Insights

Japan’s wage obsession

By Tetsuo Harry Ishihara

Intro

Japan is obsessed with wages. The BOJ cites wage growth as the main condition for lift-off. Prime Minister Kishida made it a pillar of his economic package and attends union meetings. Consumers want it to outpace inflation. Corporates are striving to oblige and have record profits to pay for it. Wage survey results expected in late March are seen as key for BOJ’s next move and to sustain Japan’s recovery.

Obsessed with wages

For Prime Minister Kishida, wage growth is a top priority. He has attended major union events, assigned a former union official as an advisor, and made it a pillar of his economic package, after inflation. Tax breaks for wage hikes are being considered. Why?

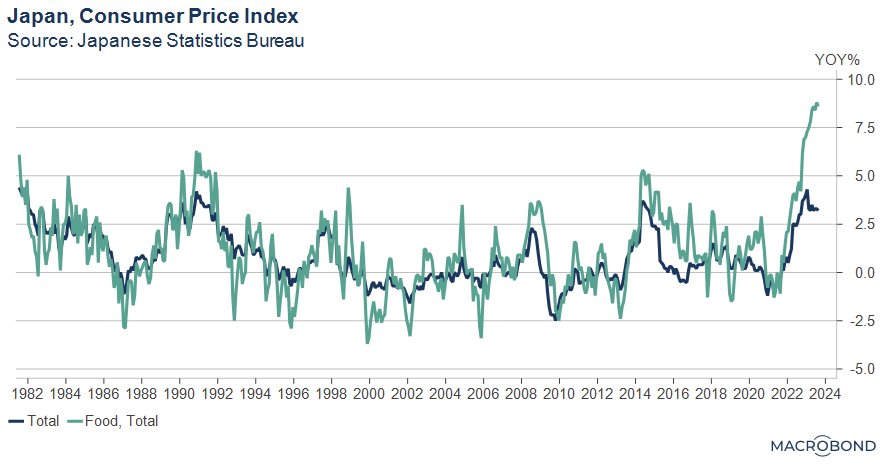

1) Voters are struggling to keep up with the highest effective inflation in over 40 years, led by food as the next graph shows.

2) It is central to his “New Capitalism” concept of “growth and distribution”.

3) “Good inflation” would lead Japan out of the lost decades, a BOJ goal.

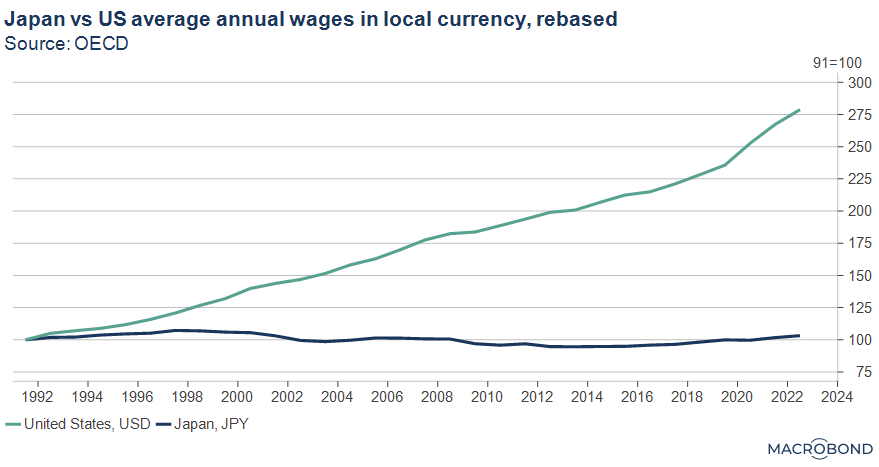

Zero inflation norm

As we wrote in “Japan’s inflation revolution”, for almost three decades Japan was stuck in a “zero inflation norm” (former BOJ Governor Kuroda). That meant that consumers punished corporates who hiked prices, while NOT rewarding those who CUT prices. Thus, the optimal corporate strategy was to keep prices unchanged, while minimizing wages to compete.

Is this time different?

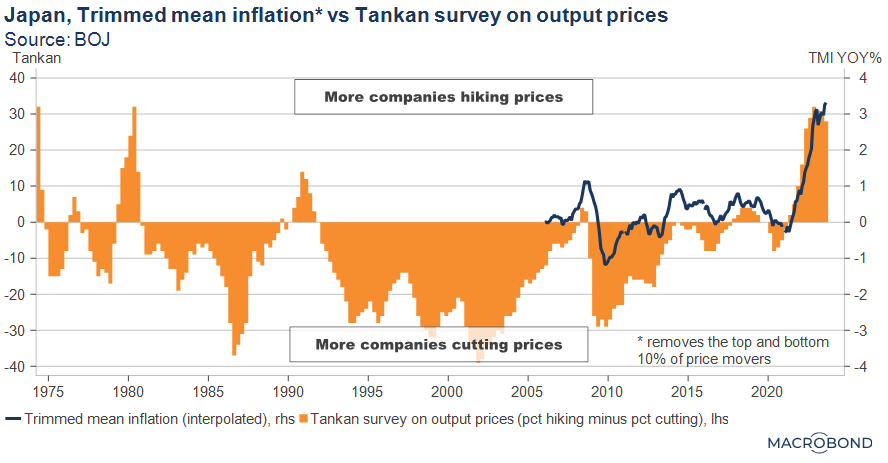

The corporate Tankan survey continues to show that the zero inflation norm may be breaking. The net percentage who say they are hiking prices remains near the highest since 1980, or over 40 years ago! Their shift seems to be driving underlying or “trimmed mean” inflation as this graph shows.

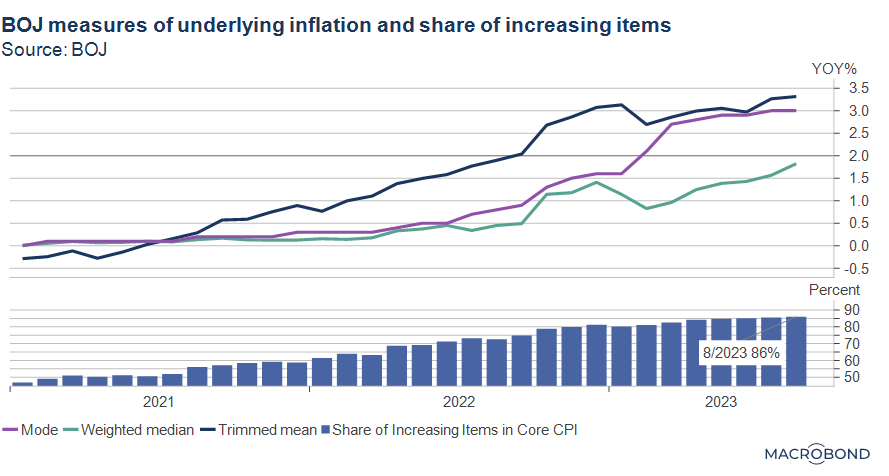

The BOJ hopes the norm is broken and cites the shrinking output gap as a tailwind. However, their continued lower for longer stance has weakened the yen to unbearable levels. As Japan imports over 80% of its energy and 70% of its calories, that drives up overall prices. For August, yearly growth in two of the three BOJ measures of underlying inflation were over 3 percent, and the last one was 1.8 percent. Meanwhile, the share of increasing items within Core CPI has hit 86 percent as the next graph shows. [1] To cope, consumers have even started to cut back on education according to NHK (Japan Broadcasting Corporation) reports.

[1]For definitions, please see: https://www.boj.or.jp/en/research/research_data/cpi/cpirev.pdf

Japanification of China?

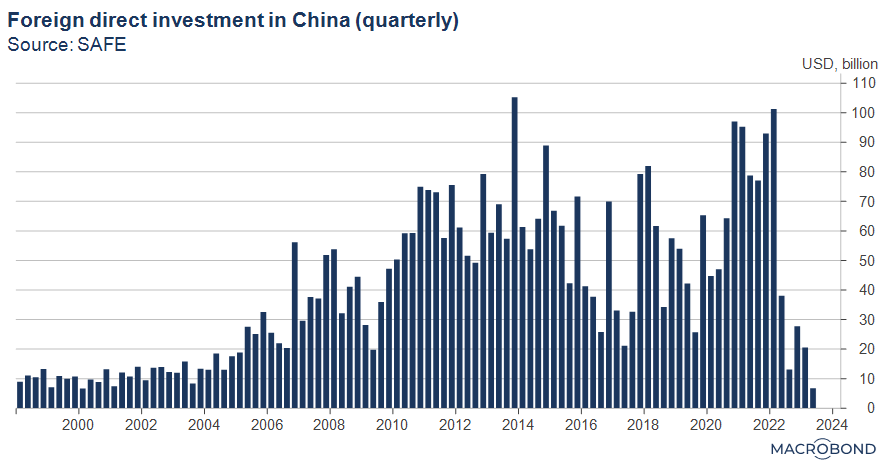

Corporate sentiment remains good, but overcast by China’s slowdown. In recent years, Japan has been sandwiched between US and China sanctions. For example, US import tariffs for China apply to products produced by JAPANESE firms in China. Even under President Biden, they average 19 percent versus 3 percent for the rest of the world, hurting export competitiveness.[2] Also, US officials note that conditions for foreign companies have worsened following the expansion of a counter espionage act this year [3]. In the second quarter, foreign investment plunged 82 percent from last year to the lowest level since 2000.

[2]https://www.rieti.go.jp/en/china/23051601.html and https://www.piie.com/research/piie-charts/us-china-trade-war-tariffs-date-chart

[3] https://www.asahi.com/ajw/articles/14994015

With Chinese growth and inflation slowing, many fret about the Japanification of China. The timeline sounds too familiar: a trade war with the US, a real-estate bubble burst, worsening demographics and an economic slowdown. Chinese corporate executives have been busy visiting management consultants in Tokyo to study how Japan coped, according to TV Tokyo commentators who visited China this summer [4].

[4]Replay available here: https://www.youtube.com/watch?v=O79FIKJdLW0

MOF hints at an important change in stance

With approval ratings at risk over inflation, the government may have intervened in the foreign exchange market on October 3. The yen has weakened 12 percent this year, and hit the psychological 150 yen to dollar level. While not confirming any action, officials made noteworthy comments after the spike. Traditionally, “excessive moves” requiring action were defined as an abrupt move over a day or week, but the Ministry of Finance said that steady, gradual yen falls over a protracted period will also be considered.

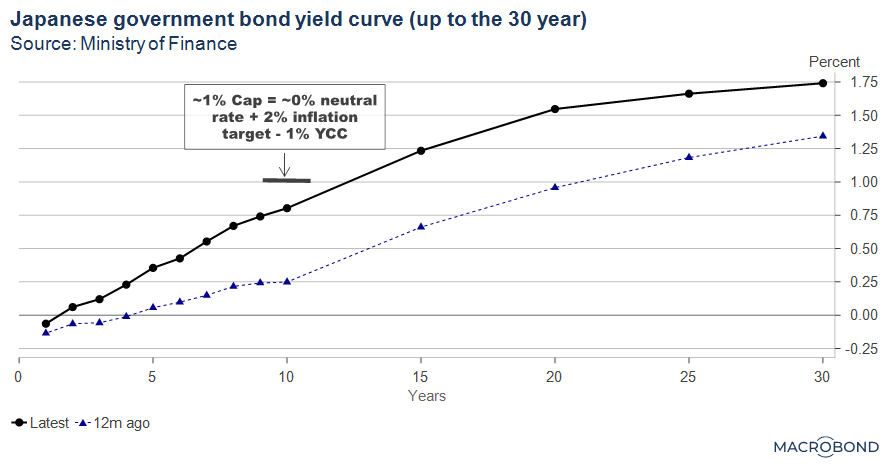

~1% Cap=~0% neutral rate+2% inflation-1% YCC

With higher US yields and speculation about more BOJ action, Japanese government yields are moving higher with investors avoiding rate risk in domestic governments and corporates. Some prominent corporate new issues were forced to launch at the high end of their announced yield range. In Q3, Japanese ten-year yields rose the most in twenty years, and hit a ten year high of 0.77 percent (Nikkei 10/6).

The bearishness was worsened by the BOJ’s surprise yield curve control (YCC) tweaks in December 2022 and July 2023, where the ten-year cap was moved to 0.5 percent, and then effectively to 1.0 percent. The current cap is reportedly justified by a modified Fisher hypothesis, which states that nominal rates should equal the real rate plus expected inflation. BOJ officials explain that a 0 percent or so “neutral (or natural) rate” plus their 2 percent inflation target minus 1 percent for YCC should equal about 1 percent, which is where they set the cap. Press reports on October 5 imply that Governor Ueda supports the logic [5].

[5]https://www.nikkei.com/article/DGXZQOGN010NY0R01C23A0000000/

Is lift-off next?

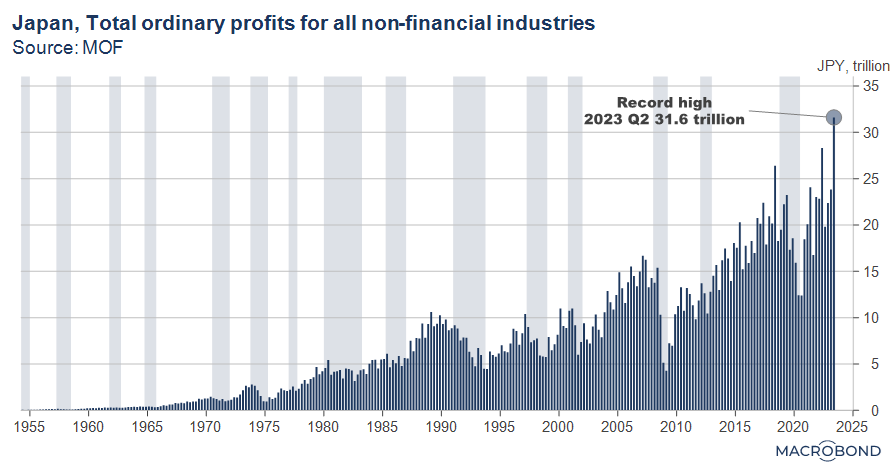

The debate about wage growth is almost deafening. One recent article blasted, “Corporates have saved enough”, “Labor’s share of underlying profits is the lowest in 49 years”, “Corporate ordinary profits rose 12% to a record high in Q2” (graph), and concluded with, “Wage growth is key to a sustained recovery” (Nikkei, 9/29).

Facing the tightest labor market in about 30 years, some companies have started giving forward wage guidance through 2030. The Nikkei newspaper’s “100 CEO survey” showed 71% citing “investing in human capital” (wages, reskilling) as the number one key to raising corporate value, well above the next highest 40% for capex.

For the BOJ, upcoming data from RENGO, Japan’s largest labor organization representing about 5,000 unions, will be key. Their initial tally on wage negotiations should come out in late March, following negotiations which traditionally start around February. If those figures show high wage growth for FY2024 following the 30-year high seen for FY2023, the BOJ could end their negative interest rate policy (NIRP). Governor Ueda, who dissented against the BOJ’s lift-off from zero interest rates in August 2000 – which preceded a slowdown followed by a rate cut in February 2001 – has stressed that “a virtuous cycle of wage and price inflation is crucial”. BOJ analysts are believed to be conducting private surveys on wage plans.

Related posts by this author:

Will markets force the BOJ to lift-off? Available here or here