TSE Cash Markets

Roles of the emerging market in creating new industries in Japan

By Shinichi Takamiya, Managing Partner, Globis Capital Partners

As the year 2021 is ending, Japan’s startup ecosystem is witnessing unprecedented growth. In only three years since Japan’s first unicorn (startup with market cap of more than 100 billion yen) Mercari went public in 2018, more than 10 companies went public with market cap of more than 100 billion yen. Furthermore, the number of IPOs in 2021 is expected to reach 136, marking a dramatic increase from 19 in 2009. Out of those IPOs, 94 companies were listed on the Mothers market, which was the record high since its establishment.

Until 1990s, founding a startup had negative images of dropping out from the mainstream corporate world, or the founder having the risk of carry a personal liability. Now entrepreneurs have become heroes for younger generations, seen as playing an essential role in creating new industries and fast-growing businesses. Now startups are regard to be “cool”.

Lagging from Silicon Valley by 30 years, Japan’s startup industry emerged with the Bit Valley movement in the 2000s. The industry has made a great leap in terms of both the quality and quantity of startups since then. Frist generation of entrepreneurs, “Generation 76 (those who were born around 1976)” spending their college life in Bit Valley (Shibuya, Tokyo), established Japan’s leading tech companies, and became angel investors and mentors for the new generation of entrepreneurs. Successful entrepreneurs utilized their experience to take on new challenges: some become serial entrepreneurs, and others join the next-generation startups as a part of the management team. Meanwhile, among the big tech companies that have grown from startups, there are increasing cases where their key persons spinning of to start their own new businesses. Furthermore, more and more talents from blue-chip companies, investment banks, consulting and other professional firms, and global tech companies such as GAFAM, as well as competent new graduates from prestigious universities are entering the startup industry.

When startups attract such excellent talent, the inflow of funds from investors further increases. While the amount of venture capital funds raised in Japan was as low as 37.5 billion yen in 2012, the amount is showing exponential growth to exceed 900 billion yen in 2021. With such a large inflow of capital, startups achieved significant growth and generated returns to investors, and, in turn, the returns were reinvested into startups. We have witnessed the start of a positive spiral, and significant evolution of Japan’s startup ecosystem.

The growth of this ecosystem is largely an attribute of flexible and open stock market in Japan. Before the Mothers market was established, over-the-counter market was only means of trading growth company stocks. Since Mothers was established in 1999, growth companies were able to be listed on the public market. Mothers is a unique market in the world, allowing companies with relatively small market cap to get listed. Before the 2000s, there was not an ample supply of capital during the private phase, and it was difficult for private companies to raise even 1 billion yen. In those days, Mothers a crucial role in supplying capital to middle and growth phase, and bread the first and second generation of Japanese startups to become Japan’s leading tech companies. Furthermore, since the late 2010s, as shown in the Mercari’s case, Mothers has also served as a launch pad for IPOs of unicorns. Mothers has provided Japanese startup with flexibility in financing and strategic options: they are able to choose to go public with a small market cap, and use the funds raised at the IPO for further growth; or they can go public at a significant size, and raise a big amount to further fuel their growth. In addition, for emerging companies, compared to other Asian stock markets, including Hong Kong and Singapore, Mothers fares much better in terms of aggregate market cap and liquidity, and is comparable to major markets across the globe. Mothers provides startups with the infrastructure for fundraising, and private investors with liquidity, and therefore provides Japanese startups with advantages in competing in the global arena. In the venture fund I manage, we have some overseas institutional investors. When we pitch to our overseas investors, Japan’s advantage of having Mothers as a home market is highly recognized, and it facilitates global capital flow into Japan’s startup ecosystem.

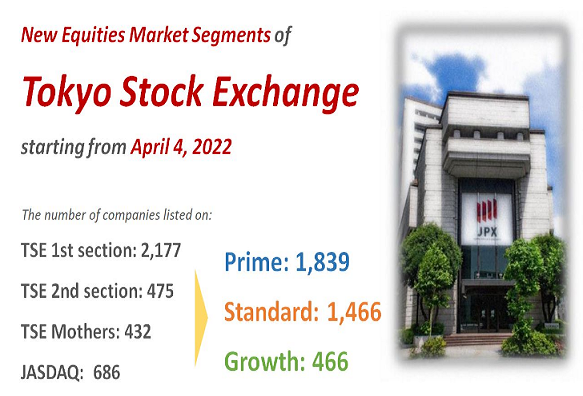

In April 2022, as the second stage, Tokyo Stock Exchange will transform into new market segments. I have high expectations for further development of Japan’s stock markets, especially for emerging companies Growth Market. The clearly defined listing criteria would facilitate healthy turnover of the companies listed on the market and ensures that the market remains attractive for investors. Moreover, clarifying the concept of the segments, Prime, Standard, and Growth, will make it easier for the investors to make their asset allocation decisions. Additionally clear definition of “floating stock” will prevent the lack of governance from cross-shareholdings, and, together with the revised new Corporate Governance Code, will enhance the transparency of Japan’s stock market and attract more overseas investors. The new market segmentation will help attract new capital to Japan’s startup ecosystem, and facilitate the creation of new industries.

With the introduction of new market segment, I have great expectations for the start of the accelerated virtuous cycle of Japan’s startup ecosystem. The new market segment will enable us to use the funds from the parent generation to create new industries for the children’s generation, and to leverage capital from overseas to nurture Japanese industries.