Insights

Japan prepares for the new US President

Written by Harry Ishihara, Macro Strategist

“No other country’s presidential election impacts the world like the US” according to former Japanese Ambassador to the US Shinsuke Sugiyama. Global financial markets, corporates and geopolitics will all be affected by the new Trump administration, which has implications for global economic policies, trade and clean energy to name a few. The Associated Press[i] claims Republicans have both chambers of Congress, making proposed changes even more likely. Preparations similar to Japan’s – the topic of this report – are probably underway around the world.

Markets scramble

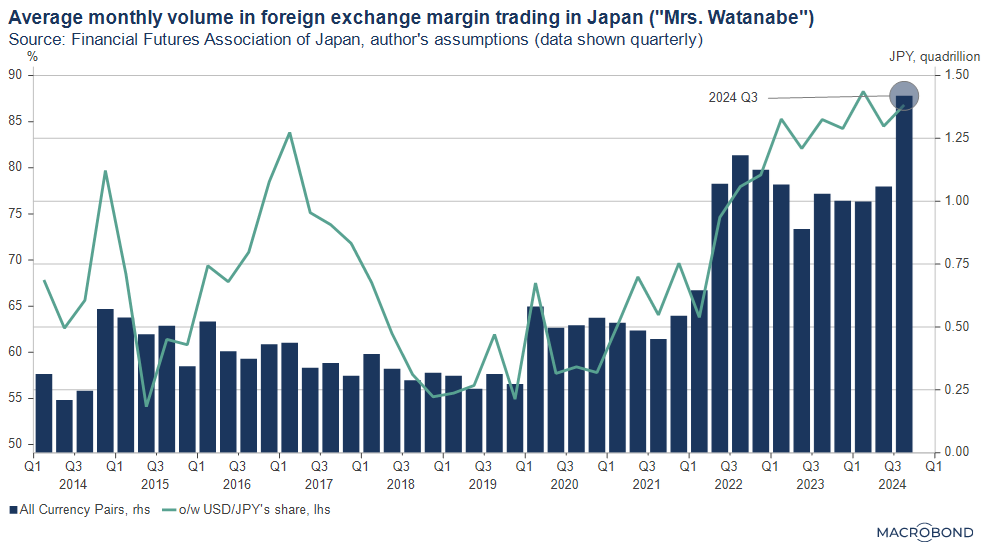

Market implications for Japan seem to be centered around the yen. Former President Trump has promised personal[ii] and corporate tax cuts, import tariffs and the deportation of illegal immigrants. Although uncertainty remains about their extent and timing, these policies are expected to be inflationary as the economy gets a jolt and import and wage costs rise. Rising US growth and inflation expectations are having knock-on effects on Japanese stocks, interest rates, and the yen, which may see a restart in the Japanese yen carry trade depicted in the next graph.

Trading places

As the next graph shows, rising Japanese 30-year government yields have now “traded places” with China. Before the US election, the driver was Japan’s rising growth expectations. In October, Blackstone CEO Shwarzman praised Japan for its “economic rebirth”, while Warren Buffet topped up his yen investing capacity. Since then, expectations for expanded domestic tax breaks (following a surge in seats held by the Democratic Party for the People in late October), more BOJ rate hikes in December or January, and of course, the “Trump effect” pushing US yields higher are also being cited as causes of the uptrend.

Automakers brace for tariffs

Trump’s proposed tariffs on imports and possible shifts in various US policies are forcing Japanese corporates – especially automakers – to rethink their supply chains and corporate strategies (Nikkei News, November 8[iii]). During his campaign, Trump proposed 10 to 20 percent tariffs on imports and 60 percent tariffs on Chinese imports.

In response, Nissan is considering the need to shift auto production out of Mexico, while Honda may shift production among other countries. Another issue for automakers is how EV policies and tax incentives will change – and how Trump supporter Elon Musk of Tesla could affect them. For example, policies on autonomous driving could diverge from electric vehicle policies.

Other industries buckle up

In other industries, Japanese banks worry that US banks may get favorable treatment from incoming US regulators in regard to Basel III bank regs. Toray, the textile giant, is aware of the effect of tariffs but does not think it is possible to “have only US production facilities”. Itochu, a major trading firm, is concerned about US clean energy policies diverging from the EU’s. Nitori, the popular low-cost furniture chain, noted “Stronger yen or weaker yen? The outlook is absolutely uncertain.” Satellite TV Wowow is mindful of a weaker yen driving import costs for movies and dramas higher. Meanwhile, Chugai Pharmaceuticals braces for change but expects US drug costs to remain suppressed by the Inflation Reduction Act of 2022. The CEO of Ajinomoto, the food company, summed up corporate efforts with, “Changes to foreign exchange, tariffs, international relations, and environmental policies will make things challenging, but we will minimize the negatives and focus on the opportunities.”

Cabinet focus

The composition of the Trump cabinet, especially the Treasury Secretary, the Secretary of Commerce and the next US Trade Representative (a Cabinet level position) are another focus, as tariff/global trade and currency policies could shift accordingly. Chief of Staff and economic advisors will also be a focus. Old bilateral trade agreements between Japan and the former Trump administration could help cushion tariff effects – if upheld. Of course, the extent and timing of any tariffs will be key, and long phase-in periods will help corporates adjust.

Geopolitics?

Trump’s “America First” stance is affecting geopolitical risks. The outlooks for Ukraine/Russia, the Middle-East and Asia-Pacific security are all in flux. Japan’s new Prime Minister Ishiba, who now leads a minority coalition, has limited international exposure and has yet to meet Mr. Trump. Many commentators are concerned of increased global instability, but Sugiyama, Japan’s ambassador to the US under the first Trump administration (during Abenomics) had very favorable first-hand impressions: “In person, Trump was absolutely warm and humorous, and he did not strike me as an aggressor at all. Of course, I admit my relationship was supported by a strong friendship between him and then Prime Minister Abe. However, as a businessman, I think he dislikes wars and prefers a peaceful environment to maximize profits”.

Takeaway?

According to Associated Press, the “Triple Red” scenario where the White House and Congress are all controlled by Republicans has now become a reality. Trump’s visions for the US economy could be enacted swiftly and forcefully. Preparations like Japan’s are probably underway around the world.

[i] https://apnews.com/article/republicans-house-elections-e3754a684a7b96b129841d4b207c15e9

[ii] The personal tax cuts are expected to be an EXTENSION of Trump tax cuts which were enacted under his first administration and continued under the Biden administration. Extensions may be less inflationary than NEW tax cuts.

[iii] https://www.nikkei.com/article/DGXZQOUC071DC0X01C24A1000000/

Related links