Insights

Record-Breaking Monthly Volume for the Three Months in a row in Clearing Service for Interest Rate Swap

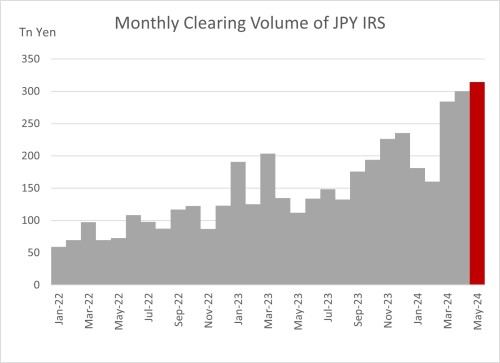

Japan Securities Clearing Corporation (“JSCC”) is pleased to announce that monthly clearing volume in its clearing services for interest rate swap transactions (“IRS”) reached 314 trillion yen in May 2024, accomplishing record-breaking monthly volume for the three months in a row from March 2024.

Since JSCC started IRS clearing service in 2012, JSCC has repeatedly improved its functions so that our users in Japan and overseas should be able to enjoy globally competitive services. Recently, we have been advancing measures for conveniences and efficiencies for users, such as enhancing STP (Straight Through Processing) from swap execution to clearing, and such as expanding cross-margins with listed interest rate products.

With the growing interest rate hedging needs in light of recent changes in the monetary policy of the Bank of Japan, through efficient and reliable clearing service by these improvements, the clearing volume has expanded since March this year hitting a monthly record high for three consecutive months.

In response to this recognition, Yasuyuki Konuma, President & CEO of JSCC, commented as follows: “We are committed to enhancing our services competitively while maintaining robust risk management standards acceptable in any relevant jurisdiction. We are glad to see the expansion of our clearing service resulting from the enhancement. We believe hedging needs of interest rates will keep growing in light of the recent Japanese Yen interest market. As a primary CCP of yen derivatives, we will continue to improve convenience and make JSCC’s clearing services widely available globally.”

About Japan Securities Clearing Corporation

In January 2003, JSCC was licensed in Japan as the first clearing organization for cash equity transactions executed on Japanese Stock Exchanges. The birth of JSCC enabled the integration of clearing processes that used to be performed separately by individual stock exchange, dramatically improving the efficiency and serviceability of the post-trading processing in securities markets. Since its start, JSCC has steadily expanded the scope of its services, and now, in addition to listed cash and financial /commodity derivatives, JSCC currently provides clearing services for OTC derivatives (credit default swaps and interest rate swaps) and OTC Japanese Government Bond transactions for outright and repo.

JSCC’s OTC derivatives clearing services are broadly used by major financial institutions, both domestic and foreign. As of May 31, 2024, JSCC has 26 Clearing Participants and 139 affiliates/clients for IRS Clearing Services.

For details on JSCC, please see the page below.

(Reference) Clearing Volume of IRS at JSCC

Related links