TSE Cash Markets

Tokyo Stock Exchange regains top spot for market capitalization in Asia

The total market capitalization of shares listed on the Tokyo Stock Exchange passed that of Shanghai‘s bourse on Thursday in dollar terms, regaining the top position in Asia.

Overseas investors are back in force in Japan‘s stock market, making up for lost time with big purchases of blue chips.

The Nikkei Stock Average rose 1.8% on Thursday to close at 35,049, gaining for the fourth session in a row and reaching its highest point since February 1990.

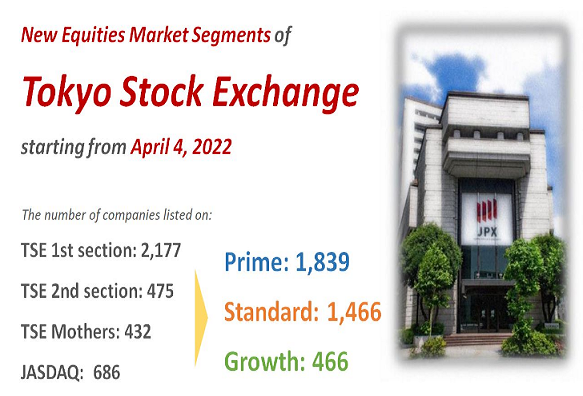

The total market capitalization of the TSE — the sum of listed companies on its Prime, Standard and Growth markets — was up 1.5% at 917 trillion yen ($6.32 trillion) while that of Shanghai was at $6.27 trillion. According to data from the World Federation of Exchanges, the Shanghai Stock Exchange had overtaken the TSE in July 2020. The market capitalization of all China stocks, including the Shenzhen Stock Exchange and Hong Kong Stock Exchange, is still more than Japanese shares.

“All of a sudden it was party time,” a trader at a major brokerage said about Thursday’s trading.

“Overseas investors have turned bullish since the beginning of the year,” and were net buyers of Japanese shares, the trader said.

Large-cap stocks made big advances, with Toyota Motor rising 3.6%, Sony Group 3.5% and Hitachi 4.2%. It is unusual for companies with market capitalizations of over 10 trillion yen ($68.4 billion) to see such significant gains in a single day.

The rally appears to be driven in part by global macro hedge funds, which place bold bets based on predictions of the direction of monetary policy, the economy and other factors.

Many market watchers no longer expect the Bank of Japan to end negative interest rates soon, especially after a powerful earthquake that struck Japan on Jan. 1. The yen has since weakened to around 145 against the dollar, reversing gains made toward the end of 2023.

The rapid strides in Japanese stocks in part reflect how far they had lagged U.S. and European peers. The Nikkei Stock Average began falling behind last November as investors anticipated a stronger yen, based on expectations of a policy adjustment by the BOJ and interest rate cuts in the U.S. But with the outlook for the yen shifting, overseas investors see room for growth in Japanese shares.

The Nikkei average has increased 4.7% since the end of 2023, compared with a 0.02% increase in the Dow Jones Industrial Average and a 0.5% decrease in the STOXX Europe 600 index.

Interest in Japanese stocks goes beyond macro funds focused on the short term. Investors on the hunt for promising assets over the medium to long term are also considering increasing their allocation to Japan.

In a December survey of institutional investors by Bank of America, the percentage of respondents bullish on Japan outpaced those bearish by 12 points.

Wealthy investors have also turned their sights to Japan. Swiss private bank Union Bancaire Privee held a seminar in London last month for clients of its family office services, and spent around 30% of the presentation on Japan.

“Many [global investors] haven’t had a chance to buy into the rally in Japanese equities, so there is new money coming in with an eye to their late start,” said Ichiro Tominaga, president and chief investment officer of UBP‘s Japan unit.

The Japanese market has also benefited from wariness over investment risks in China. Chinese video game-related stocks plunged in late 2023 after authorities announced regulations for online games. Concerns about the economic impact of China‘s property slump remain strong.

A net 89.6 billion yuan ($12.6 billion) in mainland Chinese stocks were sold in August through the Stock Connect link with Hong Kong, which reflects trading by global investors. That was the largest month of outflows since the program launched in 2014. Investors have continued to offload Chinese stocks, selling a net 9.1 billion yuan in the first 10 days of January.

“There is still uncertainty over China, and funds will likely keep flowing into Japanese equities,” said Tetsuhiro Nishi at Nomura Securities.

How long the rally continues will depend in part on what comes out of the earnings season starting this month. Investors will be watching for upgrades to full-year guidance and positive statements on increasing shareholder returns.

Related links