OSE Derivatives

JPX Derivatives Market Review for 2024

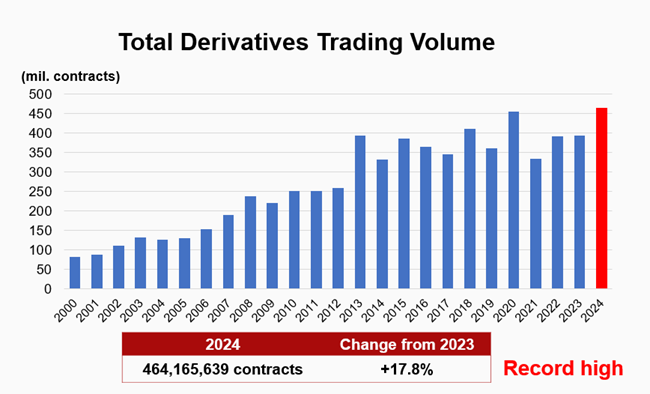

Trading volume in the Japan Exchange (JPX) derivatives market surged to a record-breaking 464,165,639 contracts in 2024, with a trading value of 4,156 trillion yen, both all-time highs. The new high volume marks a significant increase, surpassing the previous record set during the COVID market turmoil in 2020.

As shown below, derivatives across all categories – equity, bond, and commodity — have experienced growth. Equity derivatives hit a record high, playing a key role in the overall increase in trading volume in the JPX derivatives market in 2024.

< Equity Derivatives >

On December 30, the last day of trading in 2024, the Nikkei 225 closed at 39,894 yen, the highest year-end level in 35 years. The Nikkei index rose 6,430 yen (19%) and the TOPIX rose 418.53 points (18%) for the year. The Tokyo Stock Exchange (TSE) stock market performed exceptionally well, with the trading value of the TSE Prime Market (domestic common stocks) reaching an all-time high of 1,254,233.4 billion yen, making 2024 a particularly strong year.

The strong stock market helped push trading volume for Nikkei 225 Micro Futures, a new product listed on May 29, 2023, dramatically higher. Similarly, trading volumes of Bank Stock Index Futures, TSE REIT Index Futures, TSE Growth Market 250 Index Futures and TOPIX Options all hit their second-highest levels ever, which contributed significantly to the overall increase in equity derivative activity. Details of the Nikkei 225 Micro Futures are discussed below.

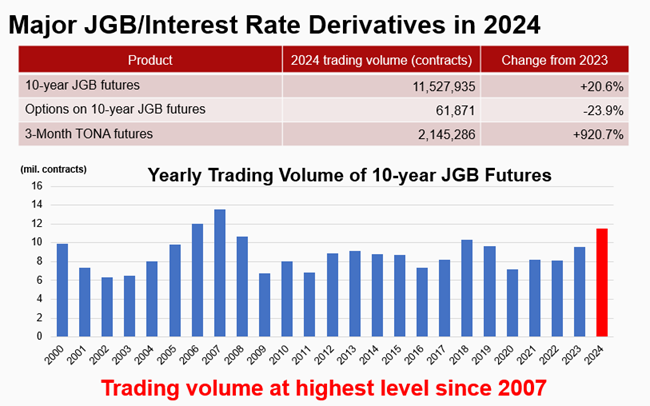

< Bond Derivatives and Interest-rate Derivatives >

In JGB and interest-rate derivatives, trading volume in 3-month TONA (Tokyo Overnight Average rate) and 10-year JGB futures increased significantly. Investors realized interest rates would rise in 2024 due to the Bank of Japan’s change in monetary policy. Trading in the long-term JGB futures, which had been sluggish during the previous low-interest rate period, rose to its highest level since 2007 as investors reacted to signs of rising interest rates. A similar trend was observed in the 3-month TONA interest rate futures, as discussed in detail below.

< Commodity Derivatives >

Trading in futures contracts for precious metals such as gold and platinum surged in 2024. The price of gold hit record highs, while platinum remained at elevated levels, driven partly by growing concerns over geopolitical risks in the Middle East and elsewhere.

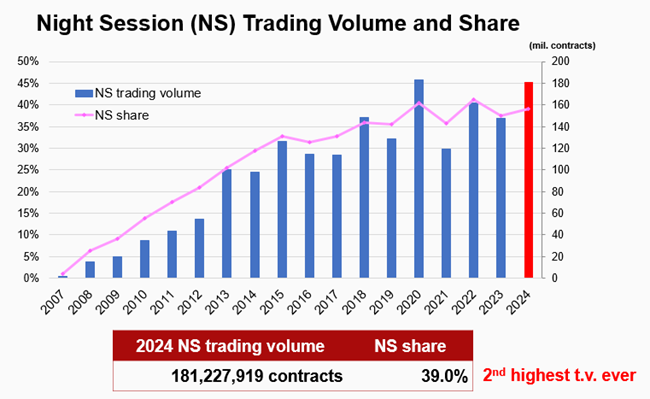

< Night Session Trading Status >

In 2024, Night Session trading volume reached 181,227,919 contracts, marking the second highest level on record. The proportion of Night Session trading to total trading volume remained strong at 39%. The rise in trading by foreign investors is consistent across the derivatives market, reflecting growing interest and participation.

< Holiday Trading Status >

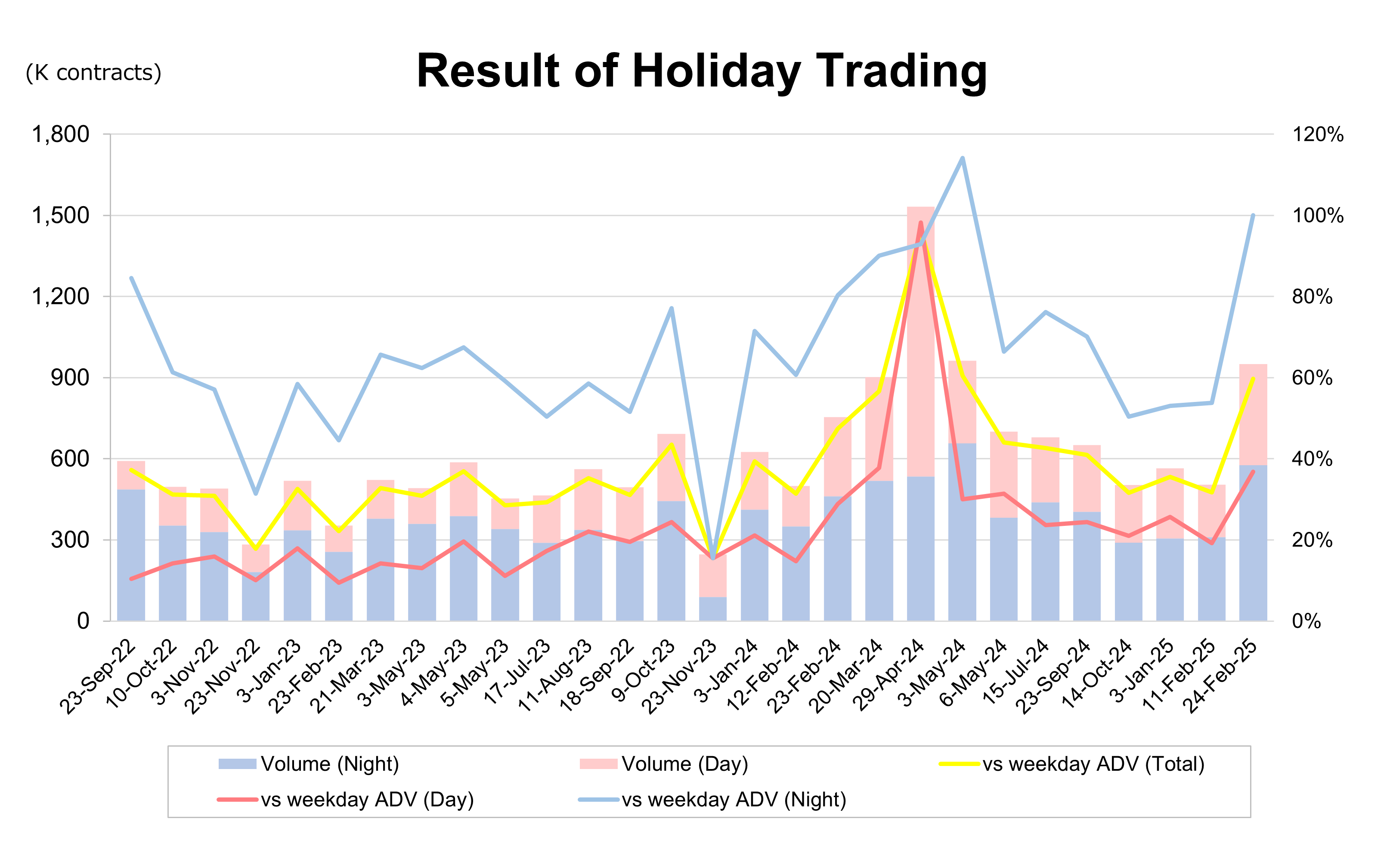

Japan observes 16 national holidays per year, more than many other countries. In response to the needs of retail/individual investors and the growing number of overseas investors, JPX introduced holiday trading in derivatives in September 2022.

Ten holiday trading sessions took place in 2024. As more investors become aware of holiday trading, volume continues to increase. When holiday trading was first introduced, holiday trades amounted to 20-30% of weekday activity. Since the beginning of 2024, holiday trading volume has consistently exceeded 40% of weekday totals.

During Japan’s annual Golden Week holiday, which takes place from late April to early May, trading volume on April 29 was comparable to that of a typical weekday. On that day, the dollar-yen exchange rate briefly hit 160-yen before quickly returning to 155 yen. These fluctuations, coupled with increased volatility in commodity prices, mainly stock index futures, contributed to a significant rise in trading activity.

Holiday trading offers opportunities, such as using derivatives for hedging, during closure of the Japanese stock market on holidays. The steady increase in holiday trading has enhanced the price indexation and reliability of derivatives during holiday periods and has become a key reference for non- derivatives, helping them predict market trends after the holiday.

Upcoming holiday trading schedules can be found here.

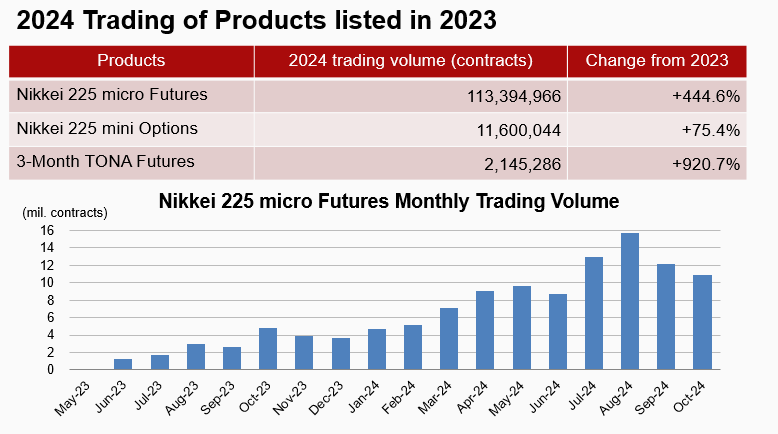

< New Products of Rapid Growth >

New products have played a pivotal role in the higher derivatives trading volume in 2024. Among products listed in May 2023, trading in three — Nikkei 225 Micro Futures, Nikkei 225 Mini Options, and 3 Month TONA Futures — saw significant growth.

Trading volume in the Nikkei 225 Micro Futures ranked second in the derivatives market, just behind Nikkei 225 Mini Futures. This substantial growth helped drive the record-high trading volume across the entire derivatives market. Retail/individual investors account for 30% of all Nikkei 225 Micro Futures investors, compared with about 10% for the Nikkei 225 Futures and 20% for the Nikkei 225 Mini Futures.

Trading in 3-month TONA Futures has risen steadily since late 2023, when the BOJ’s policy revision becomes more conscious. The BOJ’s policy shifts, including the removal of negative interest rates and the Yield Curve Control (YCC) on March 19, 2024, followed by the rate hike to 0.25% on July 31, 2024, have significantly boosted trading activity. A subsequent rate hike to 0.5% on January 31, 2025, and another potential hike in 2025 are expected to further stimulate trading. This activity has drawn attention not only from foreign investors, who are already active, but also from domestic financial institutions.

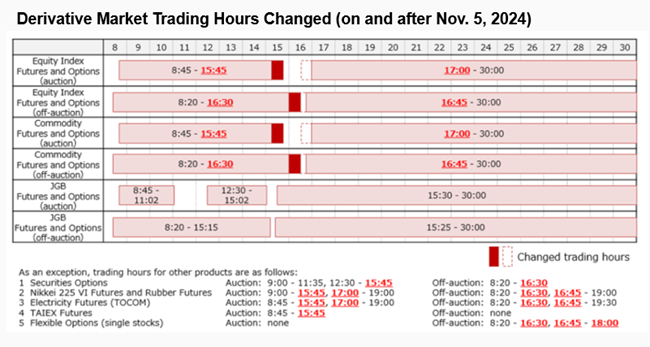

< Trading Hours Extended >

The extension of trading hours on the TSE was a major topic for the market in 2024. Trading hours on the derivatives market were also adjusted, without causing any major disruptions.

< JPX Derivatives Market in 2025 >

Derivatives trading volume reached a record high in 2024, and JPX is planning measures in 2025 to further expand trading. On May 26, 2025, JPX intends to introduce institutional improvements and new products aimed at driving continued growth, including:

– adding Wednesday maturities to Nikkei 225 mini Options

– adding more contract months to TOPIX futures

– adding fiscal year contracts to Electricity futures

– listing of Shanghai Natural Rubber Futures

JPX will continue to focus prioritize enhancing market convenience to better meet the needs of investors.