OSE Derivatives

Commodities Edge Higher in Q2 – Most Sectors Decline

A composite of the 29 primary commodity markets traded on the U.S. and U.K. exchanges edged only 0.21% higher in Q2, thanks to gains in animal proteins and soft commodities. Over the first six months of 2023, the asset class fell 1.79%. Commodities were 3.83% higher in 2022 and 26.79% higher in 2021.

The overall winner of the 29 for the second quarter was lean hog futures, as the seasonal rise during the start of the grilling season sent the pork futures 27.11% higher since the end of March. Natural gas recovered and rose 26.26%, followed by feeder cattle futures that rallied 23.28%. Soybean oil and cocoa futures rounded out the commodities with double-digit gains, with 17.16% and 13.13% respective rallies.

The biggest loser for the second quarter was the physical rhodium market which plunged 47.14%. Rhodium also led the way on the downside since the end of 2022, with a 68.91% loss. In Q2, the Baltic Dry Index dropped 20.74%, LME zinc fell 18.29%, and palladium and corn futures were down 16.76% and 16.05%, respectively. Double-digit percentage losers included LME nickel forwards, Rotterdam coal, LME aluminum, and soybean meal futures.

The US dollar is typically a significant factor for commodity prices, as it tends to have an inverse value relationship with raw material prices. The dollar index edged 0.39% higher in Q2 but was 0.66% lower for the first half of 2023.

US 30-Year Treasury bond futures fell 3.49% in Q2 and were only 1.25% higher over the first half of 2023, after a 21.66% decline in 2022. Lower bonds typically weigh on commodity prices, increasing the cost of carrying inventories.

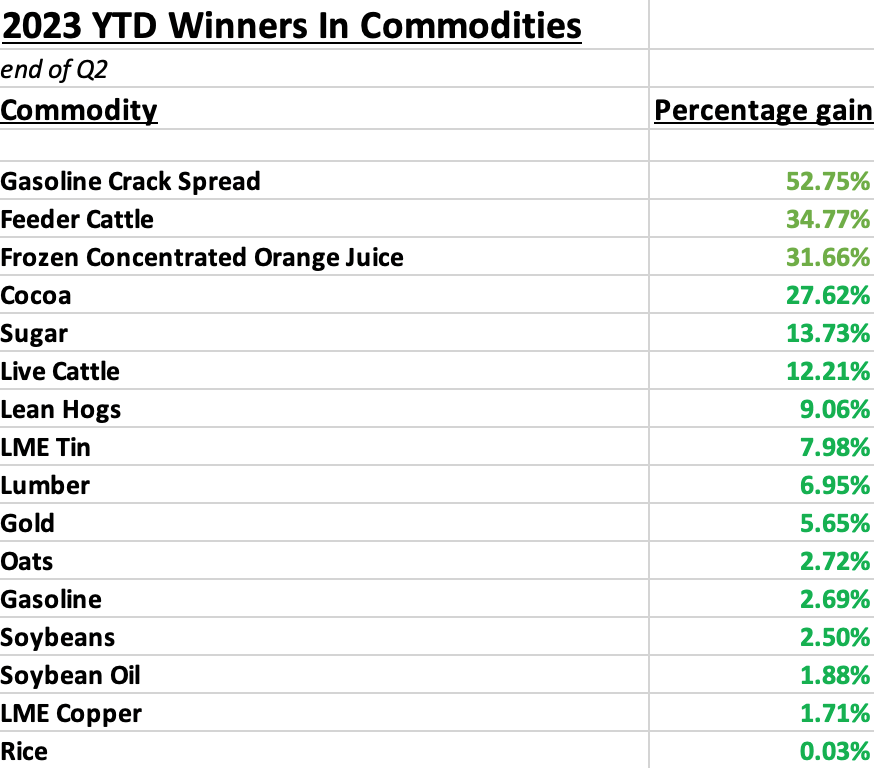

Winners in Q2 and over the first half of 2023

Thirteen commodities posted gains from April through June 2023, with five posting double-digit percentage increases. The list of gains is as follows:

Sixteen commodities posted gains over the first six months of 2023, with six posting double-digit percentage increases. The list of gains is as follows:

Losers in Q2 and over the first half of 2023

Twenty-seven commodities declined in the second quarter of 2023. There were nine double-digit percentage losers in Q2:

Twenty-four commodities posted losses over the first half of 2023. There were sixteen double-digit percentage losers over the period:

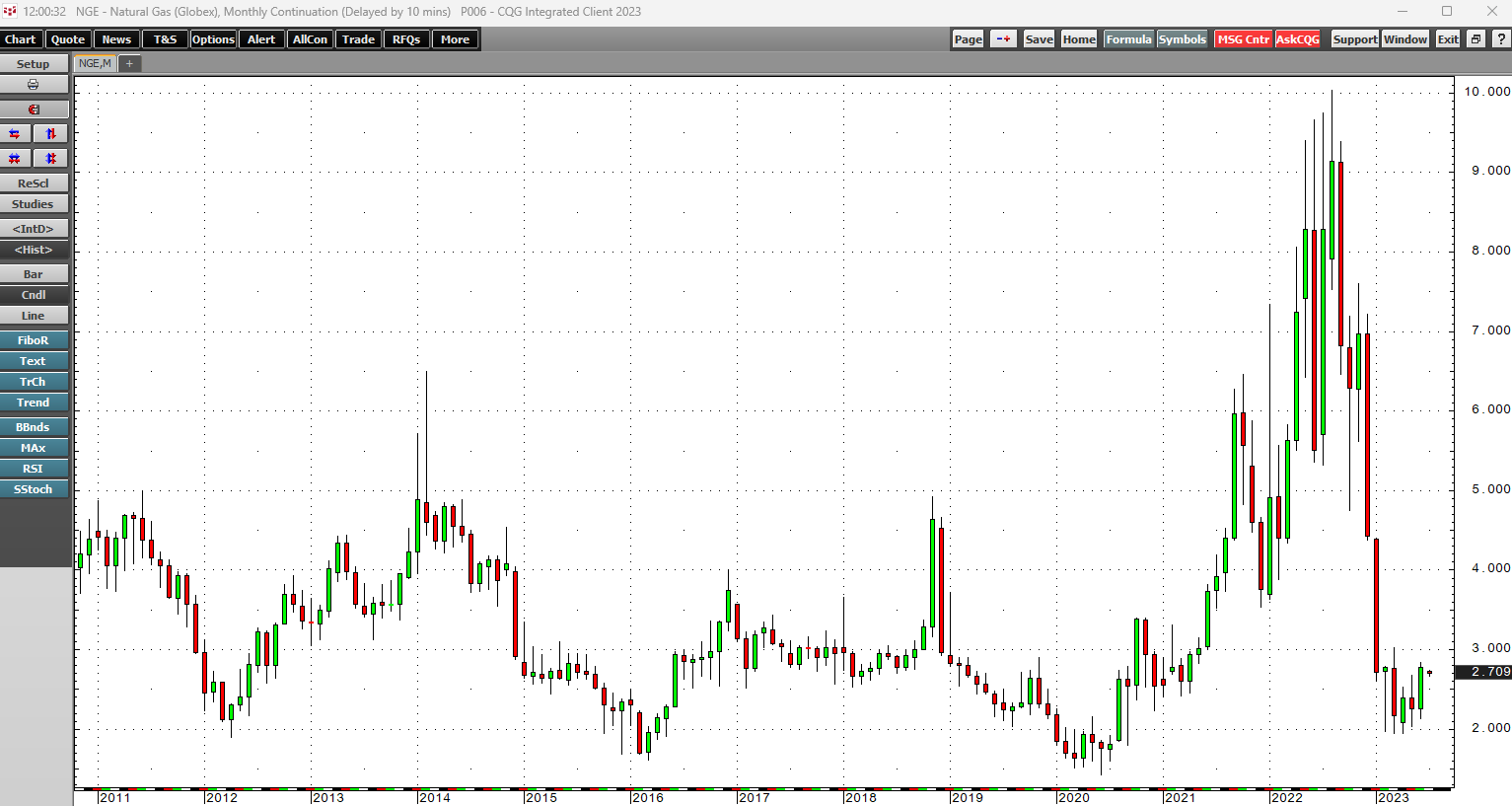

Hogs and natural gas were the Q2 leaders

Lean hog and natural gas futures led the way on the upside in Q2, with 27.11% and 26.26% gains.

The chart highlights the rally from 75.250 cents on March 30, 2023, to 95.650 cents per pound on June 30. Hog futures rallied as the animal protein sector moved into the peak demand season during the 2023 grilling season that began in late May.

The monthly chart highlights nearby NYMEX natural gas futures' rally from $2.216 on March 30 to $2.798 per MMBtu on June 30. Natural gas probed below the $2 level in February, March, and April. Still, prices recovered in Q2 as natural gas posted the most substantial gain in the energy sector and was the second-leading commodity over the three months.

LME Zinc, palladium, and corn fall over 15% in Q2

LME zinc was the worst-performing of the commodities that trade on U.S. and U.K. exchanges. Three-month LME zinc forwards fell 18.29% in Q2.

While LME zinc led the base metals lower, NYMEX palladium was the worst-performing precious metal, with a 16.76% Q2 loss.

Meanwhile, CBOT corn futures led the grain sector lower with a 16.05% decline.

Issues to look forward to in Q3 2023

The economic costs of the global pandemic are its legacy, remain staggering. The liquidity and stimulus will influence markets over the coming months and years. The trajectory of Fed rate hikes has slowed, but the move from zero to 5.125% and quantitative tightening continue to filter through the economy, threatening recessionary pressures.

Q3 begins with the summer doldrums, which could lead to significant volatility as liquidity tends to decline.

While monetary policy will impact markets, the war in Europe could continue to turbocharge volatility, making the central bank's actions far less influential in markets. The war and geopolitical bifurcation affect production, trade deals, and logistics, causing shortages in some regions and oversupply in others. Prices could be highly volatile, reflecting significant changes in the supply and demand equations for many raw material markets.

Low liquidity in markets across all asset classes over the coming weeks could pose the most significant and volatile threat on the immediate horizon. Keep your eyes open for opportunities and avoid unnecessary risks!

Related links