TOCOM Energy

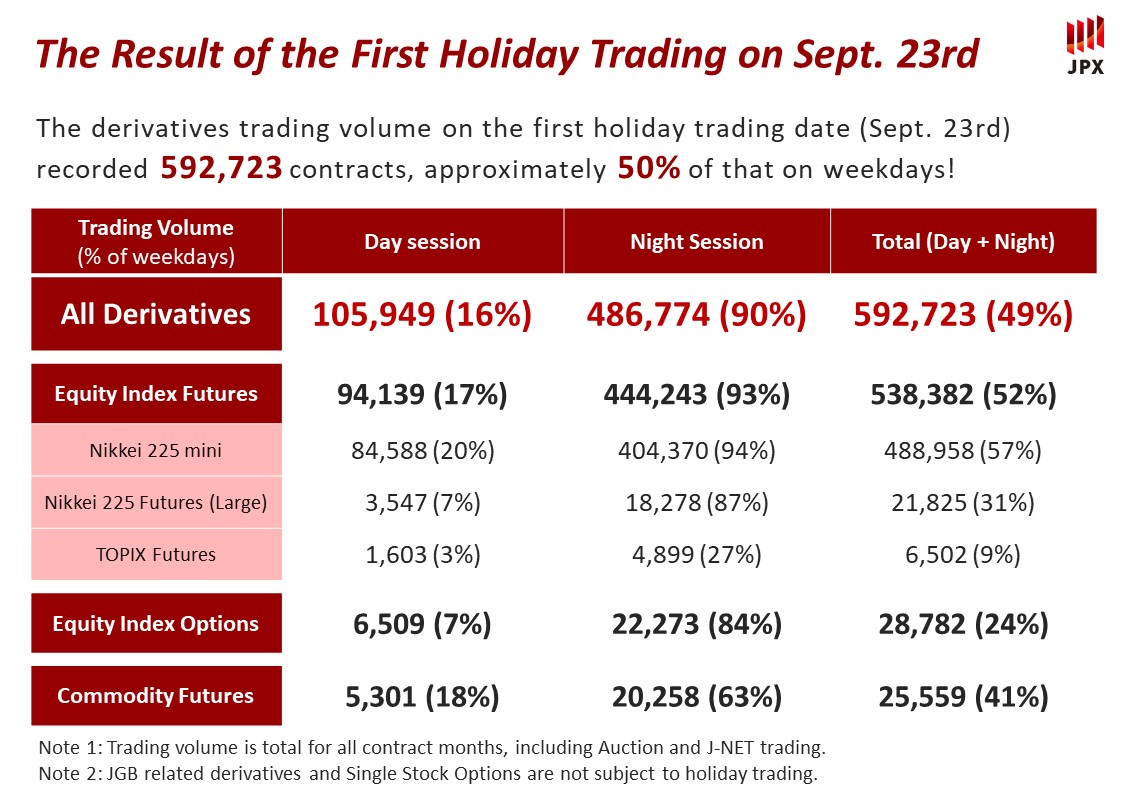

The Result of the First Holiday Trading on Sept. 23rd

Iwanaga Moriyuki, President and CEO of Osaka Exchange, Inc. (and Representative Director and Chair of Tokyo Commodity Exchange, Inc.), commented:

I am pleased to announce that the JPX derivative markets, under OSE and TOCOM, have successfully launched holiday trading today.

More than two years have passed since the Working Group for the introduction of holiday trading was established in January 2020 and discussions began. It is thanks to the cooperation of our trading participants and other related parties that we were able to make this day a reality. I would like to express my deepest gratitude to all those involved.

In recent decades, financial transactions have become more and more globalized. However, while the Japanese economy and companies' activities are greatly influenced by overseas events, because Japan is geographically separated from the major Western countries, previously, limited trading hours in Japanese financial markets meant that if an event impacting the Japanese market occurred overseas after the Japan trading session had closed, investors could not take action until the next trading session began. If the event had negative impact on Japanese market, investors had no choice but to resume trading with a fall in Japanese stock prices.

To deal with this situation, we began to provide trading opportunities after the existing trading session in order to improve the convenience of investors who use the Japanese market and improve its functionality and competitiveness. This began with the launch of the evening session in the year 2000. After that, we gradually extended the trading hours at every opportunity, introducing the night session in 2011 and extending it to 6:00 a.m. in 2021 in line with the trading system renewal (J-GATE 3.0), which made it possible to trade almost 24 hours a day on weekdays.

On the other hand, since Japan has comparatively more national holidays than other countries and therefore more market-close days, allowing trading on national holidays has been a long-cherished wish for us as it finally enables us to provide a fully-fledged hedging function for Japanese stocks. Today, we have finally realized this wish.

Related links