Insights

Forward wage guidance versus AI in Japan

Intro:

Japanese demographics has flipped from being deflationary to inflationary, at least temporarily. As evidenced by the highest wage growth in 30 years, Japan’s labor markets have gotten extremely tight. To attract recruits, some companies have even started giving “forward guidance” on wages – all the way through 2030. At the same time, Japan is embracing AI as a solution.

Forward guidance on wages?

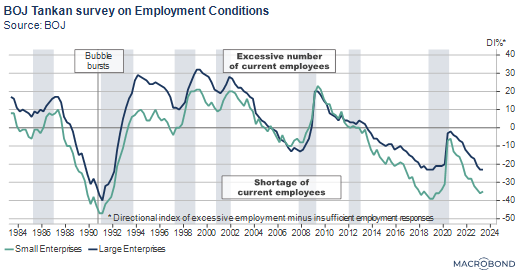

Japanese forward guidance on…WAGES? Various data confirm that the Japanese labor market has become super tight. The corporate Tankan survey implies they may soon be the tightest since the asset bubble burst over 30 years ago. Food services, information technology, and construction staff are in high demand, while truck drivers are trying to get free delivery ads banned.

To attract new recruits, some companies across multiple industries have started giving forward guidance on wages:

“We will continue to raise wages after 2024”

“We will raise wages through at least 2027 by 4% per year”

“We have agreed with the union to raise base salaries every year through 2030”

“We will raise wages by 6% in FY2024 as we did in FY2023”

“By 2030, annual compensation will be raised by 60% from 2020 levels”.

(Source: Nikkei, June 27)

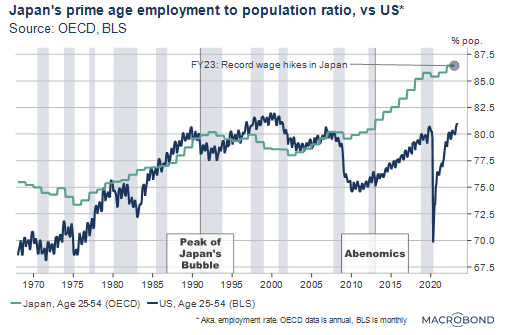

Global comparisons

Chair Powell often speaks of the labor market tightness in the US, but the important “prime” or 21 to 54 year old segment looks much tighter in Japan. As the next graph shows, the number of people employed as a ratio of the population in the prime segment is approaching 90%. OECD data for that ratio confirm Japan’s prime segment as the tightest among major nations and the tenth tightest in the OECD. Another ratio, the prime age “labor force participation rate” – meaning the labor force as a percent of the population over 16 – is also approaching 90% in Japan vs 82% in the US and 83% in the OECD.

Does the BOJ want inflation?

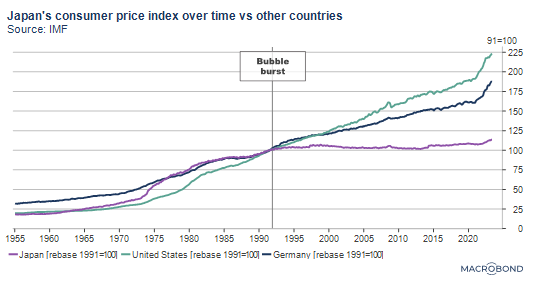

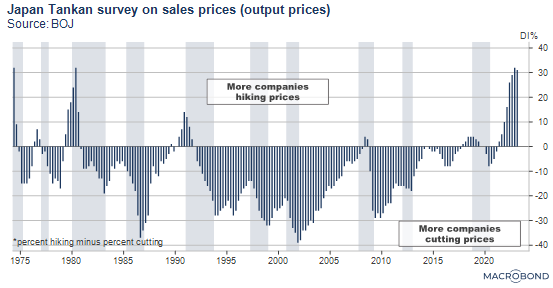

Japan’s equity and real estate bubbles burst in 1990 and 1991 respectively. The bubbles were the result of stimulative policies to fight the recession caused by the 1985 Plaza Accord and the 1986 US-Japan Semiconductor Agreement. Their burst drew Japan into the infamous lost decades of disinflation and deflation as the next graph shows.

Over those 30+ years, inflation proved transitory, but is this time different? Japan’s demographics were always seen as a driver of DEFLATIONARY forces.

However, that may be changing. Excluding subsidies, consumer price inflation is near 40-year highs, while wage growth is near 30-year highs. Producer input costs – defined as wages, producer prices and the yen [1] – may have crossed their “boiling point” thresholds, according to preliminary BOJ research [2]. They mention the “menu cost” hypothesis to explain the existence of thresholds – the classic example is the price stickiness at restaurants who avoid hiking prices and printing new menus until the benefits outweigh the costs.

Passing those thresholds, especially for sticky wages, implies companies might continue to pass on costs to consumers if their cost growth is sustained. The 9,000 enterprise Tankan survey on sales prices (output prices) may be a useful indicator.

[1] A weaker yen drives import costs higher, and Japan imports about 80% of its energy.

[2] T. Sasaki, H. Yamamoto and J. Nakajima (2023), Nonlinear Input Cost Pass-through to Consumer Prices: A Threshold Approach, Bank of Japan Working Paper Series

Top priority = wage growth

Meanwhile, wage growth continues to be a top priority for policy makers, who are embracing the signs of change. The BOJ has pursued 2 percent in “stable and sustained inflation supported by wages” for over a decade. Post corona inflation started with cost-push or “bad” inflation, but the goal is to attain demand-pull or “good” inflation [3]. Wage growth, which is sticky, is seen as essential.

In the quest for good inflation after 30 years of fighting DEFLATION, the Ueda-BOJ is letting inflation run hot by supporting wage growth. BOJ support from the Kishida administration is fanning the flames by calling wage growth the absolute top political priority.

[3] Detailed in, As Ueda takes the helm of the Bank of Japan, do record wage hikes finally portend “good inflation? and Sustainable monetary easing and record wage hikes

Why Japan needs AI

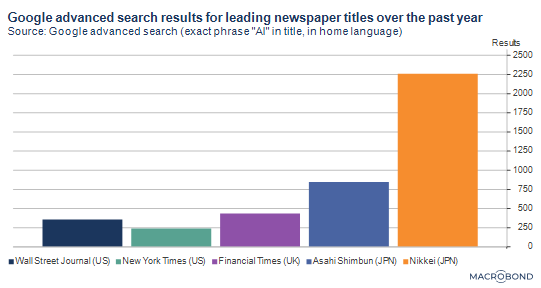

The labor shortage is also stoking excitement over AI. The fervor shows up in the high number of newspaper articles vs western newspapers through mid-June.

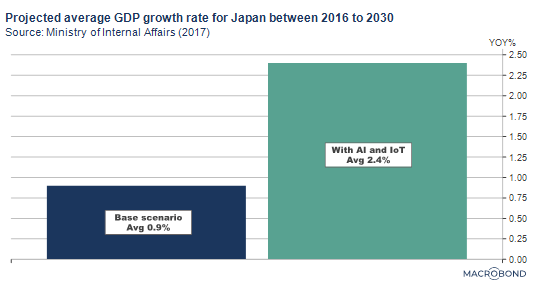

Potential GDP is driven by growth in labor, growth in capital (ie. factories) and growth in productivity. AI and robots are hoped to replace labor, boost capital and boost productivity, lifting potential GDP. In 2017, the Ministry of Internal Affairs projected AI (including the Internet of Things) would boost 2030 real GDP from 593 trillion yen to 725 trillion yen, implying the average growth rate would almost triple from 0.9% to 2.4%, as the next graph shows. In 2016, using a close approximation of GDP, Accenture made a similar projection that Japan’s annual economic growth rates would triple from 0.8% to 2.7% by 2035 [4].

[4] M. Purdy and P. Daugherty (2016), Why Artificial Intelligence is the Future of Growth, Accenture

Tech redux

AI and robots will naturally boost demand for semiconductors, or the “new oil” of the 21st century. Japan’s leadership in the 80s was badly hurt by the US-Japan Semiconductor Agreement, which enforced not only export restrictions, but the disclosure of cost structures and the acceptance of prices set by the US. Market share went to Taiwan, Korea and China. The digital age after the 90s coincided with Japan’s lost decades and hastened the slide.

However, post-corona cooperation with the US and Europe regarding semiconductor production and development is rejuvenating Japan’s tech industry. Robots and self-driving cars will probably be a focus, supported by Japan’s existing expertise.

In sum

Japan’s demographics have flipped from being deflationary to inflationary, at least temporarily. Some companies are even giving forward wage guidance to attract new recruits. Over 80 percent of CEOs are reporting labor market tightness [5]. Wages may have passed “boiling point” thresholds, meaning consumer inflation could be stickier for longer, but the BOJ remains accommodative.

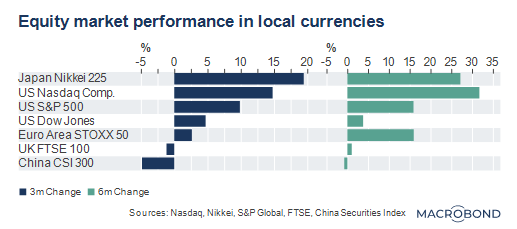

AI is being embraced as a solution to replace labor, and Japan is delighted that ChatGPT works in Japanese. Some estimates project a tripling of GDP growth. And in a tech redux, Japan is cooperating with the US and Europe over semiconductors. These sea changes – wage growth, escaping deflation, AI’s potential, the tech redux – are supporting the Nikkei’s neck and neck performance with the Nasdaq.

[5]Nikkei survey of over 140 companies, published July 3, 2023