JGBs

Leading products are bond derivatives such as 10-year and 20-year Japanese Government Bond (JGB) Futures and Options. The OSE launched a 20-year JGB Futures Market Stimulation Program intending to increase convenience for investors by improving market liquidity on April 4, 2022.

-

BOJ holds steady while bonds/stocks look attractive

Harry Ishihara, Macro Strategist

3月 21, 2025 5 min read

-

JPX Derivatives Market Review for 2024

OSE

3月 12, 2025 4 min read

-

Japanese foreign bond flows – an update

Harry Ishihara, Macro Strategist

3月 10, 2025 4 min read

-

Japan’s Inflation Beats the US while Households Feel It’s 17% – Why Is the BOJ so Cautious?

Harry Ishihara, Macro Strategist

1月 29, 2025 5 min read

-

Why is Warren Buffet topping up in Japan?

Harry Ishihara, Macro Strategist

11月 1, 2024 5 min read

-

Are Japanese bond investors re-engaging foreign bonds?

Harry Ishihara, Macro Strategist

9月 15, 2024 4 min read

-

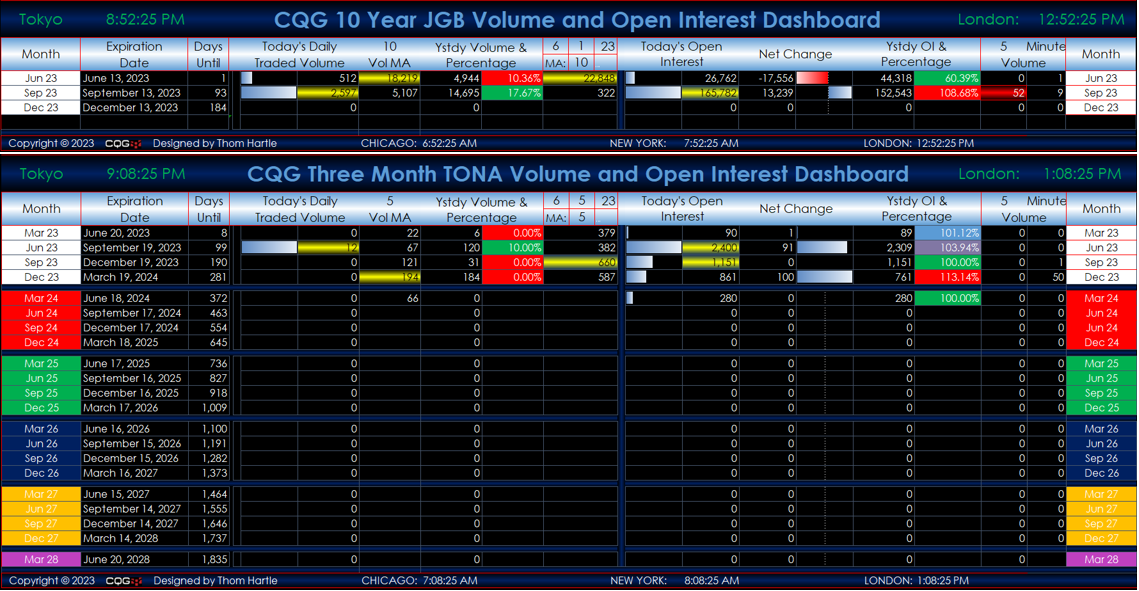

CQG Offers Roll Dashboard of JPX 3-Month TONA Futures and 10-year JGB Futures

CQG

9月 9, 2024 3 min read

-

Japanese retail’s yen carry trade

Harry Ishihara, Macro Strategist

8月 16, 2024 4 min read

-

Japan’s Inflation Revolution – an update

Harry Ishihara, Macro Strategist

7月 31, 2024 4 min read

-

Is the yen’s weakness more structural now?

Harry Ishihara, Macro Strategist

6月 19, 2024 5 min read

-

Did Bank of Japan Governor Ueda do a 360 on the yen?

Harry Ishihara, Macro Strategist

5月 23, 2024 4 min read

-

From LIBOR and Euroyen TIBOR to TONA and OSE 3-Month TONA Futures: A Brief History

Alexis Stenfors, Associate Professor in Economics and Finance, University of Portsmouth

4月 22, 2024 3 min read