OSE Derivatives

Gold Investment and Trading Gain Momentum in Japanese Market

The Japanese market has witnessed a surge in gold investment and trading, establishing itself as a key player in the global gold landscape. Various avenues for investment, including physical gold and gold-related financial instruments such as futures and exchange-traded funds (ETFs), have contributed to the market’s growth.

Historically, physical gold has been traded among market players, including central banks, predominantly on negotiated spot markets in London, New York, and Switzerland. However, gold as a financial instrument is actively traded worldwide in the form of ETFs, mutual funds, futures, and contracts for difference (CFDs), facilitating commodity trading and arbitrage transactions between markets.

Gold futures trading in Japan commenced in 1982 and currently the Japanese market ranks sixth globally (as of 2023) in terms of trading volume on the Osaka Exchange (OSE). This remarkable achievement places Japan among the largest international open futures markets, following prominent exchanges such as NYMEX and the Shanghai Futures Exchange (SHFE).

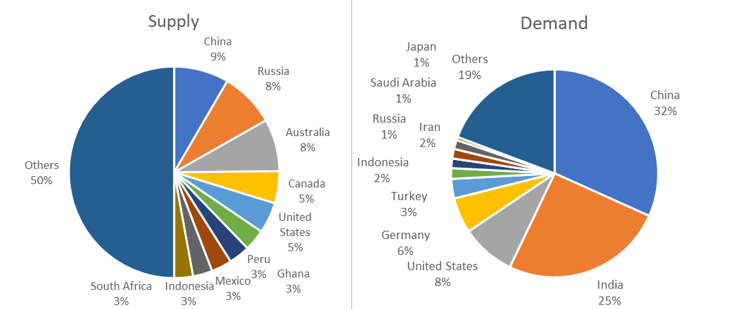

Gold’s Demand and Supply

In terms of supply, South Africa held the mantle as the world’s top gold producer for a significant period, until China took over in 2007. On the demand side, jewelry and investment contribute approximately 75% of the global gold demand, while industrial demand accounts for about 10%. Notably, China and India, with their strong affinity for jewelry, collectively represent over 50% of the world’s gold demand.

Meanwhile, the Japanese market experienced a peak in gold demand by individual and retail investors during the 1990s. The World Gold Council (WGC) reports that the highest demand, exceeding 500 tons, was recorded in 1986, partly due to the special demand effect stemming from commemorative coins celebrating the 60th anniversary of Emperor Hirohito’s reign. Nevertheless, since then, physical gold has maintained its popularity among retail investors, serving as a preferred investment option in jewelry and coins, just as investment through ETFs has also gained traction in recent years.

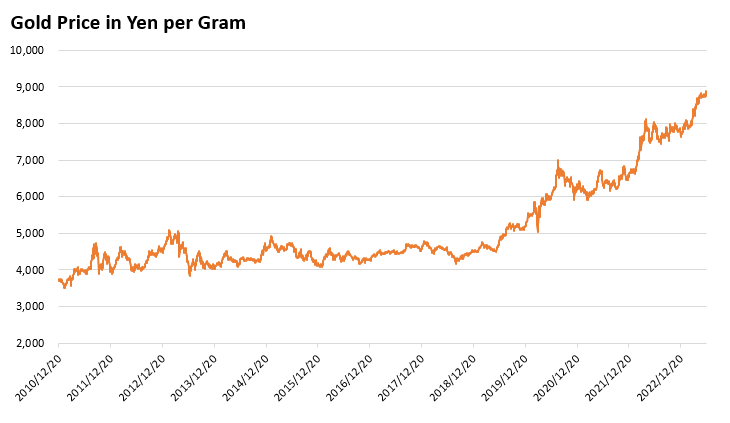

Gold Prices

The price of gold is influenced by various factors, including supply and demand dynamics, global events that prompt safe-haven buying (commonly known as “gold for contingency”), monetary policy trends such as interest rate hikes, and central banks’ holdings as part of their foreign exchange reserves.

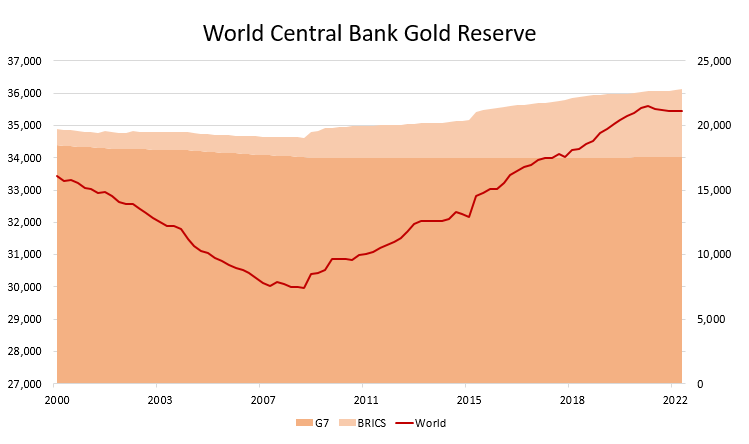

Gold Reserves by Central Banks

Central banks’ gold holdings, estimated at around 35,700 metric tonnes or 20% of the global total as of March 2023, play a significant role in the gold market. Central banks in emerging economies, particularly the BRIC nations, have been increasing their gold purchases in response to the prevailing geopolitical and economic risks.

Gold Investments in Japanese Markets

Since the liberalization of gold exports in April 1978, retail investors in Japan have been the driving force behind active trading in physical gold. Following the introduction of gold futures in 1982, and the emergence of new investment options like ETFs in the 2000s, the retail and institutional markets experienced a significant influx of investors.

The Japan Exchange Group (JPX), the parent company of the OSE, offers various such gold-related investment products, including ETFs with gold as the primary underlying asset and gold futures contracts.

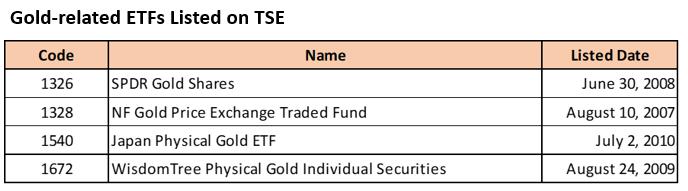

1. ETFs

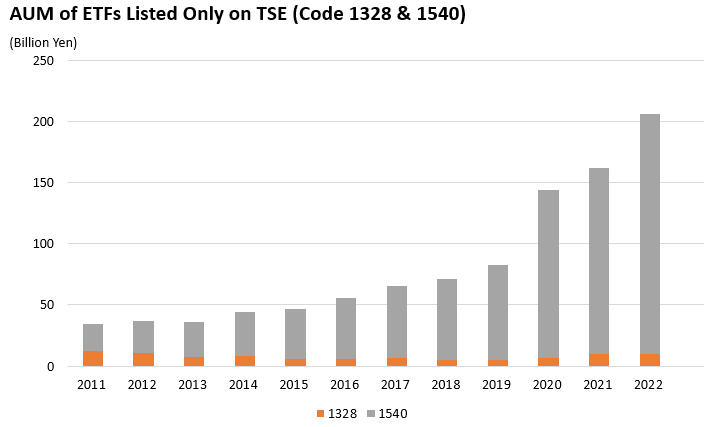

ETFs emerged as a popular investment option with the introduction of the first gold-based ETF on the Tokyo Stock Exchange (TSE) in 2007. As of July 2023, a total of four gold-related ETFs are listed. These ETFs cater to the diverse needs of pension funds, individual investors, and others who have historically been hesitant to invest in physical gold due to storage complexities. The net asset value (Asset Under Management) of gold-related ETFs has witnessed significant growth, particularly in the 2020s, driven by the increasing popularity of alternative investments.

2. Gold futures

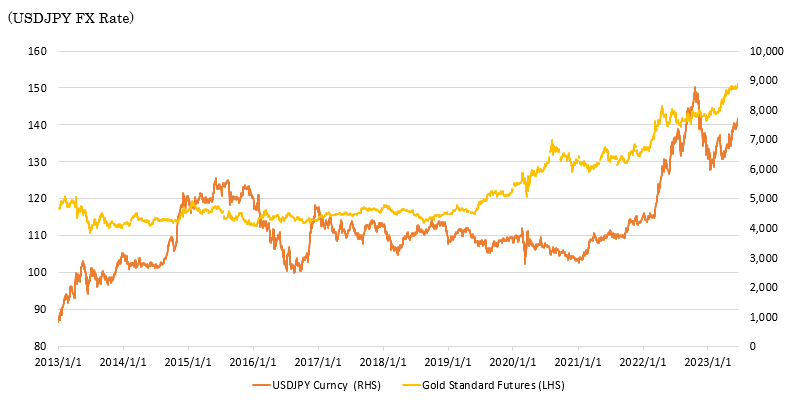

Gold futures trading has also played a vital role in the Japanese market since its inception in 1982. The initial price of Japanese gold futures was JPY 2,641 per gram, and in June 19, 2023, the Gold Standard Futures price briefly reached a record high of JPY 8,915 per gram. This remarkable achievement can be attributed, in part, to the depreciation of the yen against the US dollar and the sustained high international market price of gold.

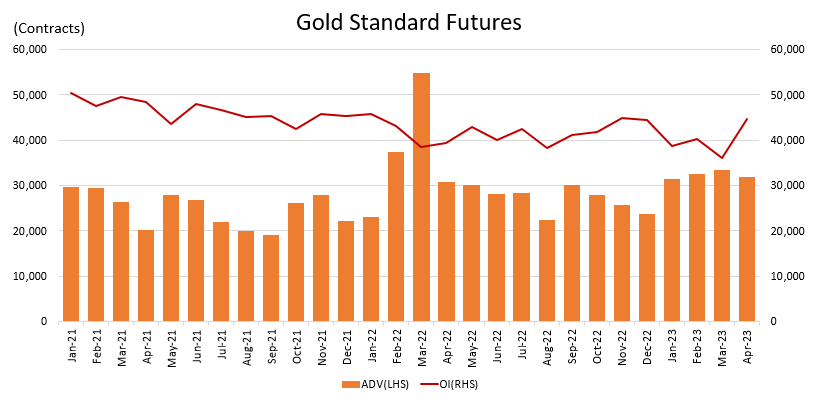

This trend is expected to persist, helping the OSE expand, as demand for gold as a safe-haven asset continues to grow. Indeed, as of June 2023, the market has witnessed a recovery that has captured the attention of both domestic and foreign investors as the open interest (OI) balance returned to the 50,000 contracts level, while the average daily volume (ADV) remained stable at the 30,000 contracts level.

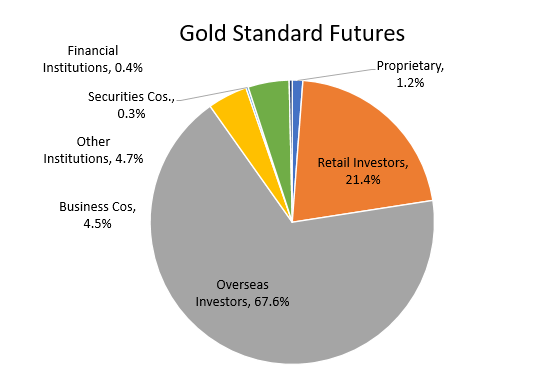

The Japanese gold futures market stands out with its high participation of foreign investors, accounting for approximately 70% of the market share. Foreign investors are particularly active in arbitrage transactions with other markets. Notably, retail investors hold more than 20% of the market share, highlighting the strength of the domestic retail investor base and its historical significance.

Japanese gold futures are denominated in the yen, and their prices have been bolstered not only by international gold price increases but also by the yen’s depreciation against the US dollar.

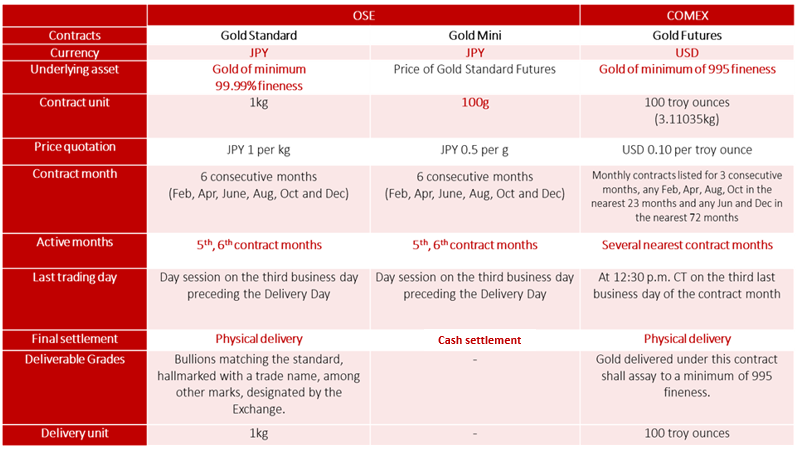

Gold Futures Specs

The specifications of OSE gold futures are notable as they differ from those traded on COMEX and other exchanges. The trading unit on the OSE is kilograms rather than troy ounces, and the size of the OSE’s gold futures contracts, including the Gold Standard Futures, is one-third that of COMEX Gold Futures. This distinction reflects the long-standing dominance of retail investors in the Japanese market.

The Gold Standard Futures, the most liquid on the OSE, can be settled through physical delivery of gold bullions of at least 99.99% fineness. The contract’s total delivery volume stands at 2,423 kg per year.

Apart from the Gold Standard Futures, other gold futures products are available on the Japanese market. These include Gold Futures Mini contracts with a trade size of 1/10th and cash settlement, and Gold Rolling-Spot Future contracts (also known as a gold contract day) with no settlement deadline. Retail investors have embraced these various types of gold futures, leading to steady growth in trading volumes.

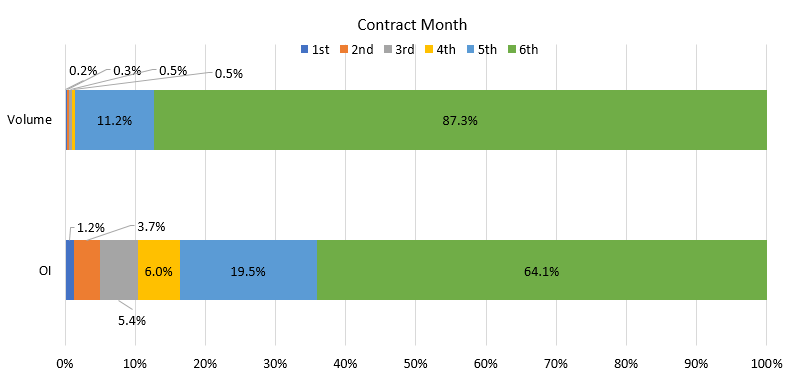

Another feature common to this Japanese commodity futures markets is the concentration of trading in the forward contract month. Approximately 90% of trading and 60% of open interest (OI) in Gold Standard Futures occur in the farthest contract month. This concentration reflects the historical dominance of domestic retail investors in the market. Interestingly, the 6th contract month serves as the most liquid contract month for OSE platinum futures, a pattern observed across all commodity futures traded in Japan.

With trading volumes in gold investment expanding globally due to escalating geopolitical tensions and evolving interest rate trends and the active participation of domestic and foreign investors in Japanese gold ETFs and derivatives markets, the OSE remains committed to expanding the market and providing abundant market liquidity to accommodate a variety of transactions.

Related links