 years” (Nikkei) [v]. Reportedly this was due to signs of political instability in 2 of their favorite European markets, France and Germany. A snap election in France over the summer led to rating agency actions over their deficit, while the German coalition collapsed in November. Also as implied earlier, FX hedged French bonds were yielding lower than JGB’s to begin with, which may have exacerbated the sales.

Underlying demand intact

On the positive side, the bond ETF market in Japan is growing. Between 2020 and 2023, TSE-listed global bond ETF’s have doubled in number and quintupled in net assets, led by demand from domestic financial institutions as well as foreign entities. Also, anecdotally speaking there seems to be growing appetite from retail Japanese investors, although this report focused on institutional investors. These signs imply that Japan’s underlying demand for foreign bonds is intact, and that in general Japanese investors are just waiting for the right timing. More rate cuts abroad would help their appetite by lowering the hedge cost.

Related posts from this author and JPX:

Are Japanese Investors Re-engaging Foreign Bonds?, Sept 2024

Understanding Japanese Investor Flows into the Global Bond Markets, Jan 2024

Japanese Retail’s Yen Carry Trade, Aug 2024

[i] We will largely stick to the Ministry of Finance definition of foreign bonds, which means non-domestic bonds.

[ii] During Abenomics, extraordinary monetary easing resulted in lower domestic yields, pushing domestic investors abroad.

[iii] Net flows=Gross purchases minus gross sales & redemptions. In the first graph we used gross purchases to reflect gross trading activity. For simplicity we did not show gross sales & redemptions, which are of a similar scale to gross purchases. Market participants and the media follow net flows as a better indicator of the impact on yields, which we used here.

[iv] GC repos=General collateral repos. Repos are a widely used form of secured lending generally using highly rated government bonds as collateral. In a GC repo, a wide range of bonds are accepted as opposed to a SC or Special collateral repo, which limits the collateral.

[v] https://www.bloomberg.com/news/articles/2024-09-10/french-bonds-suffer-exodus-of-japanese-cash-in-sign-of-fragility

Related links