TSE Cash Markets

Expecting changes in mindset: from “endorsement from the TSE” to “leading by example”

By Principal, Astonering Advisor LLC

Visiting Researcher, CFO Education and Research Center, Hitotsubashi University

There is not yet a shared image of what is expected of the Prime Market-listed companies among market participants. Different parties have different views. For example, some parties have an image that “the Prime Market takes over the current TSE First Section.” Other parties have an image that, since companies make their own decision on selecting the Prime Market, the market comprises “companies that have global perspectives, and are determined to compete with global corporations in the world.” Mainly, most institutional investors are likely to expect the latter. I am one of them.

I assume an actual profile of the Prime Market will become clear only after June 2023 for the following reason: Some principles of the Corporate Governance Code revised in 2021 (hereinafter, “the CG Code”) stipulate matters which many Japanese companies, except some forward-thinking companies, have not necessarily identified as priority corporate imperatives and not worked on. I think it is difficult to establish effective structures and measures to comply with such principles only in 6 months between June 2021when the revised CG Code was published and December 2021 when the first deadline for response whether comply or explain.

Such principles refer to “ensuring diversity in core human resources”, “promoting sustainability initiatives”, “investment in human capital”, “investment in intellectual properties and intangible assets” and “reviewing business portfolio”, etc. Therefore, although companies may be able to develop formal structures and measures within 6 months or 1 year from the revision of the CG Code, I assume they may need another year to put such structures and measures into practice, and share/recognize outcomes within a company. This led to the estimate of around June 2023. Then we can finally see qualitative changes in the new Prime Market that requires a higher level of governance.

Expected qualitative changes include not only governance, but also the ability to generate ideas, courage and energy to take on unprecedented challenges, and continuous competition among the companies with a sense of “leading by example.”

Core challenge is the revision of TOPIX

In order for companies listed on the Prime Market and the other market segments to continuously take on challenges with the sense of leading by example, I believe an appropriate environment is needed. Overseas markets have such an environment. The environment refers to setting the maximum number of constituents of a stock price index that represents the respective market, and regular restructuring of the constituents. While the criteria for selecting constituents of an index is obviously important, setting the maximum number of constituents and reshuffling the constituents are indispensable for the following reasons: If the number of companies that satisfy the criteria exceeds the maximum number of constituents, the constituents will be selected from upper layer companies that satisfy the criteria up to the maximum number, so the quality of constituent companies will significantly exceed the criteria. Furthermore, through regular reshuffling of constituents, competition over the quality will continue.

Although the Financial System Council’s Capital Market Working Group has discussed revisions of TOPIX, it has not reached a conclusion. Some members were against major revisions by arguing that the continuity of the basis for calculation is also important, since TOPIX is used by a wide range of index users. Furthermore, passive investors whose investments are actually linked to TOPIX are also cautious about significant revisions as they are concerned about possible impact on their investment practices. However, when you thoroughly consider why TOPIX-linked passive investments are meaningful, and compare such investments to major index-linked passive investments in other countries, you should sincerely examine a striking long-term gap between returns from TOPIX-linked investments and other index-linked investments where the maximum number of constituents is set and the constituents are reshuffled.

I suggest that the Tokyo Stock Exchange should make proactive efforts by imagining how many Japanese companies will be included in major global equity funds in 30 years from now. Such funds place importance not only on the liquidity, but also on the growth potential, ability to create corporate value, and management’s ability to get things done, including ability to provide explanations. Considering the demographic composition in 30 years from now, it is likely to be difficult to support total market capitalization of Japan’s stock market solely with domestic financial resources. In the meantime, it is also difficult to imagine that the existing TOPIX attracts foreign investments. Of course, there will be cases where foreign investors make selective investments into few Japanese companies that are globally competitive. Market capitalization of companies other than those few Japanese companies may rapidly decline. When that happens, it will be much more difficult to revise the index.

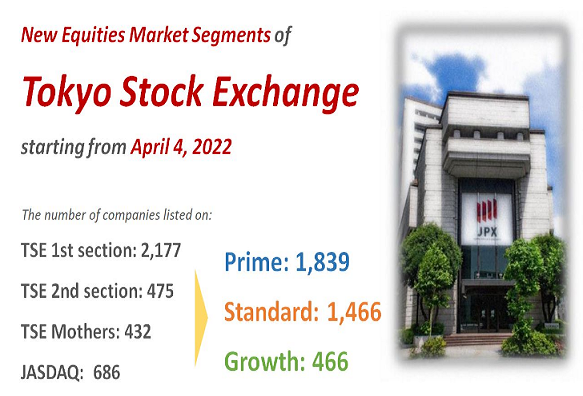

With the TSE’s market restructuring, the traditional linkage between TOPIX and all companies listed on the First Section is to be discontinued. I regard it as the first step of reform, and expect further preparations for the next steps.