Insights

Japan’s inflation revolution

By Tetsuo Harry Ishihara

Introduction

Japan’s first real inflation in over 30 years is causing a revolution across the economy. Nominal GDP, wages and corporate revenues are growing at the fastest rate in 30 years. Wage hikes may be the new norm, with companies announcing forward wage guidance like central banks. The weak yen, which was a major driver of inflation, is fueling a tourist boom, which is entering a second leg. Meanwhile, the global semiconductor shortage, which was another driver of inflation, has triggered a foreign investment led tech redux and capex could hit a new record. Behind the scenes, the Bank of Japan remains supportive.

Economic boom

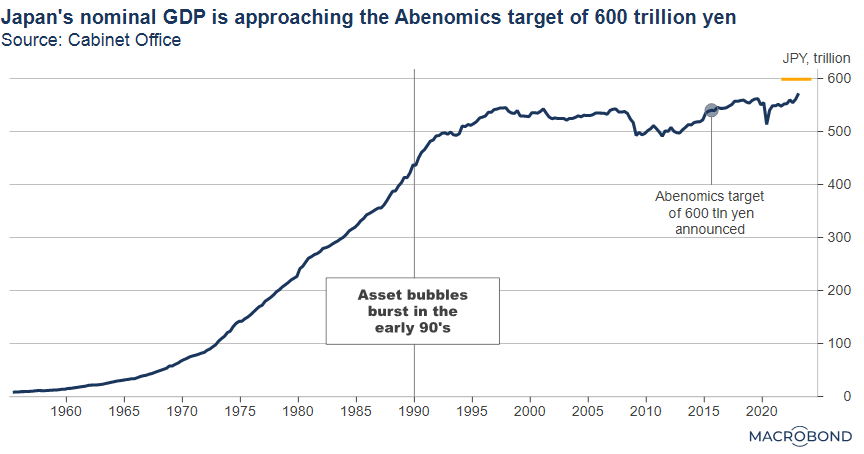

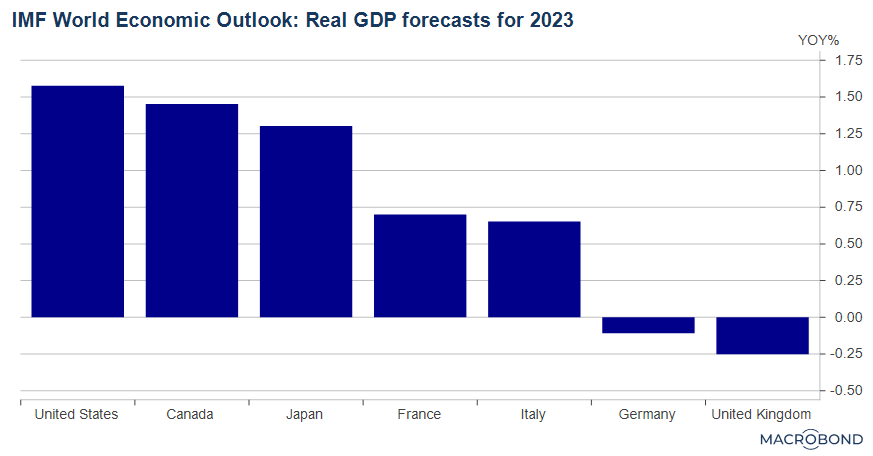

By Japanese standards, the domestic economy is booming. Fiscal 2023’s nominal GDP is expected to grow by 4 percent, the highest in 32 years (Nikkei survey). Meanwhile the IMF is forecasting real GDP growth to be the 3rd highest in the G7.

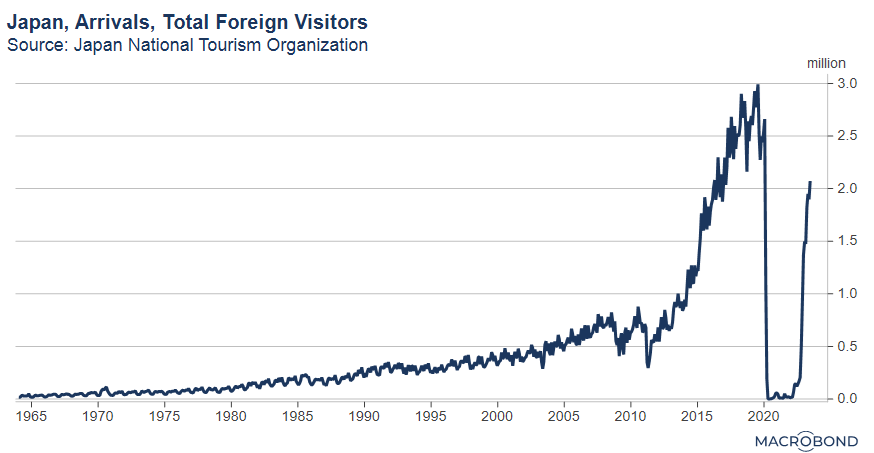

The output gap, which is closely watched by policymakers, is the difference between actual GDP and potential GDP. Thanks to the boom, Japan is about to cross over from negative to positive, or from being deflationary to inflationary. One factor is the boom in tourism, which has entered a second leg thanks to Chinese tourists according to department stores [1] . Consumer confidence has improved for 5 consecutive months, which the Cabinet Office described using the word “improvement ” for the first time in nearly ten years.

[1] Japan’s restaurants are one attraction, with Tokyo having more Michelin-starred restaurants than any other city as of 2022 (Source: Statista.com and CNBC)

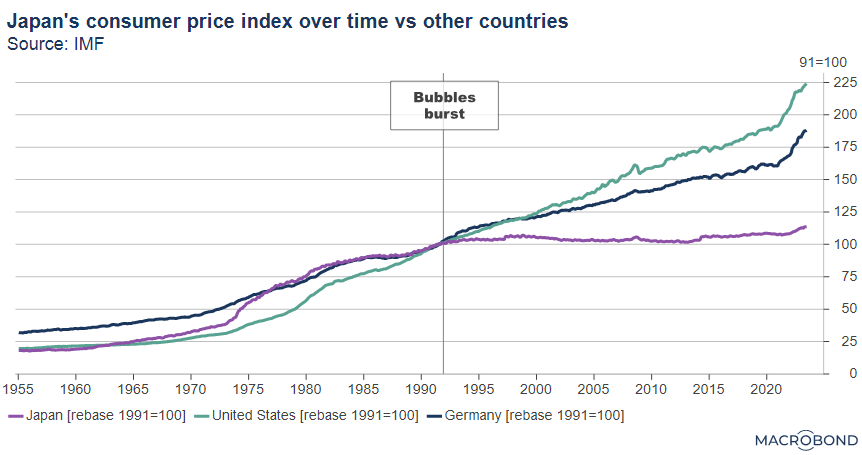

Inflation in Japan?

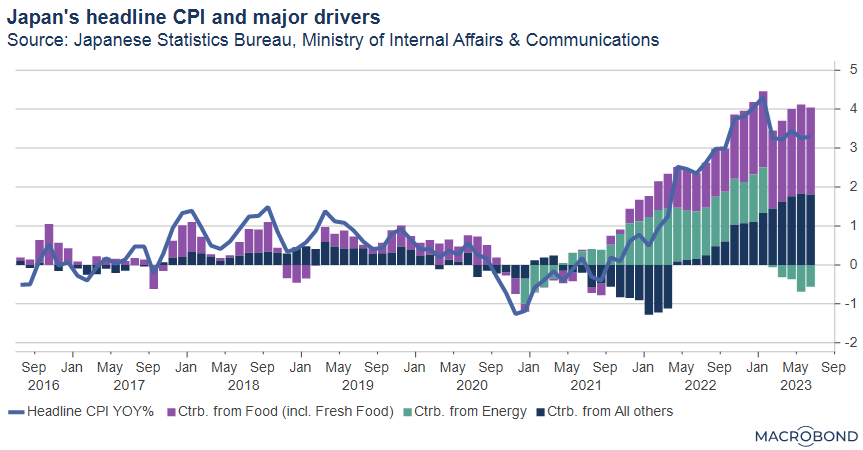

Interestingly, the trigger for the boom was inflation. Excluding subsidy effects, inflation hit 40-year highs at over 4 percent. For much of the past 30 years, it had hovered at around zero to one percent.

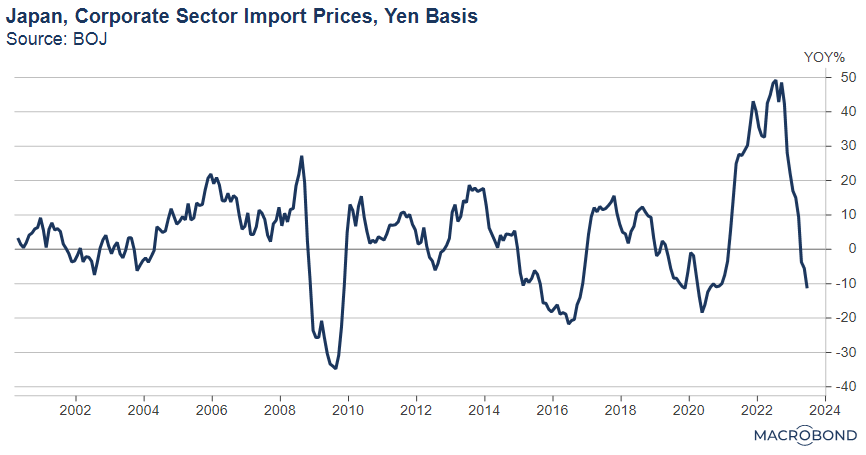

Behind the scenes, BOJ monetary policy played a role. Inflation was exacerbated by the weak yen, which was caused by the widening interest rate differential with the US. As the US hiked policy rates by over 5 percent, Japan stayed put. A weak yen boosts import prices, and as Japan imports about 80 percent of its energy and 70 percent of its calories, this sparked inflation via food and energy as the next graph shows. However, at the same time, the weak yen is helping the boom in tourism.

Wage hikes

The inflation also sparked wage hikes, which has become a top political priority for the Kishida administration. According to Rengo, which represents 5,000 unions across multiple industries, workers won the highest wage hikes in 30 years [2]. And in a surprise, both public and private sector officials acknowledge that wage hikes may be becoming the norm.

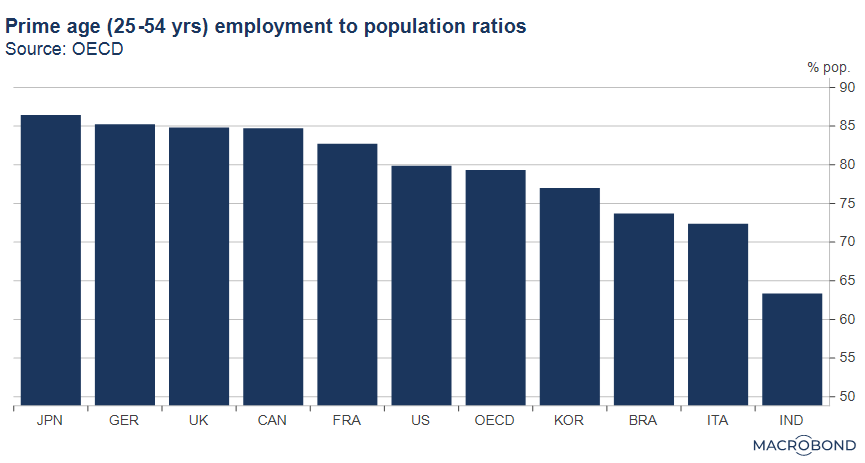

Besides inflation, this is partially due to the extreme labor shortage. Japan’s labor market tightness for prime workers (25-54 years) is the tightest among major nations according to OECD data on employment to population ratios. Major construction companies have started to turn down short term projects due to the lack of labor. Most interestingly, companies have started to announce “forward guidance” on wages – eg. “We will raise wages through at least 2027 by 4% per year” [3] .

[2]Detailed in, Sustainable monetary easing and record wage hikes

[3]Detailed in, Forward wage guidance vs AI in Japan

Real wages may turn positive

At the moment, wage growth is running below inflation, meaning real wage growth is negative. But thanks to massive energy subsidies and the yen, inflation has slowed, and if wage hikes continue, real wage growth could turn positive. As the next graph shows, import prices are rapidly slowing and are expected to drag overall inflation down with it. Food prices, which are the main driver of inflation in Japan, are now expected to slow, with the number of price hikes expected to plunge from August onwards.

Another BOJ tweak

A more controlled yen will also help inflation slow. Late last month, the BOJ announced another tweak to its yield curve control policy on 10-year yields. They will now allow yields to temporarily rise to as much as 1 percent while keeping the target range of plus minus 0.5 percent, and an official target of around 0 percent. Although the BOJ claimed this is not a move toward normalization (ie. lift off from negative short rates), the market sees the new effective ceiling at 1 percent instead of 0.5. This should tighten the interest rate differential with the US and prevent the yen from over-weakening, helping import inflation slow.

The increased flexibility is also hoped to make monetary easing more sustainable while limiting government bond purchases. The BOJ also acknowledges that the inflation target of 2 percent in a “sustainable and stable manner supported by wages” is closer to being achieved.

Corporate Japan

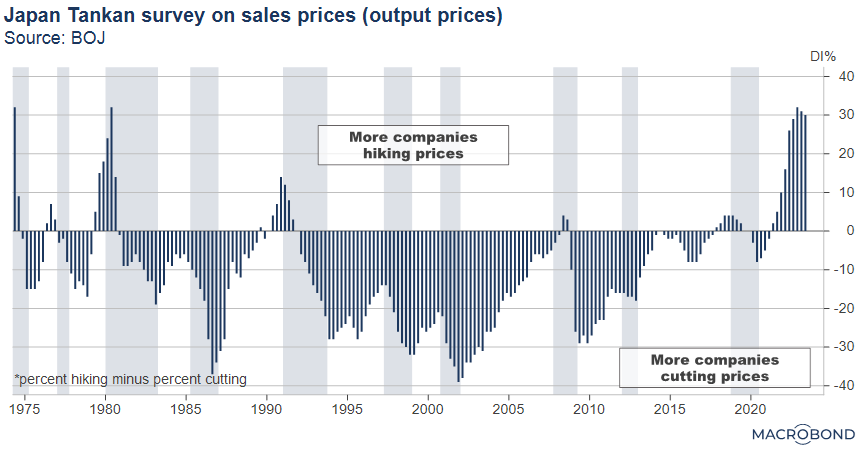

Inflation woke up corporate Japan too. The government has taken extraordinary measures to help companies of all sizes hike wages. Eg. March and September are now called “Cost pass-thru months”, where smaller companies are encouraged to pass on higher costs to their larger clients, and to report any unfair negotiations. To pay for the wage hikes, companies must boost profitability. Price hikes, long shunned in Japan for fear of losing market share in a deflationary environment, are now widely accepted as the corporate Tankan survey indicates in the next graph.

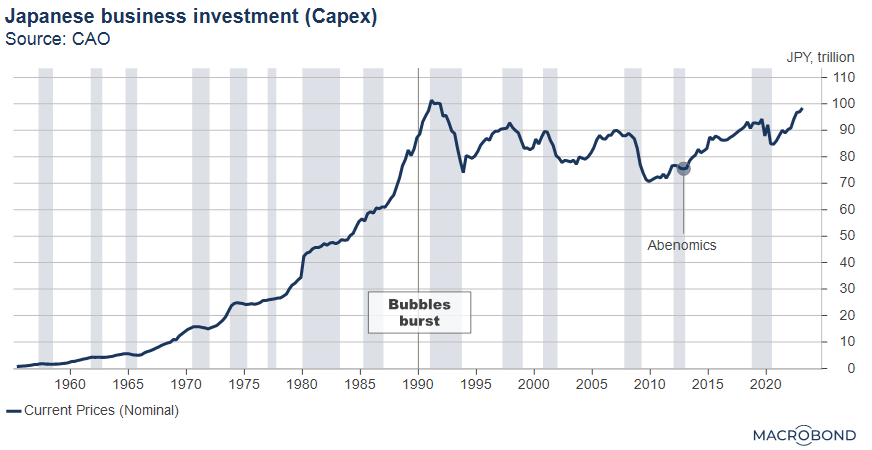

Homegrown activism among the large companies is also playing a major role. New equity index criteria triggered a move to raise price to book ratios and ROE. Along with increased dividends and stock buybacks, capex is rising and is expected to continue. According to the Nikkei news, nominal capex is on the way to pass 100 trillion yen and set a new record.

Tech redux led by TSMC, Samsung, Intel and others

Semiconductors are so industrially important that they are sometimes called the New Oil. The semiconductor shortage during corona was a driver of global inflation, even halting automobile production. Japan once dominated semiconductors and tech in the 70s and 80s, but then stagnated on the back of the Plaza Accord of 1985, the US-Japan Semiconductor Agreement of 1986, and the advent of the digital age from the 1990s. The loss of tech leadership coincided with Japan’s “lost decades”.

Now, Japan is attracting investment from both home and abroad to join global semiconductor supply chains. Examples of foreign investments from the semiconductor industry include Taiwan’s TSMC into Kumamoto, Korea’s Samsung into Yokohama, America’s Intel into Toyama, America’s Micron into Hiroshima, and Belgium’s Imec into Hokkaido. Domestic investments include Japan’s Renesas into Kofu, Japan’s Kyocera into Kagoshima, and Japan’s Nidec into Kawasaki.

Inflation revolution

The inflation revolution is showing up in hard data, with nominal GDP approaching the Abenomics target of 600 trillion yen. Meanwhile, fiscal year 2022 revenues for major corporates improved by 11 percent on the year, the fastest growth in over 30 years. Foreign investments are causing a tech redux, and this decade, artificial intelligence could nearly triple economic growth [4]. Corporate Japan and policymakers hope to extend the boom.

[4]In 2017, a report from the Ministry of Internal Affairs implied average real GDP growth through 2030 would increase from 0.9% to 2.4%. Detailed in, Forward wage guidance vs AI in Japan