OSE Derivatives

New derivatives products will debut at OSE on May 29, 2023

Osaka Exchange, the derivatives arm of Japan Exchange Group, will introduce six new derivatives products on May 29, 2023: Nikkei 225 micro Futures, Nikkei 225 mini Options, three types of ESG Equity Index Futures, and Short-Term Interest Rate (3-Month TONA) Futures, to grasp market trends and investors demand. We will introduce the overview of these newly launching products here.

Nikkei 225 micro Futures and Nikkei 225 mini Options

In recent years, the need for more precise risk management tools has been increasing against the trend toward smaller investment units in the cash equity market, and the launch of futures and options with smaller trading notional amounts than before has also been called for.

Also, since the Covid-19 breakout, a new generation of young individual investors have entered the market. Global exchanges, such as CME and Eurex, have launched micro-sized derivatives products and got new trading flows from these kinds of new players.

Of course, it doesn’t always have positive effects, but it brought fresh blood to the market that revived market structure and created a set of diverse needs regarding market access and product design in the industry.

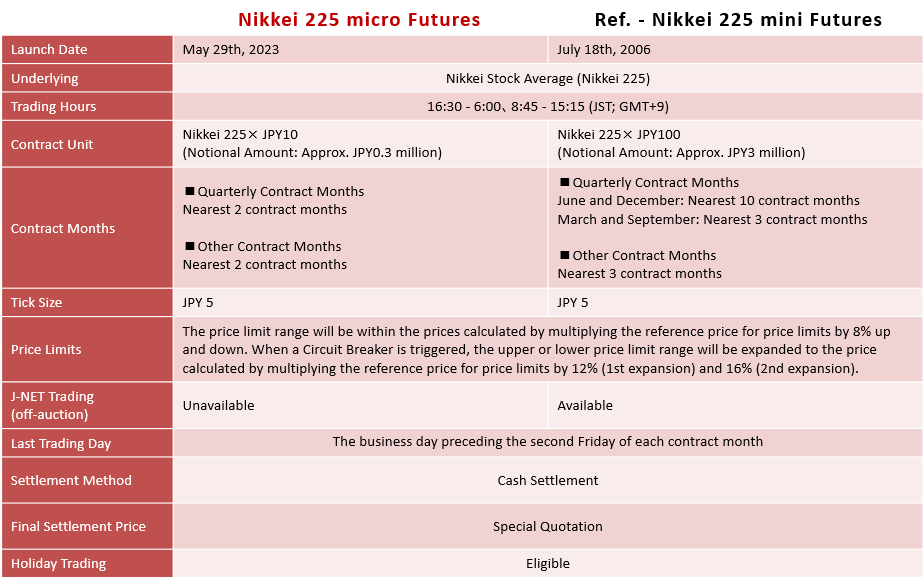

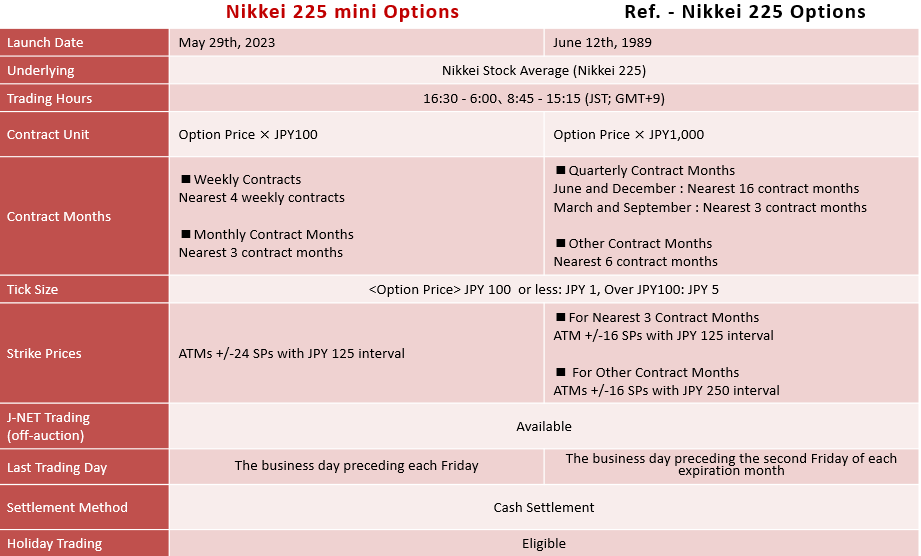

In light of these trends, OSE decided to launch Nikkei 225 micro Futures and Nikkei 225 mini Options on May 29, 2023 by reducing the contract unit to one-tenth of the size of existing products.

Contract specifications

Contract specifications

For more detailed information about the product specifications, please see our website from here.

ESG Equity Index Futures

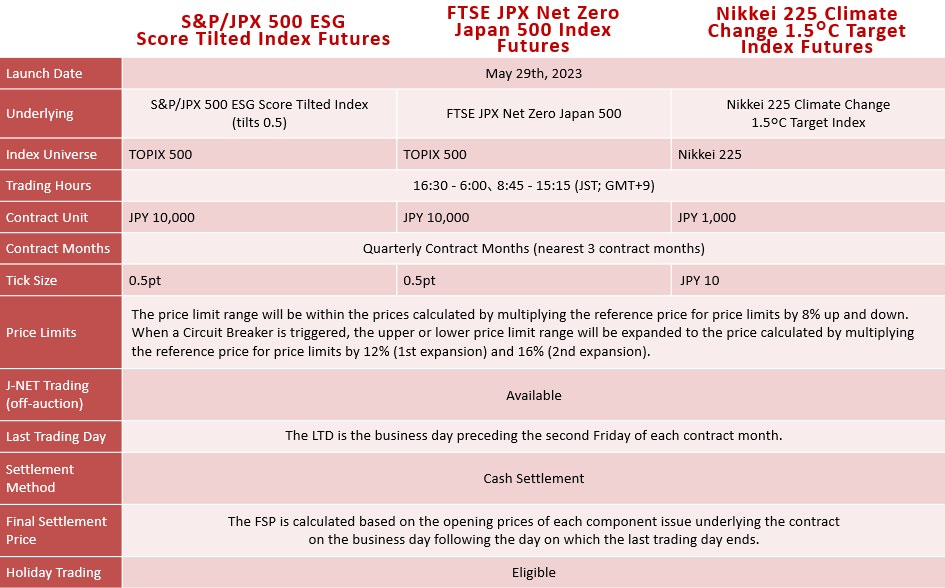

Creating a sustainable society by utilizing market mechanisms is one of the key missions of JPX. As part of this effort, we will launch three types of ESG equity index futures on May 29, 2023: S&P/JPX 500 ESG Score Tilted Index Futures, FTSE JPX Net Zero Japan 500 Index Futures, and Nikkei 225 Climate Change 1.5°C Target Index Futures.

These contracts are underlying ESG related indices, S&P/JPX 500 ESG Score Tilted Index (0.5), FTSE JPX Net Zero Japan 500 Index, and Nikkei 225 Climate Change 1.5°C Target Index, designed to reflect the performance of Japanese companies, based on the constituents reflecting specific ESG (Environmental, Social, and Governance) point of views.

For more detailed information about the product specifications, please see our website from here.

Short-Term Interest Rate (3-Month TONA) Futures

As the BOJ’s governor will change in April, the prospect of the monetary policy normalization could spur Japanese Government Bonds (JGBs) and their derivatives, creating exciting opportunities for investors.

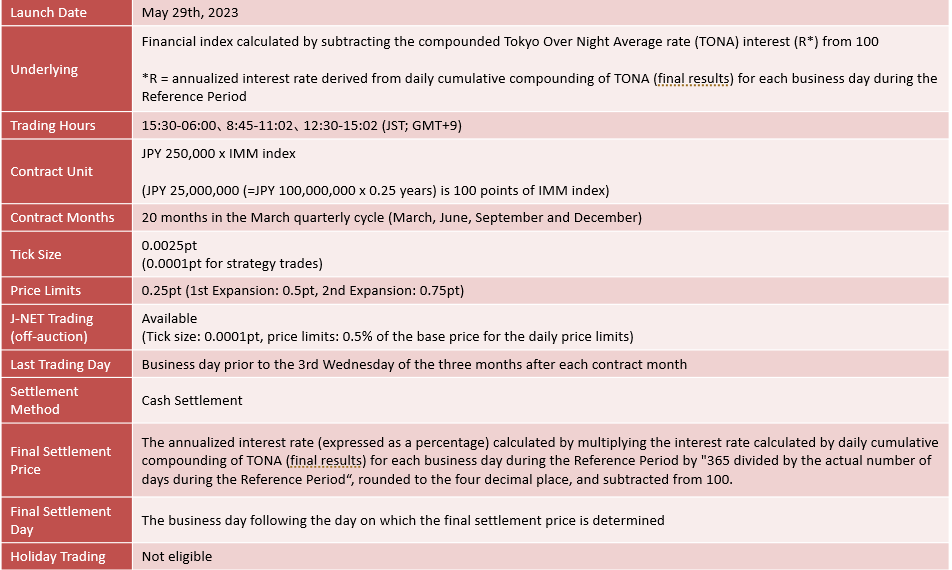

Taking this opportunity and considering the transition to JPY interest rate alternative benchmarks against the background of the permanent suspension of the publication of JPY LIBOR at the end of December 2021, OSE will launch 3-Month TONA Futures contracts linked to a daily cumulative compounded Tokyo Over Night Average rate (TONA) over a 3-month period.

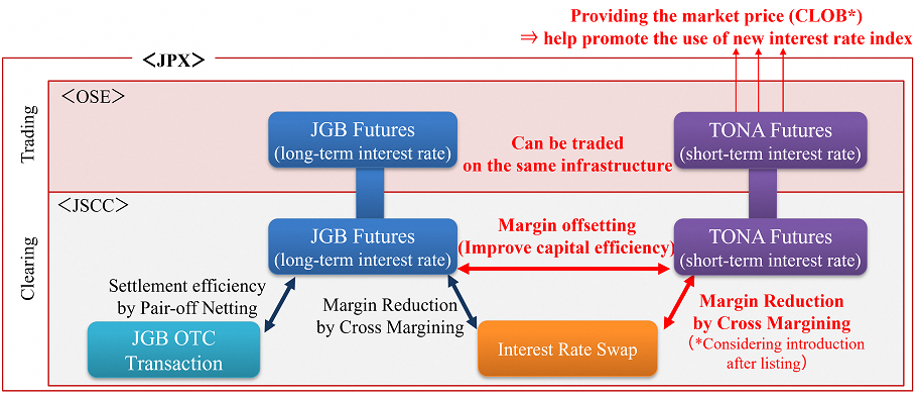

With the listing of the futures contracts, we will be able to provide a one-stop market infrastructure for trading interest rate products ranging from short to long term, together with existing JGB futures and option, thereby synergistically improving convenience of market participants and further developing the JPY interest rate derivatives market.

In addition, we are considering providing cross-margining between OSE’s 3-Month TONA Futures and OTC interest rate swaps cleared at Japan Securities Clearing Corporation (JSCC) following the launch. We have received strong interest from margin-conscious investors and several market makers who will provide initial market liquidity.

Product specifications

The following image shows the structure of the Margin Offset:

For more detailed information about the product specifications, please see our website from here and an article published on Bloomberg.