Insights

Monthly Global Equity & Fixed Income Futures Performance (January 2025)

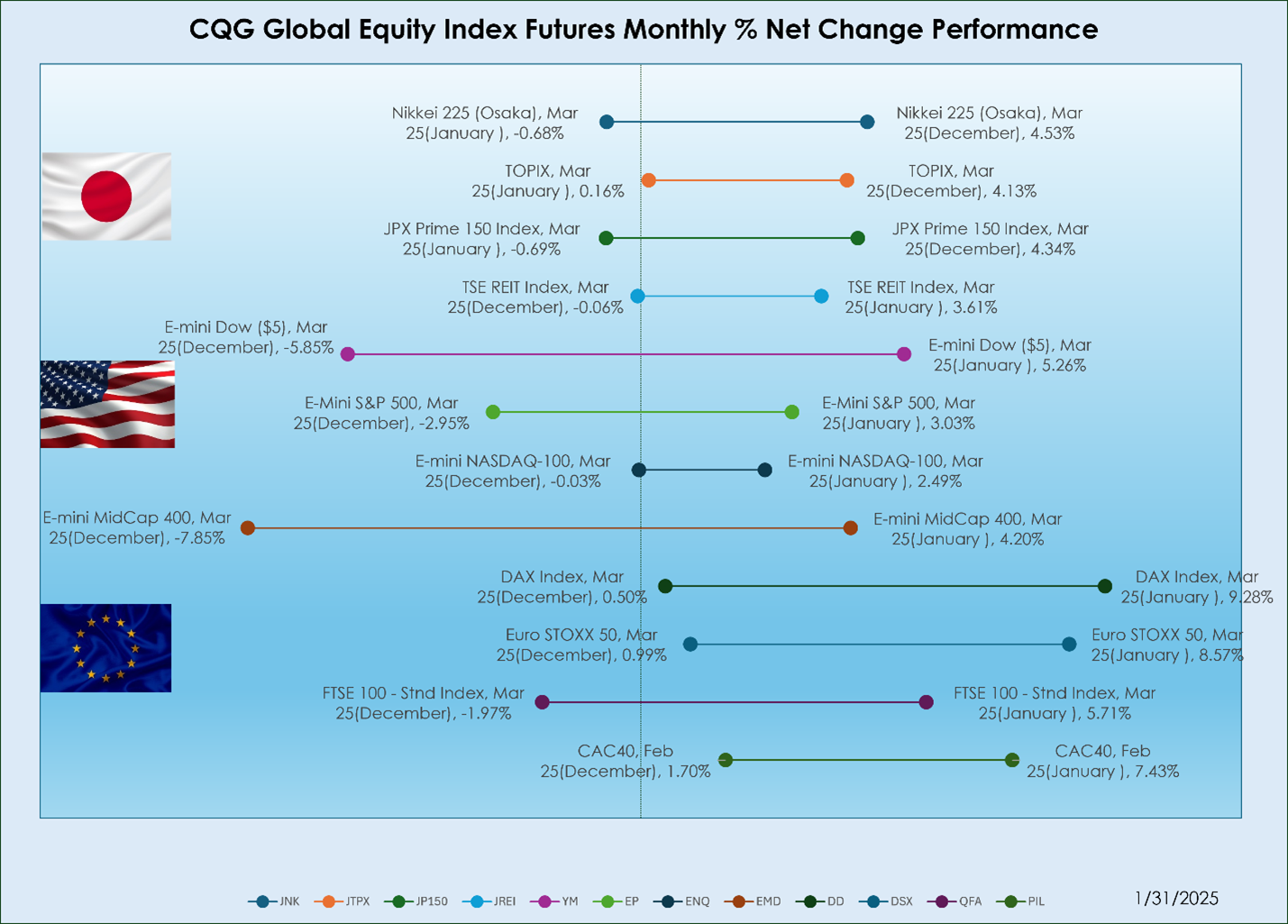

Monthly Global Equity Futures Performance

This monthly snapshot for January shows a relatively high performance for the Equity futures markets. The best performer in the Japanese market was TSE REIT Index, Mar 25 with a +3.61% gain. The best performer in the USA market is the E-mini Dow ($5), Mar 25 with a gain of +5.26%. The best performer in the European markets is the DAX Index, Mar 25 with a +9.28% gain.

The previous month (December) ended with mixed performances for the Japanese equity index futures contracts. The best performer last month in the Japanese market was the Nikkei 225 (Osaka), Mar 25 with a +4.53%. The best performer last month in the USA market was the E-mini NASDAQ-100, Mar 25 with a loss of -0.03%. The best performer last month in the European markets was the CAC40, Feb 25 with a gain of +1.70%.

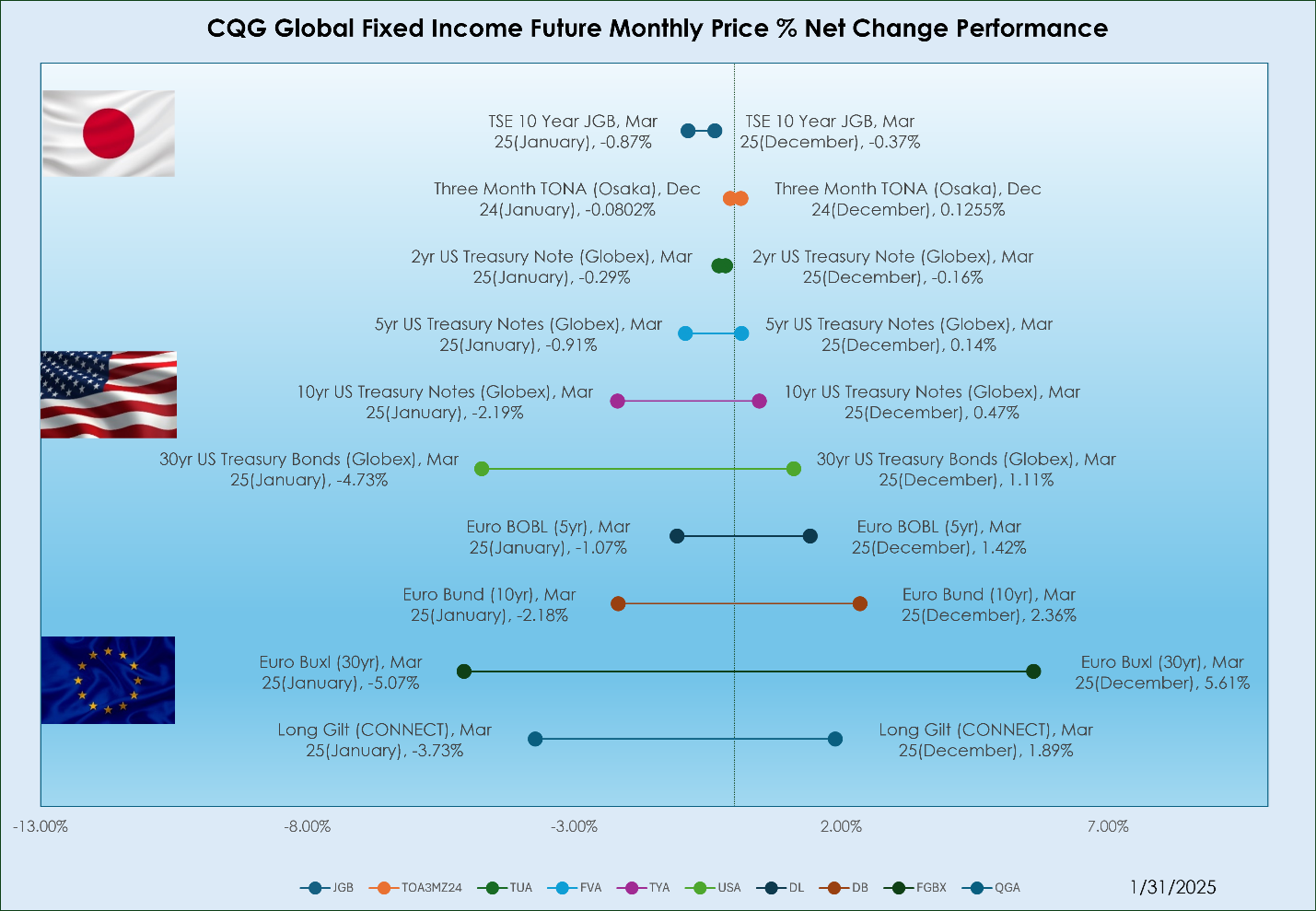

Monthly Global Fixed Income Futures Performance

The Fixed Income futures markets ended January with negative movement for all futures contracts. The Three Month TONA (Osaka), Dec 24 contract was down -0.0802%. The best performer in the USA market is the 2yr US Treasury Note (Globex), Mar 25 contract with a -0.29% loss. The best performer in the European markets is the Euro BOBL(5yr), Mar 25 contract with a -1.07% loss.

The previous month (December) ended with mixed performance for the Japanese fixed income futures contracts. The Three Month TONA (Osaka), Dec 24 contract finished with a +0.1255% gain. The best performer in the USA market was the 30yr US Treasury Bonds (Globex), Mar 25 contract with a gain of +1.11%. The best performer in the European markets was the Euro Buxl (30yr), Mar 25 contract with a +5.61% gain.

Note: For scaling purposes, the chart displays the current midweek net percentage change and the previous week’s net percentage change for fixed income products. If the percentage net change is positive then yields have fallen. If the percentage net change is negative then yields have risen.