Insights

Japan’s Financial System Overhaul – Making Japan more prosperous –

Written by Harry Ishihara, Macro Strategist

Japan has been undergoing a major overhaul of its financial system, with the overarching goal of increasing household wealth. In this post we will try to simplify the numerous phrases and terms used by the outgoing Kishida Administration, and their interactions with each other. The goal of becoming an “Asset Management Center” seemed central to the overhaul, and so far, efforts appear to be succeeding. This overview should help readers understand any upcoming changes by the next administration.

Intro and backdrop

Numerous phrases and terms related to the overhaul were used by the outgoing Kishida Administration, starting with “A New Form of Capitalism”, “Doubling household wealth”, “(becoming an) Asset Management Center” and finally, the four “Global Financial Cities”.

Early in the administration, the visions of “A New Form of Capitalism” and then “Doubling household wealth” were most prominent. In essence, it seems the former was an effort to spur more long-termism in the corporate sector and to get it to invest more in its employees. This was linked to the latter goal of “doubling household wealth”.

Asset Management Center

However, later in the administration, the goal of becoming an “Asset Management Center” (AMC) became more prominent. The numerous proposals in the name of AMC often looked like wish-lists from major agencies such as METI and the FSA. These proposals included smaller ones such as making it easier to open bank accounts in English.

NISA Year One and JPX’s market reforms

However, many international investors would probably agree that the two major results attained under AMC were 1) the expansion of NISA (Nippon Individual Savings Accounts), and 2) the market reforms led by government together with JPX to spur higher corporate valuations.

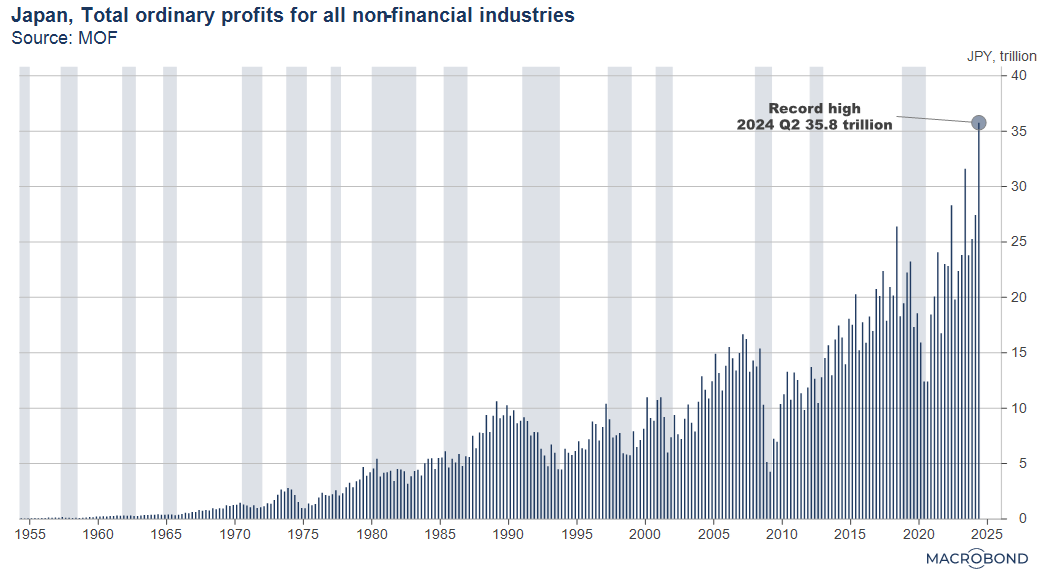

The expansion of NISA from 2024 was so major that government officials refer to 2024 as NISA Year One according to Finance Minister Suzuki. Meanwhile, the government-led market reforms especially from 2023 were widely credited for spurring Japanese valuations higher, and even inspired Korea and China according to Euromoney[i]. Corporate profits hit record highs as shown in the next graph.

Understanding the term “Global Financial City”

This year four zones were chosen as “Financial and Asset Management Special Zones” (SEZ[ii]) to assist them in becoming “Global Financial Cities”. These were Tokyo, Osaka in the west, Fukuoka in the south and Sapporo in the north, as well as their relative prefectures. The initiative aims to attract overseas financial institutions and asset management companies by improving regulatory conditions and reducing bureaucratic hurdles.

Key measures include allowing company registrations in English and introducing new visas for financial support personnel, making it easier for foreign entities to enter and operate. The number of institutions getting regulatory approvals in English is growing, according to this list maintained by the Financial Services Agency of Japan (FSA). By strengthening Japan’s position as a competitive international financial center, the government hopes to accelerate the cycle of growth from startups to established companies.

But why four cities?

According to Daiwa Research Institute and other sources, the term Global Financial City was initially exclusively used for Tokyo, as in “Global Financial City: Tokyo”. During the Kishida Administration the term was expanded to include Osaka, Fukuoka and Sapporo (and their prefectures). Apparently, this was done to spur growth more evenly across the nation.

Comparing Tokyo, Osaka, Fukoka and Sapporo

Tokyo, the capital of Japan, is also the headquarters for much of the nation’s real economy. Thus, as an onshore financial center, the bulk of assets and investments can remain in Japan. This differentiates it from offshore financial centers such as Hong Kong and Singapore, where investing mostly flows out of the country.

Osaka in west Japan is an ideal choice as a startup hub. It is the second largest city in Japan, has the largest derivatives exchange, and has a deep history of being a capital of commerce and innovation. With a historic rice futures market, it is sometimes known as the world’s first futures market. Panasonic, Sumitomo Group, Sharp and other major companies have roots there.

Fukuoka is an ideal choice as a gateway to Asia. It is a port city (Hakata port) in south Japan, with proximity to China, Hong Kong, Korea and Singapore. Besides low-cost direct flights to those regions, there is even a ferry to Korea.

Finally, Sapporo is an ideal and symbolic choice to be a Green Transformation (GX) leader. It is the capital of the northern island of Hokkaido, known for its natural beauty including the Niseko Ski Resort. The cool climate and a large land mass – about double the size of the Netherlands – make it ideal for wind turbines and the cooling of large data centers. Investments from Asia have been seen in its abundant water resources as well[iii].

In this way, we can see that the choice of cities other than Tokyo makes sense: Osaka as a startup hub, Fukuoka as a gateway to Asia, and Sapporo as a GX leader.

Make Japan more prosperous

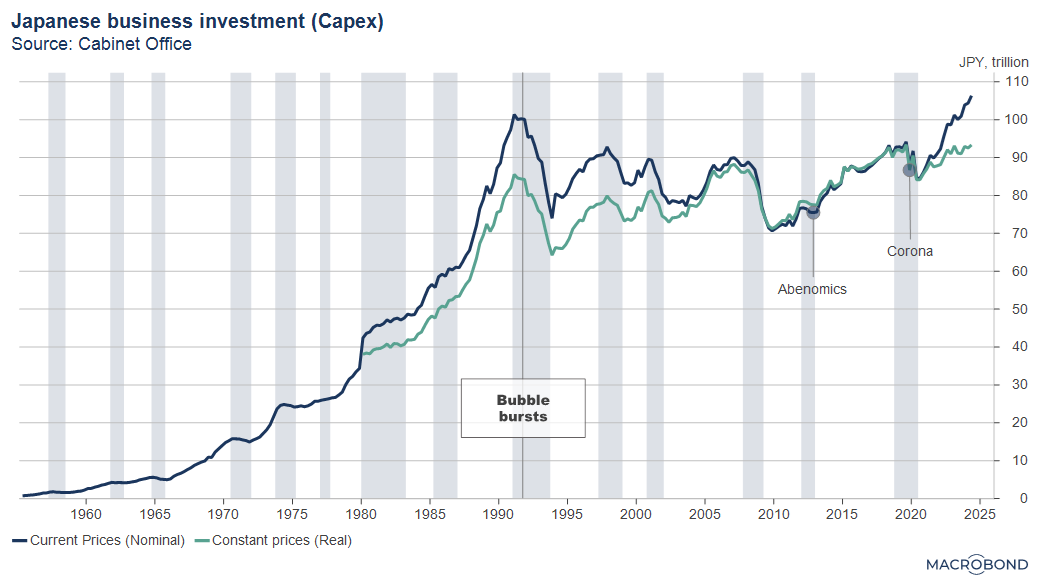

As written in past posts, Japanese retail investors (aka. Mrs. Watanabe) and institutional investors are globally influential, supporting the AMC concept. As the well-received NISA expansion and market reforms show, the financial overhaul appears to be working. Japan’s repositioning as a tech manufacturer, an inflation revolution, excellent US-Japan relations[iv], and finally record capex (next graph) are also tailwinds for the cycle of growth from startups to established companies needed to make Japan more prosperous.

Sources:

Summary of Discussions on Measures to Improve the Effectiveness of the Market Restructuring (Jan 2023, JPX Tokyo Stock Exchange)

Promoting Japan as a Leading Asset Management Center (Aug 2024, FSA Vice Minister Ariizumi’s English presentation)

“Awakening Japan’s 2000 trillion yen is the mission of finance” (Feb 2024, Finance Minister Suzuki’s Japanese interview)

Policy Plan for Promoting Japan as a Leading Asset Management Center (Dec 2023, updated Aug 2024, FSA homepage)

FSA International Financial Center Success Stories (FSA Financial Market Entry Office, last post July 2024)

[i] “How Japan’s stock market reform inspires Asia”, Euromoney, March 2024

[ii] Special Economic Zone. Although SEZ is not the official abbreviation, we feel this is more widely used overseas.

[iii] https://www.suntory.co.jp/sfnd/research/detail/2016_308.html

[iv] https://www.bloomberg.com/news/articles/2024-07-31/us-japan-alliance-robust-regardless-of-election-ambassador-rahm-emanuel-says

Related links