OSE Derivatives

A GUIDE TO TSE’S BANKS INDEX, ETFS, AND FUTURES

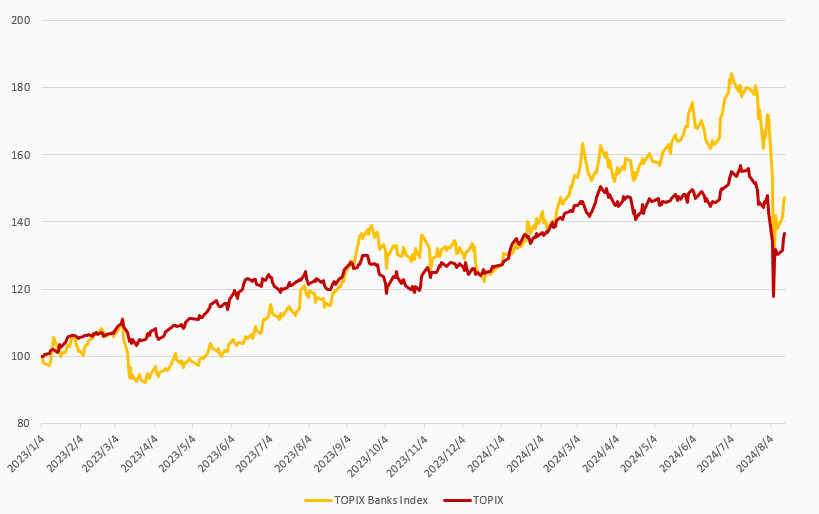

Like other major Japanese stock indexes, the Tokyo Stock Exchange (TSE) Banks Index has continued to rise in recent years. From the end of 2022 until now, the TSE Banks Index has tended to outperform TOPIX (Tokyo Stock Exchange Stock Price Index), a leading index of Japanese stocks, during periods when the Bank of Japan (BOJ) was expected to raise interest rates.

< Comparison between TOPIX and the Banks Index >

Numerical value with the end of 2022 as 100

[ Source: TSE, Bloomberg ]

Although the Japanese stock market sank in early August 2024, investors looked favorably on the TSE Banks Index dividend yield of 3.9% (versus TOPIX’s 2.9%) and its relative immunity to currency fluctuations, as compared to automotive, trade and other sectoral indexes.

The BOJ has conducted large-scale monetary easing since 2013. Since 2022, when the BOJ revised its yield curve control (YCC) policy, the TSE Banks Index has experienced a sharp rise paralleling that of the Japanese stock market. The likely explanation is the rise in interest rates on the 10-year JGB, which widened the gap between long- and short-term interest rates and increased interest margins in the banking sector and, in turn, raised expectations of improved earnings.

< Comparison between the 10-year JGB and the Banks Index >

[ Source: TSE, Bloomberg ]

Also fueling the Banks Index’s success, since March 2023 TSE has urged listed companies to “take action to implement management that is conscious of the cost of capital and stock prices”. This directive raised expectations in the banking sector of improvements in management indicators, such as P/B ratio and corporate governance.

What is the TSE Banks Index?

The TSE Banks Index tracks 78 banking stocks in the TOPIX. Like TOPIX, the Banks Index is calculated using the free-float based market capitalization-weighted average method. The top 10 TSE Bank stocks account for approximately 80% of the index components as shown below. At the end of June 2024, the Banks Index ranked first in terms of market capitalization among TOPIX’s 33 industrial sectors.

< Top 10 Banks Index Components >

[ Source: Bloomberg, as of July 26, 2024 ]

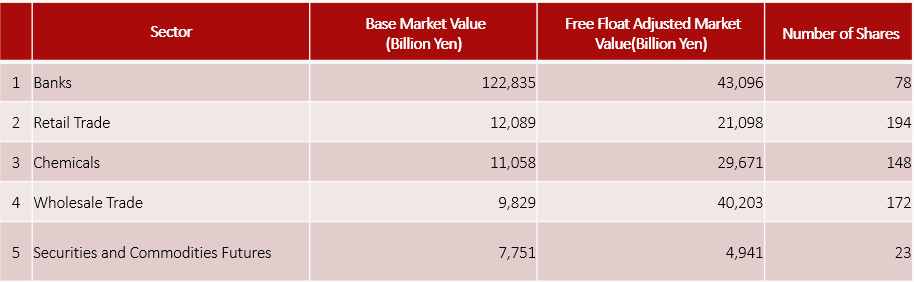

< Top 5 of the 33 Sector Indexes, Based on Market Capitalization >

[ Source: JPX, as of June2024 / https://www.jpx.co.jp/english/markets/indices/related/value/index.html ]

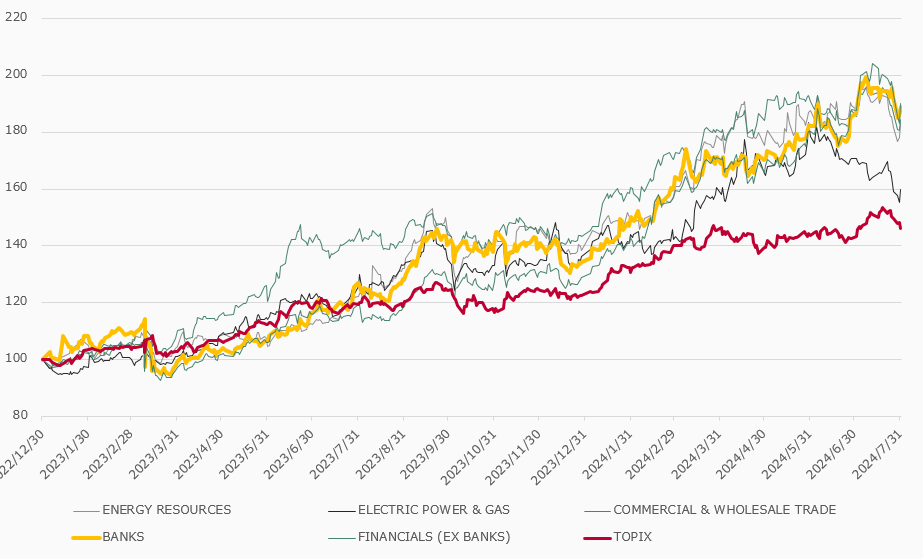

In the first half of 2024, banking notched the fourth best performance by industry, behind energy resources, trading/wholesale, and financials (excluding banks), and significantly outperformed the TOPIX, as the index is more likely to benefit from higher interest rates.

< Performance Comparison by Industry Sector Indexes and TOPIX >

[ Source: TSE ]

Two Banks Indexes

The TSE Banks Index has a base date of January 6, 1992, and a base value of 1,000. The TOPIX-17 Banks Index has a base date of December 30, 2002, and a base value of 100. The component stocks of both indexes are the same.

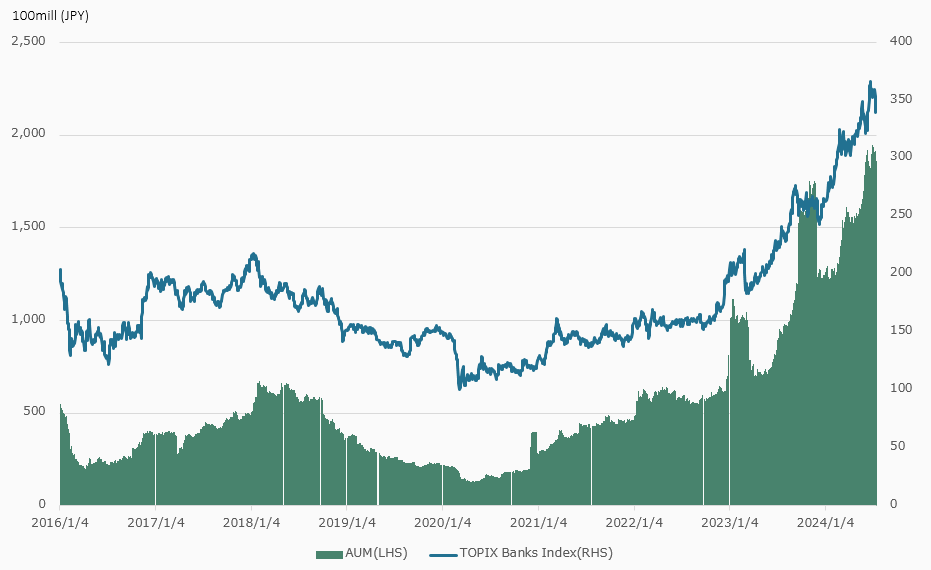

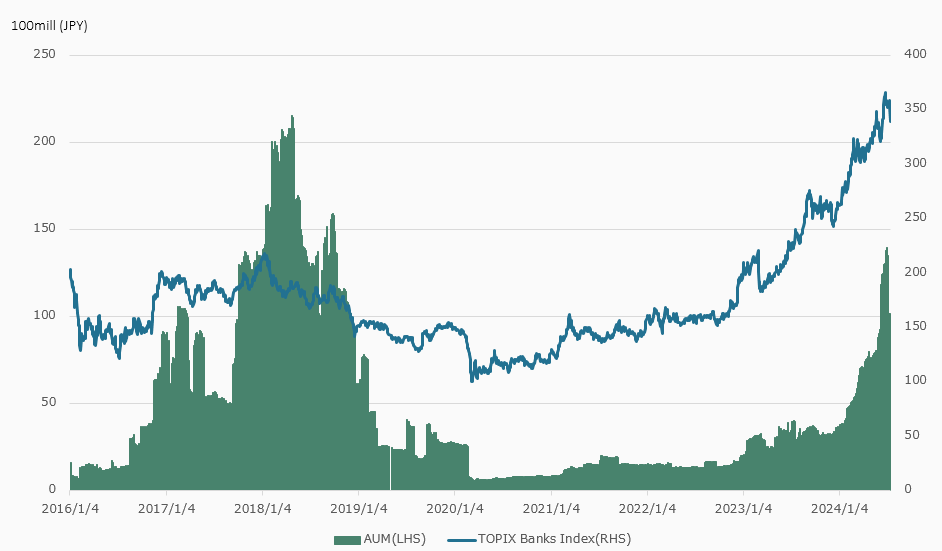

BANKS INDEX ETFS

An ETF linked to the TSE Banks Index, NEXT FUNDS TOPIX Banks Exchange Traded Fund (1615) provided by Nomura Asset Management, is listed on the TSE. Since its listing in 2002, this ETF has expanded in size and its AUM has steadily grown. Another ETF linked to the TOPIX-17 Banks Index, NEXT FUNDS TOPIX-17 BANKS ETF (1631) also by Nomura, was listed in 2008. This ETF saw its balance grow 375% in the first half of 2024.

< Net Asset of NEXT FUNDS TOPIX Banks Exchange Traded Fund (1615) >

[ Source: https://nextfunds.jp/en/lineup/1615/?from=quick ]

< Net Asset of NEXT FUNDS TOPIX-17 BANKS ETF (1631) >

[ Source: https://nextfunds.jp/en/lineup/1631/?from=category ]

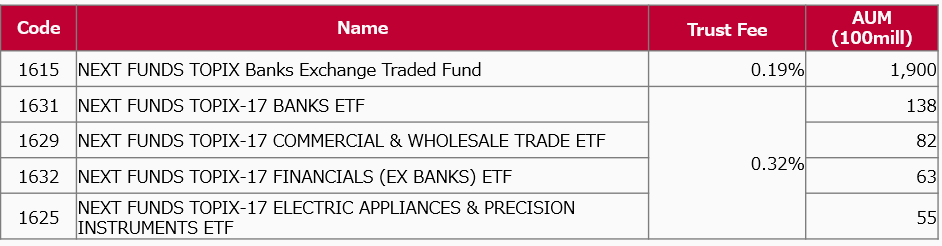

These banks index ETFs also rank high in net asset value among the sector-specific ETFs listed on TSE, as shown below.

< Top 5 AUM of Sector-specific ETFs >

[ Source: TSE ]

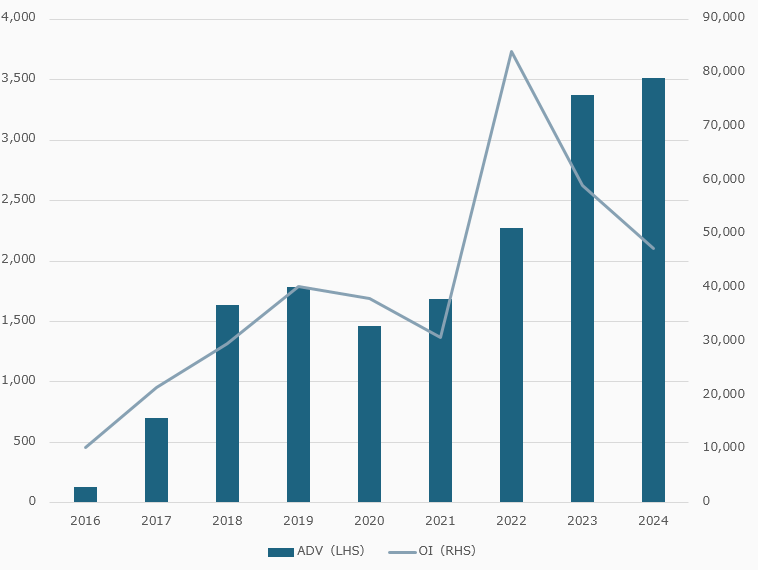

BANKS INDEX FUTURES

Since 1988, TOPIX Banks Index Futures have been listed on the Osaka Securities Exchange (OSE) as derivatives, using the TSE Banks Index as the underlying asset. The trading unit for TOPIX Banks Index Futures is the value of the underlying index multiplied by 10,000 yen, which will be JPY 2,790,000 (approximately USD 19,000) based on the closing future price on August 6, 2024. The initial margin per contract on OSE will be approximately 400,000 yen (approximately $2,760) as of August 6, 2024. The last three listed contract months of the March, June, September, and December cycles are traded.

More than 90% of TOPIX Banks Index Futures trading volume is conducted off-screen (or J-NET), and the market is dominated by large-lot trading from domestic and foreign institutional investors. Traders incorporate TOPIX Banks Index Futures in investment strategies to gain exposure to interest rate-sensitive Japanese equities in the form of futures, the contract for which is based on the index of bank stocks listed on TSE.

Trading volume and open interest balance for TOPIX Banks Index Futures contracts have been increasing in line with the increase in the net asset balance of ETFs listed on TSE that are linked to the banking sector indexes. Since these futures can also meet the hedging needs of portfolios containing bank stocks and ETFs, it is expected to continue to play an important role as part of the market’s ecosystem. In addition, a market-making system has been introduced to foster TOPIX Banks Index Futures liquidity and facilitate on-screen trading.

< Average Daily Volume (unit) of TOPIX Banks Index Futures >

[ Source: OSE ]

In the Japanese market, expectations for higher interest rates via the BOJ’s revision of monetary policy have led to increased focus on bank stocks as a profit driver, as they are more sensitive to interest rates. The development of TOPIX Banks Index Futures, in addition to bank stocks and bank index ETFs, is essential to upgrading the entire market ecosystem, and OSE will continue its promotional efforts to increase market liquidity and trading opportunities.

Related links