Insights

Japan’s Inflation Beats the US while Households Feel It’s 17% – Why Is the BOJ so Cautious?

Written by Harry Ishihara, Macro Strategist

Executive Summary

In the summer of last year, the Bank of Japan (BOJ) announced a rate hike to 0.25% after lifting off from negative rates in March. This became one of the triggers that led to significant market volatility as the “yen carry trade” unwound. Sentiment shifted quickly from “how far can hikes go” to “how soon will hikes stop.” On January 24, the BOJ implemented its third rate hike this cycle, raising rates to 0.5% – the highest in 17 years. However, this was perceived as a “dovish hike,” with expectations that future hikes will be slow or may not occur at all.

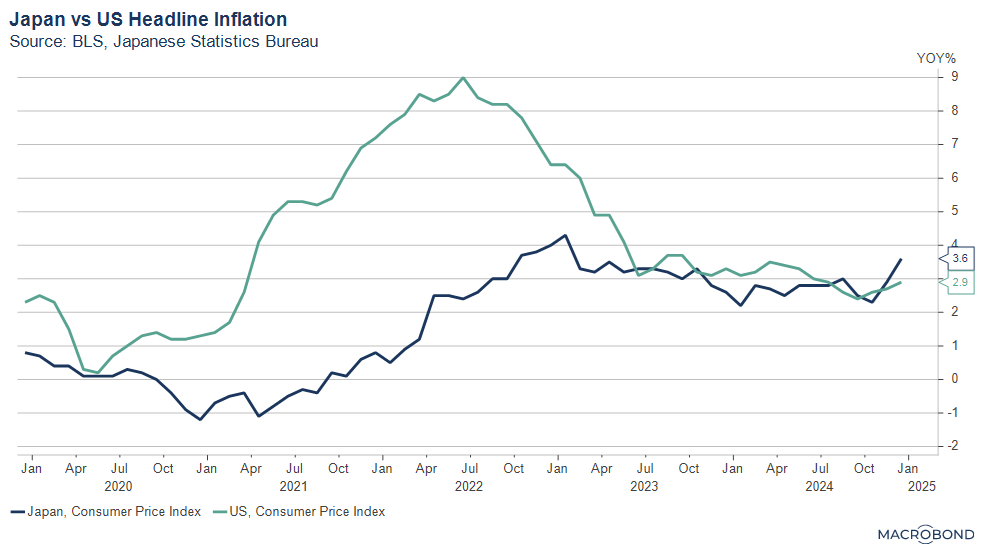

Meanwhile, Japan’s headline inflation for December surged to 3.6%, surpassing the US. BOJ surveys reveal that households feel inflation is a staggering 17%. What’s holding the BOJ back? The main culprits appear to be sluggish real wage growth and uncertainty surrounding global trade and US policy. Unsurprisingly, the BOJ provided few hints about its next moves.

Justification for the January Hike

The BOJ’s January 24 hike, increasing the upper end of its target range from 0.25% to 0.5%, followed hints from Deputy Governor Himino and Governor Ueda the previous week. While some market participants had anticipated a hike in December, the BOJ opted to wait for stronger evidence of wage growth, making March a possible alternative timeline.

The simultaneously released Quarterly Outlook report supported the hike, with policy board members projecting higher core inflation. Core inflation (all items excluding fresh food) remains above the BOJ’s 2% target, driven by steady service inflation, wage growth, and a weak yen.

Household Sentiment vs. Business Sentiment

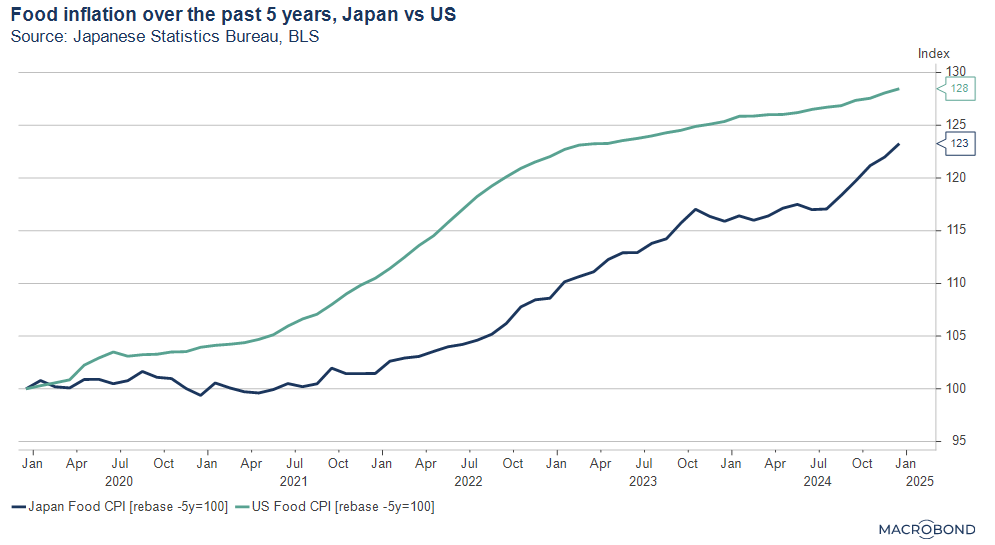

Similar to the Federal Reserve, BOJ officials often address households directly, acknowledging the challenges of high inflation. Food prices have been a major factor. For example, Japan’s food CPI (including fresh food) has risen 23% over the past five years, as reflected in this rebased index.

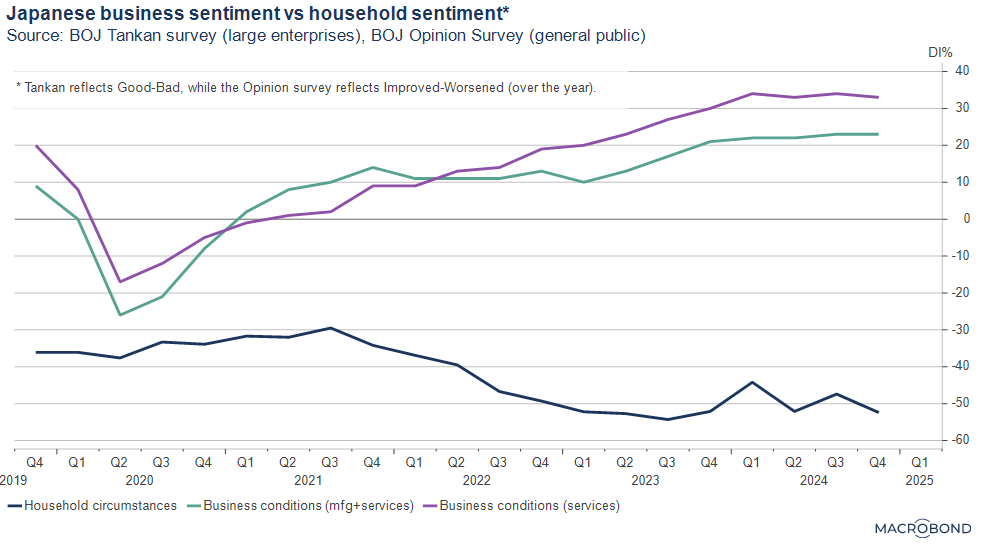

While household sentiment remains low due to food-led inflation, business sentiment is thriving as the next graph shows. Corporate profits are near record highs, with the services sector maintaining its strongest sentiment levels since the 1990s. This divergence highlights the uneven impact of inflation across different segments of the economy.

Households Feel 17% Inflation

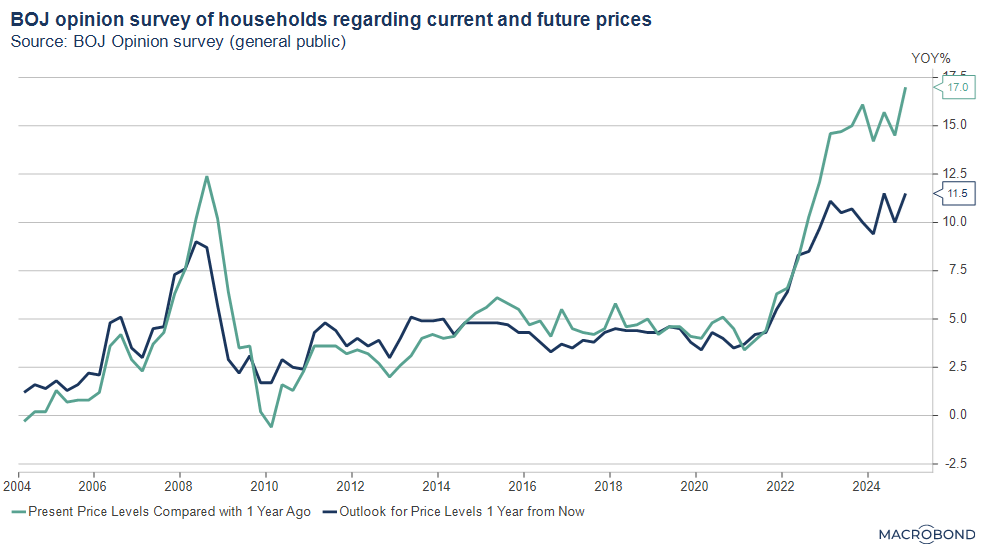

According to the latest BOJ Opinion Survey released in January, households perceive prices to be 17% higher than a year ago – a stark contrast to the official headline inflation rate of 3.6%. This disconnect is a growing concern for both policymakers and politicians, as inflation remains the top issue for households.

Reasons to Hike Quickly – and Reasons Not To

Several factors support the case for more rapid rate hikes:

- A persistently weak yen.

- An upcoming key parliamentary election in July.

However, there are also strong reasons for the BOJ to proceed cautiously:

- Avoiding another post-hike market rout by improving communication.

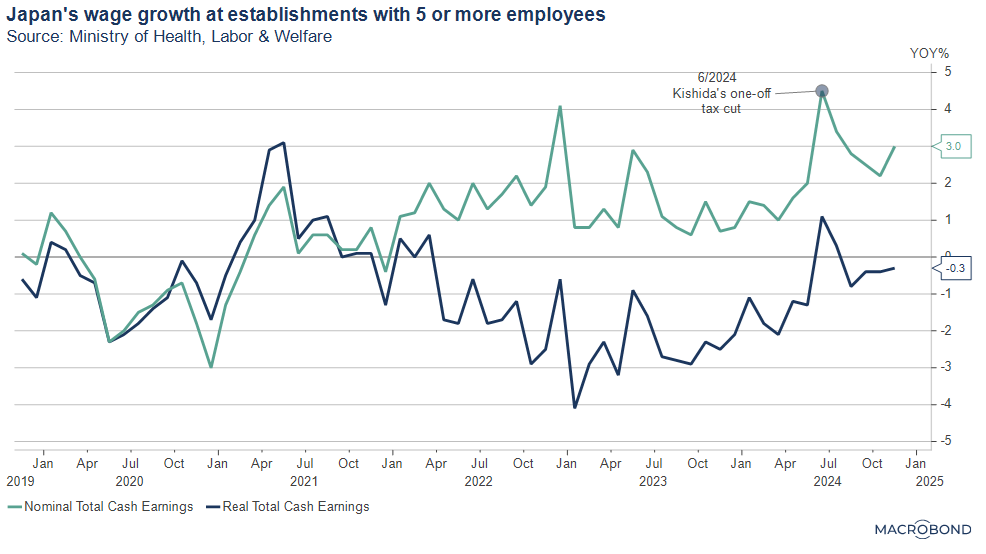

- Rather sluggish real wage growth as the next graph implies.

- Uncertainty surrounding global trade, US inflation, and currency policy—coined the “Trump effect.”

Back in December, unnamed BOJ officials told Nikkei News that hikes can be expected roughly every six months, leading some economists to predict the next hike may be delayed until September rather than July to avoid the election[i].

Is Inflation in Japan Really Higher Than in the US?

Japan’s headline inflation reached 3.6% year-on-year in December, surpassing the US rate of 2.9% after months of being nearly identical. The 0.7% acceleration in Japan’s inflation from November’s 2.9% was attributed to fading government energy subsidies[ii] and a record 65% year-on-year rise in rice prices. However, the implication that the acceleration is transitory seems debatable[iii].

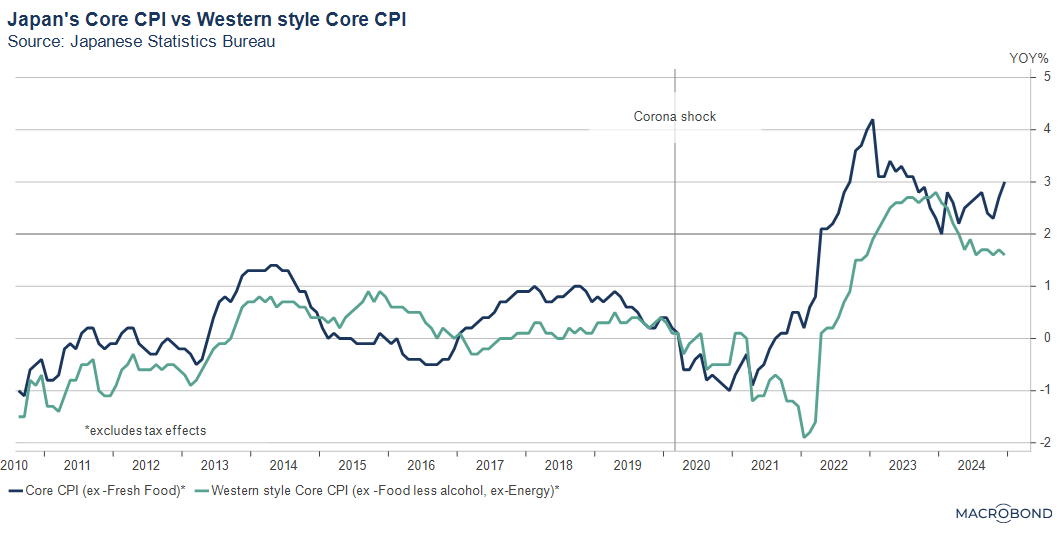

Western-Style Core CPI Tells a Different Story

Some economists prefer using “Western-style” or “US-style” Core CPI – which excludes all food (except alcohol) and energy – as a measure of underlying inflation[iv]. By this measure, inflation in Japan has slowed to below 2%, contrasting with the BOJ’s targeted Core CPI (which excludes only fresh food but includes energy) that remains stubbornly above 2%.

In the US, Core CPI and Core PCE – which exclude all food and energy – are popular measures of underlying inflation. In other words, hypothetically speaking, if Fed officials had attended the latest BOJ meeting, they might have argued against a rate hike using the Western-style Core CPI in the next graph. Although more analysis is needed, this divergence highlights the complexity of inflation dynamics in Japan.

Conclusion: Future policy probably hinges on the US

During the press conference at the BOJ, there were multiple questions about the “neutral rate”, which is sometimes assumed to be about 1%, implying 2 more hikes. However, Governor Ueda gave few hints about the neutral rate and when or if future hikes are coming.

Future policy probably hinges on the US. For example, while expected Trump tariffs are mostly seen as inflationary, one risk is that they slow consumption or hurt global stocks. The Trump administration may also try to weaken the dollar as part of its trade policy – strengthening the yen. Another risk may be a slow response by the Fed to tame inflation, leading long term US yields to rise, weakening the yen. The first risk calls for caution around future hikes, while the second risk calls for action.

The BOJ finds itself in a delicate balancing act, navigating between inflation, sluggish real wage growth, and global uncertainties. Households claim they feel a staggering 17 percent inflation, on average. At the same time, strong business sentiment and record corporate profits suggest resilience in key sectors of the economy.

Flexibility will be critical for the BOJ as they weigh the risks of moving too fast against the dangers of falling behind the curve.

[i] The BOJ’s 8 monetary policy meetings (MPM’s) are scheduled for January, March, April, June, July, September, October and December, with Outlook Reports – which often provide data justification for major changes – scheduled for January, April, July and October.

[ii] The subsidies are being brought back, which could cause February inflation prints to hook down.

[iii] For example, energy accounted for only 0.3 percentage points of the acceleration, while food contributed 0.4 percentage points. Notably, fresh vegetables – not rice – were the primary driver of food inflation. For the moment, it appears media reports that imply the acceleration was transitory seem slightly overdone.

[iv] Confusingly, some call this Core Core CPI instead of Western style Core CPI. But the version of Core Core CPI that BOJ officials sometimes refer to often only excludes FRESH food and energy, not ALL food and energy. Fresh food is volatile but has a small weighting compared to ALL food. Terminology in the press is inconsistent as well.

Related links