Insights

BOJ’s tweak and hold

By Tetsuo Harry Ishihara

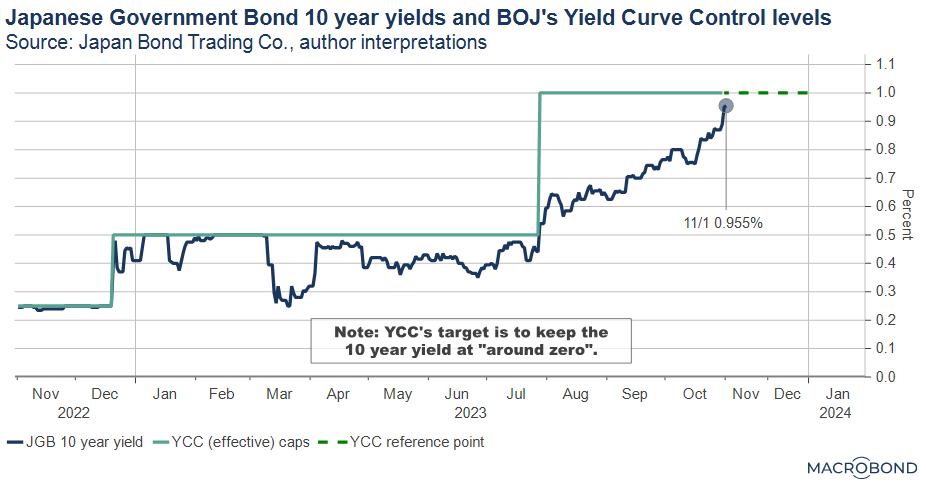

BOJ Governor Ueda hinted that he did not think markets would test their new 1 percent cap on the 10-year Japanese government bond so soon. The rise was driven by higher US yields, and domestic inflation. In response, on Halloween they made 1 percent a “reference point” and ceased their unlimited daily bond buying operation. Meanwhile, the “Negative Interest Rate Policy” was kept on hold at negative 0.10 percent. Importantly, their 2 percent target of stable and sustained inflation – supported by wages – “now feels closer”. That was evidenced by their FY2024 inflation outlook moving from 1.9 percent to 2.8 percent. Many saw that as a sign that negative rates will end sometime soon, which will be widely welcomed. Upcoming wage growth data remains key, but uncertainty remains “extremely high”.

Tweak…

At the latest policy meeting that ended October 31, BOJ Governor Ueda hinted that he did not think markets would test their new 1 percent YCC (Yield Curve Control) cap – just raised from 0.5 percent at the end of July – on the 10-year Japanese government bond so soon. The rise was mostly caused by higher US yields, followed by “stickier than expected” domestic inflation.

In response, they made 1 percent a “reference point” instead – a dotted line. The powerful unlimited daily bond buying operation that was enforcing the former cap was also suspended. This 1) prevents the BOJ from overloading its balance sheet with JGBs, 2) makes their accommodative stance more sustainable, and 3) should slightly improve market functioning.

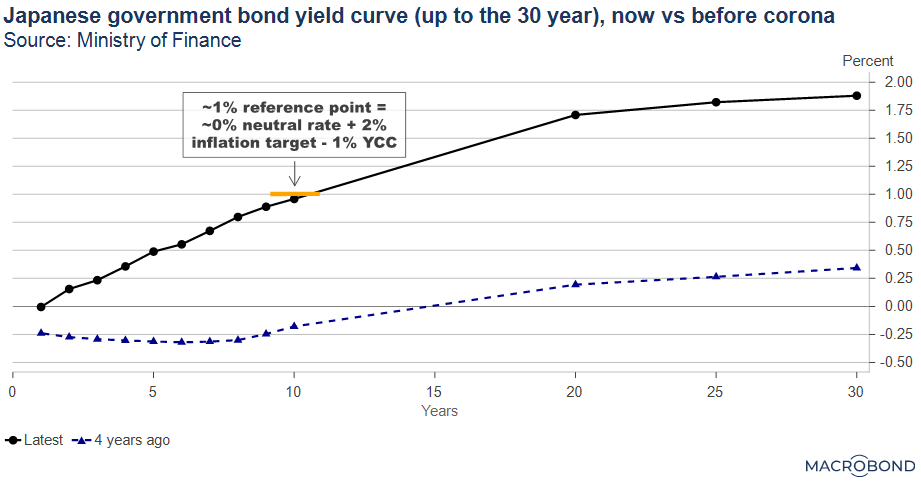

Why 1 percent? As we wrote in “Japan’s wage obsession”, a BOJ official recently explained that in theory, the 1 percent level is the sum of an estimated neutral rate of 0 plus their 2 percent inflation target minus 1 percent from YCC. The hope is that yields above 1 percent should be short lived. The new dotted line is being tested as this chart shows.

…and hold

Meanwhile, the Negative Interest Rate Policy or NIRP was kept on hold at negative 0.10 percent, along with the long-term YCC “target” of 0 percent (The “cap” and “reference point” levels give them flexibility to ACHIEVE the “target”). Those were kept on hold because the 2 percent target of stable and sustained inflation – supported by wages – “now feels closer” but is “not yet attained”. The proximity was evidenced in the change to their FY2024 outlook from 1.9 to 2.8 percent.

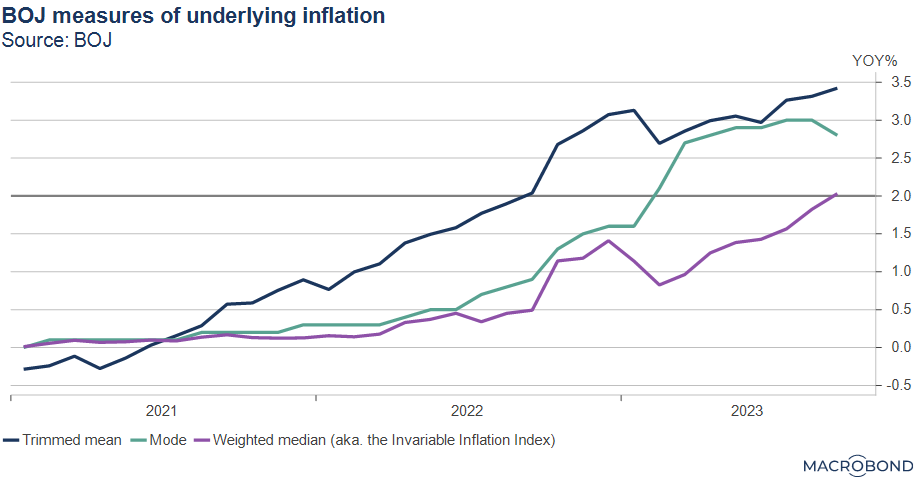

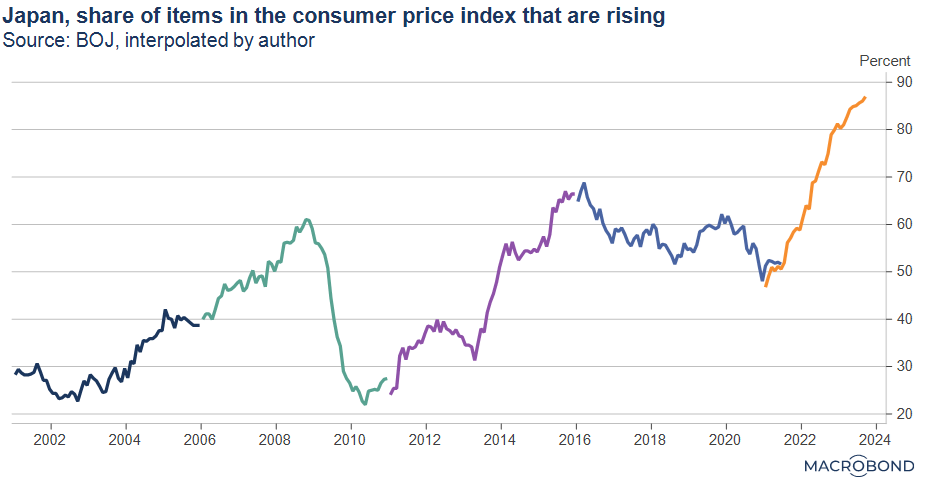

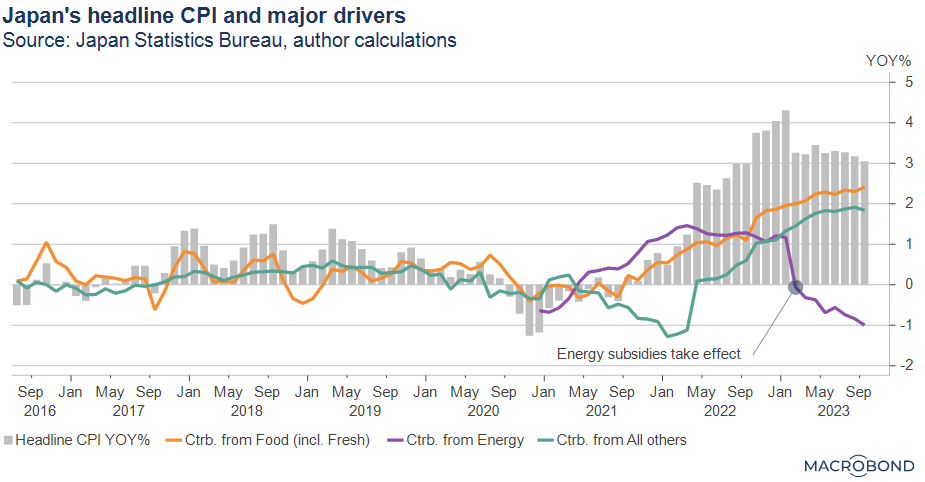

As the next charts show, critics say that even their three measures of underlying inflation – the trimmed mean, the mode, and the weighted median – have all passed the target. The weighted median’s rise is especially surprising as it had been stuck at zero for years – earning the nickname “the invariable inflation index”. Currently close to 90 percent of items in the consumer price index are rising, with Food growing at 9%, which appears to be a 47 year high. Food accounts for 2.4 percent of the 3.1 percent in headline CPI, and is by far the biggest driver.

“Our forecasts have underestimated inflation”

Flashing a sheepish grin, Governor Ueda admitted “our forecasts have underestimated inflation for so long” adding that “Although import costs have slowed, the pass through of those costs have continued for longer than expected,” “That effect should abate soon”.

Lift-off from NIRP?

The change to FY2024’s median inflation forecast from 1.9 percent in July to 2.8 percent in October was extremely important. It implies that the BOJ expects inflation to be well above target for THREE YEARS IN A ROW – FY2022 was 3 percent, FY2023’s forecast is 2.8 percent, and FY2024’s forecast is also 2.8 percent. Consensus is that NIRP will end soon, reflected in the now positive yield curve.

“A Japan with positive rates”

The BOJ followed Europe [1] into the NIRP world in early 2016. At the time, sales of fireproof home safes surged 2-3 times on the year at major hardware stores who warned, “Are you prepared for negative rates?”. Ultimately NIRP was only applied to bank reserves at the BOJ, and today, it is mostly symbolic, only applying to a tiny portion of them.

Nevertheless, lift-off from NIRP could have wide-ranging effects. One magazine featured a series titled, “A Japan with positive rates [2]”, while a newspaper headline read, “Ten-year time deposit rates increase 100 times!”…..to 0.2 percent.

[1]https://www.weforum.org/agenda/2016/11/negative-interest-rates-absolutely-everything-you-need-to-know/ This primer starts from 2012’s Denmark, but Switzerland once applied negative rates in the 1970s.

[2]A direct translation would be “A world with rates (Kinri aru Sekai)”. https://weekly-economist.mainichi.jp/%E9%87%91%E5%88%A9%E3%81%82%E3%82%8B%E4%B8%96%E7%95%8C/

Lift-off in April?

An upcoming Rengo (the labor organization representing 5000 unions) wage survey in late March “remains key”. The BOJ now has “some confidence” in wage growth. This February, Rengo called for hikes of “about 5 percent”, but next February will probably demand “at least 5 percent”. Meanwhile, Prime Minister Kishida continues to stress that “wage growth is key” for a virtuous economic cycle.

A tightening labor market is a tailwind, but it is getting extreme. Corporates giving forward wage guidance to nab recruits. Bus routes being cancelled from a lack of drivers. The Ministry of Health to begin testing shuttle services for senior citizens who want work [3], and so on.

With BOJ staff conducting their own wage surveys, a go/no-go decision could possibly be made BEFORE the Rengo survey. However, the market consensus is April at the earliest.

[3]https://www.nikkei.com/article/DGKKZO75386350Y3A011C2EP0000/

“Extremely high uncertainties”

Ueda warned of “extremely high uncertainties” without going into detail. Here are some that WE would note:

1) Wage growth could underwhelm. Corporates and unions have historically used inflation when negotiating wages. When this year’s negotiations began in February, January’s Core CPI was 4.2 percent. Now it is 2.8 percent.

2) Overseas and market developments. Eg. a) US long term rates often move the yen, which is a major driver of inflation – both upwards and downwards. B) Japan is reliant on oil from the Middle East, where a painful war has started. c) China could slow more than expected.

3) Japan’s inflation revolution. The highest inflation in 40 years has been a net positive for Japan, and the BOJ had a lot of nice things to say. Corporate profits. Corporate sentiment. Capex. Consumer spending. Consumer sentiment. Employment. Wage growth. Inbound tourism. Improving output gap. Improving potential GDP.

Yen woes are a driver

“Exchange rate volatility was a factor” for the latest tweak. The weaker yen is welcomed by major corporates but has caused inflation. For some automakers, every 1 yen of weakening improves annual profits by an estimated 300 to 400 million dollars.

About the same time as the BOJ announcement, government disclosures revealed that the Ministry of Finance did NOT intervene in early October, when the yen strengthened by nearly 3 yen in one minute after hitting 150 yen. That, combined with BOJ’s tweak and hold, caused the yen to weaken through the 151.70 level on October 31 – approaching the weakest level in 33 years.

It seems the BOJ will need to execute lift-off soon.

Related links