OSE Derivatives

Overview of Japanese and Chinese Government Bond Futures Markets

On September 7, 2022, Japan Exchange Group (JPX) and China Financial Futures Exchange (CFFEX) signed an MOU to enhance their cooperation on the development of both derivatives markets.

This article will take the opportunity to introduce a brief market overview of the government bond futures listed at JPX and CFFEX.

Overview of the Government Bond Markets in Japan and China

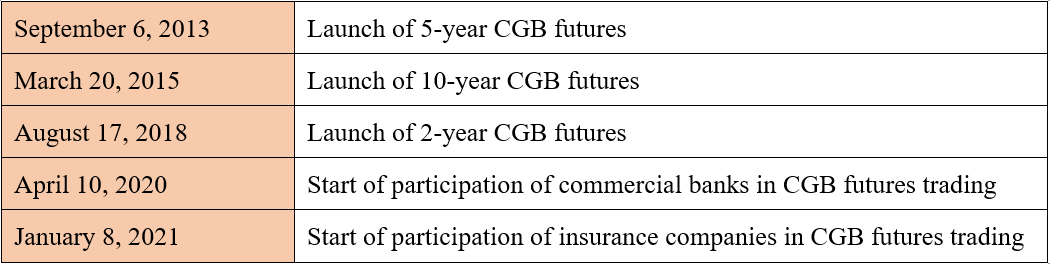

Japan and China have the second and third largest economies in the world in terms of GDP, so their sizable government debts also have a significant presence. For their outstanding debts at the end of 2021, Japan came second, and China came third, following the U.S., which has the largest amount of debt. According to China’s Ministry of Finance, outstanding local government debt at the end of 2021 was RMB 30.5 trillion, equivalent to around USD 4.9 trillion, accounting for 58% of total government debt outstanding.

World Government Debt Outstanding at the End of 2021

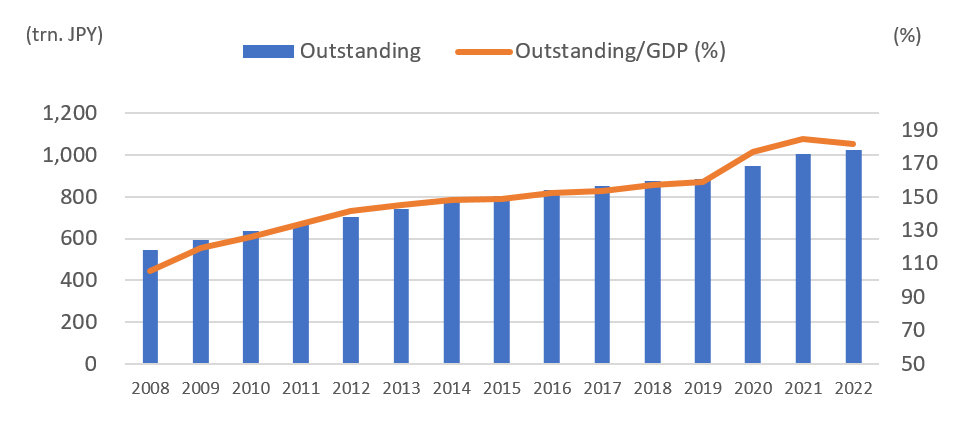

Outstanding JGBs at the End of the Fiscal Year

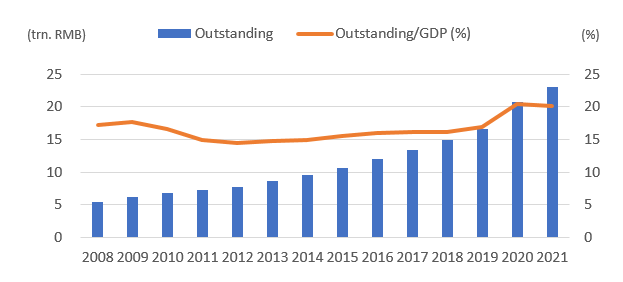

The issuance of Chinese Government Bonds, or CGBs, re-started in 1981 and growth rapidly expanded in the late 1990s. Outstanding CGBs excluding municipal bonds (RMB 34.9 trillion) is currently over RMB 25 trillion, equivalent to around USD 3.8 trillion, at the end of 2022.

Outstanding CGBs Excluding Municipal Bonds at the End of Year

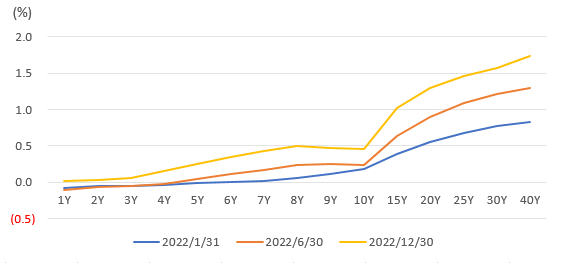

In Japan, the unconventional monetary policy led by the Bank of Japan (BoJ) significantly impacts the whole JGB market. The BoJ introduced Yield Curve Control (YCC) in September 2016, in addition to the qualitative monetary easing (QQE) which started in April 2013, to keep bond yields stably low.

A critical feature of YCC is to control short- and long-term interest rates, applying a negative interest rate to financial institutions’ excess reserves and maintaining a peg on 10-year yields within a range of plus or minus 0.5% (previously 0.25%) from the target rate of around 0%.

Yield Curve Structure of JGBs

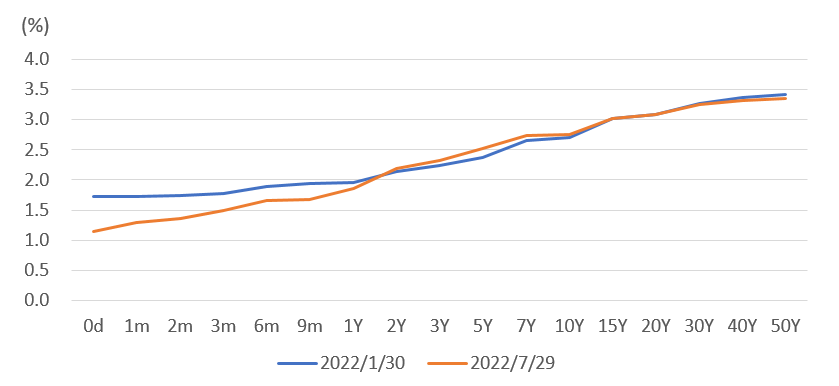

In China, with a sound monetary policy, the People’s Bank of China (PBoC) controls the short- and mid-term interest rates, the 7-Day Reverse Repo Rate, and the 1-year medium-term lending facility (MLF) as the policy interest rate of the open market operations.

For instance, China’s CPI growth rate increased from 0.9% to 2.7% from February to July 2022. However, as shown in the chart below, short-term interest rates went down over the past six months in response to the reasonably abundant liquidity in the banking system.

Yield Curve Structure of CGBs

The interest rates of CGBs are relatively higher than those in countries such as Japan and Germany, which could attract yield appetite investors. This could be one of the reasons overseas investors have almost doubled their CGB holdings since 2019.

In terms of market structure, cash-government bonds in both countries are mainly traded at OTC markets or off-exchange, which is the trading norm in the U.S., as well.

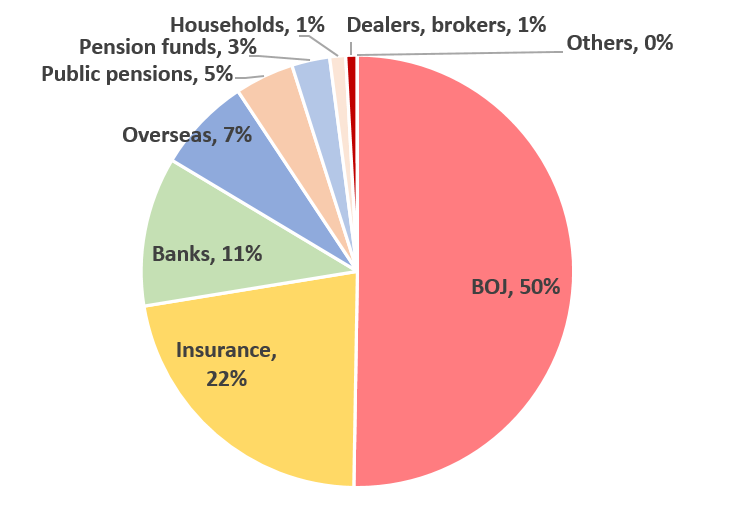

In Japan, domestic banks were traditionally the biggest JGB holders, but their share dramatically dropped in 2013 in light of the ultra-low yield environments stemming from the BoJ’s introduction of its monetary easing policy. Instead, the BoJ purchased a massive amount of JGBs and became the largest holder in 2015.

JGB Holders as of September 2022

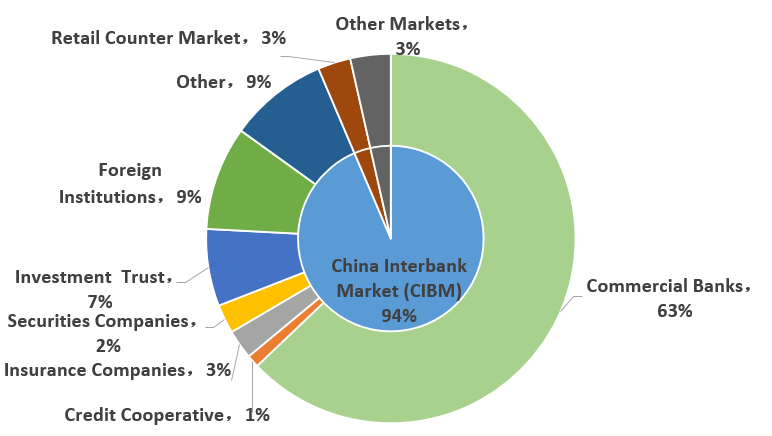

As shown in the chart below, domestic commercial banks hold 63% of the CGBs in China. As of November 2022, foreign institutions’ holding share was 9.1%.

CGB Holders as of November 2022

CGBs were included in the Bloomberg Barclays Global Aggregate Index (BBGA), J.P. Morgan Government Bond Index – Emerging Markets (GBI-EM) and FTSE World Government Bond Index (WGBI) from 2019. These index inclusions will capture more trading flows of passive investment, and the holding share of overseas investors is expected to increase in the long-term.

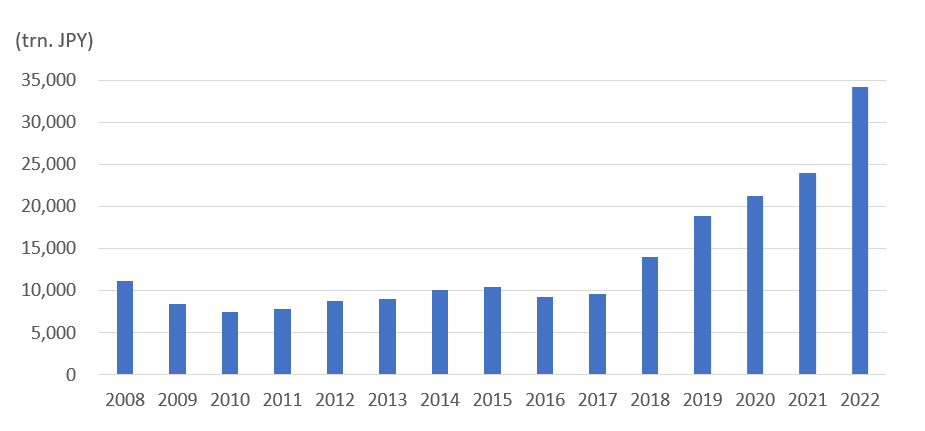

A growth in trading turnover of government bonds is trending in both markets. Even in the ultra-low interest rate environment in Japan, the annual trading turnover of cash-JGBs in 2021 was a record JPY 24,000 trillion, equivalent to around USD 200 trillion.

Cash-JGBs Trading Turnover

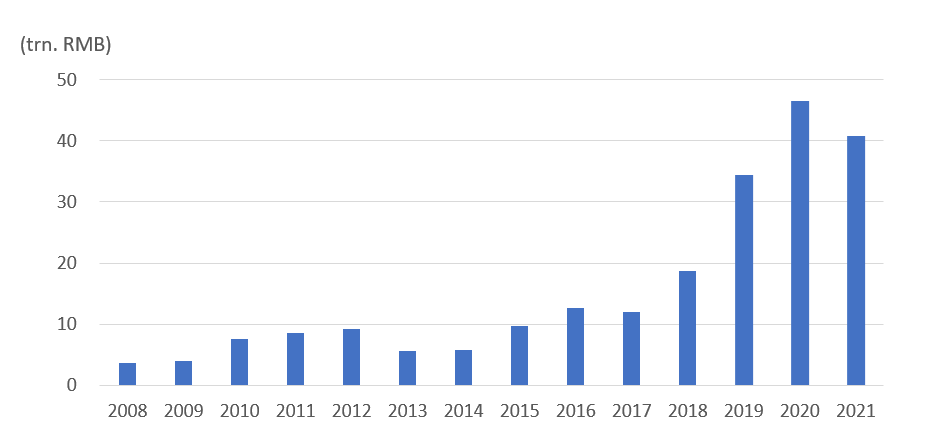

The annual trading turnover of cash-CGBs increased five times in the last five years. It reached RMB 55 trillion, equivalent to around USD 8.2 trillion, in 2022.

Cash-CGBs Trading Turnover (excl. Municipal Bonds)

Market Overview of Government Bond Derivatives of the JPX and the CFFEX

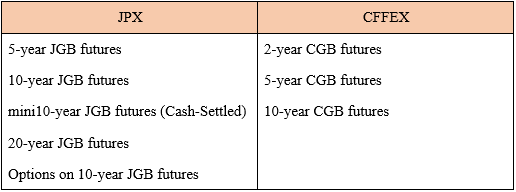

In line with the cash-government bond markets, there are active listed government bond derivatives markets in Japan and China. The table below shows the product lineup of the government bond derivatives listed in JPX and CFFEX.

Listed Government Bond Derivatives Lineups

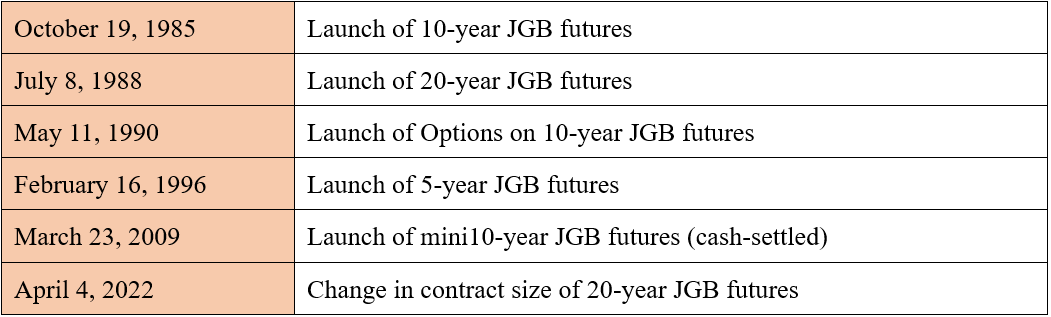

The first JGB-related listed derivatives in Japan, 10-year JGB futures, started trading in 1985. Since then, JPX has expanded its product lineup and has improved trading rules and trading systems in response to demand from market players, such as extending trading hours, introducing calendar spread trading, and off-floor trading.

In line with China’s financial market reform and the momentum of the cash-CGB market’s strong growth, the CGB futures market has been growing steadily in size and influence, with more diverse product offerings, enhanced market liquidity, and further participation of institutional investors.

A History of Listed Government Bond Derivatives in Japan and China

・JPX

・CFFEX

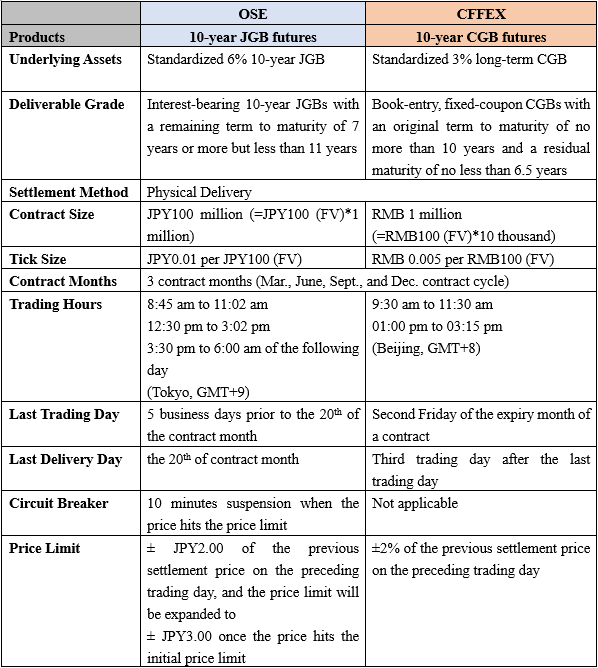

Comparing product specifications between JGB futures and CGB futures, the most notable differences are contract size and underlying assets of the contracts. In the case of 10-year government bond futures, the contract size of JGB futures is JPY 100 million, equivalent to USD 0.9 million, while that of CGB futures is RMB 1 million, equivalent to USD 0.2 million.

For 10-year JGB futures, underlying assets and deliverable grades are 6% coupon bearing 10-year JGBs with a remaining term to maturity of at least 7 years, but no more than 11 years. Meanwhile, for 10-year CGB futures, underlying assets and deliverable grades are 3% coupon bearing CGBs with a remaining term to maturity of at least 6.5 years but no more than 10 years.

For more details about the differences in product specs and trading rules, please see the table below.

Comparison of Product Specs and Trading Rules of 10-year Government Bond Futures

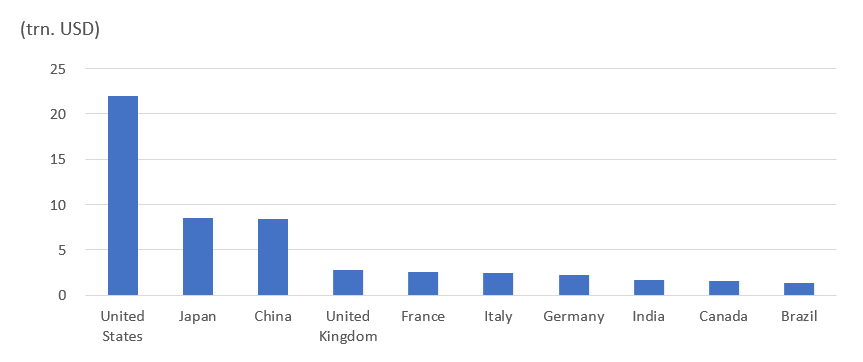

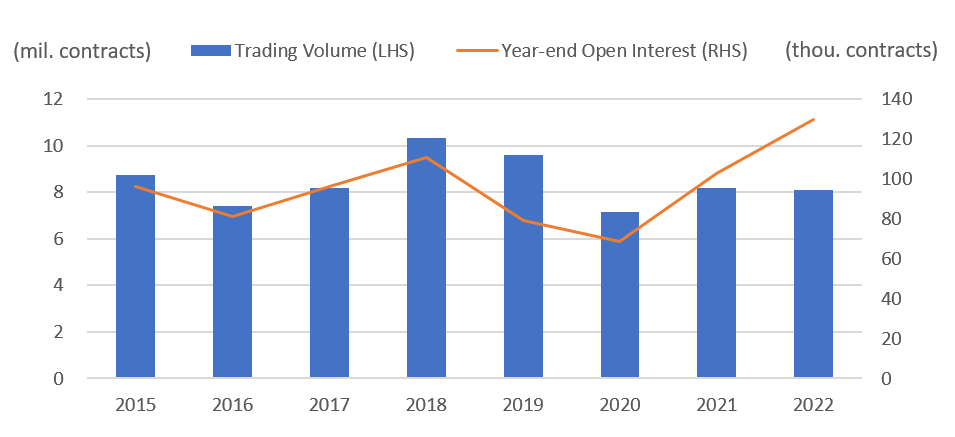

In terms of market transactions, around 99.9% of the trading volume of all JGB listed futures comes from 10-year JGB futures, and their daily average trading turnover is around JPY 10 trillion, equivalent to around USD 76 billion in 2022.

To expand the market ecosystem in an adverse ultra-low volatility environment, JPX has made efforts to attract overseas investors, so around 70% of the total trading volume of 10-year JGB futures is from overseas investors, and the remaining 30 % is occupied by banks and brokers.

Annual Trading Volume and Open Interests of all JGB Listed Futures

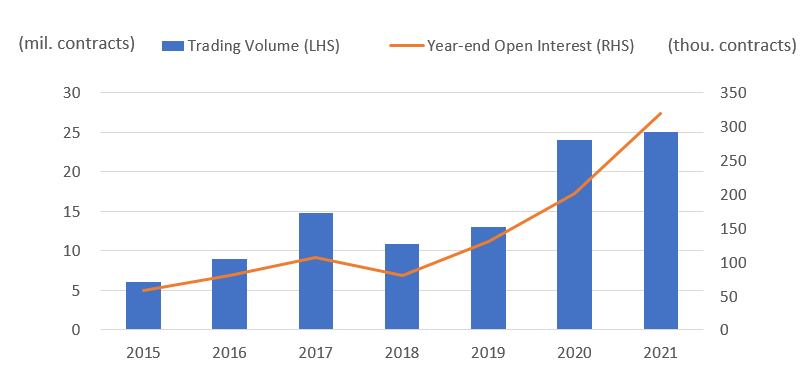

In China, the CGB futures market is growing steadily in tandem with the underlying government bonds market’s rapid expansion and increasing institutional participation. Around half of the trading volume of all CGB listed futures comes from 10-year CGB futures. 2-year and 5-year CGB futures account for 20% and 30%, respectively. Their total daily average trading turnover is around RMB 192 billion, equivalent to around USD 28.4 billion in 2022.

Annual Trading Volume and Open Interests of all CGB Listed Futures

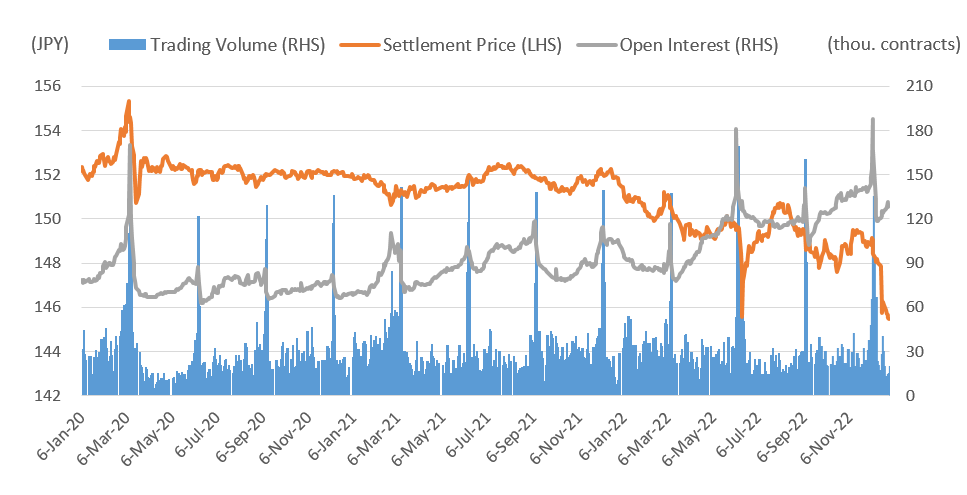

As for the current market trends for 10-year JGB futures contracts, the market experienced big price movements in March 2020 and June 2022.

The spike in JGB futures in March 2020 was due to the initial impact of the spread of COVID-19, but the momentum didn’t last as the BoJ immediately reacted and eased its monetary policy. In contrast, the sharp drop in June 2022 was due to speculative selling mainly by overseas investors to bet on the BoJ’s monetary policy, setting a long-term interest rate cap at 0.25%, amid surging inflation pressure and global interest rate hikes.

Current Market Conditions of 10-year JGB Futures

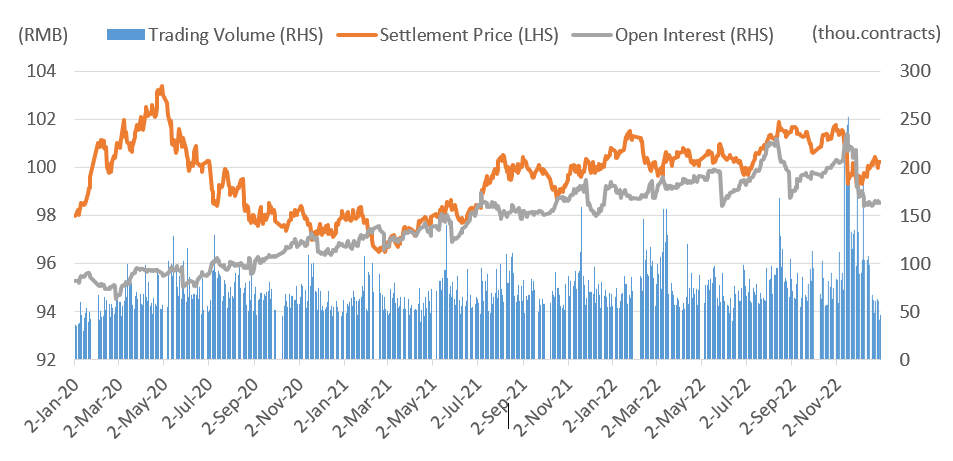

In the case of 10-year CGB futures contracts, prices rose to an annual high in May 2020 due to market turbulence caused by the COVID-19 pandemic and heightened uncertainties worldwide, and then remained at relatively low levels following a bumpy decline. After February 2021, prices regained strength, maintaining fluctuations within a tight price range.

Current Market Conditions of 10-year CGB Futures

Japan and China are the leading countries with large cash-government bond markets, and the derivatives markets in both countries have expanded their presence within the global market. Under the MOU signed in September 2022, JPX and CFFEX will accelerate further cooperation toward developing both derivatives markets.

Related links