OSE Derivatives

From LIBOR and Euroyen TIBOR to TONA and OSE 3-Month TONA Futures: A Brief History

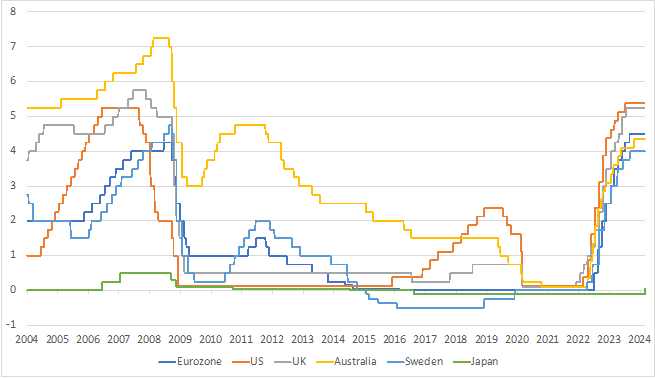

On 19 March 2024, the Bank of Japan finally abandoned its policy framework of yield curve control and negative interest rates.

However, international financial markets in general and money markets in particular have changed dramatically since the last Bank of Japan rate hike in 2007. The “menu” of benchmarks and financial products linked to them looks totally different. This is not only important for market participants who want to hedge against, or speculate on, interest rate changes. It is also relevant for economists, analysts, and commentators following developments in Japan.

To understand the current Japanese product menu, and what it means, we need to reflect on its history.

When the Chicago Mercantile Exchange (CME) launched the first cash-settled futures contract in the world, the 3-month Eurodollar future, in 1981, it quickly became the most actively traded short-term interest rate contract.

The Eurodollar future later came to be indexed to the 3-month USD London Interbank Offered Rate (LIBOR). LIBOR, in turn, was an estimate-based benchmark originally designed to capture the activity in the interbank money market, or the so-called “Eurocurrency” market, which had been around since 1957.

LIBOR came to be copied in other financial centres (TIBOR in Tokyo, FIBOR in Frankfurt, and so on), and corresponding futures contracts were introduced, such as the 3-month Euroyen TIBOR future in Japan.

Most interest rate derivatives traded in the over-the-counter (OTC) market, such as forward rate agreements and interest rate swaps, were also tied to LIBOR-type benchmarks.

However, the LIBOR scandal, which erupted in 2012, revealed that the estimate-based benchmark was susceptible to systematic manipulation and collusion. Problematically, it also turned out that the underlying term money market was considerably less liquid than previously thought—and sometimes nonexistent.

As stated by Andrew Bailey, Chief Executive of the UK Financial Conduct Authority: “The underlying market that LIBOR seeks to measure – the market for unsecured wholesale term lending to banks – is no longer sufficiently active. […] If an active market does not exist, how can even the best-run benchmark measure it?”.

As a result, financial regulators around the world recommended a transition away from IBOR-like benchmarks towards so-called risk-free rates that were based on actual transactions and had sufficient liquidity in underlying markets.

Since then, countries have chosen different alternatives to replace LIBOR. For instance, the US has opted for the Secured Overnight Financing Rate (SOFR), a secured overnight interest rate, whereas the UK has chosen the Sterling Overnight Index Average (SONIA), a transaction-based average rate based on banks’ overnight borrowing.

In Japan, the Tokyo Over-Night Average (TONA) has been selected as the risk-free rate. TONA is the uncollateralized overnight call rate in Japan.

The most important feature in the shift towards alternative risk-free rates has been the adoption of actual transactions, instead of non-binding quotes and estimates, as the basis for the benchmark calculation.

Another crucial aspect concerns the maturity. Because the interbank term money market has dried up, all major benchmarks are now referencing the overnight money market rate instead of maturities such as 3 months. This means that the 3-month LIBOR was a “forward-looking” term rate because it was fixed and known at the start of the contract period. The 3-month TONA, however, is “backward-looking” because it requires the actual overnight rates to be compounded in arrears after the 3 months have passed.

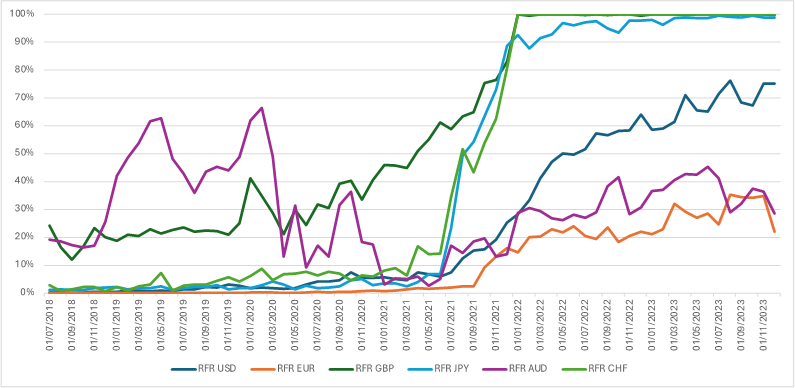

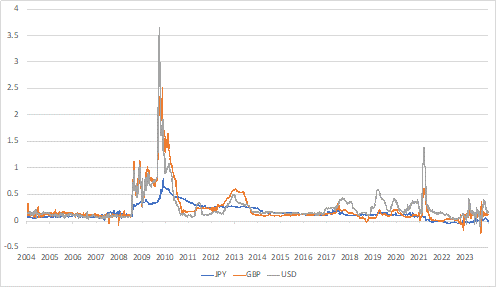

The transformation towards alternative risk-free rates has already dramatically impacted the market structure. By late 2022, nearly 100% of GBP, JPY, and CHF interest rate swaps referenced SONIA, TONA, or the Swiss average overnight rate (SARON), respectively. The transformation has been most dramatic for JPY, where less than 10% of the interest rate swap market referenced TONA as late as 2019.

The impact on the exchange-traded market has also been profound. By 2022, the share of futures based on risk-free rates had jumped to 100% for GBP and CHF.

Perhaps the most visible and symbolic change has been the disappearance of the 3-month Eurodollar futures contract in 2023. CME launched SOFR futures in May 2018, and the contract has become the de facto replacement of the historic Eurodollar futures contract.

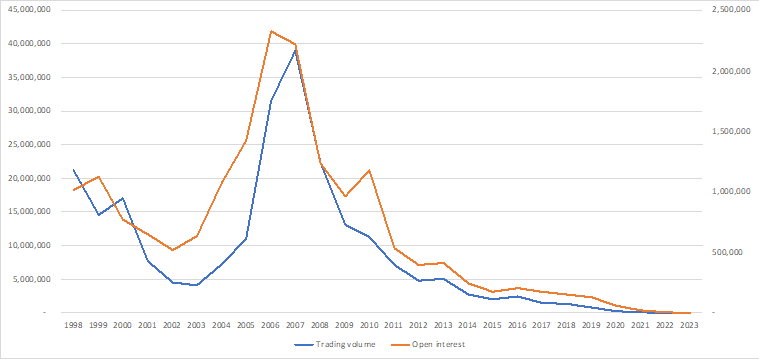

In Japan, the 3-month Euroyen TIBOR futures contract has traditionally represented the exchange-traded interest rate derivatives market. Although a LIBOR-based futures contract was also trialled in the past, the TIBOR-based future remained the flagship contract for more than a quarter of a century. However, with a permanent end of the Euroyen TIBOR scheduled for December 2024, trading more or less dried up in early 2023.

The OSE 3-month TONA futures contract was launched on 29 May 2023 not only as its replacement but also as a new alternative to hedge against and speculate on movements in the Japanese short-term interest rate using TONA as the benchmark.

Compared to its predecessor, the OSE 3-Month TONA futures market has four benefits.

Benefit 1

First, the underlying interest rate reference rate (TONA) is based on actual transactions rather than non-binding or indicative quotes and estimates. This makes the benchmark underpinning the OSE 3-month TONA futures market considerably less susceptible to manipulative or collusive attempts than LIBOR or TIBOR.

Benefit 2

Second, because of differences in calculation methodology and maturity, more mathematically precise and granulated trading and hedging strategies can be crafted in the OSE 3-month TONA futures market. Further, with the calendar of BOJ monetary policy meetings announced far in advance, the derivative instrument can also be used to derive the future path of central bank policy rates as expected by market participants.

Benefit 3

Third, the OSE 3-month TONA future is exchange-traded and, therefore, has the same general benefits of standardisation as the 3-month Euroyen TIBOR future. Trading strategies may also include combinations with TONA overnight index swaps (OIS) traded in the OTC market, echoing the linkage between the exchange-traded and OTC-traded LIBOR and TIBOR interest rate derivatives back in the past. Two important changes are notable, though. First, the reset (or fixing) risk has decreased dramatically due to the adoption of overnight rather than 3-month underlying maturities. Second, with cross-margining between TONA OIS cleared at Japan Securities Clearing Corporation (JSCC) and OSE 3-month TONA futures having been launched on 4 March 2024, cross-product trading, risk management, and monitoring have been facilitated, and the collateral burden has been reduced.

Benefit 4

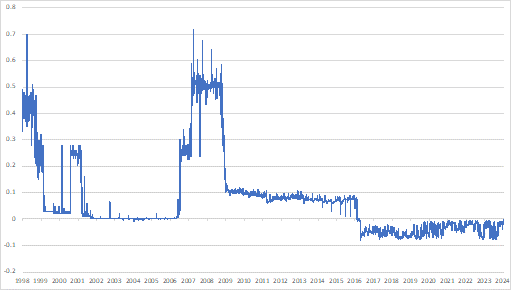

Fourth, LIBOR was a benchmark for borrowing and lending in the interbank term money market. This means that the rate was not only determined by the current and expected future central bank interest rates. It was also influenced by the perceived credit risk among the counterparties and the cost of accessing liquidity over a 3-month horizon. The credit and liquidity risk premia could be significant, particularly during periods of stress, uncertainty, and crises in the banking and financial systems. However, compared to 3-month Euroyen TIBOR futures, OSE 3-month TONA futures are virtually immune to money market risk premia in the underlying, which may have a significant impact on the curve structure.

In 2013, following the LIBOR scandal, the Board of the International Organization of Securities Commissions (IOSCO) published a report on the principles of financial benchmarks. According to them, a good benchmark should demonstrate 5 attributes: robustness and resilience, reliability, usability, transparency and representativeness. TONA, without a doubt, ticks all of those boxes.