Insights

Can Japan exit deflation? Governor Ueda seems to think so.

By Harry Ishihara, Macro Strategist

Intro

For over 10 years, the BOJ has been seeking a virtuous wage-price spiral in the hope of exiting deflation. This year, a “lift-off” from negative rates is widely expected around April, following wage data in mid-March.

At the BOJ meeting ended Jan 23, markets focused on the BOJ’s thoughts regarding 1) wage growth, 2) inflation and 3) monetary policy. Although all tools were left unchanged, a new sentence in the Outlook Report may have been a hint of changes to come. And during a speech last Christmas, Governor Ueda stated that he expects Japan will exit deflation “this time”, citing record corporate profits, a severe labor shortage, and less deflation from abroad.

#1 Wage growth

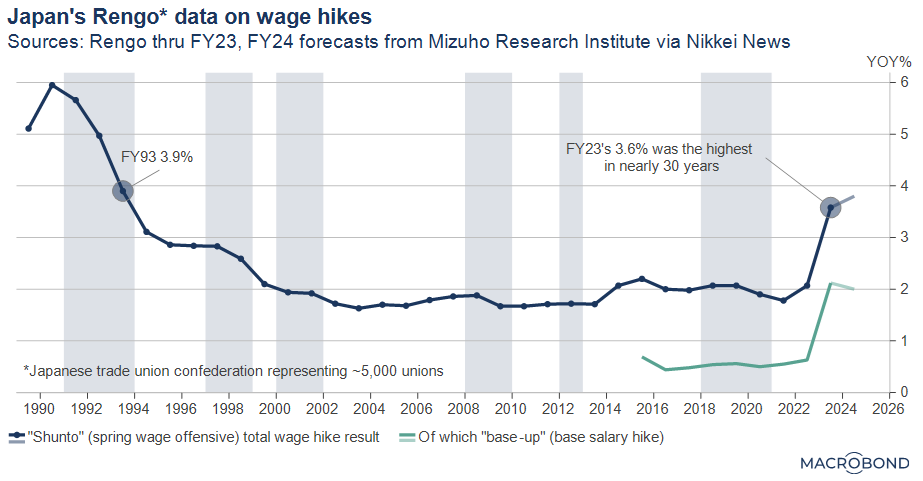

Governor Ueda and other officials have consistently pointed to wage growth as being crucial for upcoming monetary policy decisions. As the first graph shows, FY23’s wage growth was the highest in about 30 years, and FY24 may come in even higher, with some companies announcing 7 percent hikes (Nikkei news).

This year’s negotiations officially kicked off on Jan 24 with an annual labor-management forum led by Keidanren, Japan’s largest business lobby. Its big business members are being told by Keidanren to use their record profits to hike wages as a “social responsibility”. Another tailwind is an extreme labor shortage spreading across Japan. Rengo, the labor organization, is calling for “at least 5 percent” versus last year’s “about 5 percent”.

Those results will be released in stages from mid-March onwards via Rengo. Although the BOJ has been conducting its own surveys, it is believed they will wait for at least the initial release in mid-March.

But when exactly? A late March lift-off might rattle bank balance sheets which close FY23 on March 31. Also, the BOJ would probably want to “lift-off” before expected Fed cuts begin – to avoid rattling the yen. That leaves April as the earliest possible month.

At the Jan 23 BOJ press conference, Ueda continued to hint that upcoming wage data – including for SME’s – will be key.

#2 Inflation

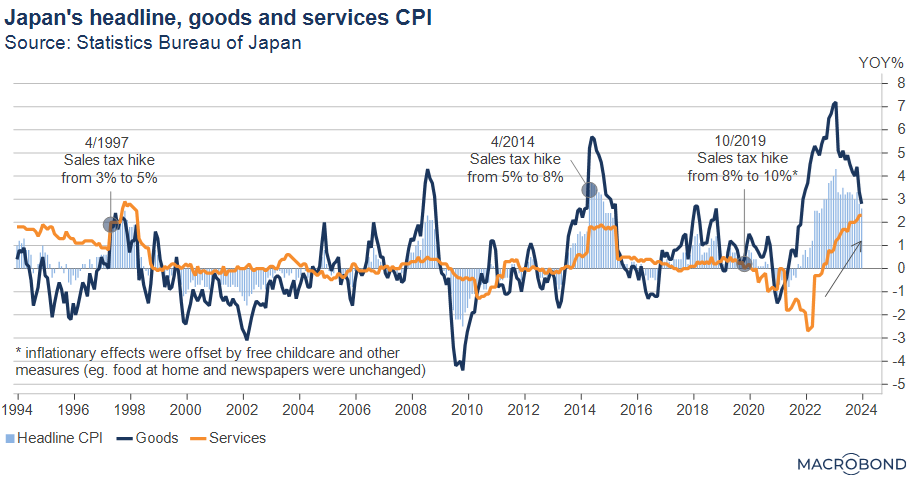

Japan’s highest inflation in 40 years (excluding subsidy effects) was initially driven by higher import prices of energy and food post-corona and Ukraine. Ueda refers to this import inflation as the “first force” of inflation movers. Since early last year however, energy subsidies, slower energy prices, and a stronger yen have tamed GOODS inflation as the next graph shows.

On the other hand, as the arrow in the chart above shows, SERVICES inflation is on the rise and has attained 2 percent, the highest level in at least 30 years excluding tax effects. Ueda refers to this as the “second force” of inflation movers . The BOJ actually welcomes this as evidence of wage growth, and more growth is expected. On Jan 22, the Service Rengo, a federation of 200 service unions, announced they will demand a record- breaking 3 percent hike in base salaries for FY24 versus last year’s demand of “at least 1 percent”.

At Jan 23’s press conference, Ueda acknowledged progress towards the 2 percent core inflation target, especially in services, but insisted it has not been achieved. This was confirmed in the Outlook Report’s median view of just 1.8 percent for FY25. However, the report had a new line that read, “The likelihood of realizing this outlook has continued to gradually rise…”

#3 Monetary policy

April will also coincide with the next quarterly Outlook Report and its inflation forecasts, which could be used to justify a lift-off. Lift-off would be the BOJ’s first-rate hike in 17 years, and would also symbolize Japan’s exit from deflation, which is a Kishida administration goal.

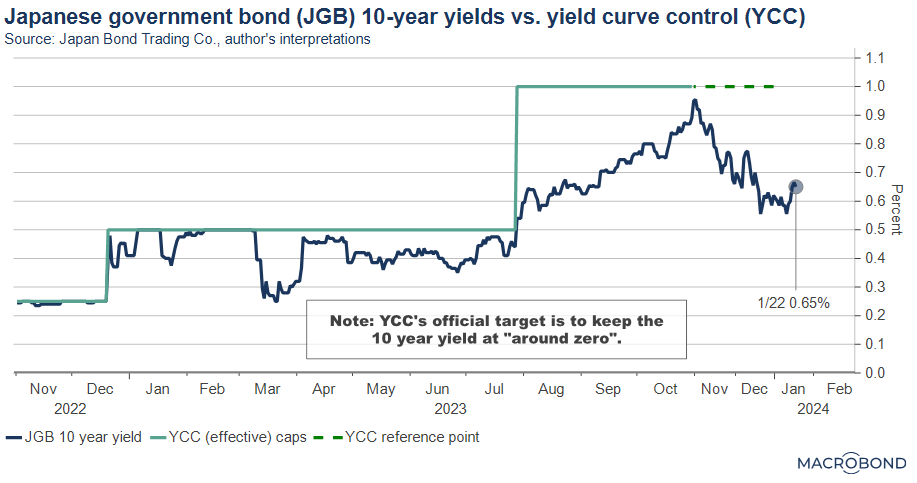

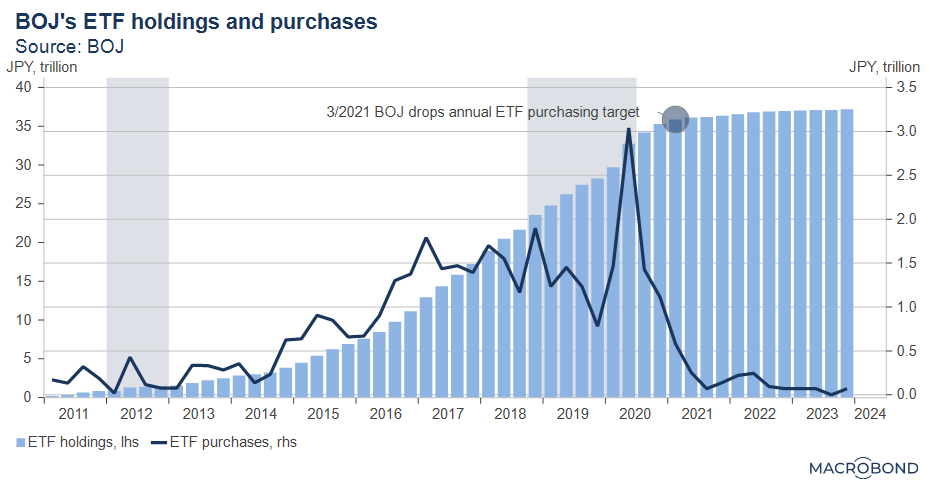

The Jan BOJ meeting ended with all tools unchanged, with Ueda keeping all options open. What about the other forms of quantitative and qualitative easing (QQE)? As the next 2 graphs imply, Yield Curve Control (YCC) is seen to be near defunct at the moment, with yields well below the effective cap of 1 percent. Similarly, equity ETF purchases have been tapered since early 2021, and Ueda recently hinted to lawmakers they may no longer be needed. The reduced BOJ market presence is generally welcomed.

BOJ’s wage-price spiral ambitions

At home and abroad, the BOJ has been criticized for being “behind the curve” in tackling inflation. Real wage growth has been negative for about 20 months, and food inflation, including supermarket “shrinkflation” has been painful.

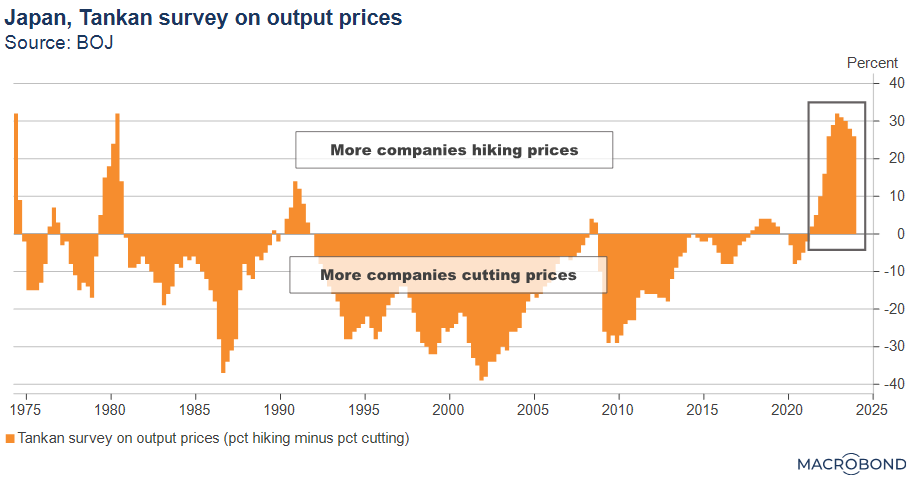

Of course, their caution comes from the preceding 30-year struggle against DEFLATION. During that time, corporates that hiked prices were punished, while those that cut prices were not rewarded.

But it seems that “zero inflation norm” is breaking. Tankan surveys in the next graph show that on net, more companies are hiking prices at net response levels unseen since the 80’s. Recently a CEO in the food industry declared that his company and others should “no longer apologiz e” when hiking prices, as “price and wage hikes go hand in hand” (Nikkei news). Meanwhile, political support for a wage-price spiral continues to be strong, with Prime Minister Kishida reportedly saying that “an exit from deflation will be huge” (Nikkei news). Government agencies are helping the spiral by issuing notices to companies unwilling to accept higher costs from their vendors, allowing them to pass on labor costs.

Ueda’s Christmas speech

Governor Ueda’s Dec 25 speech to Keidanren was more interesting, especially when he clearly stated Japan’s exit from deflation looks likely:

“I expect that this time around, Japan’s economy will get out of the low-inflation environment and achieve a virtuous cycle between wages and prices.”

He then cautioned, “In the past, there were times when moves to raise prices did not become widespread…” So, what is different this time? The current combination of record corporate profits, a severe labor shortage, and less deflation from abroad seemed to be his rationale.

Japan’s inflation revolution continues.

Related posts from this author:

Japan’s wage obsession (available here or here)

Japan’s inflation revolution (available here or here)

Related links