TSE Cash Markets

A Quick Guide to J-REIT Markets

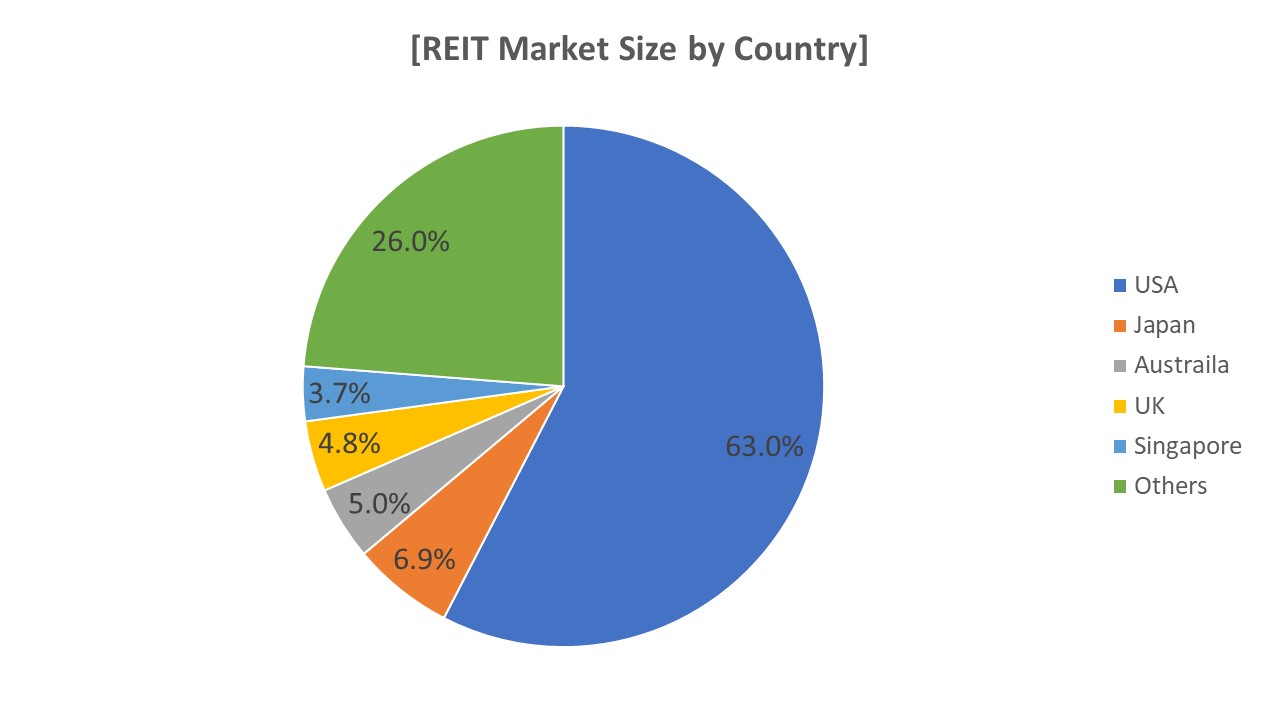

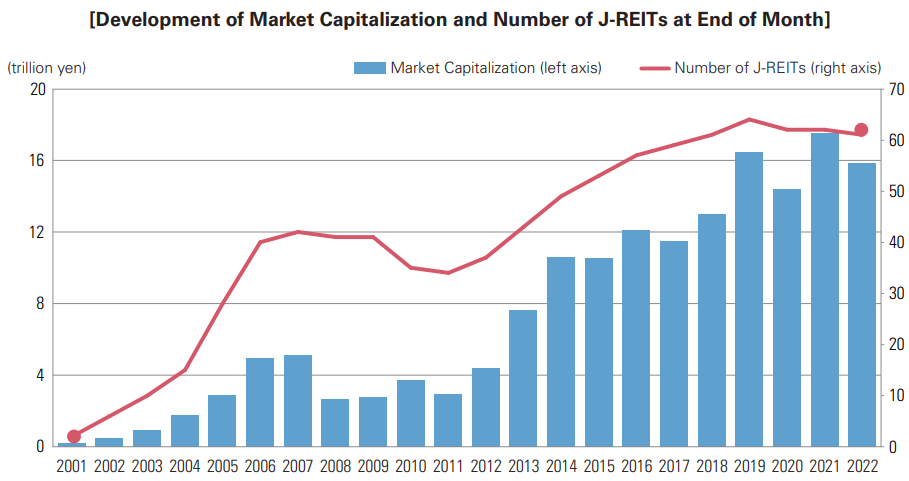

Japan’s REIT market is the second largest in the world, after the far larger US market. Patterned after US REITs created in the 1960s for individual investors to benefit from large-scale real estate investments, Japanese REITs (J-REITs) first appeared in November 2000 and a listing market was established in March 2001. Market trading began in September with two issues and a market capitalization of 240 billion yen.

Today, Japan boasts 61 listed issues, with a total market capitalization of over 17 trillion yen (as of November 2022).

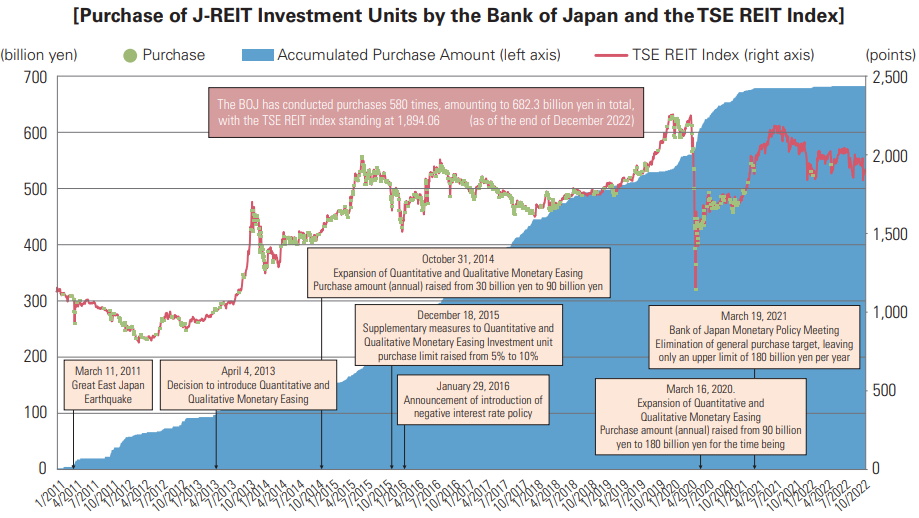

J-REIT purchases by the Bank of Japan (BOJ) as part of its monetary easing measures are believed to have helped reduce market volatility. The BOJ has purchased J-REIT investment units since October 2010 with a purchase limit of about 50 billion yen.

In response to the Great East Japan Earthquake, the European debt crisis, and other market disruptors, BOJ raised the limit. In March 2021, BOJ removed the annual purchase of 90 billion yen in March 2021, leaving only an upper purchasing limit of 180 billion yen and authorization of concentrated purchasing when investment unit prices plummet.

J-REIT Market Features

J-REITs are classified into single-use (devoted to single use properties) and multiple-use (J-REITs with a portfolio of multiple-use properties). The latter are further divided into “combined portfolio” that will invest in real estate properties with two uses and “comprehensive portfolio”, that invest in properties with three or more uses, or without limiting the use types.

J-REITs specialized in single-use properties invest in properties for specific uses, such as office buildings, residential properties, retail facilities, logistics facilities, hotels and healthcare facilities. J-REITs with a combined portfolio will invest in properties such as office/retail developments. Those with a comprehensive portfolio will diversify investments in properties for multiple uses, including office buildings, residential properties and retail properties.

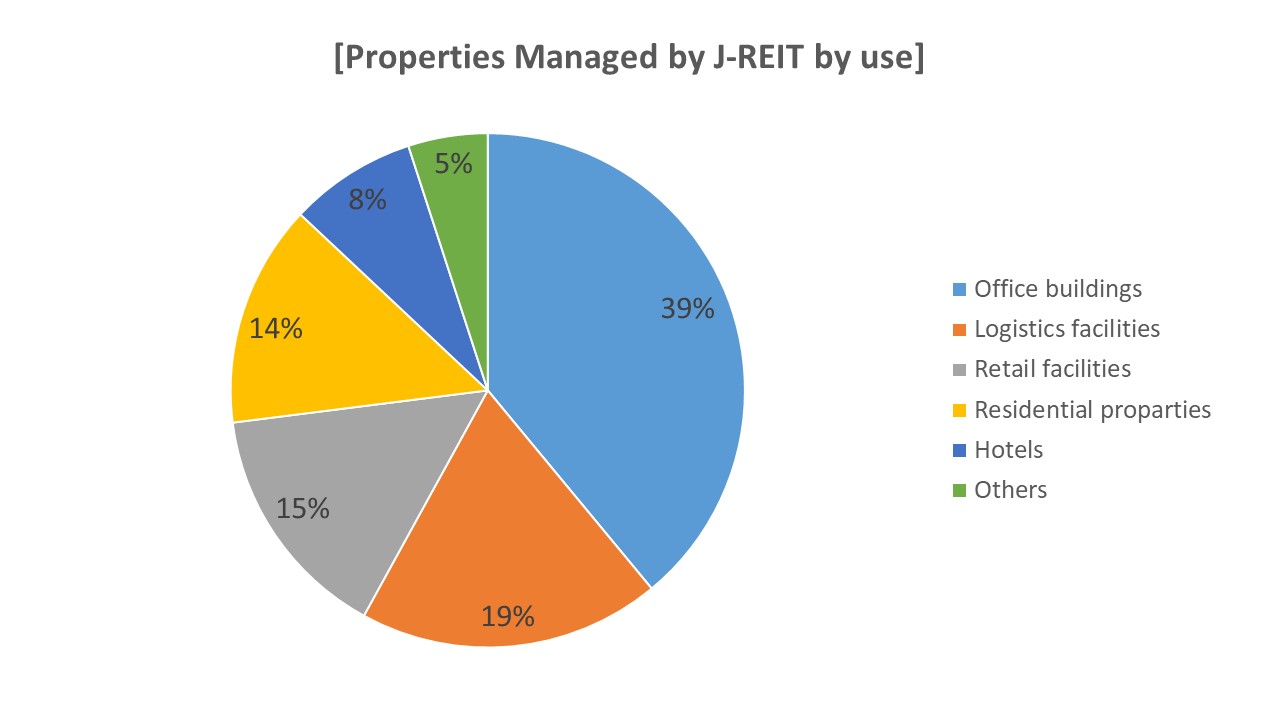

Office buildings account for the largest share of properties by use, roughly 40% of all assets managed by J-REITs, followed by logistics facilities and retail facilities.

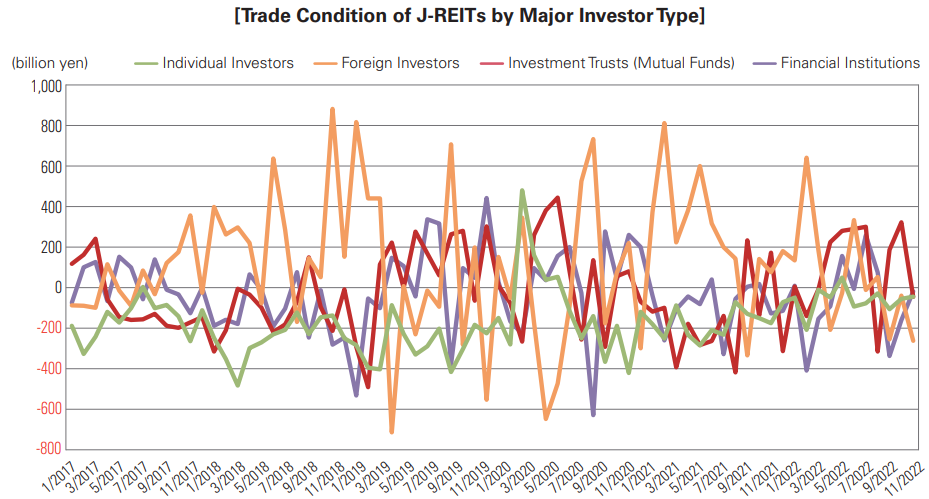

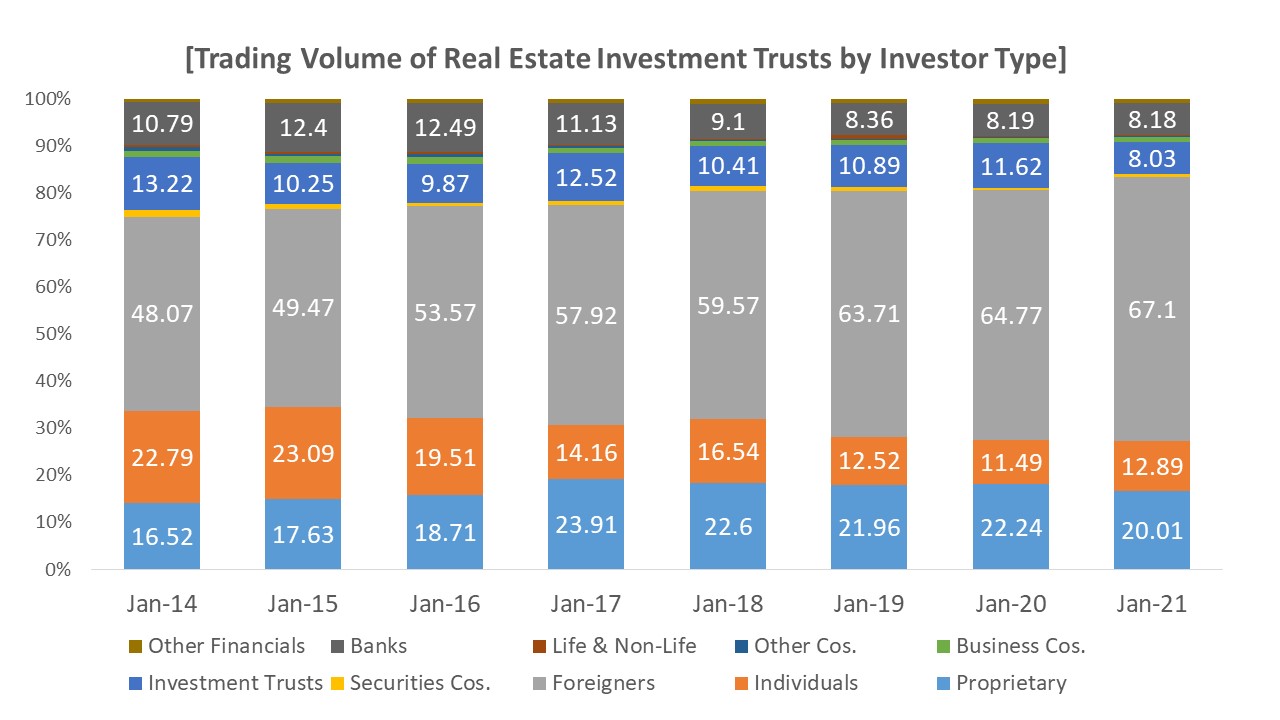

J-REIT investors are largely divided into “proprietary” traders, such as securities companies and others trading on their own accounts, and “brokerage” traders entrusted by investors to trade on their behalf. Brokerage trades are mainly conducted for “individual” and “foreign” investors.* Recently foreign investors have accounted for about 70% of brokerage trading, indicating that they lead the J-REIT market.

* Individual investors are domestic. Foreign investors are non-resident individuals/companies/ institutions of Japan.

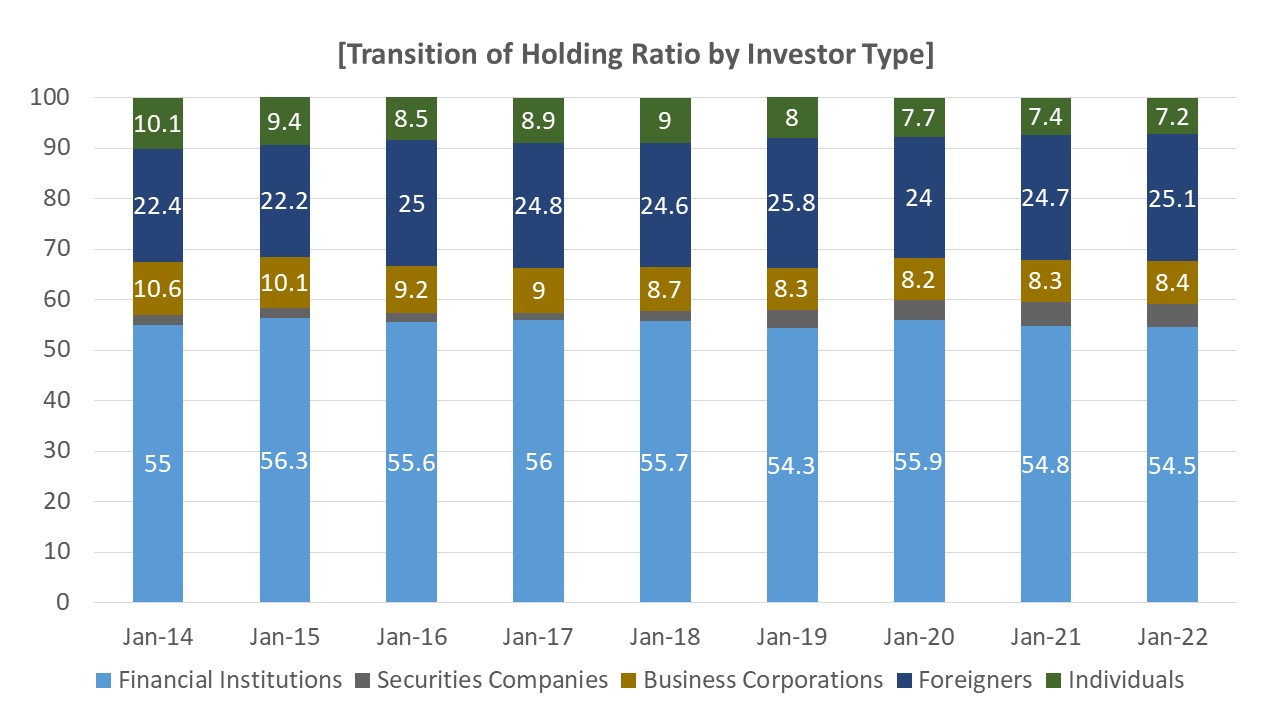

On the other hand, the holding ratios by investor type, based on the holding value (the ratios of holding value of each type to the total holding value) show that trust banks have the largest share, at 44.0%, followed by foreign institutions, etc. at 24.5%, individuals and others at 7.8%, and business corporations, etc. at 8.3% as of February 28, 2021.

Most trust bank holdings are investment trusts, which account for 34.7% of their total holding value. Because many investment trust users are individual investors, it can be noted that individual investors have a certain presence in the J-REIT market in terms of holding value as well.

J-REIT ETFs

In addition to investing in individual J-REITs, investors can also invest in exchange traded funds (ETFs) that invest in multiple J-REITs. Listed J-REIT ETFs include ten ETFs linked to the TSE REIT Index, one ETF linked to the Nomura High Yield J-REIT Index, three ETFs linked to the TSE REIT Core Index, one ETF linked to the TSE REIT Logistics Focus Index, and one ETF linked to the Nikkei ESG-REIT Index (as of June 30, 2021). Current listings are available at https://www.jpx.co.jp/english/equities/products/etfs/issues/01-07.html.

J-REIT ETFs offer more issues in which investors can invest at smaller amounts than investing directly in individual J-REIT issues. Investing in J-REIT ETFs means indirectly investing in all the individual issues included in the J-REIT-related indexes. As such, investors can invest in a variety of real estate properties in a diversified manner in small amounts.

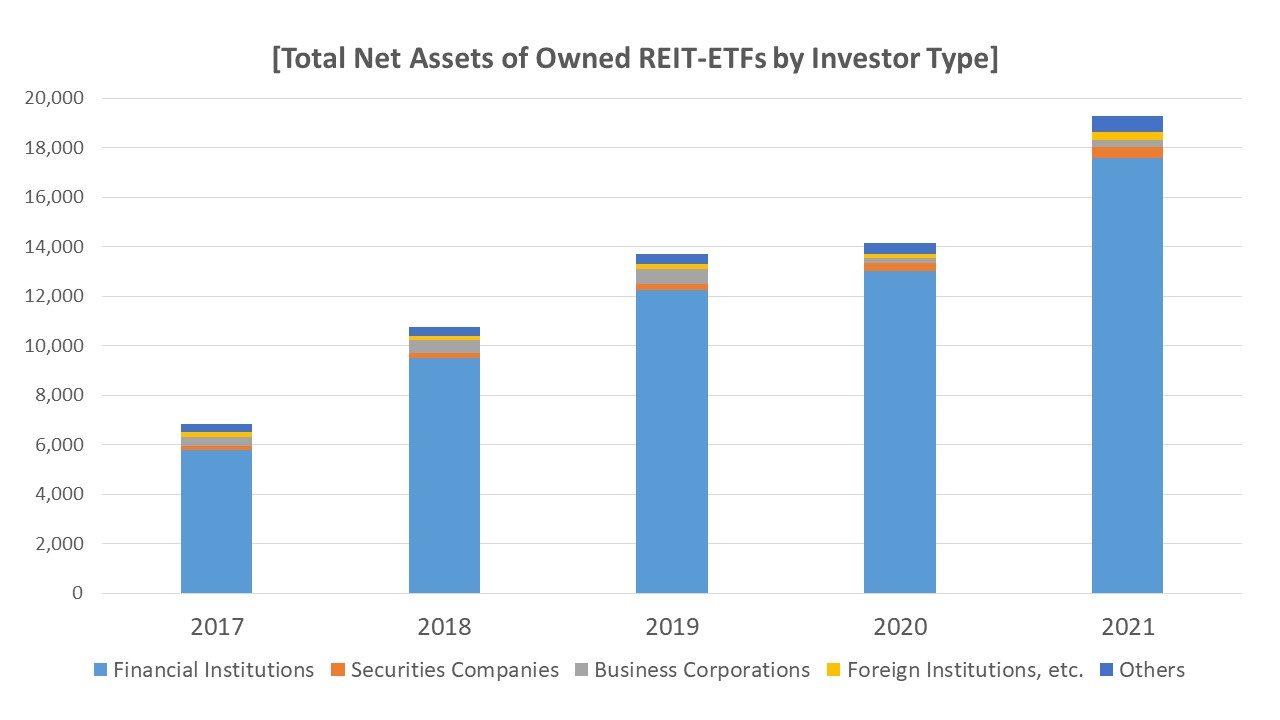

In addition, while individual J-REIT issues have been subject to insider trading regulations since April 2014, J-REIT ETFs are excluded from the same. As is the case when directly investing in individual J-REIT issues, J-REIT ETFs provide stable and relatively high distribution yields. Due to these and other factors, investment in J-REIT ETFs is currently expanding, mainly among financial institutions.

J-REIT Futures Market

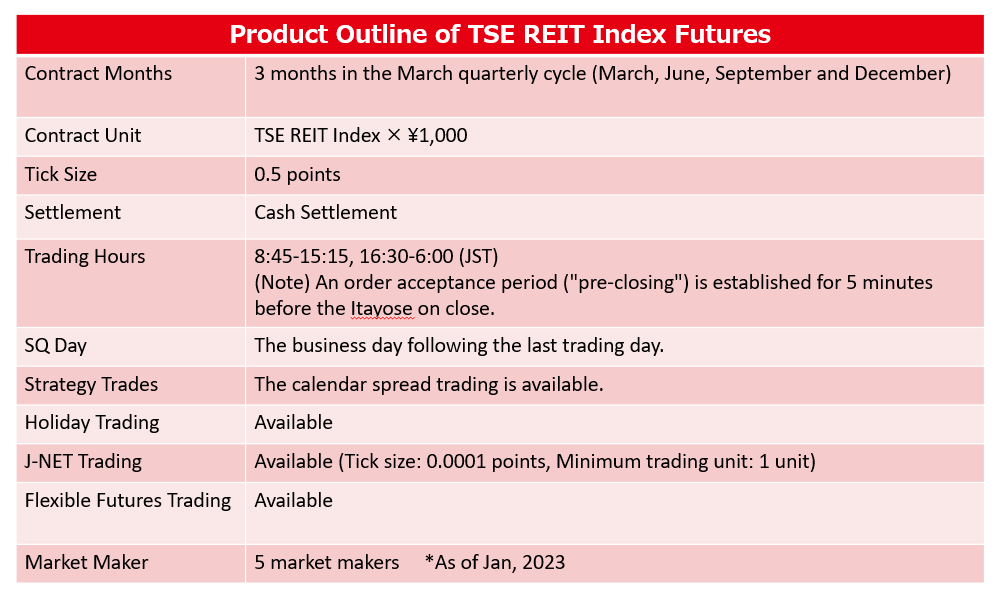

Osaka Exchange (OSE), a part of the Japan Exchange Group, offers futures trading with the TSE REIT Index as the underlying asset (TSE REIT Index Futures). J-REIT futures allow institutional and other investors with investment units across many J-REIT issues an opportunity to hedge against price fluctuations in the entire J-REIT market due to changing economic conditions.

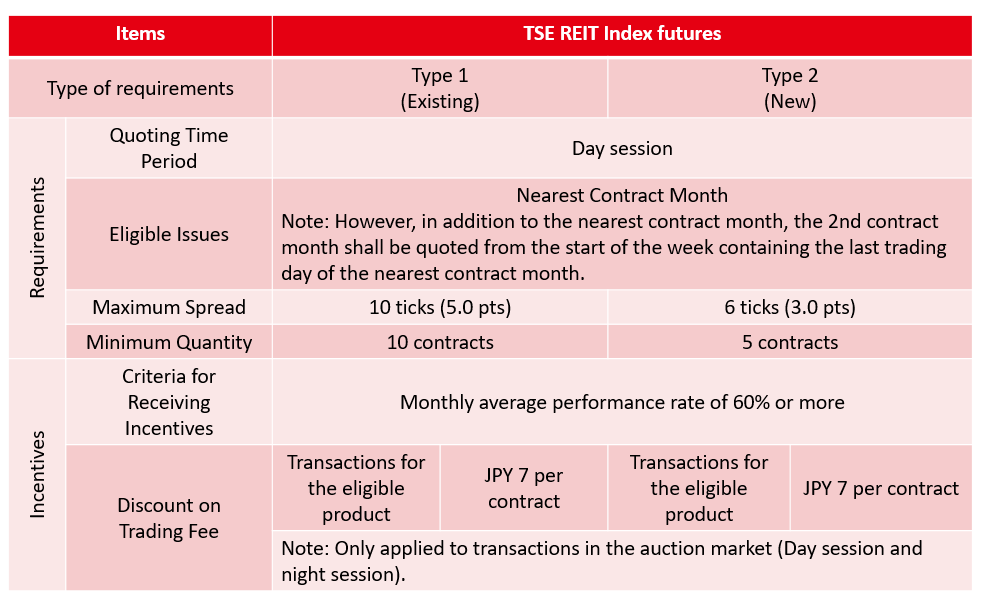

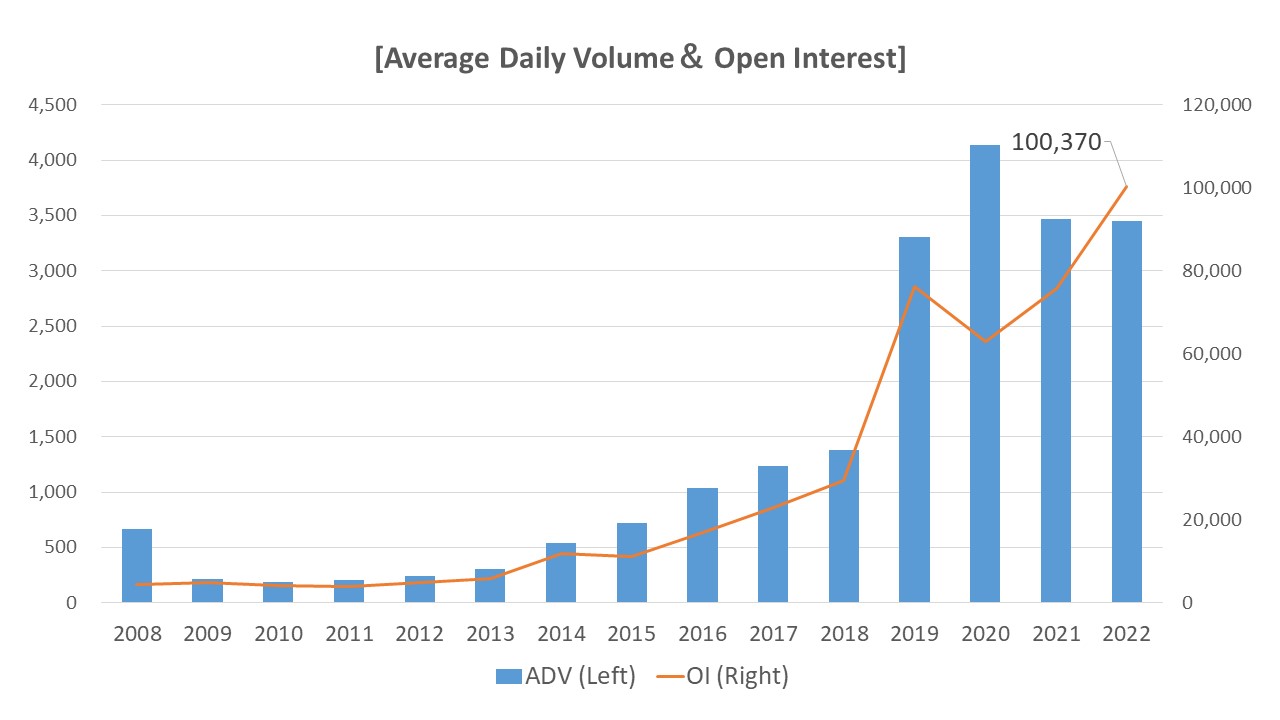

TSE REIT Index Futures contribute to the stability and expansion of the J-REIT market through arbitrage transactions between the TSE REIT Index Futures and J-REIT investment units. Liquidity in the futures market is expanding due to the OSE’s market promotion measures, such as the introduction of a market making (MM) system to supply liquidity.

More recently, the trading volume and number of contracts on the TSE REIT Index Futures have trended upward in conjunction with the J-REIT market’s expansion.

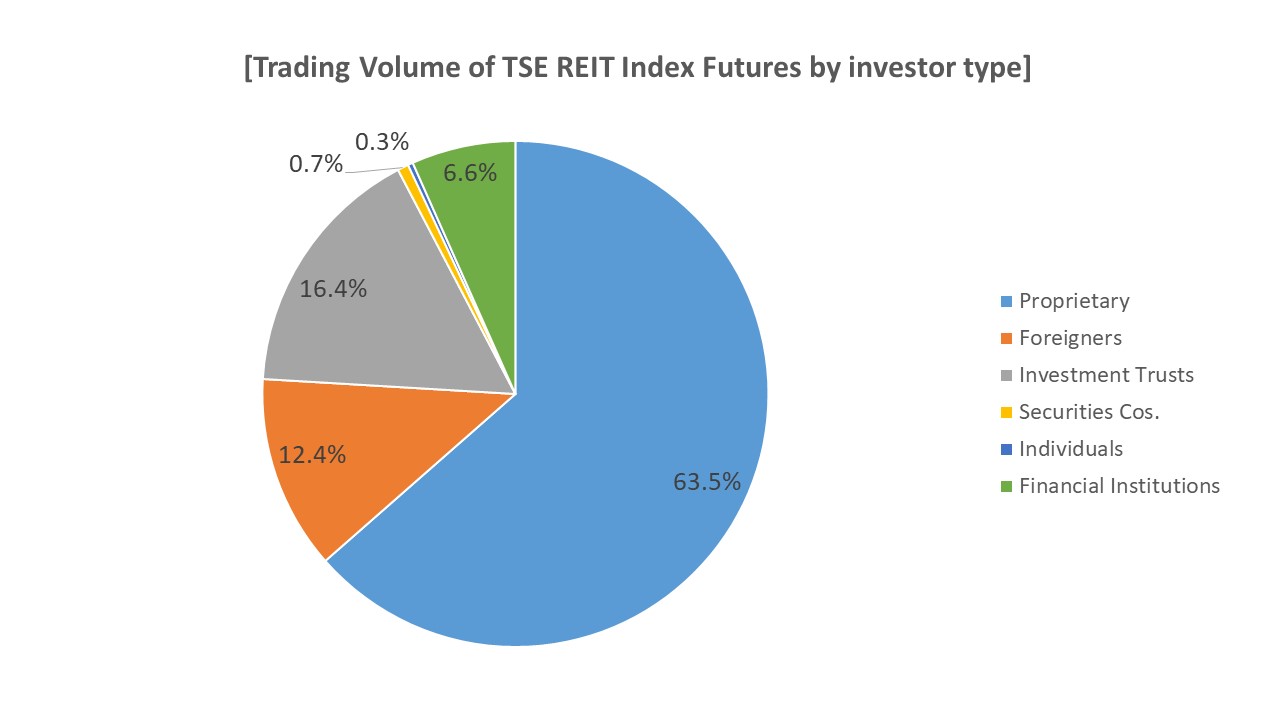

In terms of trading volume by investor type, brokerage firms’ own trading accounts for more than 60% of trading volume, while foreign investors account for 60% of trading volume in cash J-REITs, but only about 12% in futures.

OSE will continue their efforts to improve liquidity further by providing information to overseas investors and introducing market makers .

Related links