TSE Cash Markets

Stock buybacks are expected to reach 17 trillion yen, the highest level ever for the third consecutive year

Stock buybacks by listed companies are on the rise. In 2024, it is expected to reach approximately 17 trillion yen, a 70% increase from the previous year, marking the highest level ever for the third consecutive year. In response to requests from the Tokyo Stock Exchange and investors to improve capital efficiency, there has been active movement toward increasing shareholder returns. Stock buyback is also used as a vehicle for the dissolution of cross-shareholdings. The challenge will be balancing increasing shareholder returns with raising employee wages.

Nikkei investigated the stock buyback quota settings of all listed companies (including delisted companies) and found that as of December 19, 2024, the quota has increased by 75% to 16.8149 trillion yen. In terms of the number of companies (excluding duplicates), the number has increased by 22% from 2023 to 1,079 companies.

Approximately 17 trillion yen is equivalent to about 30% of the net profits of all listed companies and is almost the same as the total dividend amount of all listed companies. The combined ratio of share buybacks and total dividends to net profit is approximately 60%. Japanese companies have tended to place a strong emphasis on dividends, but share buybacks have also become an important means of returning value to shareholders.

In 2024, a series of companies carried out multiple share buybacks. Mitsubishi UFJ Financial Group set up an acquisition limit of 300 billion yen in November, following on from 100 billion yen in May. Sumitomo Mitsui Financial Group and Tokio Marine Holdings also increased the amounts of acquisition limit.

One of the aims of share buybacks is to absorb shares released as a result of the resolution of cross-shareholdings. Shin-Etsu Chemical will purchase its own shares from five companies, including Sompo Japan and MUFG Bank, for approximately 94 billion yen through January 2025. “In light of the intention to sell, we took into consideration the impact on stock liquidity and market share prices,” the company said. In response to financial institutions’ intention to sell their shares, DENSO decided to buy back 450 billion yen of its own shares in October.

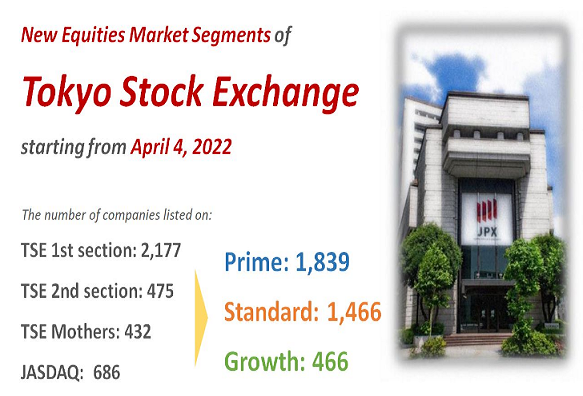

Companies are being urged by the Tokyo Stock Exchange and investors to improve capital efficiency. The Tokyo Stock Exchange has called on companies to manage their businesses with an awareness of capital costs and stock prices and has requested companies to disclose their responses. According to a survey compiled by Masashi Akutsu, chief Japan equity strategist at BofA Securities, of companies listed on the prime market that have “already disclosed” specific measures, 42% have announced share buybacks after December 2023.

Corporate performance is strong and gives companies the means to allocate funds to share buybacks. Net profits of listed companies for the April-September period of 2024 are expected to increase 15% from the same period last year, reaching a record high for the fourth consecutive year. Yuichi Chiguchi, chief investment strategist at BlackRock Japan, said, “Companies are strengthening shareholder returns in line with growing performance. The increase in share buybacks signals a change in management’s mindset.”

There is also a move to allocate acquired company shares to employees as stock compensation. These companies intend to encourage employees to become shareholders and encourage employees to feel involved in management. In May, Sony Group announced a share buyback worth 250 billion yen and said it would use the acquired shares for a stock-based compensation plan with transfer restrictions. Recruit Holdings, which announced a 600 billion yen share buyback in July, is also considering using the funds for stock compensation for employees.

Share buybacks are supporting Japanese stocks market from the supply and demand side. According to the Tokyo Stock Exchange’s stock trading trends by investment sector, business corporations purchased more than 7 trillion yen in total from the first week of January to the second week of December 2024. As overseas investors have been in a stronger tendency to sell since July, they have become the largest buyers.

Share buybacks are likely to remain high in 2025 as well. Kazunori Takebe, Japan equity strategist at Goldman Sachs, said, “As long as governance reforms at Japanese companies continue, the trend toward strengthening shareholder returns will not change.”

The challenge is to balance this with wage increases and growth investments. According to the Ministry of Health, Labour and Welfare, real wages, which exclude the effects of price fluctuations, have been sluggish. “The momentum for wage increases has not kept pace with increased shareholder returns,” said Kobayashi Shunsuke, chief economist at Mizuho Securities. As of the end of September, listed companies had cash on hand of approximately 112 trillion yen. Companies will be asked whether they can increase share buybacks while also actively allocating funds to wage increases and growth investments.

Related links