OSE Derivatives

What to expect from the Ueda BOJ

By Harry Ishihara, Macro Strategist

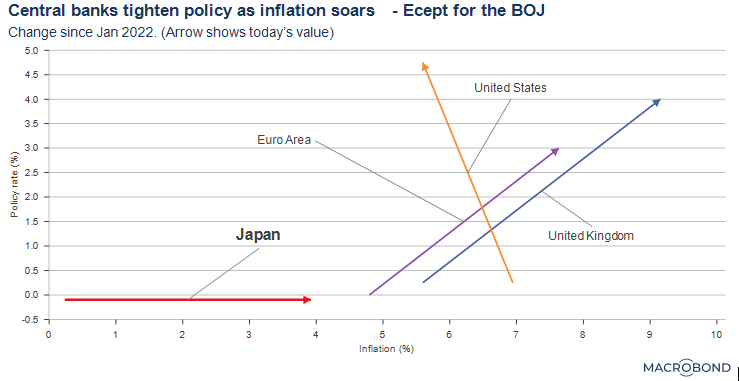

Since 2020 Japan has been the outlier among global peers in keeping a supportive monetary policy stance in the wake of higher inflation, only slightly tweaking its Yield Curve Control (YCC) program in recent months. A surprise choice as the governor of the Bank of Japan (BOJ) has left the market speculating about what to expect from the new central bank governor. With this note I hope to unpack the “Kuroda Code” and provide my view around what to expect from the incoming governor and his deputies.

The incoming trio

The next BOJ governor and deputy governor posts are set to go to Mr. Ueda, Mr. Himino, and Mr. Uchida. Mr. Ueda is a pragmatic MIT-trained economist and was a BOJ policy board member about 20 years ago, pioneering “forward guidance”. He is seen as a wise “owl”, rather than a dove or hawk. Mr. Himino is a former FSA commissioner, Basel capital accord expert, and non-performing loan disposal expert. Mr. Uchida is a career central banker and an architect of QQE. The trio of academic expert, regulatory expert, and monetary policy expert are held in high regard.

Their mission

It is no secret what is expected of the trio, namely, FIX MARKET FUNCTIONING. In April 2013, just appointed Governor Kuroda announced QQE – huge purchases of Japanese government bonds (JGB’s), equity ETF’s, and REIT’s – in an all-out effort to attain 2% inflation in 2 years. This bazooka unleashed on markets was in accordance with the January 2013 Accord with the Abe government to overcome deflation. It was also the first arrow of the “Three Arrows” of Abenomics: 1) aggressive monetary easing, 2) fiscal consolidation, and 3) structural reforms.

Monetary easing measures were subsequently strengthened, with increased asset purchases, a Negative Interest Rate Policy (NIRP) and “Yield Curve Control (YCC)” added to the mix. Ten years have passed since the Accord, but Governor Kuroda contends that the BOJ has still not attained 2% inflation.

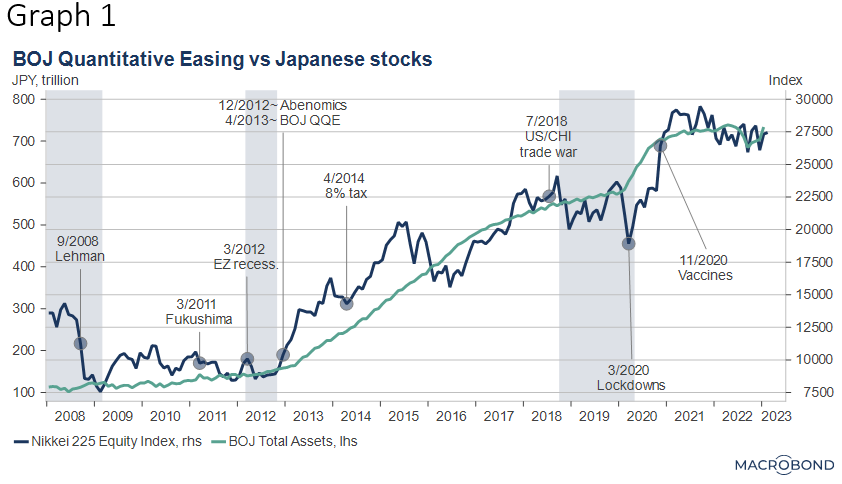

The hot political issue is how to unwind the market distortions that QQE has supposedly caused. For example, Graph 1 shows how QQE pushed stocks upwards. Initially that was welcomed by the markets. However, as a result of the near ten years of QQE, the BOJ now owns over 50% of outstanding JGB’s. Also, as YCC has kept the 10-year yield capped at around ZERO percent, QQE is blamed for weakening the financial system. Thus, at Mr. Ueda’s confirmation hearing, the message was clear – Mr. Ueda, please fix those market distortions.

Kuroda-code #1, target not met?

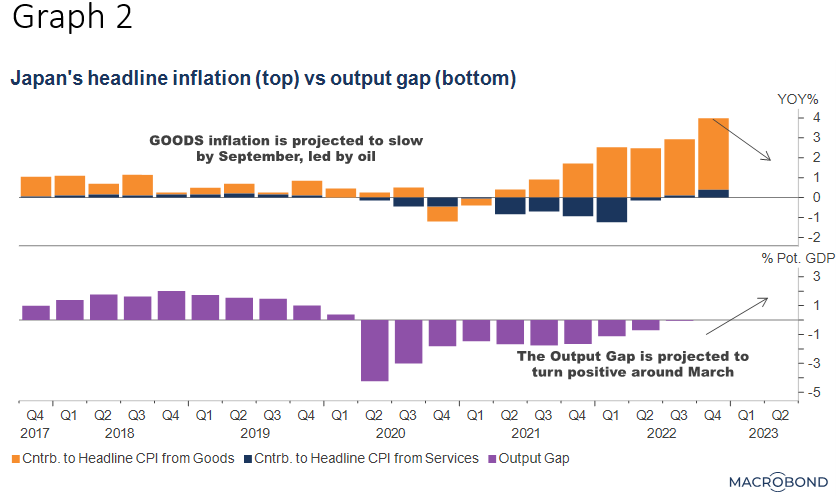

With inflation running at 4% versus a target of 2%, why is Governor Kuroda saying the target has not been met? The code is that his target is 2% on a 1) stable and sustained basis, 2) supported by wages.

Graph 2 (top half) shows the high share of Japan’s GOODS inflation, which Kuroda expects to come down, led by oil prices. Thus, the inflation is NOT stable and sustained, in his view.

Unfortunately for the BOJ, food (including fresh food) inflation has so far been a steady driver of inflation, as a bout of weak yen last year caused import costs to rise. Those higher costs are now being passed on to consumers, who are in turn angry at the weak yen. Note that Japan imports about 70% of calories consumed, thus the weak yen hit consumers especially hard – some blamed the BOJ and the Kishida administration. Another unfavorable development is that electric power companies are set to hike utility bills by double digits to offset import costs from the weaker yen. Meanwhile, the BOJ’s official outlook is for inflation to fall back below 2% soon. A further weakening of the yen would be a political disaster.

Kuroda-code #2, accommodating inflation?

Another puzzle is why the BOJ has stayed so accommodative while the Fed and the ECB have been tightening. The code here is the output gap, or the difference between actual and potential GDP. A negative gap is deflationary while a positive gap is inflationary, however Japan is JUST about to pass the line from negative to positive (Graph 2, bottom half). The post-corona economic recovery is the driver, and the BOJ wants the economy to continue to run above potential for a while longer. The BOJ forecasts that the updraft from the output gap improvement will offset the downdraft from slower goods inflation this year.

Kuroda-code #3, this Shunto is different

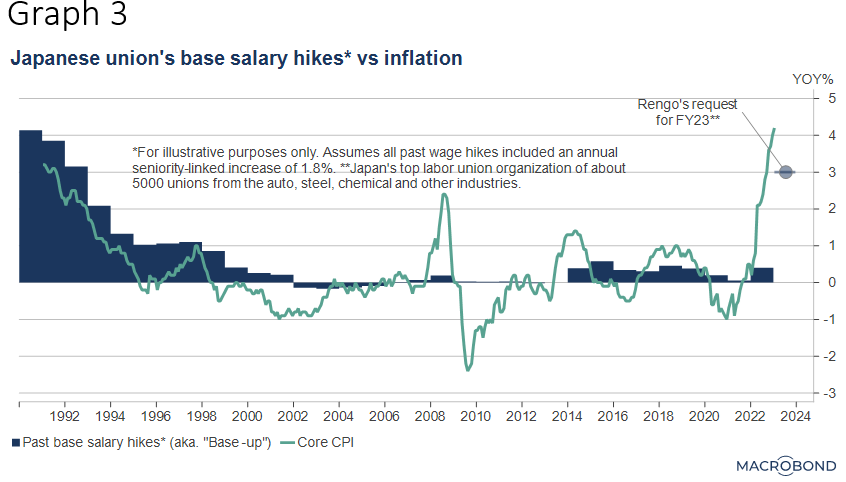

How about Kuroda’s “supported by wages” code? After decades of wage stagnation, this year Japan is finally seeing green shoots.

Japanese unions are organized by company not industry. To increase bargaining power, an organization of about 5,000 unions known as Rengo synchronizes the negotiations during the Spring Wage Offensive, or Shunto.

Wage hikes can be split into seniority-based hikes and base-salary hikes. Confusingly, the seniority-based hikes look like a rising staircase on paper and sound automatic but are actually optional. Meanwhile, the base-salary hikes, or “base-ups” mean the whole staircase is moved upwards, implying everybody gets a raise. For decades, base-ups have been negligible (Graph 3), but the BOJ hopes base-ups will spur a virtuous wage-price inflation spiral.

Spurred by the highest inflation in 40 years, this Shunto is different. Both the union demands and the responses to them are the highest in at least 20 years. In a grab for high quality employees, major companies are racing to announce wage hikes of 5% to as high as 40%, including base-ups of over 3%, versus recent years of around 2% with negligible base-ups. However, the caveat here is “major companies”. About 70% of employees work for small and medium-term enterprises, who say they lack the profits to hike wages. The employees are generally not unionized either, which means their Shunto efforts will not be reported by the Rengo.

Market expectations

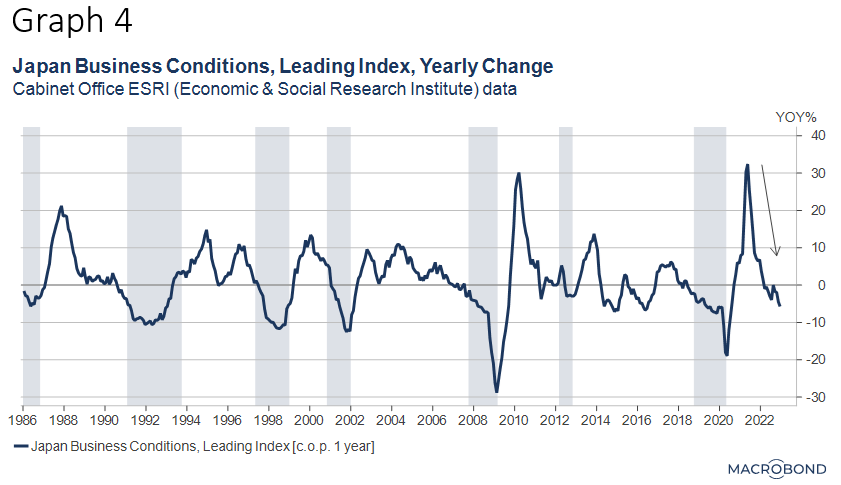

During his confirmation hearing, Mr. Ueda insisted that an accommodative policy is still needed, causing one lawmaker to gasp, “You sound just like Governor Kuroda!” But with Japan’s deflationary demographics and global economic uncertainties already showing up, complaints should tone down (Graph 4).

As for fixing market distortions, Mr. Ueda refused to give away specifics. Expected options include widening the YCC 10 year yield target from its current ±0.5%, shortening the YCC target to the 5 or 2 year JGB, phasing out or shutting down YCC purchases, and moving the ETF and REIT assets to a different entity.

A survey of 20 BOJ watchers had all of them expecting changes to YCC this year, evenly split between the first and second half of 2023. It is looking increasingly likely Mr. Himino and Mr. Uchida will put their relevant expertise to good use, though how, how much and the markets reaction to these changes it is too early to tell.