OSE Derivatives

Japan’s Natural Rubber Futures Have Enhanced Global Supply Chains

Since 1952, natural rubber futures contracts have been traded in Japan at the Osaka Exchange (OSE). The physical delivery requirement under these contracts has helped diversify rubber supply chains and improve market functions.

History of Natural Rubber Grades

Before the 1950s, manufacturing standards of the U.S. Rubber Manufacturers Association (RMA) (Green Book) and the Singapore Chamber of Commerce Rubber Association (Blue Book) were recognized as the international standards for tradeable sheet-rubber. The Kobe and Tokyo rubber exchanges adopted the U.S. RMA standard as the required physical delivery grade when they began trading rubber futures in 1952.

Despite the standards, weight-padding and grade fraud were rampant, especially among Singaporean packing concerns, resulting in a great many complaints from natural rubber consumers. Amid mounting calls for a unified standard to alleviate fraud, in 1955 the International Rubber Quality and Packing Conference (IRQPC) resolved to formulate an internationally recognized standard based on the U.S. RMA model. In 1957, IRQPC created International Standards of Quality and Packing for Natural Rubber Grades. Problems continued, however, as the new standard did not replace the existing Green Book or Blue Book standards, which the exchanges remained free to adopt.

In 1962, the IRQPC decided to remove the Blue Book standard and finally promulgated unified “International Standards of Quality and Packing for Natural Rubber Grades,” which aimed to bring reliable delivery and guaranteed quality to rubber trading. The new unified standard, dubbed the “The Green Book” for the color of its cover, was last updated in 1979. Japan’s natural rubber (RSS) futures adopted the Green Book standard for physical rubber delivery mechanism in 1962.

Efforts to Improve Quality

Prior to adopting the international standards, Japan recognized multiple standards for natural rubber quality, which sometimes resulted in trades of inferior rubber with no mechanism to bring a complaint under the contract. The Rubber Importers Association of Japan (today’s Rubber Trading Association of Japan (RTAJ)) advocated for standardizing quality in imported products (standardized product purchase method) and implementing dispute arbitration in Japan.

As a result, the quality of rubber imported to Japan gradually improved, but quality problems still occurred frequently. Problems were not limited to overseas suppliers; Japanese suppliers sometimes engaged in fraud, selling imported natural rubber that differed from the stated grade. To deal with these cases, in 1960 the Japan Rubber Importers Association and other related associations in Japan, along with the Tokyo and Kobe Rubber Exchanges established the Japan Natural Rubber Quality Council to improve imported rubber quality.

When Japanese futures trading began on the rubber exchanges in 1952, Malaysia accounted for 64.5% of Japan’s natural rubber imports and Indonesia accounted for 34.5%. After 1960, thanks to a natural rubber replanting scheme financed by the World Bank, Thailand increasingly satisfied Japan’s growing demand for rubber. By 1970, Thailand accounted for 60-70% of Japan’s imports and was the nation’s largest natural rubber trading partner until Indonesia overtook it again in the mid-2000s. For most of that time, Japanese industry groups lobbied producers, mostly in Thailand, to improve the quality of natural rubber.

Current Delivery Specification of Natural Rubber

In 1981, following incidents of contamination and insufficient smoking and drying in cargoes originating from Thailand, the Rubber Importers Association of Japan (today’s RTAJ) imposed a registration system on shippers (exporters in the country of origin) and packing houses for rubber imported from Thailand. The RTAJ’s system remains in effect, with 23 Thai shippers and 43 Thai packers registered.

The exchange rules define the deliverable grades of Japan’s rubber (RSS3) futures as RSS3 according to international standards (Green Book), but the rules do not specify a place of origin. On the other hand, exchange-arranged quality inspections only deal in rubber produced and exported by firms listed on RTAJ’s registry. The registry covers Thai rubber only, and as a result, all RSS rubber currently available for delivery through Japan’s futures market originates in Thailand.

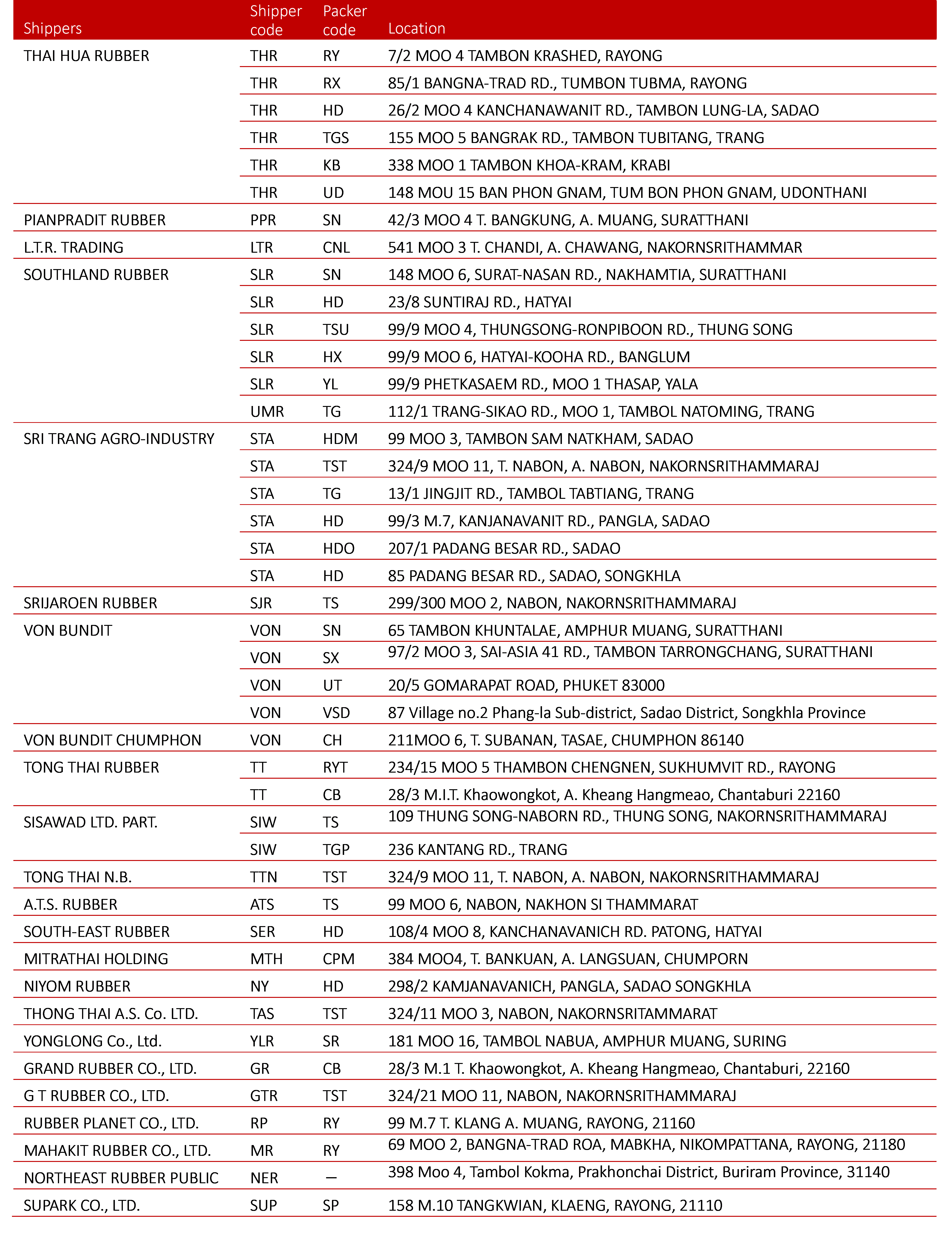

RTAJ’s Packing House List (as of April 4, 2024)

Source: RTAJ “Packing House List”

Quality Inspection by the Exchange

In the early days of trading, quality inspections of rubber to be delivered for RSS Futures (known as delivery goods or deliverable grades) were conducted by the receiver (the commodity broker who buys RSS Futures) at the time of delivery. However, due to an increase in the number of intermediaries unable to perform inspections, an exchange-arranged quality inspection system was introduced in 1958 to allow receivers to waive inspection with a certificate issued by the Exchanges. The certificate lends credibility and helps ensure the quality of rubber delivered through futures trading.

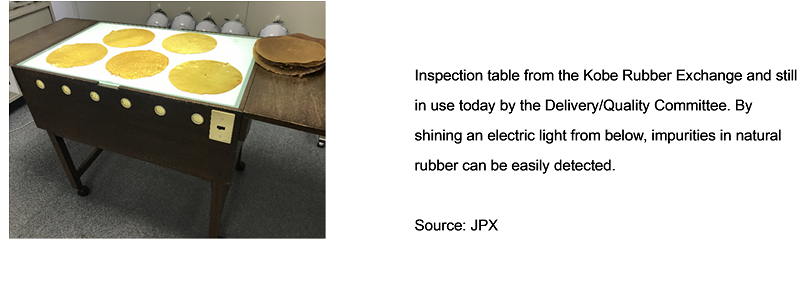

An inspection table used by the Delivery/Quality Committee

For natural rubber futures to merit deliverable grades, natural rubber users must first and foremost have confidence in its quality. OSE conducts quality control through inspections, and as a result, 10,000 to 20,000 tons of natural rubber (RSS) is delivered through the futures market each year. The amount accounts for around 5% to 10% of RSS rubber imported annually to Japan. Currently, Japan’s futures market is fully open to offshore players, who are also major players in the physical rubber delivery at the OSE. Thus, the Japanese natural rubber futures market occupies an essential position in the natural rubber supply chain.