Insights

Japan’s CCP goes global

International investors are flocking in ever greater numbers to clear their Japanese yen swap books at the Japan Securities Clearing Corporation (JSCC). Their arrival is driving some big changes – within the clearing house itself and across the broader JPY swaps market

“One big development [in recent years] is that there have been many offshore hedge fund-type investors joining [us],” says Tetsuo Otashiro, head of the clearing planning department at JSCC in Tokyo. “Especially since 2018, we have increased our number of offshore clients. Those clients had a demand for more clearing, and they chose JSCC as an additional clearing house for their JPY swaps.”

Otashiro says that the interest of global asset managers and investors in client clearing at JSCC stems in part from the phased introduction of margin rules for non-cleared derivatives.

As more buy siders came in-scope, requiring them to post and receive initial margin on non-cleared trades, swaps became cheaper to trade via a clearing house such as JSCC than to trade bilaterally.

But the onboarding of international buy-side investment firms to client clearing is only one way JSCC is helping its members and their clients – Japanese and non-Japanese – to manage the growing regulatory pressures they now face when trading over-the-counter (OTC) derivatives.

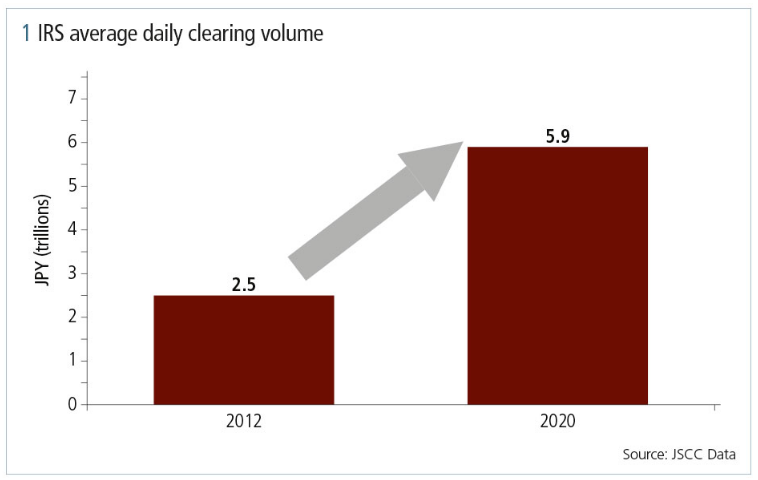

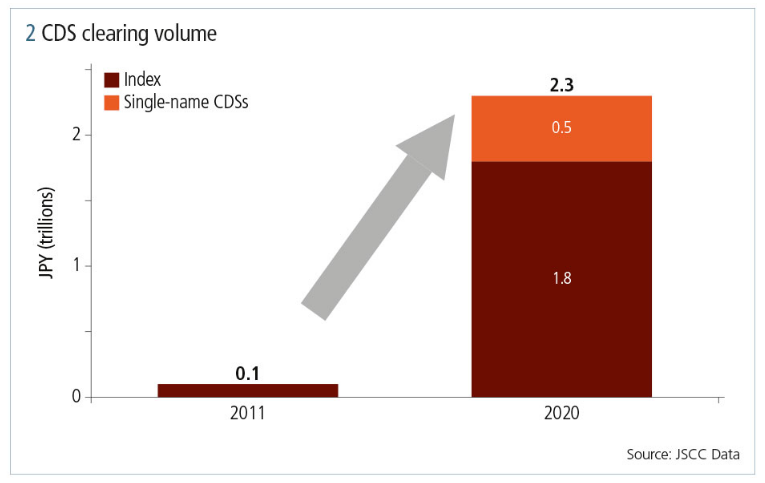

The central counterparty (CCP) has also been busy developing its suite of post-clearing services, for example, which include facilities such as trade compression that help JSCC members and their clients minimise the regulatory capital they need to set aside against their derivatives books. Another example is JSCC’s growing credit default swap (CDS) clearing service for Japanese index and single-name CDSs, where Japanese banks are now clearing CDS hedges on the credit valuation adjustment exposures they’ve recently begun reflecting in their books (see figures 1 and 2).

Looking ahead, JSCC seems destined to remain front and centre of the next big changes in the JPY swaps market – perhaps most notable of all being the transition from the outgoing JPY Libor benchmark to Japan’s risk-free rate, the Tokyo overnight average rate (Tonar), at the end of this year.

Hunting for liquidity

JSCC launched clearing for JPY interest rate swaps (IRS) in 2012, as Japan began implementing the post-financial crisis Group of 20 mandate to push more OTC trades through clearing houses. But, over the decade that has passed since that milestone, access to central clearing has grown in importance for reasons beyond mandated central clearing of standardised OTC derivatives.

The costs associated with trading non-cleared derivatives are fast mounting. Banks are required to set aside ever more punitive amounts of regulatory capital against their burgeoning derivatives books. An increasing number of large buy-side firms are now, like most investment banks, caught out by rules requiring initial and variation margin to be posted against non-cleared trades.

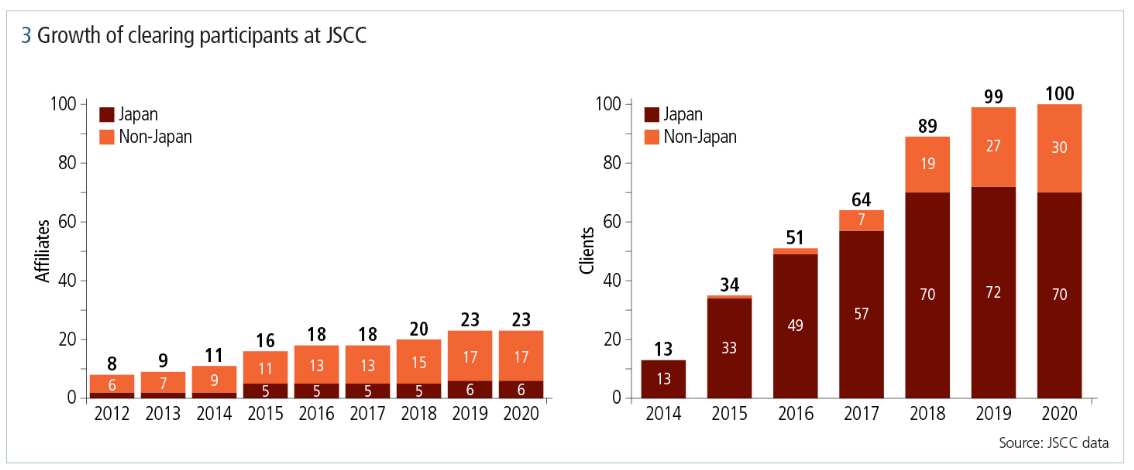

It is against this emerging regulatory backdrop that JSCC’s user base has begun to rapidly expand in recent years, driven predominantly by an influx of non-Japanese buy-side investment firms.

In 2017, for example, the number of non-Japanese clients accessing JSCC stood at seven. Then the likes of European rates heavyweights Capula Investment Management and Rokos Capital Management, and Singaporean sovereign wealth fund GIC, began to arrive. As of last year, non-Japanese firms using JSCC’s client clearing service quadrupled to 30. Over the same period, Japanese clearing clients at JSCC increased from 57 to 70 (see figure 3).

“There are clearing mandates for swaps going on globally, including Japan. Capital exposures to CCPs, under the Basel III framework, are given preferential treatment over bilateral exposures too,” says Otashiro. “So clearing is receiving more favourable treatment than bilateral exposures, and that has contributed to the general increase in clearing as the liquidity shifts from bilateral to cleared markets.”

Liquidity was, and remains, one of the key attractions for these clients. In recent years JSCC has maintained an approximately 50% market share of JPY swaps clearing globally and, particularly for longer-tenor swaps over 10 years, it has the biggest share.

The influx of non-Japanese firms at JSCC has changed the JPY swaps clearing landscape. Before they were onboarded to client clearing at JSCC, the CCP had a largely directional swap book, which was dominated by Japanese banks hedging loan books with fixed-receiver swaps. As a consequence, dealers needed to run two directional positions – one at JSCC and the other at LCH – which meant paying initial margin on hedges twice, creating a basis on JPY swaps cleared at the two CCPs.

Now the CCP’s book is more balanced – meaning dealers can more easily find counterparties willing to take pay fixed positions. This has caused a narrowing of the cost difference of clearing JPY swaps at JSCC and LCH, the other CCP in the JPY swaps market. The basis, in fact, began to turn negative in March 2019, but now sits at around zero, according to data from Bloomberg.

“The split between LCH and JSCC has driven a basis [on JPY swaps at the two CCPs], but that basis has collapsed since 2018 when we started clearing for those offshore clients,” says Otashiro.

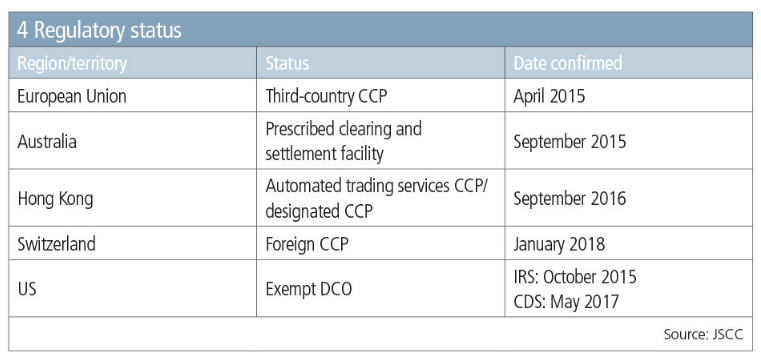

Some non-Japanese investors are known to be keen to access client clearing at JSCC, but are currently unable to because of regulatory restrictions.

In the search for higher yields, US real-money investors have been buying large amounts of long-dated Japanese yen-denominated assets in recent years. These investments are typically hedged with pay-fixed JPY IRS. However, under the regulations of the Commodity Futures Trading Commission (CFTC), US client clearing is not allowed at JSCC, and currently none of JSCC’s clearing members are registered with the CFTC as a futures commission merchant (FCM) – only US firms that are clearing members or their affiliates are permitted to clear swaps at JSCC (see figure 4).

In 2020 the CFTC came close to agreeing a regulation that would have permitted US investors to clear at so-called exempt derivatives clearing organisations (DCOs) – but it was decided further discussion within the CFTC was required to resolve some outstanding issues. One area of concern for the CFTC was that allowing US clients to clear at exempt DCOs would subject their accounts – and margin – to foreign bankruptcy regulations. However, JSCC’s segregation model, in which client collateral is placed in a trust account (see box, Protecting margin), could offer clients peace of mind that their margin is secure and protected, from both the bankruptcy of a clearing member, as well as bankruptcy of the CCP itself.

Efficiency is key

As the JPY swaps market changes, so too do JSCC’s clearing services. With new non-Japanese clients coming on board, for example, adjustments have been made to the CCP’s services for their benefit.

“JSCC is engaged in dialogue with clearing members actively through the regular working groups to develop the service in response to users’ requirements,” a clearing head at a US bank in Tokyo says. “They have enhanced client clearing services, particularly for offshore users, for example, through the documentation and extension of the clearing window. Now they have US, European and Japanese clearing brokers, and new clients are coming from Europe and Asia.

”One example of these enhancements was the introduction in late 2018 of an original English-language version of the CCP’s IRS brokerage agreement document that is executed between clearing brokers and their clients, which was previously only available in Japanese. In response to the Covid-19 pandemic, the CCP has allowed for revisions to be made to the agreement without a physical signature.

“We’re now providing documentation in English because some foreign clients may have difficulty working with documents in Japanese,” says Otashiro. “Furthermore, clients do not need to redo the paperwork for their brokerage agreement every time JSCC’s rule book is amended. As such, changes will be automatically reflected in their brokerage agreement, with these changes notified to them by their clearing brokers in advance, save for insignificant amendments.”

To help free up balance sheets and reduce minimum capital requirements under the Basel III leverage ratio for its members, JSCC is also adding to its suite of post-clearing services.

“I think efficiency is the key for banks, and especially the international banks that are JSCC’s clearing members. We have 25 clearing members at the moment, and those players clear almost every plain vanilla swap they trade. Efficiency at the CCP is crucial for them in terms of operational considerations, as well as capital. So, not only post-trade but also post-clearing services, such as compression, would be sought.”

The CCP provides a number of compression services that reduce outstanding notional exposures by tearing up offsettable trades to eliminate economically redundant positions.

There is per-trade compression, conducted daily on a client’s request, where multiple cleared trades that satisfy certain matching conditions can be unwound and replaced by a new cleared trade with a netted notional amount. Then there is so-called blended rate compression – the netting of derivatives contracts with the same maturity and cashflow dates but different coupons. JSCC also offers compression services where unwind proposals are initiated by the CCP itself, by individual members or by a third-party compression vendor.

In May, JSCC appointed a new compression vendor, Quantile Technologies, to complement the CCP’s existing third-party vendor compression service provided by TriOptima.

“We are responding to demands for efficiency from our members and providing a number of different compression services in a timely manner,” says Otashiro. “As a CCP, we want to increase the variety of vendor compression services for our members. Quantile is well regarded as a vendor, so we decided to welcome them to JSCC.”

By clearing at JSCC, derivatives users can also take advantage of cross-product margining between listed derivatives, such as Japanese Government Bond (JGB) futures on the Osaka Exchange, and OTC JPY IRS. This service, available only at JSCC, allows members to reduce the cost of their initial margin payments by offsetting the risks against 10-year JGB futures.

“JGB futures are actively traded at the Osaka Exchange and are cleared in JSCC’s listed derivatives silo,” says Otashiro. “By offering cross-product margining, clearing members can efficiently manage their exposure to JPY rates in these two very liquid markets.”

Turning to Tonar

As we head into the second half of 2021, a new regulatory challenge for the JPY swaps market is fast approaching, which the CCP is also working to help its clients manage.

In March, the UK’s Financial Conduct Authority formally announced that publication of JPY Libor is to cease by the end of 2021. Users of JPY Libor have four alternative benchmarks to replace the outgoing benchmark – a compounded version of Tonar, a term version of Tonar and the onshore and offshore Tokyo interbank offered rate (Tibor).

“We now know JPY Libor will end by the end of 2021, so we don’t have much time remaining,” says Otashiro. “Almost 90% of the swaps we clear are JPY Libor, so it is very important that we tackle this issue.”

To help clients transition out of legacy JPY Libor positions, JSCC has provided a compression reducing Libor positions, as well as establishing Tonar risk replacement trades in collaboration with TriOptima.

As a next step, JSCC is planning to automatically convert Libor-referencing swaps at the CCP to directly reference the compounded-in-arrears Tonar, instead of using contractual fallbacks and the International Swaps and Derivatives Association’s (Isda’s) industry protocol to deal with legacy contracts.

The details of this conversion are still under discussion at JSCC, but the switch is likely to occur shortly before the interbank offered rates cease publication, and would see some form of compensation paid to swaps users that see a fall in the value of their positions.

“We’ve decided not to go with the Isda fallback protocol,” says Otashiro. “We initially planned to but, after discussion with our members – and to be in line with other CCPs – we decided to have a conversion. Before Libor cessation, we plan to convert JPY Libor swaps into Tonar overnight index swaps, which will provide certainty for the transition coming by the end of 2021.”

The CCP is also closely monitoring market demand for the Tokyo term risk-free rate (Torf), which data vendor Quick Corp began calculating and publishing on April 26.

Dealers say that there could be some demand for a forward-looking term rate in the JPY loan market, due to a lack of readiness for compounded overnight rates among some clients. This could, in turn, lead to some demand for Torf derivatives to hedge those transactions.

Protecting margin

For any derivatives user signing up to a new CCP, segregation – that is, what happens to their collateral in the event of default – is an issue that matters a great deal.

While segregation models at different CCPs can vary considerably in their degree of protection, JSCC insists its approach sits at the more secure end of the spectrum.

JSCC uses a trust scheme for the collateral posted by clearing members and their clients, and for the IRS clearing service, which allows collateral to be isolated from the default risk of JSCC under Japanese law.

In the event of JSCC going bankrupt, the trust bank would return client collateral directly to each client, in accordance with payment instructions provided by an independent attorney at law. The attorney is appointed in advance as part of the arrangement and acts as an agent for all of the clients.

If a clearing member defaults, meanwhile, the impacted clients may port their positions and collateral to accounts with JSCC held by non-defaulting clearing members, subject to the prior consent from the receiving non-defaulting clearing members. Clients also have the additional option to claim directly to JSCC for the return of their collateral.

JSCC would return collateral directly to each client, after deducting only any outstanding amount of obligations that arise from the client’s own swap trades. No Japanese court approval is required, and no legal or administrative costs for the Japanese bankruptcy proceedings would be charged to clearing members and clients.

JSCC manages each client’s collateral through individually segregated accounts, where the collateral is remote from bankruptcy of clearing members and other clients clearing through the same clearing member. Once the collateral is trusted, it is protected from the bankruptcy of JSCC and of the trust bank itself. Furthermore, under JSCC’s rule book, each clearing broker should transfer clients’ collateral to JSCC without delay. That further reduces the risk, as client collateral would less likely be stuck in the account of a bankrupted clearing broker.

These measures should offer a superior level of protection. Under the US model, margin posted to an FCM by clients is combined in a single omnibus account. This means, if an FCM and its client enter into bankruptcy, non-defaulting clients may have to bear the loss, pro rata, on their claim against the defaulting FCM if the financial resources in the defaulting FCM are not sufficient to cover all of the losses.

“We are confident that our regime would provide a protection to clients that is equivalent – or superior in some respects – to the regimes in other jurisdictions. For anyone interested in our client protection regime, an in-depth comparison with the US regime is publicly available on our website”, says Otashiro. As a further option, a client and a clearing member can agree to use JSCC’s account with the Bank of Japan for the custody of collateral instead of using the trust arrangements.

Related links