Insights

Japanese retail’s yen carry trade

Harry Ishihara, Macro Strategist

Summary

Japanese retail investors, or “Mrs. Watanabe”, are probably the largest spot foreign exchange traders in Japan outside of the interbank market. They are larger than institutional investors, non-financial corporates, and even hedge funds. This is due to the popularity of foreign exchange margin trading, known as “FX”, the largest retail-driven foreign exchange market in the world. Maximum leverage can be as high as 25 times, and in recent years, about 90 percent of “FX” volume was in the USD/JPY pair – which included a “carry trade”. Although difficult to prove, stop-loss like moves in popular “FX” pairs are being cited as circumstantial evidence that Mrs. Watanabe’s carry trade unwind contributed to the global equity rout.

Blaming the carry trade

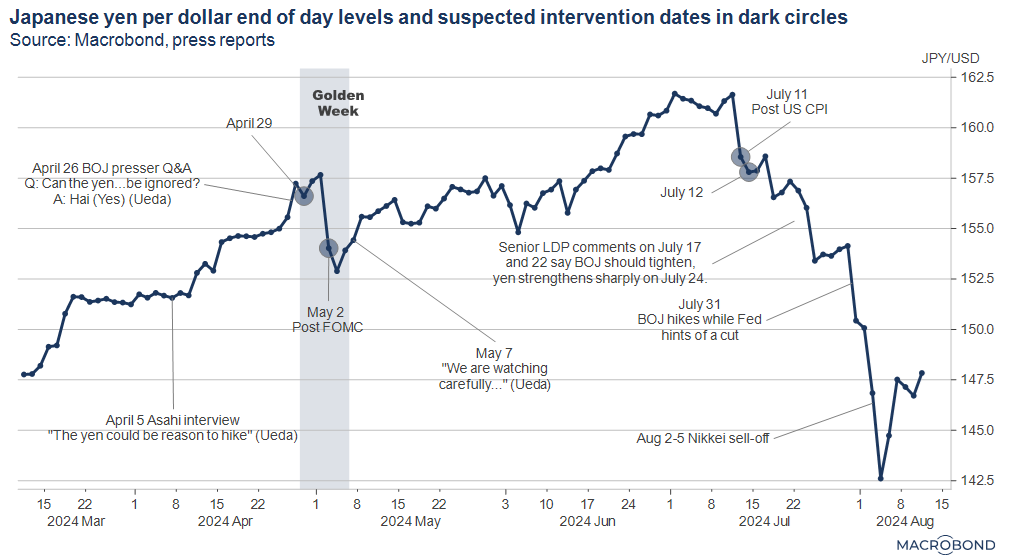

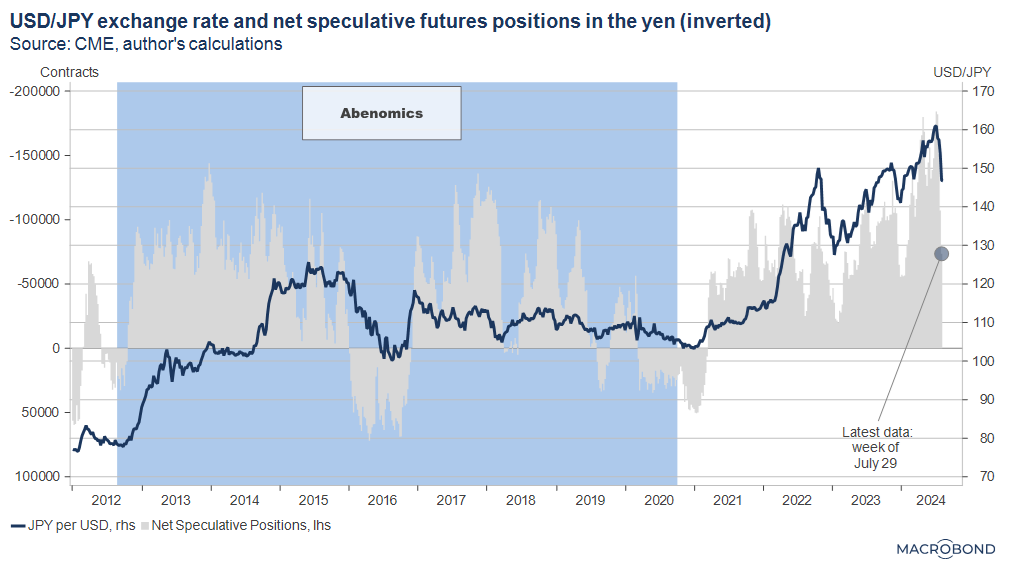

From the second week of July, the yen has surged over 10 percent against the dollar. Catalysts include suspected interventions on July 11-12, followed by jaw-boning, BOJ/Fed actions, and equity sell-offs (next graph). An unwinding of the yen carry trade – the topic of this report – is also being cited as a reason for the surge.

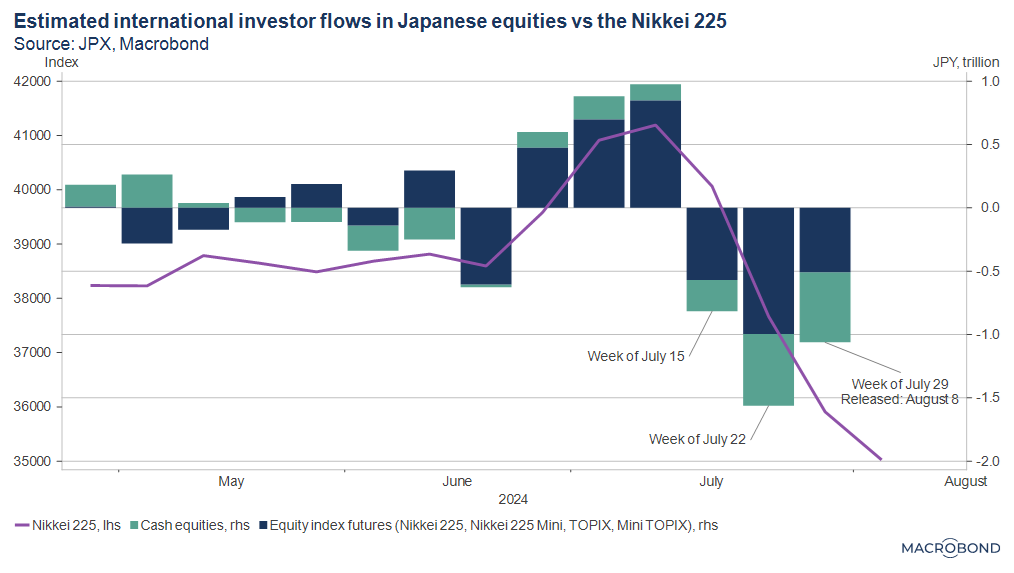

These events reportedly caused international investors to flip from multi-month high levels of net purchasing to three consecutive weeks of net selling of Japanese equities, as the next graph shows. The first week was the week following the (suspected) interventions on July 11/12 and coincided with some of the jaw-boning on July 17. The second week coincided with a US tech correction and heightened US political uncertainty. Finally, the third week saw a hawkish BOJ hike, a dovish FOMC, and a weak US employment report, including a recession warning from the unemployment rate (Sahm Rule). International sentiment often defines Japan’s market direction, due to their large share, especially in the equity index futures market.

Mrs. Watanabe basics

The carry trade is notoriously difficult to measure but is believed to have both an institutional element and a retail element. In this post, we will focus on the retail element, which is less understood outside of Japan.

Foreign exchange markets have 2 counterparty categories. The interbank market, where dealers trade with other dealers, and the influential dealer-to-customer or customer market. The interbank market is used to “cover” or reduce unwanted positions arising from the customer market (BOJ, Feb 2023). Spot-market trading, the simple trades that settle within 2 days, comprise the bulk of total volume.

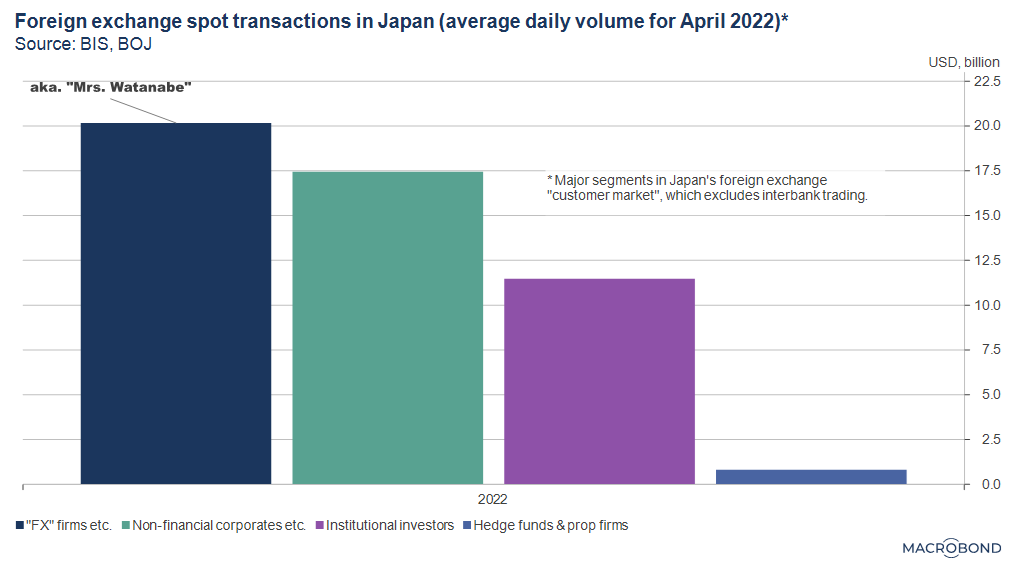

In Japan’s case, the popularity of foreign exchange margin trading, known as “FX”, appears to have made “FX” firms the largest spot trader in the customer market[i]. “FX” trading is reportedly driven by Japanese retail investors, known as “Mrs. Watanabe” abroad[ii]. The next graph, with labels used by BOJ research in June 2023, imply Mrs. Watanabe’s trading in Japan’s spot market is larger than institutional investors, non-financial corporates, and even hedge funds[iii]. Similarly, a triennial survey by the Bank for International Settlements (BIS) noted that Japan’s “FX” market is the largest retail-driven foreign exchange market in the world.

Why is “FX” so popular in Japan?

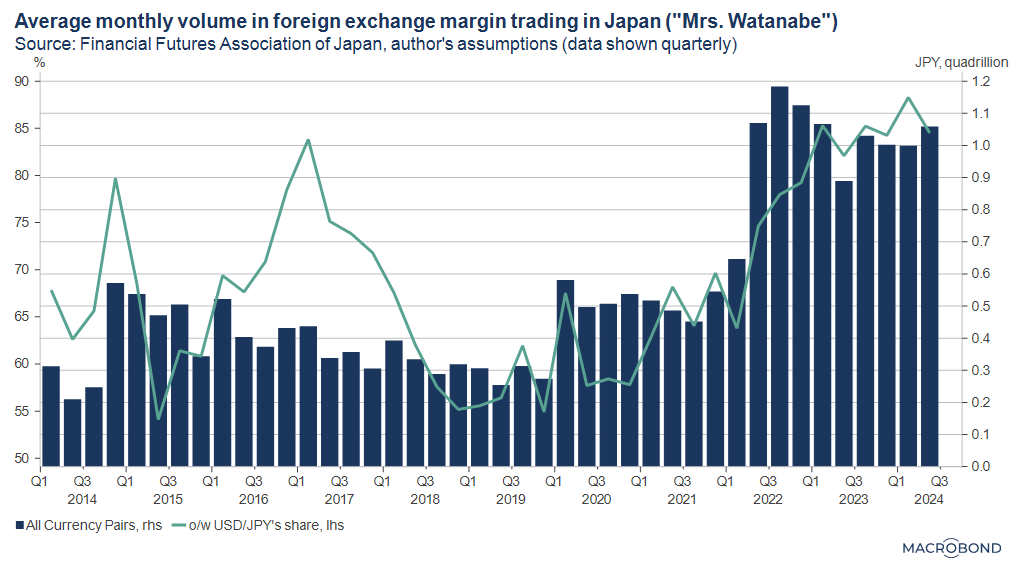

The post-pandemic weakening of the yen in 2022 caused the “FX” market to expand sharply, as the next graph shows, with close to 90 percent of volume involving the USD/JPY. The USD/JPY is the second largest currency pair in the world, according to the BIS. Since 2022, “FX” volume has been high at about 1 quadrillion yen a month, or about 7 trillion dollars.

What is driving the expansion of “FX” in Japan? FX enthusiasts say they are cheap and liquid, highly leveraged, intellectually stimulating and have a carry element, which we will explain next:

1) Cheap and liquid. Often, fees are cheap or effectively “free” (ncluded in the bid/offer spread etc.), allowing for day trading and even “minutes trading” according to BOJ research – trading within the same minute. Major firms allow 24-hour trading on smartphone and PC apps. BOJ research noted that an estimated 80 percent of all “FX” trading is less than a day.

2) Highly leveraged. Maximum leverage can be as high as 25 times[iv], and some “FX” firms allow trades from 100 yen (about 70 cents). At 25 times, a margin of 1 million yen would allow a position of 25 million yen or about 170,000 dollars, compared to a dollar denominated bank deposit of about 7000 dollars (rounded numbers using 150 yen to the dollar).

3) Intellectually stimulating. As exchange rates tend to follow interest rate differentials, some major firms offer global interest rate tables, economic indicator and central bank updates, as well as vast technical analysis tools on their homepage and apps. For example, Gaitame.com[v], who claim to be the first “FX” firm to establish a research thinktank, offers 30 currency pairs as well as the above analyses.

What is the “carry trade” element to “FX”?

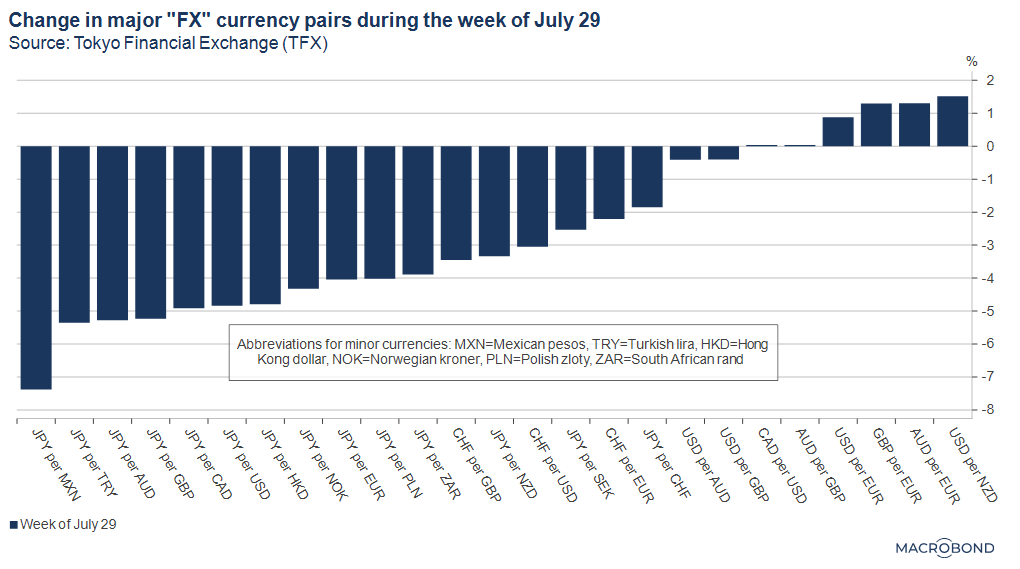

The most popular definition of a “carry trade” is to borrow in a cheap currency to invest in a higher yielding currency. The sharp strengthening in some high yielding emerging and developed market currency pairs during the week of July 29, can be seen as circumstantial evidence that Mrs. Watanabe’s carry trades were being unwound. Note that all of the largest moves involved the yen. However, hard data is hard to come by.

Specifically, “FX” firms explain the carry trade as going long the higher yielding currency and going short the lower yielding currency. For the USD/JPY that would mean buying the dollar, selling the yen, and earning the policy rate spread in the form of “swap points”. These “swap points” are usually paid daily in yen, making “FX” behave like a fixed income instrument.

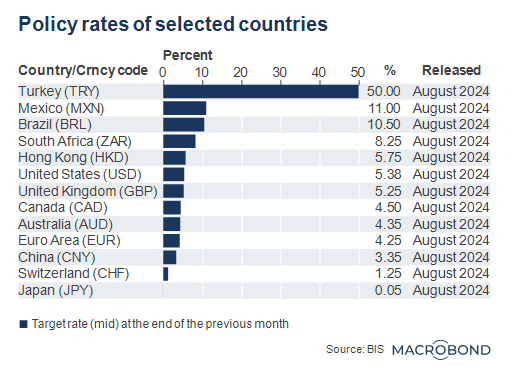

For example, the next chart of policy rates of some well-known “FX” currencies show Turkey topping the list, implying a near 50 percent annualized yield from the spread between Turkey and Japan, and a near 10 percent yield for Mexico and Brazil.

Coincidence or not?

Comparing the last 2 charts, one notices that many of the largest currency moves during the week of July 29 involved currencies of countries on the list of policy rates, which was based on an “FX” firm’s site titled, “FX for beginners” [vi]. Combined with comments from “FX” firms, that suggests that a carry trade unwind by Mrs. Watanabe occurred. Other factors that could explain the yen’s surge was an institutional carry trade unwind and a simple unwind of speculative positions, both of which are said to be reflected in the next graph.

Final thoughts

A survey conducted by Gaitame.com Research Institute in June 2018 resulted in about 70 percent of “FX” market respondents categorizing themselves as trend-followers. As the yen’s post-pandemic weakening was so strong, this could help explain the growth of the market from 2022. Meanwhile, the forced liquidation of positions under “FX” firms’ loss cutting rules can amplify market moves, as they have in the past (BOJ, Nov 2018). Comments from “FX” firms and large moves in carry trade pairs suggest a carry trade unwind by Mrs. Watanabe may have been a partial factor in the recent yen surge.

Recommended sources in English:

“Retail Foreign Exchange Margin Trading in Japan: An Analysis from the Developments in 2022” (Bank of Japan Review, Sept 2023. Japanese original: June 2023).

“Developments in and Characteristics of Japan’s FX Market: An Analysis Based on the 2022 BIS Triennial Central Bank Survey” (Bank of Japan Review, May 2023. Japanese original: Feb 2023)

“Investment Patterns of Japanese Retail Investors in Foreign Exchange Margin Trading” (Bank of Japan Review, Nov 2018)

[i] List of registered “FX” firms in Japanese: https://www.ffaj.or.jp/members/document/

[ii] Surveys show that “FX” trading is driven by men between 20 to 40 years of age (BOJ), but many Japanese find the nickname amusing and even the BOJ uses the term.

[iii] We assumed that the overwhelming bulk of “FX” trading is retail.

[iv] This is the maximum leverage allowed by Japan’s Financial Services Agency

[v] Gaitame.com would be “foreign exchange dot com” if translated.

[vi] The list was based on “major and minor currencies” in “FX for beginners” available here: https://www.smbcnikko.co.jp/products/fx/knowledge/002.html (note that the site recommended that beginners AVOID the minor currencies on the list)

Related links