OSE Derivatives

TOPIX Options: Next Tools for Portfolio Investing

Osaka Exchange (OSE) is currently promoting TOPIX Options as part of its efforts to expand Japanese derivative markets. Below, we explain the role of TOPIX as an underlying index and highlight plans to develop the market for TOPIX Options.

Japan’s Two Major Equity Indexes

Japan’s stock market, one of the world’s largest with a market capitalization of USD 5.5 trillion, is represented by two indexes — Nikkei 225 (NKY) and the TOPIX (TPX). NKY is a price-weighted index of 225 listed stocks, like the Dow Jones Industrial Average (DJI). TOPIX is a float-adjusted market capitalization-weighted index, similar to the S&P 500 (SPX), comprising more than 2,000 listed stocks.

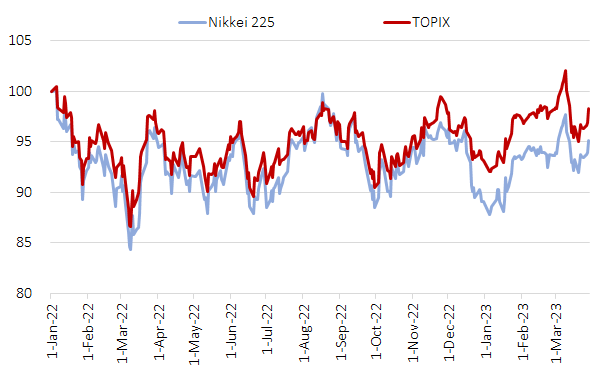

Although both indexes track Japanese equities, their performances vary due to differences in how constituent industries and stocks are weighted.

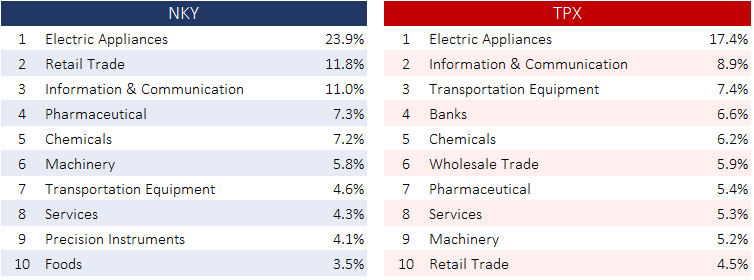

TOP10 Index Industry Weights (February 28, 2023)

Source: Nikkei, JPX

For example, TOPIX performed relatively better in December 2022, when a large decline led by tech stocks happened worldwide. On the other hand, in March 2023, when the risk of bank turmoil originating in the US increased, TOPIX, which is more heavily weighted in financial stocks, lost more of its index value than NKY.

Index Performance – Nikkei 225 vs TOPIX (January 4, 2022 = 100)

Nikkei and TOPIX Derivatives

In the Japanese derivatives market, products underlying these two representative Japanese stock indexes have the greatest market liquidity and are traded by many investors, including foreign investors and domestic retail investors.

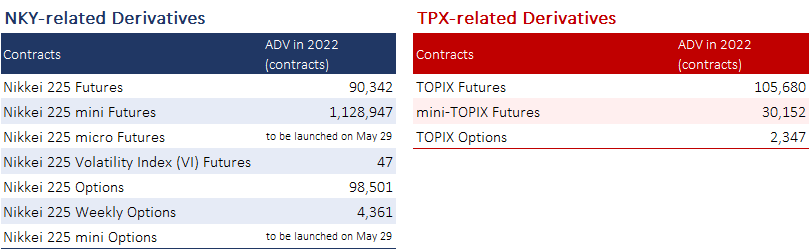

A List of Major Nikkei- and TOPIX-related Derivatives

Source: JPX

Among the OSE listed equity index futures, Nikkei 225 mini Futures (NKO) boats the largest trading volume, while Nikkei 225 Futures (NKA) and TOPIX Futures (TPA) also retaining large presences. Among index options, on the other hand, TOPIX Options are not as heavily traded as Nikkei 225 Options.

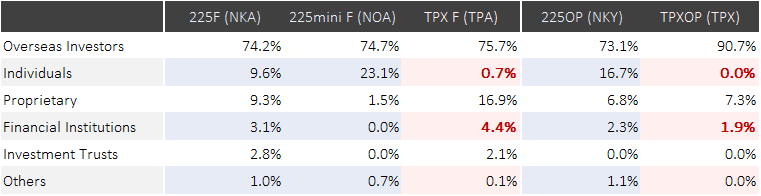

Differences in Trading by Investor Type in 2022

The investor base for these OSE listed Equity Index Derivatives is characterized by the large share of overseas investors in all derivative products. For Nikkei 225 mini Futures and Nikkei 225 Options, the share of domestic individual (Japanese retail) investors is over 15%.

Compared to Nikkei 225 Futures (NKA), TOPIX Futures (TPA) has little trading flow among domestic retail individuals, while its share among financial institutions is larger. This is because Japanese institutional investors and investment funds manage a large part of their domestic equity portfolios benchmarked to TOPIX and, as a result, have many opportunities to use futures contracts underlying the index.

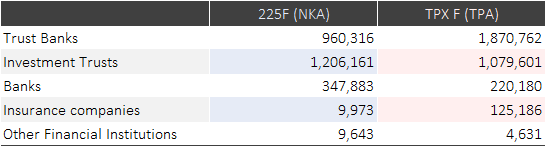

The table below shows the trading volume of financial institutions in 2022. Trust banks and investment trusts, representing domestic funds transactions, possess a large volume of transaction flow into TPA. For banks, however, transaction volume is higher in NKA, indicating different trends depending on the type of investors.

Futures Trading Volume in 2022 by Financial Institution Type

TOPIX Options: The Next Wave of Trading Opportunities

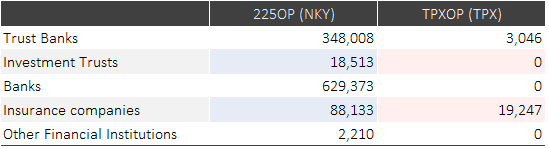

Despite being one of Japan’s leading stock price indexes, the volume of TOPIX Options in 2022 was only about 0.6 million, compared to 24 million in Nikkei 225 Options. The trading volume in OSE’s equity index options among financial institutions is not at the same level as equity index futures, but statistics show trading in TOPIX Options by institutional investors is limited.

Options Trading Volume in 2022 by Financial Institution Type

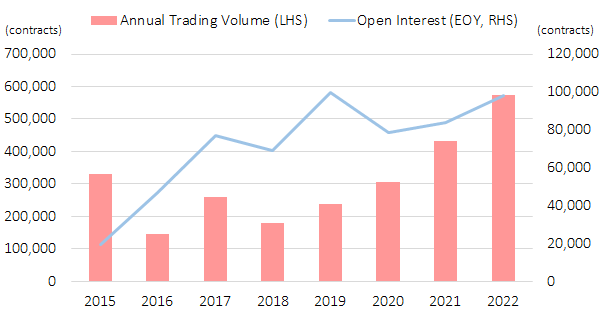

However, the market size of TOPIX Options has expanded steadily since 2018, owing to more transactions by overseas investors.

Trading in TOPIX Options

OSE anticipates a high potential demand for TOPIX Options among wholesale investors. Several institutional investors have expressed their interest in using TOPIX Options as a portfolio-hedging tool if they see sufficient market liquidity. In addition, new economic value-based solvency regulations coming in 2025 could motivate domestic insurance companies to use put options to help reduce exposure to risk in equities.

The key to expanding TOPIX Options trading is improving market liquidity and facilitating access for these institutional investors.

To that end, Optiver, a leading global market maker, has made a strong commitment to expanding market liquidity, starting with on-screen quotes for TOPIX Options in November 2022. Sam Tagliabue, Head of Wholesale Trading at Optiver in Sydney, said “With most TOPIX options currently trading OTC and a limited amount via block, we are making a long-term investment in the products’ potential and look forward to working with OSE and other partners to help grow the on-screen liquidity.”

Since Optiver’s entry, prices quoting on-screen for many contracts months and strike prices of TOPIX Options have begun to stabilize.

Order Book for TOPIX Options (9.43 a.m. of March 29, 2023)

Nippei Yasuoka, Sales Manager for Institutional Trading at Optiver, said, “If domestic institutional investors seek more quotes, we are ready to provide further off-screen quoting and matching opportunities to meet their needs.”

Furthermore, OSE offers Flexible Options Trading to meet various trading strategies of institutional investors. Investors can customize options contract specifications such as expiration date, strike price, and settlement type to suit their needs by using OSE’s off-screen trading platform (J-NET Market).

Since March 2023, market volatility has been increasing, making portfolio investment difficult for investors. Growth of the TOPIX Options market will allow institutional investors to conduct more sophisticated and efficient hedging transactions and provide new investment opportunities to many players, including overseas investors, through the increased market liquidity of TOPIX Options.