TSE Cash Markets

For the growth of start-ups to be a driving force for Japan’s economic growth

By Yusuke Murata, General Partner, Incubate Fund

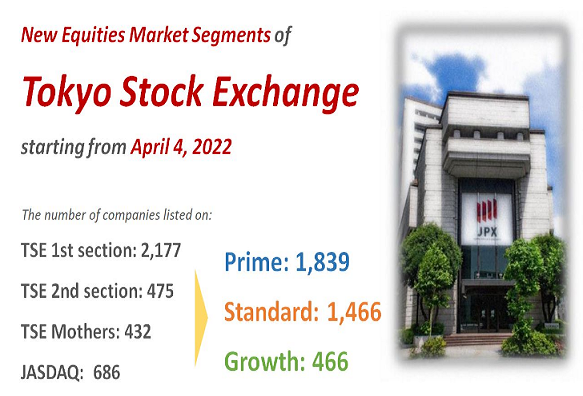

On April 4, 2022, the Tokyo Stock Exchange (TSE) will restructure its stock market into new market segments. For many start-up companies in Japan, their IPO destination will change from Mothers market to the Growth Market. In recent years, market players have been discussing not only listing criteria for the new market segments, but also the process of setting an offering price at IPO, as well as the pros and cons of a Special Purpose Acquisition Company (SPAC) in Japan and direct listing, from the viewpoint of the market structure. I’d like to express my opinions on what kind of market should be developed in order for start-ups in Japan to grow to be a driver of the economy, from the standpoint of a venture capital (VC).

Looking back the fundraising environment for start-ups in Japan in the past 15 years, we experienced the “financial ice age” until around 2012 due to a series of adverse events including the Livedoor shock in 2006, the collapse of Lehman Brothers in 2008, and the Great East Japan Earthquake in 2011, but thereafter saw the constant growth for 10 years. In 2018, the amount of funds raised in the year exceeded 500 billion yen, which was the largest amount ever. In 2021, the amount raised by the 3rd quarter already exceeded 600 billion yen, and the annual amount is estimated to exceed 800 billion yen. This can be due to the combination of the following situations on the part of issuers and investors. As for issuers, the quality of corporate managers of start-ups improved and they have higher motives, and businesses are scaled up. As for investors, Japan’s VCs, which provide funds, began to acquire funds from Japanese and foreign institutional investors; Japanese and foreign institutional investors, who essentially invested in listed stocks, started investing in start-ups as crossover investors; and foreign VCs/PEs entered in Japan’s market one after another.

On the other hand, looking at the IPO environment, although the offering size is becoming larger every year, if we look only at the amount raised by public offerings, an average amount has remained around 120 billion yen in the past 10 years. From the viewpoint of issuers, the gap between the amount publicly raised and the amount raised at IPO has been widening. Traditionally, IPO is recognized as a method for issuers to raise a large amount of money. However, now IPO is being recognized as a method for securing the liquidity, and I feel there is a growing trend where start-ups plan to raise funds through public offerings after they build credibility in the market. Furthermore, as mentioned earlier, Japanese and foreign institutional investors are increasingly acting as crossover investors and investing in private companies as well. From the viewpoint of institutional investors, the boundary between listed and unlisted companies in their investment universes are increasingly becoming blurred.

These phenomena can be seen not only in Japan, but also everywhere in the world. Start-ups draw great attention as a future economic driver, and an unprecedented amount of money flows into start-ups. The number of unicorns exceeded 1,000. Globally, it is now not rare that start-ups go public with an IPO valuation of more than 1 trillion yen.

Taking this fact into account, I have a request to TSE and market players as well as issuers who plan to make IPOs: each one should pursue higher goals at their own positions. The Growth Market, following its predecessor Mothers market, take on regulations that allow for the easiest listing in the world. While recognizing such market characteristics, I hope a large IPO offering size, which is sufficient for attracting investors from all over the world, becomes common.

The Japan Venture Capital Association (JVCA) set “three targets of one trillion” to be achieved by the end of 2023: (1) there is/are case(s) where market capitalization exceeds 1 trillion yen within 1 year from IPO; (2) annual total of fundraising by start-ups exceeds 1 trillion yen; and (3) The amount of VC funds established in Japan in a year exceeds 1 trillion yen. I’d like to work with everyone to create a good market.