Insights

Monthly Global Equity & Fixed Income Futures Performance (November 2024)

Monthly Global Equity Futures Performance

This monthly snapshot shows a mixed performance for the Equity futures markets. The best performer in the Japanese market was JPX Prime 150 Index, Dec 24 with a +0.46% gain. The best performer in the USA market is the E-mini MidCap 400, Dec 24 with a gain of +9.10%. The best performer in the European markets is the FTSE 100 – Stnd Index, Dec 24 with a +2.14% gain.

The previous month (October) ended with a negative performance for the Equity index futures contracts. The best performer last month in the Japanese market was the TOPIX, Dec 24 with a -0.58% loss. The best performer last month in the USA market was the E-mini NASDAQ-100, Dec 24 with a loss of -0.94%. The best performer last month in the European markets was the DAX Index, Dec 24 with a loss of -1.87%.

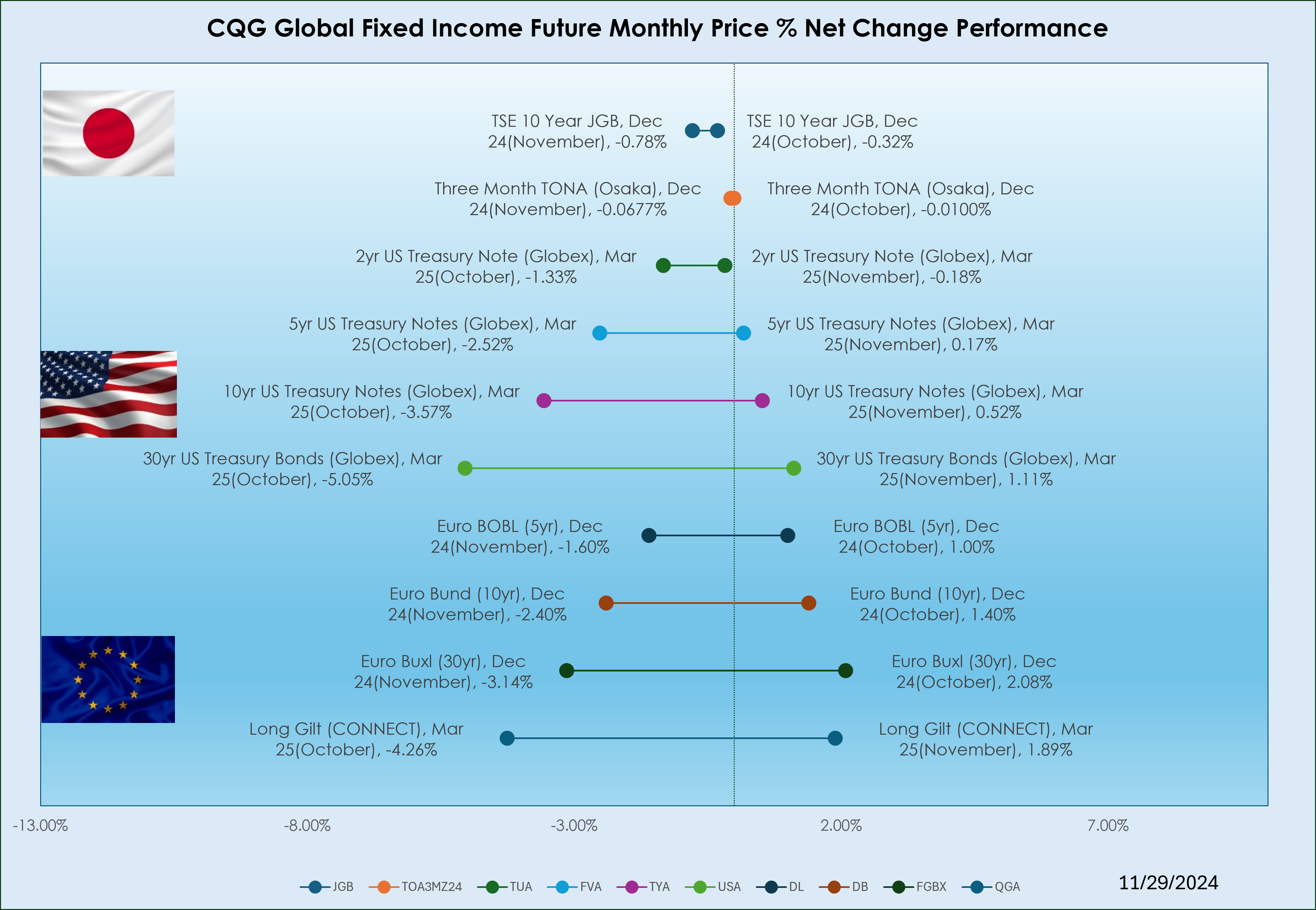

Monthly Global Fixed Income Futures Performance

The previous month (October) ended with mixed performance for all futures contracts. The Three Month TONA (Osaka), Dec 24 contract finished with a -0.0100% loss. The best performer in the USA market was the 2yr US Treasury Note (Globex), Mar 25 contract with a loss of -1.33%. The best performer in the European markets was the Euro Buxl (30yr), Dec 24 contract with a +2.08% gain.

Note: For scaling purposes, the chart displays the current midweek net percentage change and the previous week’s net percentage change for fixed income products. If the percentage net change is positive then yields have fallen. If the percentage net change is negative then yields have risen.