Media

TCFD Disclosure Continues to Expand among Japanese Companies

In January 2023, Japan Exchange Group, Inc. published the “Survey of TCFD Disclosure in Japan (FY2022),” covering the constituent companies of the JPX-Nikkei Index 400. This showed increased disclosure in all the TCFD’s recommended disclosure categories. This article summarizes the results of the survey and other recent movements around TCFD in Japan.

In April 2022, Tokyo Stock Exchange (TSE) launched its new market segments (Prime, Standard, and Growth) partly with the aim of clarifying the concepts of each segment. The Prime Market concept focuses on companies of a certain size who keep a higher quality of corporate governance and put constructive dialogue with investors at the center of their business.

As part of this, Japan’s Corporate Governance Code was revised in 2021 to ask listed companies on the Prime Market (on a comply-or-explain basis) to collect and analyze the necessary data on the impact of climate change-related risks and earning opportunities on their business activities and profits, and enhance the quality and quantity of disclosure based on the recommendations of the Task-force for Climate-related Financial Disclosures (TCFD) or an equivalent framework.

As a result of these revisions, as well as other efforts by the Japanese government and TSE’s parent company Japan Exchange Group, Inc. (JPX), many listed companies, centered around those on Prime, have accelerated their work on TCFD-based disclosure. To shed light on how this trend is progressing in practice, in January 2023, JPX published its second “Survey of TCFD Disclosure in Japan,” following on from the first survey published in November 2021.

This year’s survey covers not just companies who have actively declared support for TCFD as in the first survey, but all the constituents of the JPX-Nikkei Index 400, meaning a wider and more representative view of the Japanese market. JPX hopes this will be helpful for companies looking to prepare their own climate-related disclosure.

Here are some of the key findings.

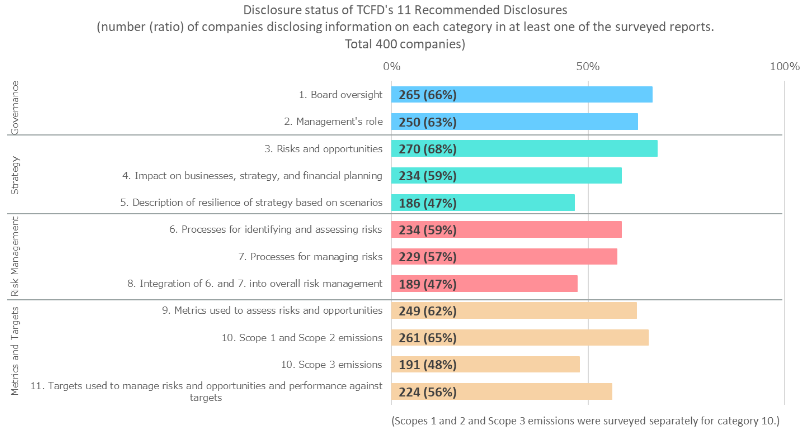

Looking at each of TCFD’s 11 Recommended Disclosures (see the full survey for these and the shortened identifiers used), disclosure was most common on 3. Risks and opportunities (270 companies, 68%), followed by 1. Board oversight (265, 66%) and 10. Scope 1 and Scope 2 emissions (261, 65%). The categories with the lowest level of disclosure were 5. Description of resilience of strategy based on scenarios (186, 47%) and 8. Integration of 6. and 7. into overall risk management (189, 47%).

For this survey, disclosure on Scope 3 emissions was counted separately from that of Scopes 1 and 2. 191 companies (48%) disclosed information relating to Scope 3 emissions.

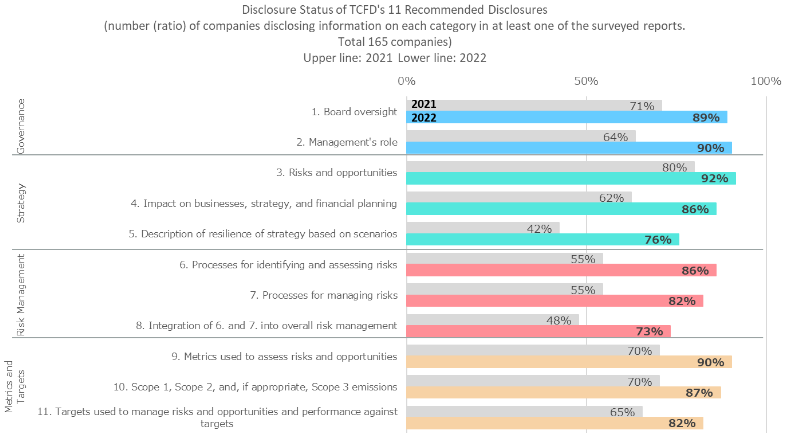

Looking at the 165 companies that were included in both this survey and the November 2021 survey (covering the 259 listed companies that had declared support for TCFD as of March 31, 2021), disclosure rates have increased in all categories. The biggest increases came in 5. Description of resilience of strategy based on scenarios (a 34-point increase) and 6. Processes for identifying and addressing risks (31 points).

By disclosure category, the categories where disclosure was highest (3. Risks and opportunities, 1. Board oversight, and 10. Scope 1 and Scope 2 emissions) and those where it was lowest (5. Description of resilience of strategy based on scenarios and 8. Integration of 6. and 7. into overall risk management) were along the same trends as the previous survey. There was no notable difference between the disclosure rates of Governance and Risk Management categories, for which TCFD recommends disclosure from all companies, and Strategy and Metrics and Targets categories, which should be based on materiality (apart from Scope 1 and Scope 2 emissions, disclosure of which is recommended regardless of materiality).

Among companies that were also included in the previous survey, disclosure has increased in all categories, and the category with the lowest rate of disclosure – 5. Description of resilience of strategy based on scenarios – had the highest rate of increase. This suggests an improvement in the availability of information that companies can use when engaging with shareholders and other stakeholders. While a company’s material issues and the kinds of information it can most easily gather and disclose depend on its attributes (size, sector, etc.) and external environment, the survey results suggest that companies are starting from wherever their circumstances allow and gradually expanding their activities and information disclosure from there.

It is important to note that this survey specifically covered four types of reports, including the Annual Securities Report, based on the TCFD’s recommendation that disclosure should be included in a company’s annual financial filings (or, in some cases, other official company reports published once a year). However, many companies publish related information on their websites in order to supplement these reports.

The regulatory environment around sustainability-related disclosure in Japan is moving at pace. In January 2023, the Financial Services Agency amended the Cabinet Office Order on Disclosure of Corporate Affairs to, among other things, add a new section on approaches and responses to sustainability to the Annual Securities Report and require disclosure of detailed sustainability-related information, including responses to climate change, under this section (partially dependent on materiality). The new rules will apply to Securities Reports covering fiscal years ending on or after March 31, 2023. In March 2023, the Sustainability Standards Board of Japan (SSBJ) announced that it plans to publish drafts of localized sustainability disclosure standards by March 2024, referencing those issued by the International Sustainability Standards Board (ISSB), which are now in the finalization stage and are expected by the end of Q2 2023.

JPX will continue to support its listed companies’ efforts to improve the quality and quantity of disclosure based on the TCFD recommendations, and in future, the standards published by SSBJ, through information provision via the JPX ESG Knowledge Hub and other platforms, as well as surveys such as this one where necessary.

The full report can be found here:

https://www.jpx.co.jp/english/corporate/news/news-releases/0090/20230120-01.html

See here for an overview of the November 2021 survey:

https://investmentjapan.jp/research/3242/

Related links