Insights

Understanding Japanese Investor Flows into the Global Bond Markets

By Tetsuo Harry Ishihara

Introduction

Japanese institutional investor flows into foreign bonds can affect the world markets via global interest rates. That could in turn affect the valuation of equities and other risk assets. Major drivers include the outlook for the yen and the FX hedge cost.

Size

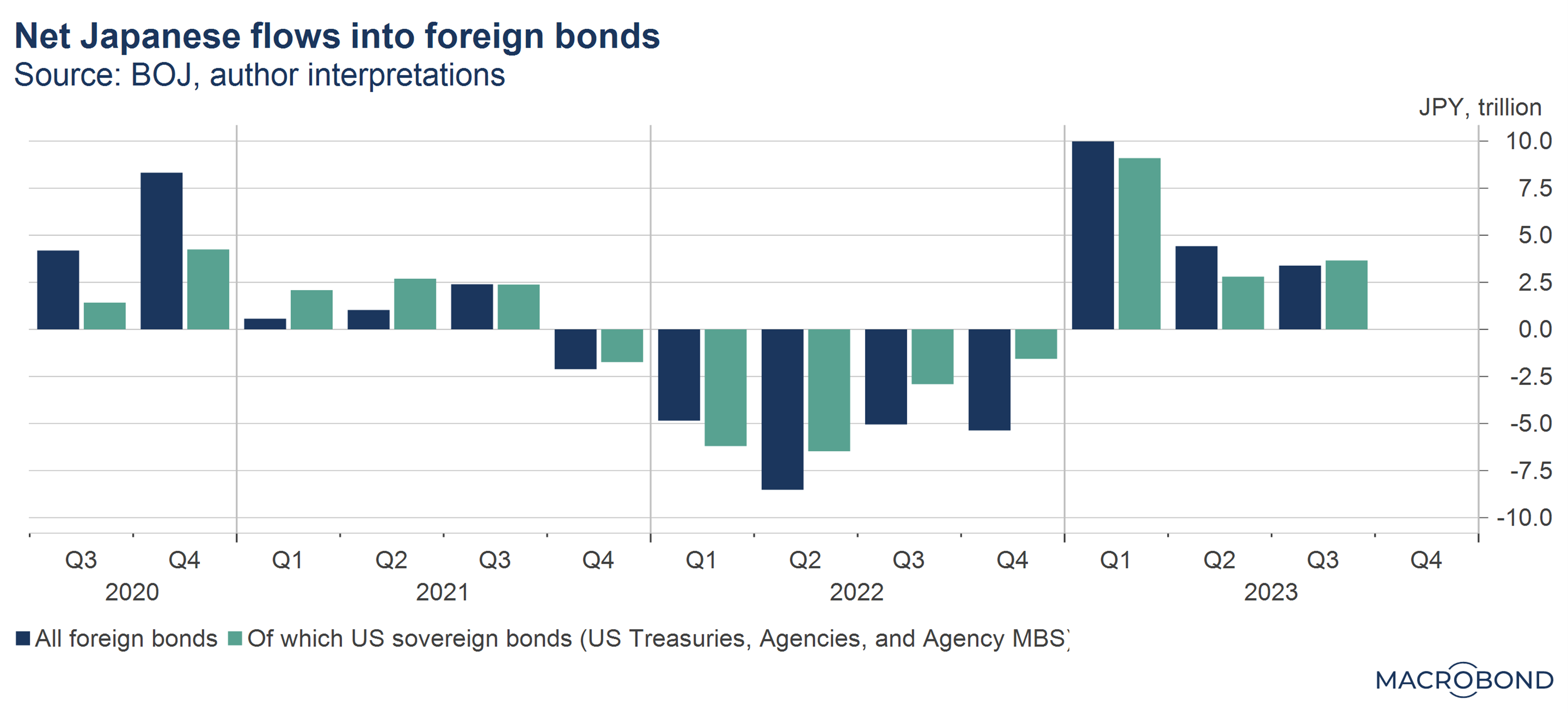

Japanese institutional investor flows[i] can affect world markets due to their size and effect on global interest rates. In some years, their trading in the US treasury market can be almost dominating – even bigger than the Fed before the spread of COVID19. Although Chinese holdings of US treasuries can sometimes be larger than Japan’s, Japanese FLOWS are often 2-4 times larger. In major bond markets in Europe and Australia, Japanese flows are widely felt as well.

[i] In this primer we will mostly ignore Japanese RETAIL investor flows. Thus when we say Japanese investors or Japanese flows, these will refer to Japanese INSTITUTIONAL investor flows.

Their effects can lead to special treatment. Occasionally, one may hear about US treasury traders traveling to Tokyo to ask clients to reduce their flows or to split up their tickets. Representatives from the US syndicated loan market association traveled to Tokyo after the Great Financial Crisis to maintain CLO flows. Some European government treasury departments have business cards and presentations in Japanese. Foreign exchange strategists from Italy to Australia keep track of Japanese flows.

Which Markets Get Affected?

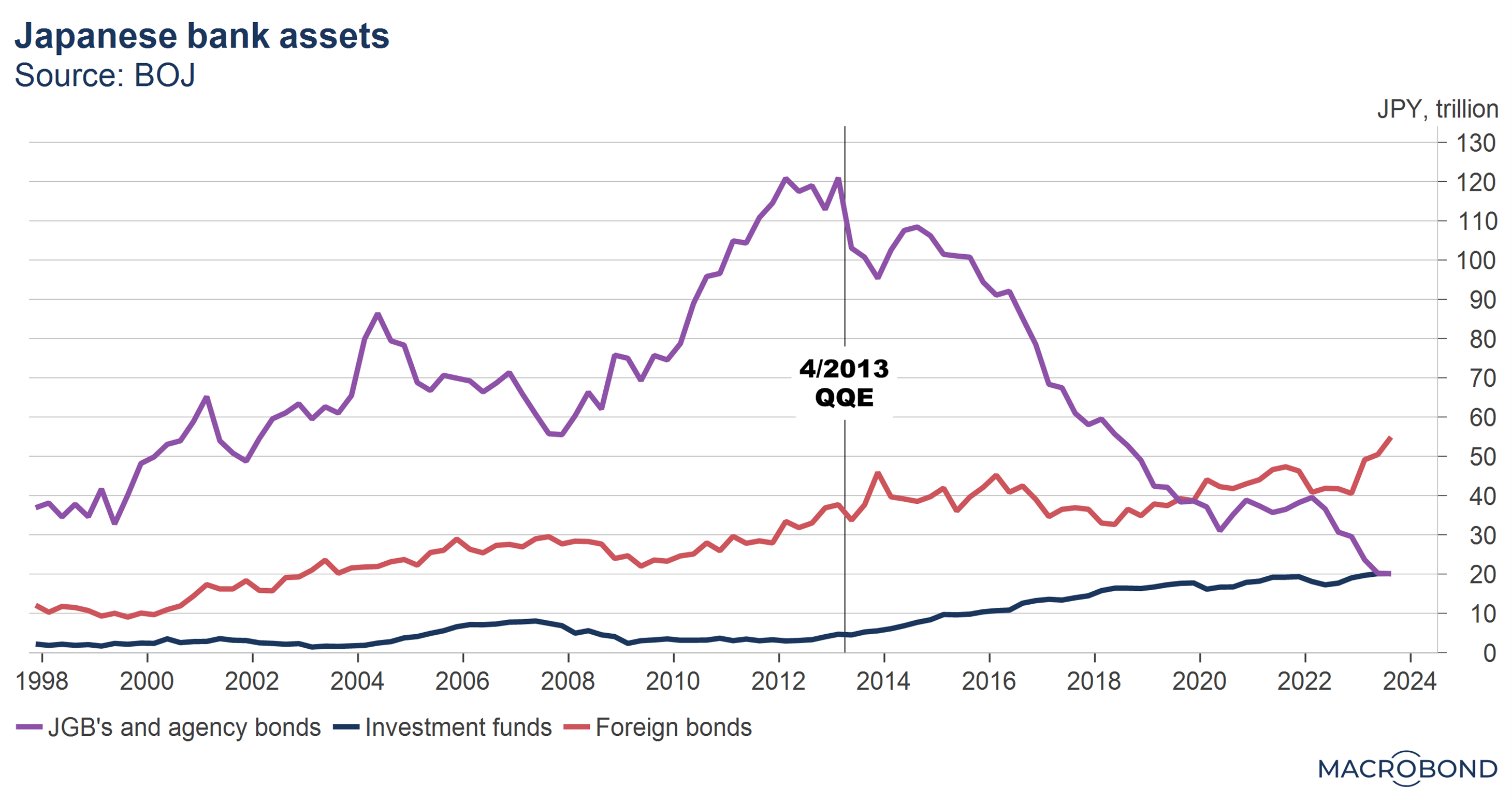

Japan’s foreign bond flows are led by domestic banks and life insurers. Banks have excess deposits that cannot be lent out domestically, while life insurers need long term yield to generate profits on their life insurance reserves[ii]. Bank of Japan’s QQE (Quantitative and Qualitative Easing) policies since 2013 drove portfolios abroad as the next graph shows.

[ii] These reserves are generated when insurance policies are sold.

In general, Japanese investors prefer large, liquid, and highly rated debt markets. When investing in foreign bonds themselves, they prefer rate risk[iii] to credit risk[iv]. Credit risk, such as US corporate bonds, is typically outsourced to asset management companies. Market size, regulatory requirements, and credit analysis limitations (language barriers etc.) drive these preferences. Thus, US treasuries followed by US agency MBS typically dominate foreign bond flows, as the next graph implies.

[iii] The risk involved with changes in interest rates, often measured by modified duration. Eg. if the modified duration of a bond is 5, this means that for every 1 percent rise in interest rates, the investor would lose about 5 percent.

[iv] The risk that the bond is not repaid, often measured by the credit ratings given to bonds and issuers by the major rating agencies (e.g., Moody’s, S&P, and Fitch).

Indirectly, US equities may also get affected, as US long term yields are used in equity valuation models. When US yields go down, equities get more attractive and vice versa. The valuation of other risk assets, such as corporate bonds, private equity and real estate, are also indirectly affected.

The Buy/Sell Matrix

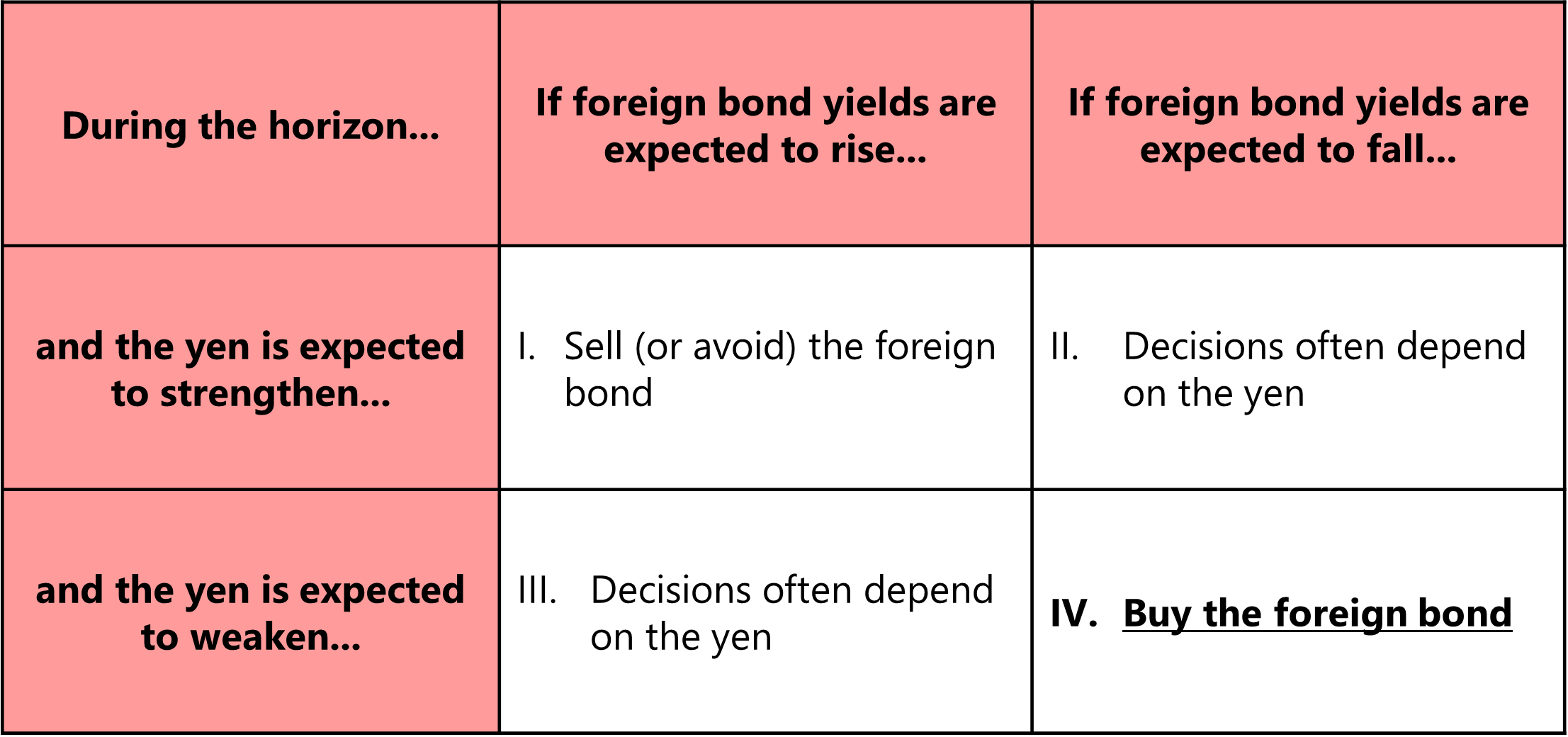

For many Japanese investors, foreign bond investments are not only based on the outlook for yields, but also involves an outlook on the yen. This could be summarized in a Buy/Sell matrix with four quadrants:

Quadrants I and IV are relatively straightforward. For example, in quadrant I, the investor will lose money on both the bond AND the foreign currency (FX). E.g., suppose an investor is buying 100 million dollars of zero coupon US treasuries at 2 percent when the dollar is 100 yen, then selling it one year later at 3 percent with the dollar at 90 yen. If the modified duration of the treasuries were 5 years, the investor would lose about 5 percent on the bond AND 10 percent on the stronger yen, for a total return of about negative 15 percent. By contrast, in quadrant IV, the investor will try to BUY to make money on the bond AND the FX.

The buy/sell decisions for quadrants II and III are more nuanced, but as the volatility of the FX market is generally higher than the volatility of yields, the best action often depends on the yen. For example, in quadrant II – where foreign bond yields are expected to fall – if the expected FX loss is greater than the expected capital gain from falling yields, the foreign bond could be sold (or avoided).

Caveats to the Matrix

It is important to note that not ALL Japanese flows are determined by the matrix above. For example, some investors have bond portfolios that are funded in the foreign currency. This would include bank portfolios funded with US dollar deposits or life insurance portfolios funded with US dollar policies. Also, some investors can use the US dollar repo market, along with other currencies.

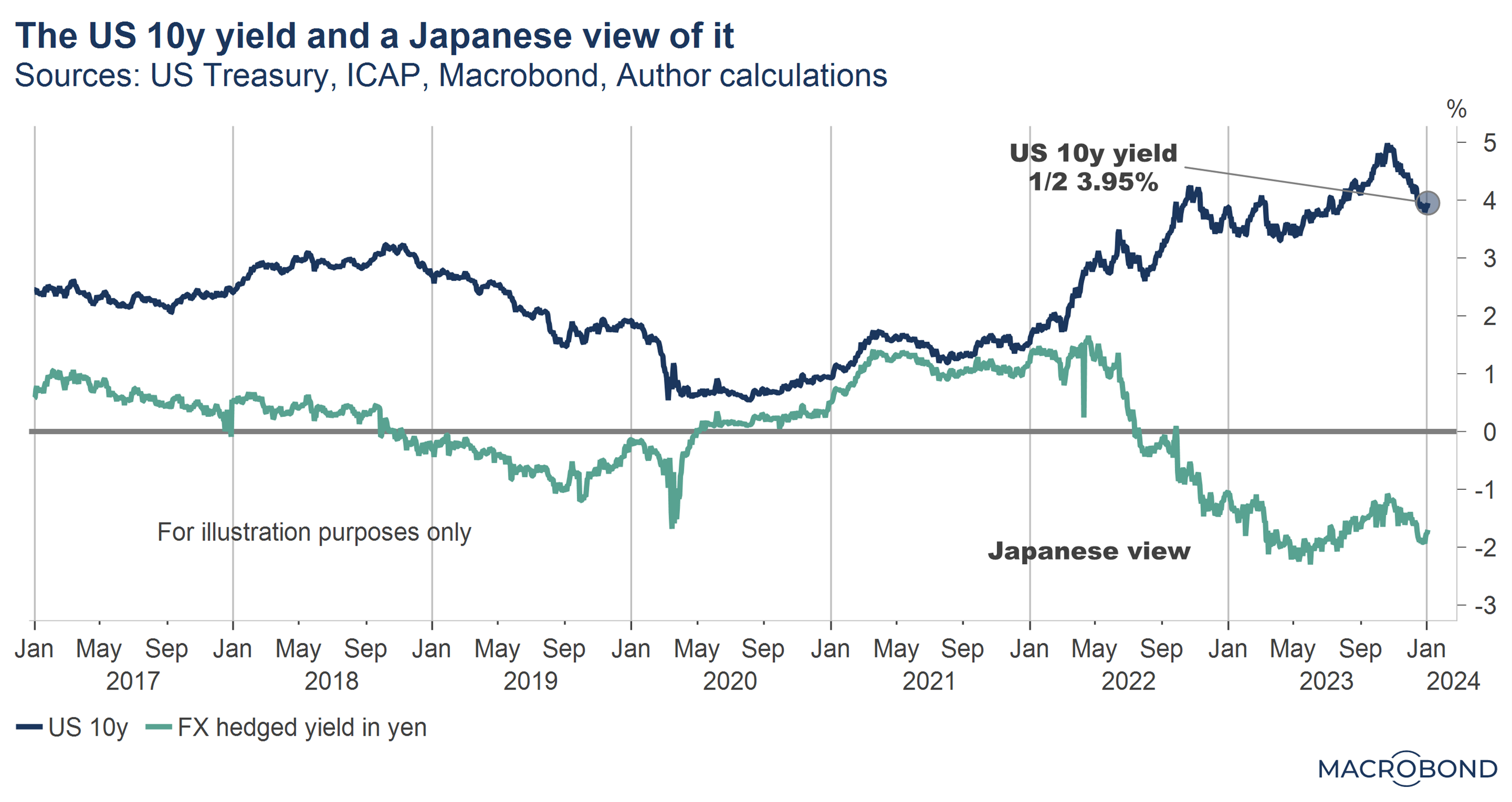

The FX Hedge Cost

However, the majority of Japanese flows have exposure to foreign exchange risk (FX risk). This risk is often hedged – or converted to yen – using derivatives such as FX forwards, interest rate swaps and currency swaps. When investing in US treasuries, a popular hedge would be to sell the dollar every 3 months using FX forwards, then annualizing the theoretical cost. This FX hedge cost is driven by the US/Japan interest rate differential and is currently around 6 percent at the time of this writing. This means a yield of 4 percent on a US treasury becomes NEGATIVE 2 percent in yen as the next graph shows. Note that in 2021, investing in US treasuries with the FX hedge resulted in around 1 percent in yen, which was attractive at the time.

Takeaways

1) By affecting global bond markets, Japanese flows could indirectly affect global equity and corporate bond valuations around the world as long-term yields drive valuations.

2) Their favorite foreign bond market is the US treasury market followed by other large, liquid, and highly rated bond markets in the US, Europe and Australia.

3) As most foreign bond investments from Japan involve taking FX exposure, investment decisions often involve an outlook for the yen, including the FX hedge cost.

What quadrant are Japanese investors in now? For US treasuries, most Japanese investors are probably in quadrant II of the Buy/Sell matrix. I.e., expecting US yields to fall but wary of the yen and high FX hedge costs.