ESG

TSE Begins Trial of Carbon Credit Trades

Japanese carbon credit market set to start shortly

As previously reported (https://market-news-insights-jpx.com/insights/article002501/), Japan Exchange Group (JPX) began a test run of carbon credit trading on the Tokyo Stock Exchange (TSE) on Thursday, September 22. A total of 627 CO2-tonnes was traded in the four categories under the J-Credit scheme on Thursday, with the most-active renewable energy credit settling at 3,300 yen ($23) per CO²-ton.

TSE was commissioned by the Ministry of Economy, Trade and Industry (METI) to conduct this “Technical Demonstration Project for a Carbon Credit Market” prior to establishing the first exchange-based market for carbon credits in Japan, which will allow participants to offset their emissions or monetize reduced emissions.

During the trial, registered members, numbering 156 as of October 14, including Hitachi, Mitsui, MUFJ Bank, KDDI, and ENEOS, can trade existing carbon credits (J-Credits) that have been voluntarily traded over-the-counter since 2013.

A J-Credit is meant to certify the holder’s emissions reductions or removal of greenhouse gases through energy-saving devices, forest management and other methods. Trading hours at TSE are 9:00-11:29 and 12:30-14:59 JST (0000-0229 and 0330-0559 GMT).

Transaction prices are set twice a day and published after trading hours. Overseas business operators can register to participate in the J-Credit demonstration if they have a J-Credit account and a bank account in Japan. However, documents and services related to this demonstration are provided in Japanese only.

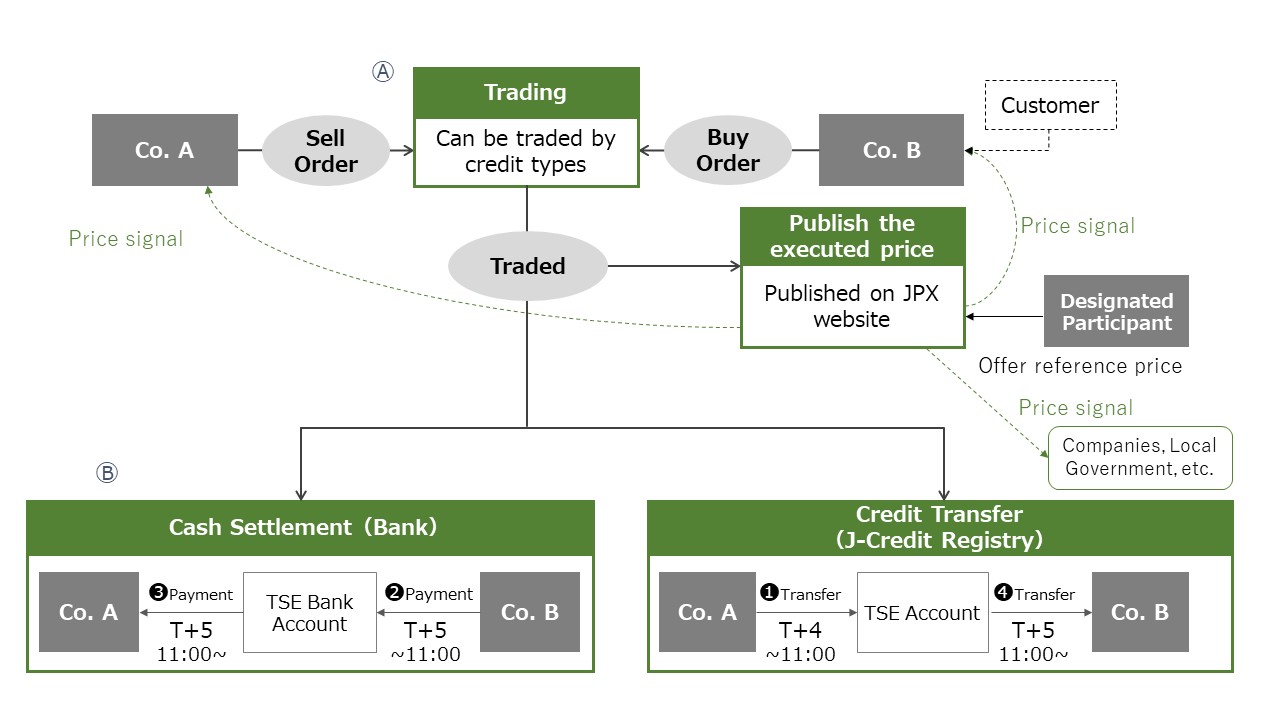

Scheme of Carbon Credit Market (J-Credit Demonstration)

〈Notes〉

Ⓐ Orders are made via the Internet.

Ⓑ TSE acts as “escrow” for the settlement.

〈Timing of Cash and Credit Transfer〉

Settlement shall be made on the fifth business day after the day of transaction (T+4).

❶ T+4 Until 11:00 :Transfer cred❸it from the seller to TSE

❷ T+5 Until 11:00 :Transfer money from the buyer to TSE

❸❹ T+5 After 11:00:Pay the money from TSE to the seller

Transfer the credit from TSE to the buyer

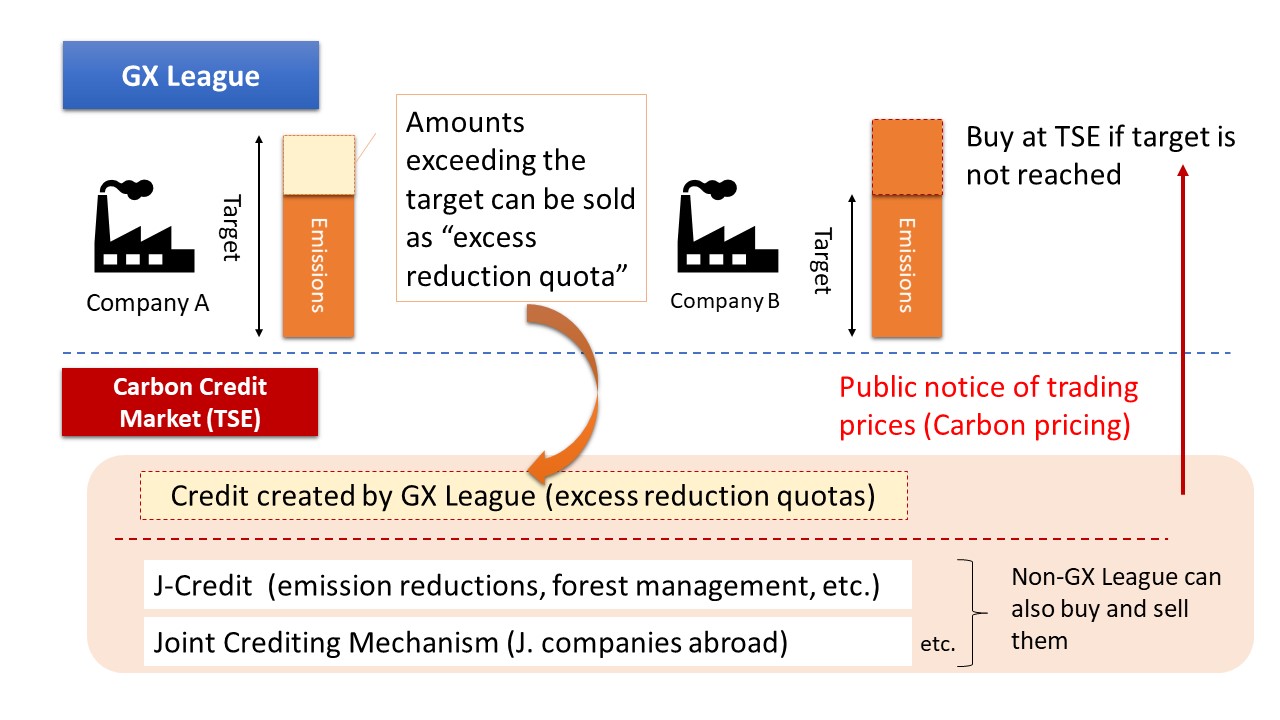

To reach carbon neutrality in Japan by 2050, METI has proposed a Green Transformation League (GX League) tackle the nation’s Green Transformation (GX). A collaboration of government, academia, and the financial industry, the League will address transforming Japan’s entire economic and social system and spearhead the creation of new markets to achieve decarbonization.

A nationwide carbon credit market for internationally accepted credits will allow trading among companies participating in the GX League to trade publicly available carbon credits and excess reduction.

The TSE market demonstration project will focus on two credits; existing J-Credits and credits to be created by the GX League. Simulated trading of GX League credits, with no actual exchange of money or credits, is scheduled to start in November.

Companies participating in the GX League, 496 as of end-September, will be required to pledge and disclose their emissions reduction targets in accordance with a methodology set by the government. If the target is not met, they will trade emissions through the market on a voluntary basis.

GX League and Carbon Credit Market

Japanese carbon crediting system

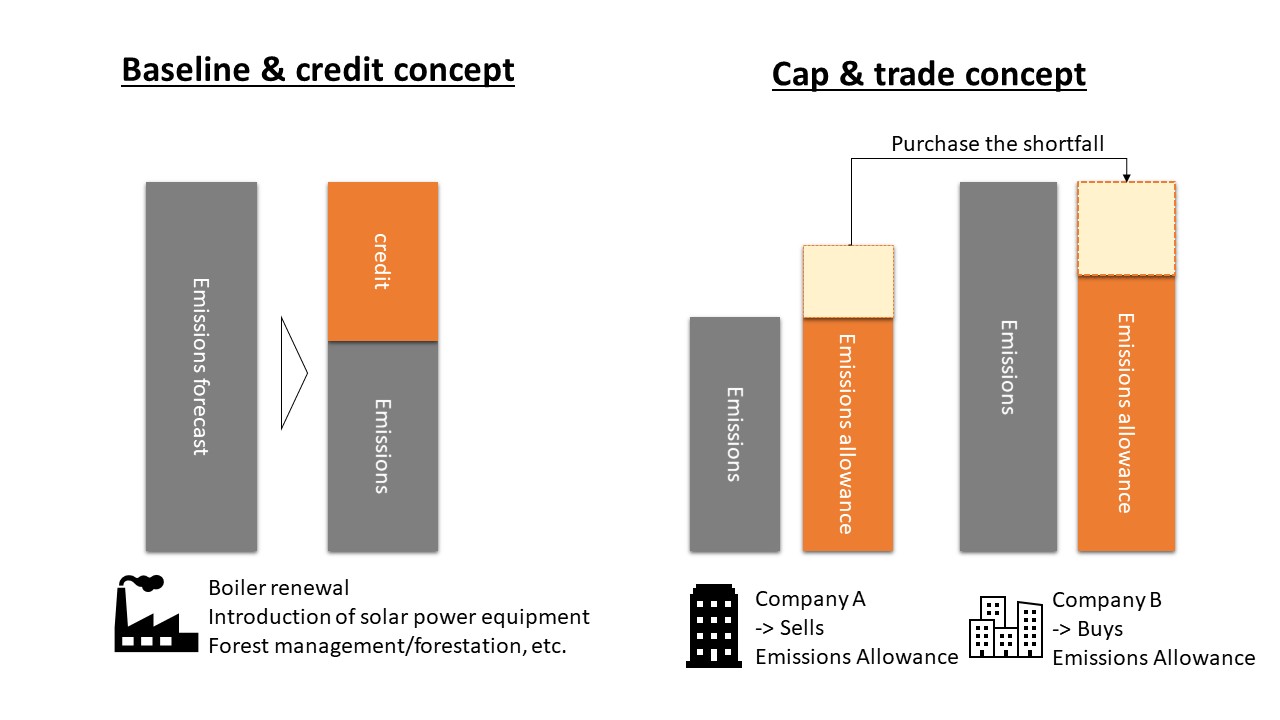

A carbon credit is a tradable permit that allows the holder to emit one ton of carbon dioxide or an equivalent of another greenhouse gas. The credit is essentially an offset for producers of such gases.

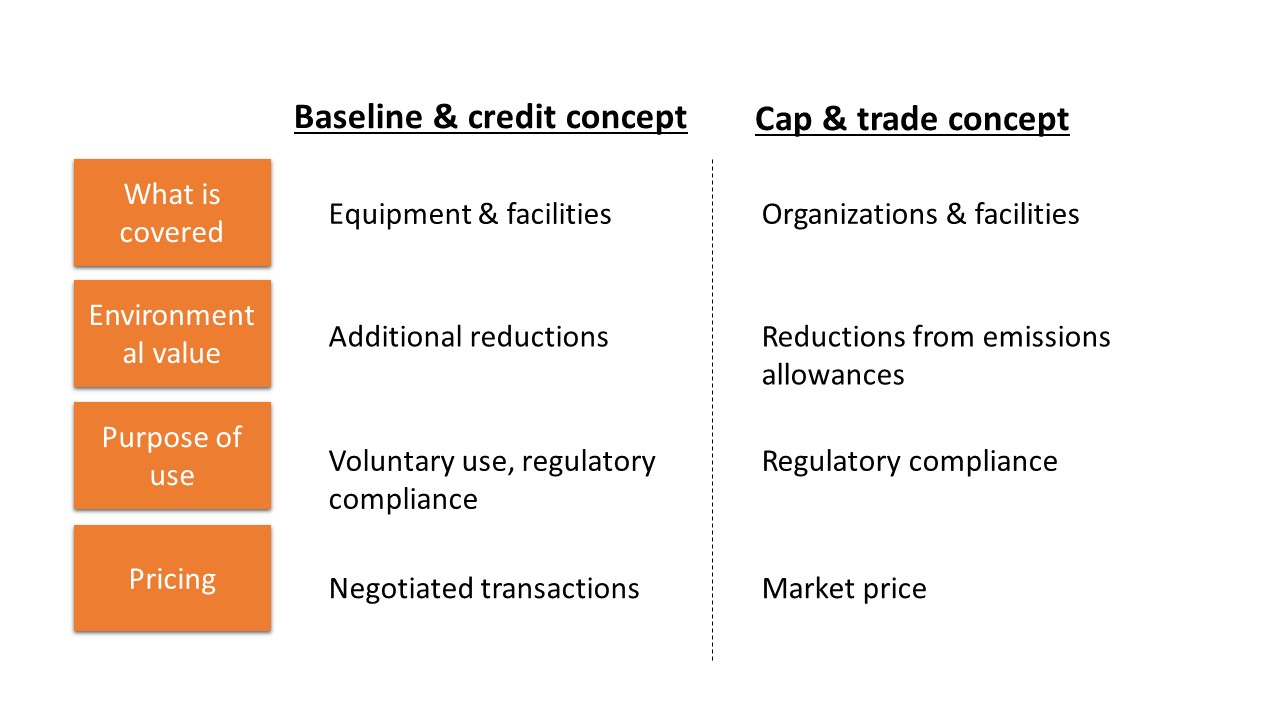

Emissions trading systems (ETS) are generally of two types. Those in Europe, California, China, Tokyo and Saitama Prefectures and elsewhere are “cap-and-trade”, in which the number of emission allowances or licenses is fixed.

Companies that pollute can purchase credits that allow them to continue polluting up to a certain limit (cap) that is reduced periodically. Meanwhile, the company may sell any unneeded credits to another company that needs them. Supply and demand determine the price of carbon in the marketplace.

Cap-and-trade ETS is characterized as a regulatory mechanism that serves as a form of carbon pricing. The carbon credit trading system envisioned by the GX League resembles EU-ETS but voluntary, rather than regulatory, and lacking penalties for non-compliance.

Differences between baseline-and-credit and cap-and-trade

J-Credit is a “baseline-and-credit” system, whereby buyers can use credits voluntarily for carbon offsetting or, depending on the credit type, in regulatory systems. As an incentive toward emissions reduction, carbon sequestration, and carbon removal, carbon issuers can earn revenue from the sale of carbon credits.

The system certifies units of emissions reduction and carbon removal or sequestration generated through projects such as renewal of boilers, introduction of solar power generation equipment and forest management. Emission reductions are calculated based on the difference between baseline and actual emissions or removals established through monitoring, reporting, verification (MRV) process.

The demonstration project will continue until the end of January. TSE will monitor performance of the trading and settlement systems and public price announcements before full-scale operation. In the future, JPX/TSE will consider ways to manage foreign credits and participation by foreign business operators.