TSE Cash Markets

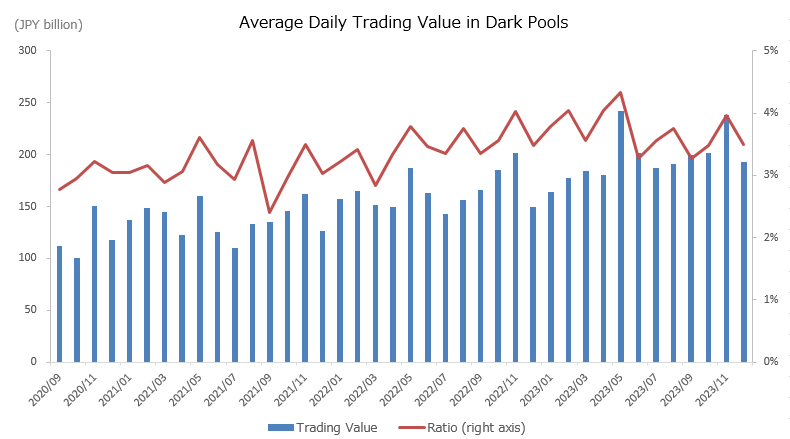

Trading Value in Dark Pools (until December 2023)

In June 2019, the Working Group on Financial Markets under the Financial System Council indicated measures for increasing the transparency of dark pool transactions, such as the close monitoring of dark pool usage. Accordingly, the Cabinet Office Order on Financial Instruments Business and the Comprehensive Guidelines for Supervision of Financial Instruments Business Operators were revised on June 19, 2020, and TSE has introduced a flag system to identify orders matched in dark pools that are routed to the ToSTNeT market to contribute to increased dark pool transparency.

Based on this flag system, we have compiled a summary of the changes in trading value in dark pools (September 2020 to December 2023), as follows:

Notes:

1. Trading value: the total trading value of ToSTNeT transactions that were flagged as dark pool transactions.

2. Ratio to total trading value (right axis): the percentage of total trading value for on and off-exchange trading that is in dark pools.

3. Trading value on the exchange is the sum of TSE auction trading and ToSTNeT trading.

4. The data for off-exchange trading value was obtained from the following link published by Japan Securities Dealers Association. (https://off-exchange.jp/offexchange/findMonthReportEnter)

| ADV (billion) | Ratio | |

| 2020/09 | 112 | 2.78% |

| 2020/10 | 100 | 2.96% |

| 2020/11 | 150 | 3.22% |

| 2020/12 | 117 | 3.05% |

| 2021/01 | 137 | 3.04% |

| 2021/02 | 149 | 3.16% |

| 2021/03 | 144 | 2.89% |

| 2021/04 | 122 | 3.07% |

| 2021/05 | 160 | 3.60% |

| 2021/06 | 125 | 3.17% |

| 2021/07 | 110 | 2.94% |

| 2021/08 | 133 | 3.57% |

| 2021/09 | 135 | 2.40% |

| 2021/10 | 146 | 2.96% |

| 2021/11 | 162 | 3.50% |

| 2021/12 | 126 | 3.04% |

| 2022/01 | 157 | 3.22% |

| 2022/02 | 165 | 3.41% |

| 2022/03 | 152 | 2.83% |

| 2022/04 | 150 | 3.34% |

| 2022/05 | 187 | 3.79% |

| 2022/06 | 163 | 3.46% |

| 2022/07 | 143 | 3.35% |

| 2022/08 | 156 | 3.76% |

| 2022/09 | 166 | 3.35% |

| 2022/10 | 185 | 3.56% |

| 2022/11 | 201 | 4.03% |

| 2022/12 | 150 | 3.49% |

| 2023/01 | 164 | 3.79% |

| 2023/02 | 178 | 4.04% |

| 2023/03 | 185 | 3.56% |

| 2023/04 | 181 | 4.05% |

| 2023/05 | 242 | 4.34% |

| 2023/06 | 201 | 3.27% |

| 2023/07 | 187 | 3.57% |

| 2023/08 | 191 | 3.76% |

| 2023/09 | 200 | 3.27% |

| 2023/10 | 202 | 3.47% |

| 2023/11 | 238 | 3.96% |

| 2023/12 | 193 | 3.50% |

Related links