OSE Derivatives

Japan’s Natural Rubber Futures Trading: History and Development

Natural rubber futures constitute a rarity among derivatives – an Asian-dominated globally traded derivative listed primarily on Asian exchanges in Japan, China, Singapore, Thailand, and India. Japan joined the natural rubber futures marketplace in 1952 with the Tokyo Rubber Exchange, whereas trading on the Nikkei 225 futures and TOPIX futures debuted more than 30 years later in 1988.

Origins of Natural Rubber Futures Trading

Cultivation of natural rubber in Southeast Asia dates from 1876, when a British explorer, Sir Henry Alexander Wickham, smuggled rubber tree seeds from Brazil, despite a ban on their export. The seeds were entrusted to the Royal Botanic Gardens at Kew, and seedlings were later transported to Sri Lanka and Singapore. Eventually, Southeast Asia, the Malay Peninsula in particular, became the major producer of natural rubber.

Natural rubber from the Peninsula and the Dutch East Indies (present-day Indonesia) was collected in Singapore, where it underwent milling and packaging before being exported to London, as demand for natural rubber at the time was greatest in Europe and the US.

By the early 20th century, rubber prices worldwide were set on London’s Mincing Lane where natural rubber was intensively traded and distributed.

Mincing Lane today (Source: Wikipedia)

Initially, spot and forward trading of natural rubber was conducted on a negotiated (person-to-person, OTC) basis. However, as the global automotive industry developed and the demand for and supply of natural rubber increased, the need for spot players to hedge their positions grew. In 1920-21, a “terminal market” was established in London where natural rubber futures were traded in addition to spot and forward trades. Futures trades were largely unregulated, and unlike other commodity futures, rubber futures trades there were based on a contract for differences (CFD) not linked to spot delivery.

Beyond London, Singapore and New York began trading natural rubber futures in the 1920s. After WWII, however, as Singapore became the center of natural rubber trading due to its proximity to production areas and its growing presence as a trading hub, the scale of futures trading in London and New York declined appreciably, ultimately disappearing altogether.

Asian Natural Rubber Futures Markets

In December 1951, Japan’s first natural rubber futures exchange was established in Kobe, then a center of natural rubber imports and trading. Trading began in January 1952, followed by Tokyo’s Rubber Exchange in December 1952. To encourage market rationalization in response to changes in Japan’s economic structure, commodity futures exchanges continued to merge. Natural rubber futures were traded at the Tokyo Commodity Exchange (TOCOM) from 1984 until October 2019, when it became part of Japan Exchange Group (JPX). In July 2020, natural rubber futures trades were transferred to the Osaka Exchange (OSE), a part of JPX.

Trading floor in 1952 (Source: JPX) Trading on floor was in place until 2014 (Source: JPX)

The system has been digitized, and since December 2014 trades have been made exclusively on the system.

Today, natural rubber futures are traded on OSE in Japan, the Shanghai Futures Exchange (SHFE) and its subsidiary Shanghai International Energy Exchange (INE) in China, the Singapore Exchange (SGX) in Singapore, the Thailand Futures Exchange (TFEX) in Thailand, and elsewhere. Rubber futures traded on the exchanges are primarily RSS (Ribbed Smoked Sheet) and TSR (Technically Specified Rubber). RSS rubber futures on the OSE and TSR rubber futures on the SGX are now recognized internationally as representative price indexes for natural rubber futures. China’s rubber futures market has developed remarkably since late 2000s and is now the world’s largest in terms of trading volume.

| country | exchange | natural rubber futures | target natural rubber origin |

| Japan | OSE | RSS

TSR |

mainly Thailand

Thailand |

| China | SHFE

INE |

SCR/RSS

TSR |

China, Thailand, Indonesia, Malaysia, Sri Lanka

China, Thailand, Indonesia, Malaysia |

| Singapore | SGX | RSS

TSR |

Thailand

Indonesia, Malaysia, Thailand |

| Thailand | TFEX | RSS | Thailand |

(Source: OSE, SHFE, INE, SGX, TFEX)

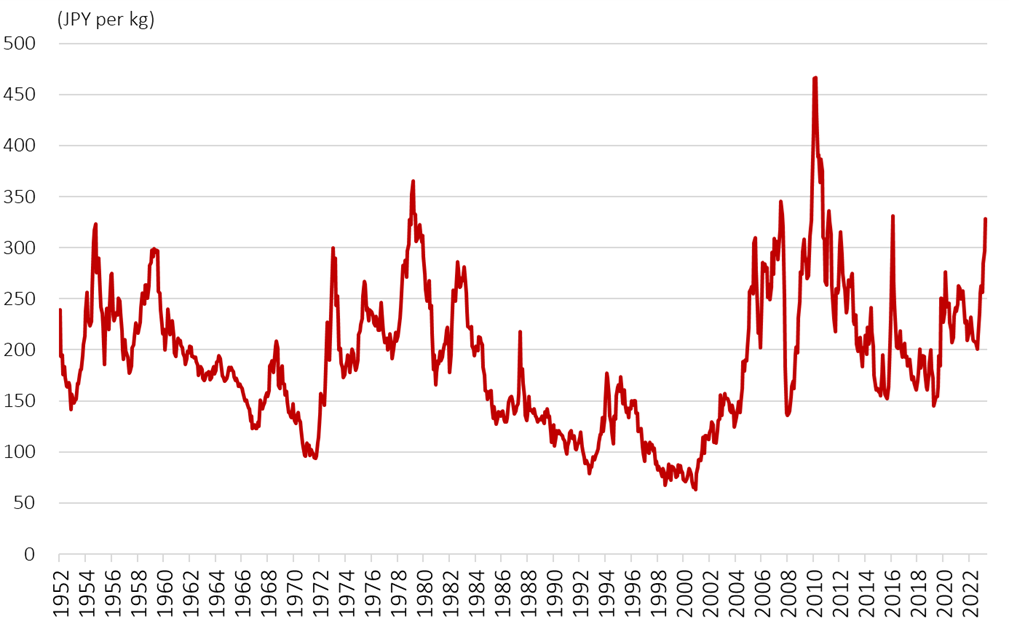

OSE RSS Futures Prices since Listing (monthly closing prices)

(Source: JPX)

Natural rubber is unique among commodities, as its production, consumption, and futures trading are all centered in Asia. Japan has long played an important role in rubber futures. Today, Japan’s rubber exchanges attract natural rubber producers and trading firms as well as Japanese retail investors and global financial players.

For more information on the Japan’s rubber futures market, please see:

https://www.jpx.co.jp/english/derivatives/products/rubber/RubberFuturesInformation/index.html

Related links