Insights

Why is Warren Buffet topping up in Japan?

Written by Harry Ishihara, Macro Strategist

Summary

In October, Warren Buffett’s Berkshire Hathaway raised ¥281.8 billion ($1.9 billion) in a seven-tranche yen-denominated bond deal. This was their largest sale in yen since they began issuing in 2019 and its second this year. In February, they revealed that almost all their equity investments in Japan were being funded by bonds. Thus this top up is being seen as indicative of their expectations for upside in Japanese stocks. We look at some of the possible reasons why.

Warren Buffett’s success

The seven part deal from Berkshire Hathaway had tenors spanning 3 to 30 years and marked their largest yen deal since their debut sale in 2019. Berkshire has now become the largest foreign issuer of yen bonds this year (Bloomberg). All tenors were ultimately priced at the lower to middle end of their revised price guidance, evidence of strong demand despite concerns of Bank of Japan rate hikes (Reuters).

The firm first announced it would buy stakes in Japan’s “shosha” trading houses in 2020 (Reuters) with the intention of holding them long-term. Since then, it has raised its stake in Japan’s top five “shosha” to around 9 percent each in a sign of approval of their global, real-economy based long-term business models[i].

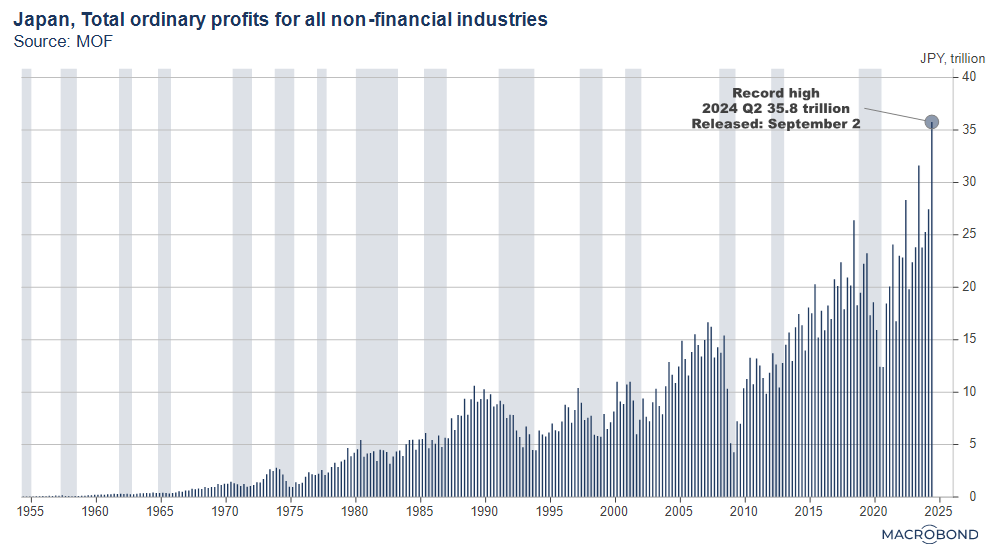

Berkshire has been issuing in yen every year since 2019, and twice a year since 2022, according to Nikkei News. However, due to regulatory filing requirements for large holdings, this round is seen as too large to go only to the shosha. Market watchers are saying that Warren Buffett may be looking to buy Japanese financial firms and shipping companies (Bloomberg). He is also known to like stocks with high returns, strong cashflow and low debt (Nikkei). The next graph shows corporate earnings hit a record for the quarter through June, helped by the weak yen that quarter.

“An economic rebirth” (Blackstone)

Buffett is not the only investor with praise for Japan. In October, Blackstone CEO Steve Schwarzman said on Bloomberg, “We are seeing an economic rebirth of the country” (Bloomberg). Although he did not elaborate, positive signs include the record corporate earnings in the previous graph and record levels of capex. Recent investments including Amazon’s $15 billion, Microsoft’s $2.9 billion and Google’s $1 billion gave a boost to the nation’s ambition to become a tech sector research and innovation hub according to US Ambassador to Japan Rahm Emanuel[ii]. Perhaps the best evidence of Japan’s economic rebirth is the consistent rise in 30 year government bond yields in Japan, a sign that potential growth expectations are improving as the next graph shows. The rise is in stark contrast to China’s.

Financial (system) overhaul continues

As noted in, “Japan’s financial system overhaul – making Japan more prosperous” the overhaul of the nation’s financial system continues to make progress.

Corporate equity buybacks have doubled in the April-Sep period[iii], a wealth effect from stocks is more evident than ever[iv], stock splits are the highest in 10 years and drawing in retail investors[v], this year’s expansion of NISA drew in many first time buyers, and equity funds can now invest in unlisted stocks[vi] as part of a national effort to support startups. A domestic recovery continues, with record wage growth for the past two years helping real wage growth turn positive for the latest two months. Tourism continues to boom, with electronics retailer Bic Camera announcing a five-fold increase in earnings and a new effort to sell Japanese whiskey to tourists[vii]. Nomura plans to hire more wealth management bankers in Dubai, probably to pitch Japanese corporates which some global investors describe as having “more endurance, innovation, and toughness relative to other nations”[viii]. Nomura’s CEO summed up international visitor’s views of Japan as “safe”, “liquid” and “cheap”, helped by a weak yen[ix].

Yen sandwich?

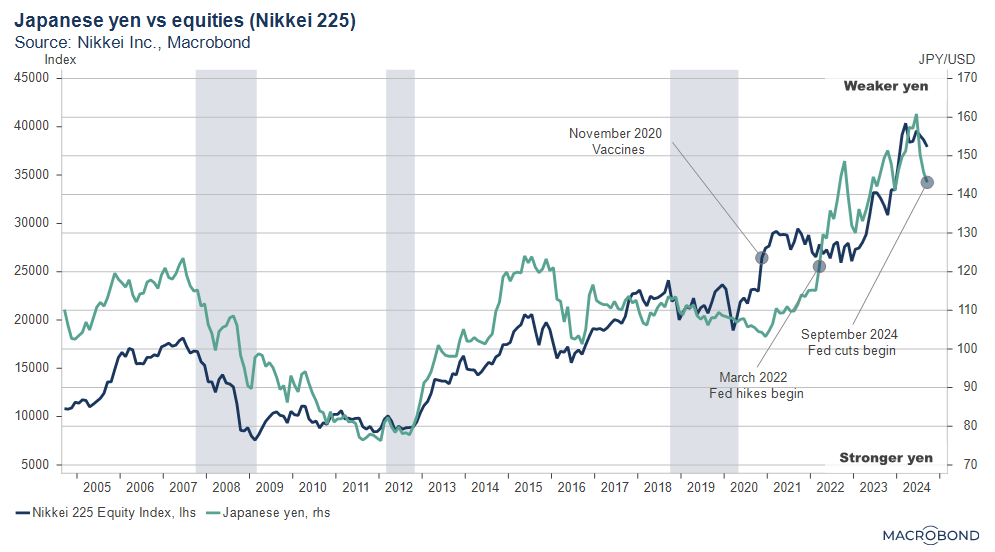

Initial statistics showed that January’s NISA expansion went about half into Japan and half abroad. The outflows probably helped weaken the yen, which often helps Japanese equities as the graph shows.

A sharp correction this summer is often partially blamed on an unwinding of the yen carry trade, where both domestic and foreign participants had bet on a weakening yen. However, futures data in the next graph imply that foreign participants have largely reversed course and expect a stronger yen. Yet, according to some domestic analysts, this is often a sign of peaking yen strength. Also, as we indicated in “Mrs. Watanabe’s (Japanese retail’s) yen carry trade”, the yen is often led by Japanese corporates and retail “FX” investors who trade on margin. Press reports note that they are not as bullish on the yen, which often follows US Japan interest rate differentials. Recent signs of strength in the US economy imply a wide differential will continue, capping expectations of yen strength. Thus, the yen seems to be sandwiched between foreign participants’ betting on yen strength and domestic participants betting on continued weakness. As the previous graph implied, yen weakness is generally favored by the equity market.

What about Prime Minister Ishiba?

In October, Japan’s prime minister changed from Kishida to Ishiba, who came from behind with rural support to beat Ms. Takaichi, seen as a successor to (market-friendly) Abenomics. Ishiba’s surprise win caused markets to correct as he had proposed a financial income tax during his campaign and was seen as more open to rate hikes. However, fears have receded since his win, and it appears he has endorsed most of Kishida’s economic policies including NISA and the more general goal of making Japan a leading Asset Management Center. He has also placed a high priority on rural revitalization.

US-Japan relations have been a tailwind

Buffet’s reload was a nice sign of confidence in Japan’s “economic rebirth”. Strong US-Japan relationships forged during former PM Kishida have also been tailwinds. According to US Ambassador to Japan Rahm Emanuel[x], evidence includes 1) a $110 million AI partnership between top universities announced during former PM Kishida’s state visit – the first official visit by a PM since 2015[xi], 2) “Artemis progam” plans for an American astronaut to be joined by a Japanese one in a return to the moon, and 3) the previously mentioned investments from Microsoft, Google, and Amazon. Meanwhile, Japan continues to be the “No.1 investor” in the US and other joint initiatives in clean energy, cybersecurity and education are underway. New leadership in both countries may lead to some changes in the relationship.

Sources in English (Japanese sources in endnotes):

- ACCJ Journal Summer 2024 available for free as “Print Editions” towards the bottom of this link: https://journal.accj.or.jp/

[i] Historically, “shosha” were conglomerates that imported and exported goods around the world, but today they are also known for their investing prowess. Unlike typical private equity investors however, they say they are much more hands-on and accept a longer time horizon to recoup their investment (Nikkei Asia)

[ii] ACCJ Journal, Summer 2024, Page 11

[iii] https://www.nikkei.com/article/DGXZQOUB105BY0Q4A011C2000000/

[iv] https://www.nikkei.com/article/DGKKZO83379540Q4A910C2EP0000/

[v] https://www.nikkei.com/article/DGXZQOUB302Z10Q4A630C2000000/

[vi] https://www.nikkei.com/article/DGXZQOUB024BZ0S4A900C2000000/

[vii] https://www.nikkei.com/article/DGXZQOUC116UB0R11C24A0000000/

[viii] https://www.nikkei.com/article/DGXZQOUB186K80Y4A910C2000000/

[ix] https://www.nikkei.com/article/DGXZQOUB306N30Q4A830C2000000/

[x] ACCJ Journal, Summer 2024, Page 11

[xi] https://www.asahi.com/articles/ASS4901DGS49UTFK01XM.html

Related links