Tokyo Stock Exchange ETF listings at highest level in 7 years, client retention under adverse conditions

A number of exchange-traded funds (ETFs) have been listed on the Tokyo Stock Exchange. In November, a leveraged type, which moves twice the price of the US stock index, and a thematic type, which invests in companies related to electric vehicles (EV), were listed for the first time. There are 32 listings this year, the most in seven years since 2015 (37).

Low fees and high transparency have attracted a lot of attention to ETFs. Amid concerns of an economic slowdown and a growing awareness of downside risks in the financial and capital markets, asset managers are focusing on product development to keep their clients in the market.

Daiwa Asset Management listed the “NASDAQ 100 Leverage” ETF, which is twice the price of the US “NASDAQ-100,” and the “NASDAQ 100 Double Inverse,” which is twice the price of the opposite, on 16th, 2012. ETFs linked to Japanese equity indices such as the Tokyo Stock Exchange Stock Price Index (TOPIX) have already listed products with twice the price movement, but this is the first time for a US equity index.

A growing number of ETFs invest in thematic companies. Global X Japan, a specialist ETF manager, has launched an ETF that invests in global automated driving and EV-related companies. The top companies included in the index are Tesla and Toyota Motor of the U.S., and Pilbara Minerals of Australia, which is involved in lithium mining and other industries.

Recently, a balanced ETF that invests in a fixed allocation of US stocks and US bonds was also listed. The product lineup has expanded like a general investment trust.

Currently, there are strong concerns about a global economic slowdown due to rapid rate hikes in the US and other countries. In the stock market, the US Dow Jones Industrial Average is down 7% since the end of last year, while the Nikkei 225 is down 3%. Downside risks are also pointed out for the outlook.

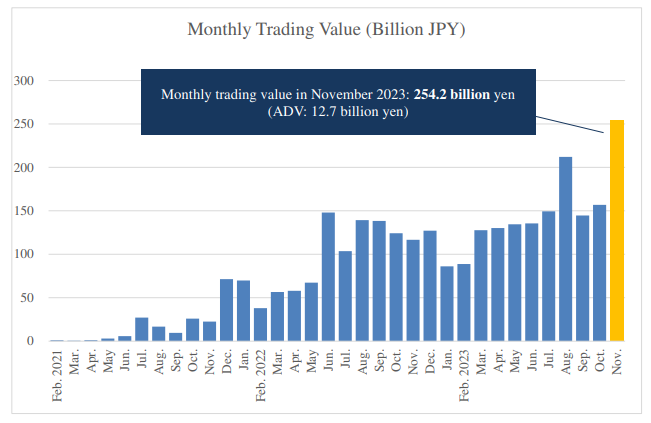

Overall Tokyo Stock Exchange stock trading value increased by about 5% year-on-year in January-October. In contrast, ETFs increased a little over 10%. Management companies are working to secure and expand their clientele by pushing the features of ETFs to the forefront.

The most important feature of ETFs is their low cost. In the case of a typical investment trust, trust fees, which are based on the amount invested, are shared among three companies: The investment management company, the distributor, and the trust bank. ETFs, on the other hand, have two companies: An asset management company and a trust bank. ETF trust fees are relatively low because there is no commission to pay to the distributor.

According to the Investment Trusts Association, ETF trust fees average 0.3%. It is low compared to both index-type investment trusts (0.39%) and active investment trusts (1.14%), which actively seek high returns.

ETFs can be bought and sold at any time during Tokyo Stock Exchange trading hours. Investment trusts trade at a base price calculated by the investment management company once every 1st, and the price at which you want to buy the investment trust may differ from the actual purchase price.

The development of new products by managers has accelerated, with 32 ETFs listed on the Tokyo Stock Exchange in 2022, up from 27 in 2021. The cumulative number of ETFs is 279, up 20% from five years ago. Client demand is also strong, with net assets of ETFs on the Tokyo Stock Exchange totaling 61 trillion yen, double the amount of five years ago.

Overseas, the US ETF market is the largest in the world, amounting to $6 trillion (about 840 trillion yen). In the U.S., there has been an increase in the number of individual transactions through financial advisors called RIAs (Registered Investment Advisors). RIAs do not receive a sales commission on financial products, but rather a commission based on the client’s investment outstanding amount of assets. The technique of managing a combination of low-cost ETFs to increase the balance has spread.

Individual uptake is also important in Japan. Most ETFs are held by institutional investors such as banks and insurance companies, in addition to the Bank of Japan, and the share of individuals is only about 2%. In Japan, many financial instruments brokerage business people tend to rely on sales commissions. This has been a hurdle for some individuals.

IFA Reading (Shinagawa-ku, Tokyo) provides financial advice for a fee based on the operationoutstanding amount of assets. It determines the optimal asset allocation for its clients and combines domestic and foreign stocks, bonds, and ETFs of alternative assets. Representative Manabu Hasegawa says, “ETFs have high price transparency and are easy to use when changing asset allocations in response to market conditions.”

Currently, the BOJ is continuing its massive monetary easing program. ETF purchases are part of this, but the current policy may not last forever. The key to the growth of the domestic ETF market will be to encourage the full-scale diffusion of ETFs among individuals through methods such as increasing client assets with a highly transparent fee structure.

Related links

The English translations provided through this service are the result of automatic and mechanical translation of contents written in Japanese and created by Nikkei or licensed by a third party, by an automatic translation system provided by a third party after certain processing of the contents by Nikkei. Nikkei disclaims all warranties, express or implied, related to the English translations, including any warranty of accuracy, reliability, validity and fitness for a particular purpose. Users shall use this service with the full understanding that it employs an automatic translation system that automatically and mechanically recognizes and analyzes information and outputs the results.

The English translations provided through this service are the result of automatic and mechanical translation of contents written in Japanese and created by Nikkei or licensed by a third party, by an automatic translation system provided by a third party after certain processing of the contents by Nikkei. Nikkei disclaims all warranties, express or implied, related to the English translations, including any warranty of accuracy, reliability, validity and fitness for a particular purpose. Users shall use this service with the full understanding that it employs an automatic translation system that automatically and mechanically recognizes and analyzes information and outputs the results.