Insights

VaR – A New Margin Calculation for Japanese Futures and Options

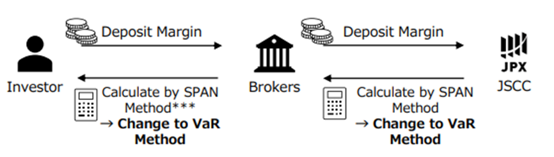

As of November 6, 2023, Japan Securities Clearing Corporation (JSCC), a JPX company, has started applying a new margin calculation method to futures and option contracts in Japan. The new method, known as VaR (Value at Risk) replaces the previous SPAN🄬 calculation (Standard Portfolio Analysis of Risks), and the margin required to be deposited by membership clearing brokers. The new calculation method is intended to shore up protections for both investors and clearing brokers by controlling sharp fluctuations in margin levels and improving risk management.

Developed by the Chicago Mercantile Exchange (CME) in 1988, SPAN 🄬 calculates margin based on 16 highly simplified scenarios. By contrast, VaR incorporates more than 1,250 data points to arrive at margin requirements. The move to VaR is intended to enhance market protections for brokers and new entrants, such as retail investors, domestic institutional investors, and foreign investors. VaR will improve market safety by applying historical data to control margin volatility, improving transparency, and optimizing margin by calculating on a portfolio basis.

As of October 2023, CME*, Eurex, OCC (US), ICE* (US, Europe) and B3 (Brazil) have adopted VaR for margin calculations for listed derivatives. Some other overseas clearing houses are moving toward adopting the method as well.

* CME and ICE are in the process of phased transition on a commodity asset basis.

Source:

CME: https://www.cmegroup.com/clearing/risk-management/span-overview/launching-span-2.html

ICE: https://ir.theice.com/press/news-details/2021/ICE-Announces-Planned-Launch-of-Phase-One-of-ICE-Risk-Model-2.0-a-VaR-Based-Portfolio-Margining-Methodology/default.aspx

What will change with VaR?

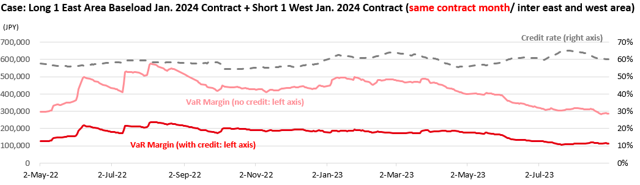

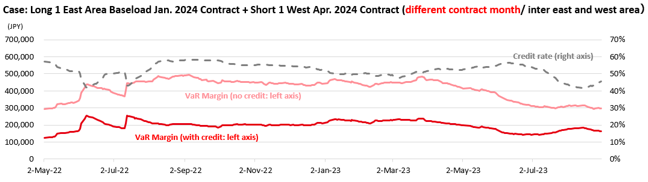

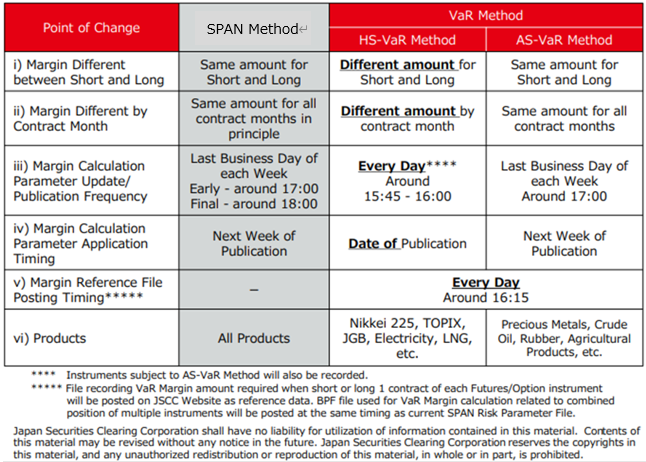

The VaR method sets margin at a level that covers 99 % of the expected loss calculated from historical data. VaR assumes that margins fluctuate daily, differ between selling and buying, and differ for each contract month. These assumptions allow for more precise risk calculations and, together with the addition of stress scenarios, help limit rapid gains and declines in margins.

When calculating margin, either of two VaR methods — historical simulation (HS-VaR) and alternative (AS-VaR) — can be used, depending on the product and characteristics such as liquidity and availability of historical data.

VaR method specifics

Ordinal or HS-VaR calculation applies a reference period (historical scenario) of the prior 1,250 days and a stress scenario to establish a margin amount that covers 99% of the expected loss under a given set of conditions.

The historical scenario is adjusted using the Exponentially Weighted Moving Average (EWMA) methodology to better reflect recent market volatility. Stress scenarios are developed based on historical data since 2008 and hypothetical data representing extreme but plausible market conditions.

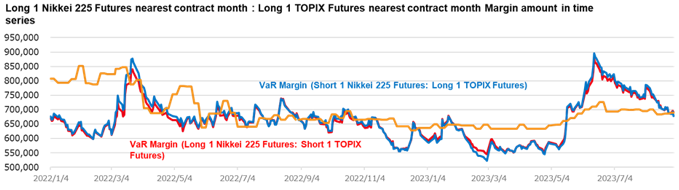

VaR does not use parameters to determine the discount rate between products as in SPAN 🄬, but rather naturally offsets the risks between products in the profit and loss calculation based on historical data. Whether or not the offset is reflected in the margin calculation is decided based on product characteristics and the relationship between products. However, with the introduction of VaR, new products** have emerged that help offset risks.

** Ex: These products are designed specifically to mitigate risk between REIT index futures/Volatility Index futures/securities options and other equity derivatives; between electricity futures of different contract months; and between electricity futures and LNG futures.

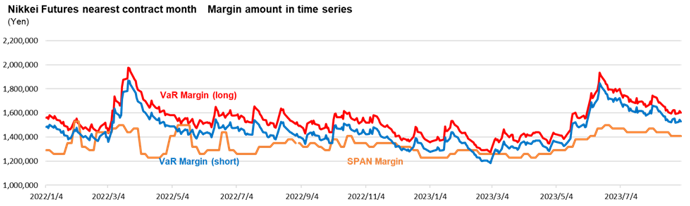

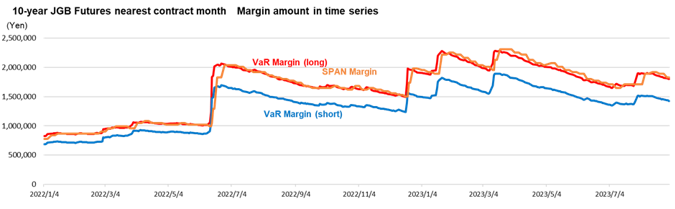

REFERENCE DATA: VaR margin amount per ticket

Equity Index Futures

JGB Futures

Electricity Futures