TSE Cash Markets

Future Policies and Status of Proof-of-Concept Testing for HTML Disclosure of Earnings Reports (Kessan Tanshin)

JPX Market Innovation & Research, Inc.(JPXI)hereby announces the status of Proof-of-Concept testing for HTML disclosure of earnings reports* (hereinafter referred to as “the PoC testing”) promoted by JPXI as of the end of November 2023, and future policies for the PoC testing In light of the revision of the quarterly disclosure system.

- See “Details of Proof of Concept Testing for HTML Disclosure of Earnings Reports (Kessan Tanshin)” dated December 17, 2021, “Webinar on “Digital disclosure and promotion of dialogue with investors” video available” dated January 23, 2023 (available only in Japanese) and “Enriching the ‘Quick Earnings Reports’ Delivered to Investors: What is the ‘HTML Disclosure of Earnings Reports (Kessan Tanshin)’ Conducted by JPX Market Innovation & Research, Inc.?” dated June 1, 2023 (available only in Japanese).

“Webinar on “Digital disclosure and promotion of dialogue with investors” video available” (available only in Japanese)

“Enriching the ‘Quick Earnings Reports’ Delivered to Investors: What is the ‘HTML Disclosure of Earnings Reports (Kessan Tanshin)’ Conducted by JPX Market Innovation & Research, Inc.?” (available only in Japanese)

Latest Status of the PoC Testing

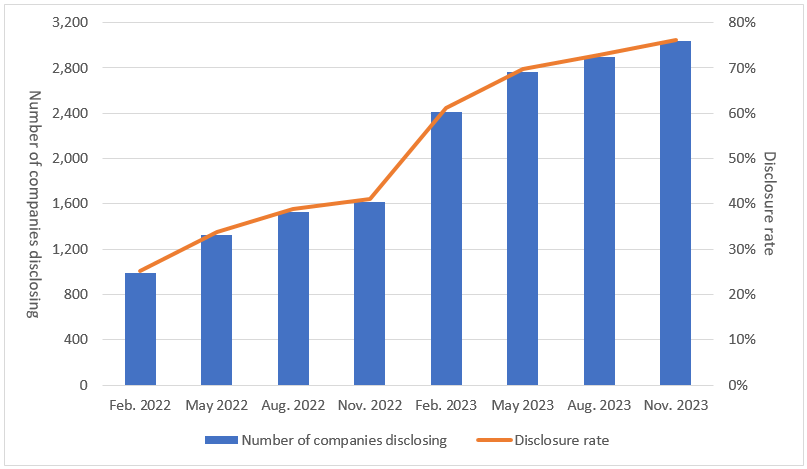

The number of listed companies disclosing their earnings reports in HTML format on a quarterly basis has increased since the start of PoC testing in December 2021. As of the end of November 2023, a cumulative total of over 3,000 listed companies (over 70% of the number of listed companies*) have voluntarily disclosed their earnings reports in HTML format.

- Percentage of the number of companies and REITs listed on Tokyo Stock Exchange, Nagoya Stock Exchange, Fukuoka Stock Exchange, and Sapporo Securities Exchange as of the end of November 2023.

(Companies Disclosing Earnings Reports in HTML by Number and Percentage (Cumulative))

Future Policies for the PoC Testing

The report published in June and December 2022 by the Financial System Council’s Working Group on Corporate Disclosure indicated a motion for the quarterly securities reports (for the first and third quarters) prescribed by the Financial Instruments and Exchange Act to be eliminated and for the contents to be integrated into quarterly earnings reports based on exchange rules. Thereafter, in November 2023, the Act Partially Amending the Financial Instruments and Exchange Act, etc. (Act No. 79 of 2023) was enacted, and in line with that, quarterly securities reports (for the first and third quarters) will be integrated into quarterly earnings reports.

Based on the considerations of the “Council of Experts Concerning the Revision of the Quarterly Disclosure System”, Tokyo Stock Exchange, Inc. (TSE) released the “Practical Policy Concerning the Revision of the Quarterly Disclosure System” on November 22, 2023 and “Revisions to Listing Rules in Accordance with Revision of Quarterly Disclosure System in Connection with Amendments to the Financial Instruments and Exchange Act and Other Changes” on December 18, 2023.

In light of this, the data format for the distribution of earnings reports will be reviewed based on the continuity of information vendors’ means of obtaining information, the convenience of a wide range of information users including individual investors, and the impact on the workload of listed companies. It will also be announced that XBRL and HTML submission will be “mandatory” for listed companies*. For listed REITs, HTML submission is not “mandatory” but desirable.

The new system will apply to quarterly earnings reports for accounting periods from April 1, 2024, and HTML submission is required for earnings reports and quarterly earnings reports (including the second quarter) submitted after July 2024. Accordingly, the PoC testing will end with the transition to the new system in July 2024.

JPXI appreciate your consideration of using HTML files of earnings reports in preparation for the transition to the new system in July 2024, and would like to ask for your continued support.

“Practical Policy Concerning the Revision of the Quarterly Disclosure System”

Public Comments “Revisions to Listing Rules in Accordance with Revision of Quarterly Disclosure System in Connection with Amendments to the Financial Instruments and Exchange Act and Other Changes”

- For XBRL, some new notes (“Notes on Segment Information”, “Notes on BS”, and “Notes on PL”) are required to be submitted for quarterly earnings reports (excluding the second quarter). Please see “Practical Policy Concerning the Revision of the Quarterly Disclosure System” for details.

Related links