OSE Derivatives

Sustainable monetary easing and record wage hikes

Written by Harry Ishihara, Macro Strategist

The Ueda-BOJ

BOJ Governor Ueda will start on April 9, kicking off the Ueda-BOJ. His predecessor, Governor Kuroda is credited with helping Japan escape deflation. Core CPI was -0.5% when Kuroda started in 2013, today it is effectively around 4%. However, Kuroda’s unprecedented policies of Qualitative and Quantitative Easing (QQE, huge purchases of bonds, equity ETF’s and REIT’s), Yield Curve Control (YCC, capping the 10 year bond yield at around zero) and a Negative Interest Rate Policy (NIRP) are blamed for weakening Japan’s financial system due to the low rate environment and market dysfunctions. The eyesore is that the BOJ now owns over 50% of outstanding government bonds (JGB’s).

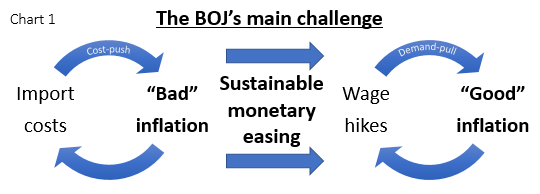

Ueda is a leading monetary policy researcher credited with inventing “forward guidance” and providing the logic for zero interest rates and QE (which later became NIRP and QQE). A former policy board member, he is seen as a wise owl rather than a dove or hawk. Together with Deputy Governor Himino, a regulatory and asset disposal expert, and Deputy Governor Uchida, an architect of QQE and the BOJ’s top monetary policy expert, the trio will focus on improving market functioning while keeping an accommodative stance. This “Sustainable Monetary Easing” is hoped to shift “bad” inflation to “good” inflation by providing support for wage hikes (Chart 1).

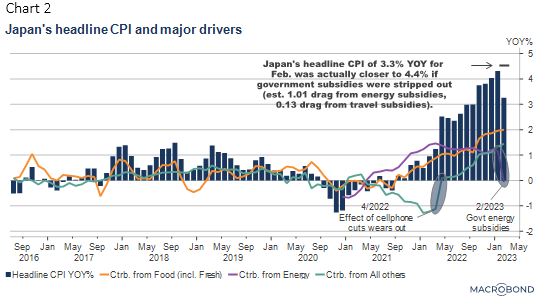

Despite effective inflation levels of around 4%, the BOJ and incoming Ueda say their official two percent target has not been attained. This is because it must be in the form of stable and sustainable inflation SUPPORTED BY WAGES. In Japan, inflation has been led by higher import prices for energy and food (Chart 2), which was aggravated by the weaker yen. The BOJ was blamed for the weakening as it was caused by a wider interest rate differential with the Fed.

Inflation remains a problem. Core CPI in February was over 4% excluding massive subsidy effects that total 15 trillion yen (115 billion dollars). Record wage hikes and price hikes for over 5,000 food items are expected in April. Meanwhile, the BOJ’s median forecast for Core CPI is only 1.6% for FY23.

Shunto wage hikes

In Japan, the “Shunto” spring wage offensive is split into 1) seniority linked annual raises and 2) base salary hikes, known as base-ups. Despite the name, the former is actually OPTIONAL, ie. not everyone gets a raise, while the latter is across the board. Thus, the BOJ and the government focus on base-ups. Wage hikes led by base-ups should promote good inflation – in other nations, disposable income and personal consumption have risen together since 2000.

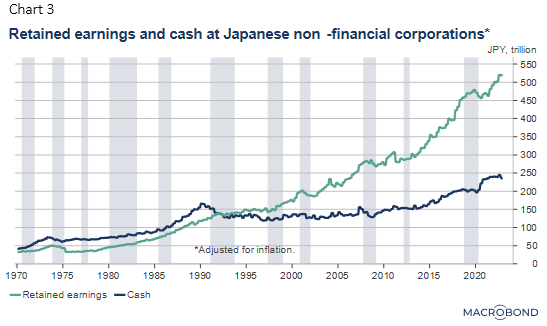

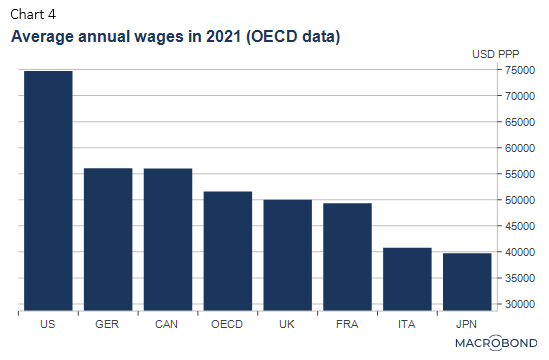

Kishida’s focus has been on income distribution to achieve a more sustainable society, which he calls, “New Capitalism”. Wage hikes are “the pillar” and a “corporate social responsibility”. Fortunately, the highest inflation in 40 years has caused calls for wage hikes to swell. For almost three decades, wages have been suppressed to retain jobs. Retained earnings and cash at corporate Japan rose to record levels (Chart 3), but recent Japanese tax data show an average wage of only 4.43 million yen, or 34,000 dollars at current market rates. Older OECD data using purchasing power parity rates is higher at 39,700 dollars, but they still show Japanese wages are low and almost HALF of the US (Chart 4).

Uniqlo/Toyota shocks

Uniqlo’s Fast Retailing shocked corporate Japan by announcing a 40% wage hike to attract quality personnel. With that, Japan abruptly woke up to an impending labor shortage. At small companies, labor shortage related BANKRUPTCIES are increasing.

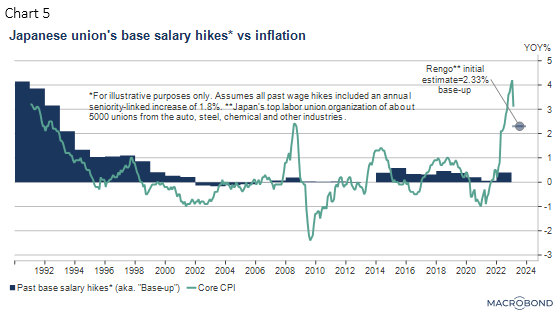

Following Uniqlo, major companies and banks raced to announce record breaking hikes of mostly 5-7%, including 2-3% base-ups for FY23. For the past 20 years, total hikes hovered around 2% including base-ups of around ZERO. In the manufacturing industry, Toyota’s announcement of fully meeting the highest demands in 20 years led 86% of major manufacturers to follow suit. According to initial estimates by Rengo, which represents 5,000 major unions, the average FY23 base-up for full-time employees at major companies was 2.33%, the highest in almost 30 years (Chart 5).

Many part-timers will also receive record hikes of 5-7%. Meanwhile, Kishida is proposing a record minimum wage hike from 961 to 1000 yen per hour.

Price pass-throughs

Japan’s small and medium-sized enterprises (SME’s) are also key as they make up about 70% of all employees. However, they are not unionized and wage hikes are difficult to track. SME surveys usually imply a majority are against wage hikes due to low profits. To help them, an event was held on March 15, the same day that major unions announced their wage hikes. Prime Minister Kishida, the powerful business lobby Keidanren, the small business lobby Japan Chamber of Commerce, and Rengo jointly announced that major companies should allow smaller vendors to PASS ON THEIR COSTS.

To ensure compliance, surveillance was stepped up. The government designated March and September as “PRICE PASS-THROUGH MONTHS”, where SME’s are ENCOURAGED to pass on their costs. Interviews and surveys on abuses of buying power are used to score large companies on their “cooperation”. Low scorers are publicized and receive a notice.

Sustainable monetary easing

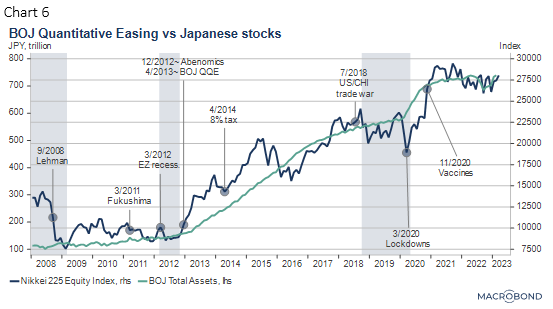

A tweak to YCC’s range from ±0.25% to ±0.5% last December and the appointment of Ueda has sparked speculation about a phase-out of Kuroda’s policies. The YCC yield target may be shortened to the 2 or 5 year. The 4+ trillion dollars of JGB’s, equity ETF’s and REIT’s on the BOJ’s balance sheet may be spun off into government funds to avoid disruptions (Chart 6). For the equity ETF’s, one novel idea involves exchanging them for perpetual bonds, dismantling the ETF’s to save fees, and using the dividends to pay interest on the bonds and to promote financial literacy.

Meanwhile NIRP will probably be left alone as the scope of it has already been limited.

According to one policy board member, reasons to be optimistic about good inflation include 1) the growth of a younger generation less experienced with deflation, 2) the record wage hikes, and 3) productivity boosts from Digital Transformation and Green Transformation.

Optimists say this Shunto’s record wage hikes “broke the dam” that was preventing good inflation. “Sustainable monetary easing” is now looking more interesting.