Insights

What’s up with the Nikkei?

By Tetsuo Harry Ishihara

Introduction

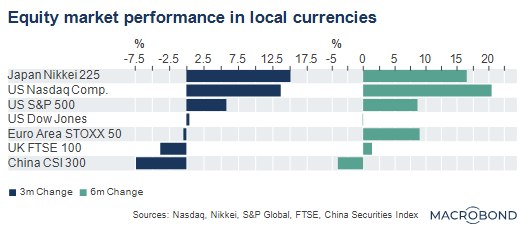

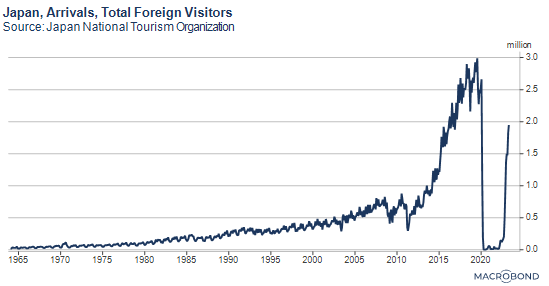

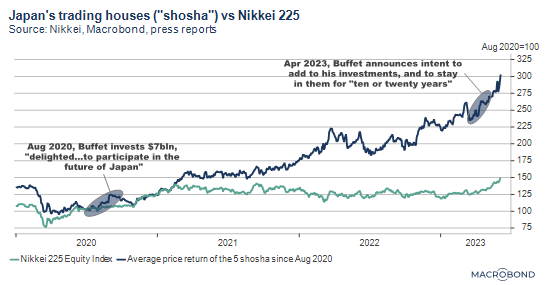

What’s up with the Nikkei, which has been neck and neck with the Nasdaq? Lots of things are up in Japan right now. Inflation, wages, earnings, tourism, home-grown activism to improve price-to-book ratios, and the dollar/yen exchange rate to name a few. Thanks to the weakness of the yen, which has been affected by BOJ policy, Japan seems on sale to foreign tourists and to foreign investors, who are driving the Nikkei 225 (graph below, data is to June 6). A recent visit by Warren Buffett helped when he said he intends to increase his investments in Japanese stocks. We look at some of the sea changes driving the trade.

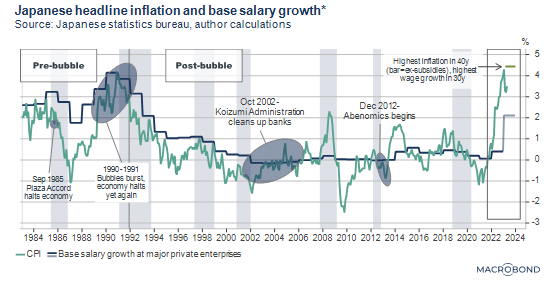

Record inflation and wage growth

Excluding the effect of 115 billion dollars worth of energy and other subsidies, inflation is at 40-year highs. That inflation, combined with fears of upcoming labor shortages, has caused a race to hike wages to 30-year highs at major private enterprises as the next chart shows.

BOJ stance

Interestingly, the Bank of Japan wants to nurture this wage-price spiral, which they have referred to as “good” demand-pull inflation, as opposed to the “bad” cost-push inflation post-corona. Since April, BOJ Governor Ueda essentially confirmed this stance, which led to a recent re-weakening of the yen.

While stimulative for the stock market, exports and tourism (next graph), a weaker yen worsens “bad” inflation via food and energy imports. Japan imports over 80% of its energy and about 70% of its calories. With the slowdown in oil, food has become the biggest driver of inflation. Surveys imply well over 2,000 food items will be hiked over the next few months, and fast-food is up almost 20% on the year.

Corporates wake up

On the other hand, inflation has lifted the possibility of escaping the “lost decades” of DEflation. Indeed, by explicitly supporting wage hikes to attain “good” inflation, Ueda seems intent on WAITING for inflation EXPECTATIONS to slowly rise to 2%.

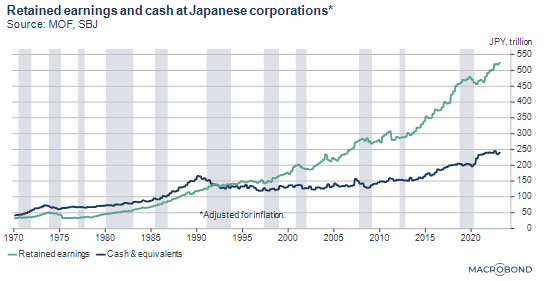

Expectations may be changing. Since the bubble burst in the early 90’s, it made sense for corporations and citizens to park their money –deflation meant MONEY was worth more over time. However, now goods and services are worth more, driving spending. Capex is apparently on the move, probably spurred by home-grown activism to lift price-to-book ratios.

Buffet effect

Excitement over Warren Buffet’s investments in Japan and his recent visit in April has been yet another driver. He increased his initial 7 billion dollar investment and announced his intent to stay in them “for 10 or 20 years”. Foreign investor flows into Japanese equities increased, pushing the Nikkei to post-bubble highs, meaning the highest levels in over 30 years. Note, many foreign investors look at the Nikkei in dollars, which has even more room to run.

Tech redux?

There is also excitement around Japan’s tech sector. For example, Chat GPT seems more welcome here than abroad, and the CEO of OpenAI held meetings with Prime Minister Kishida. Daily press reports and a new wave of books rave that the productivity from AI would boost potential GDP and offset slowing demographics. OpenAI announced their intent to open their first overseas office here, adding to the fervor.

At the same time, renewed cooperation on tech and semiconductors with Taiwan and the US has brought back memories of the tech leadership that Japan once had in the 70s and 80s [1].

[1] That leadership eroded after the 1985 Plaza Accord, which strengthened the yen, and the 1986 US-Japan Semiconductor Agreement, which imposed export and competition restrictions on Japan.

Conclusion

Along with a supportive BOJ and a bullish Warren Buffet, a salvo of sea changes seems to be driving the Nikkei. Foreign interest is said to be a driver. Market participants hope it will continue.

Related reports by this author:

“Sustainable monetary easing and record wage hikes,” April 2023