Insights

Financial Start-Up Support Program: Application Procedure

Tricor Japan has been selected by Japan Financial Services Agency (JFSA), a government agency and regulator that oversees the country’s financial services industry, to develop, operate and lead its Financial Start-up Support Program, a simplified, low cost, “one-stop” for foreign asset management companies entering the Japanese market.

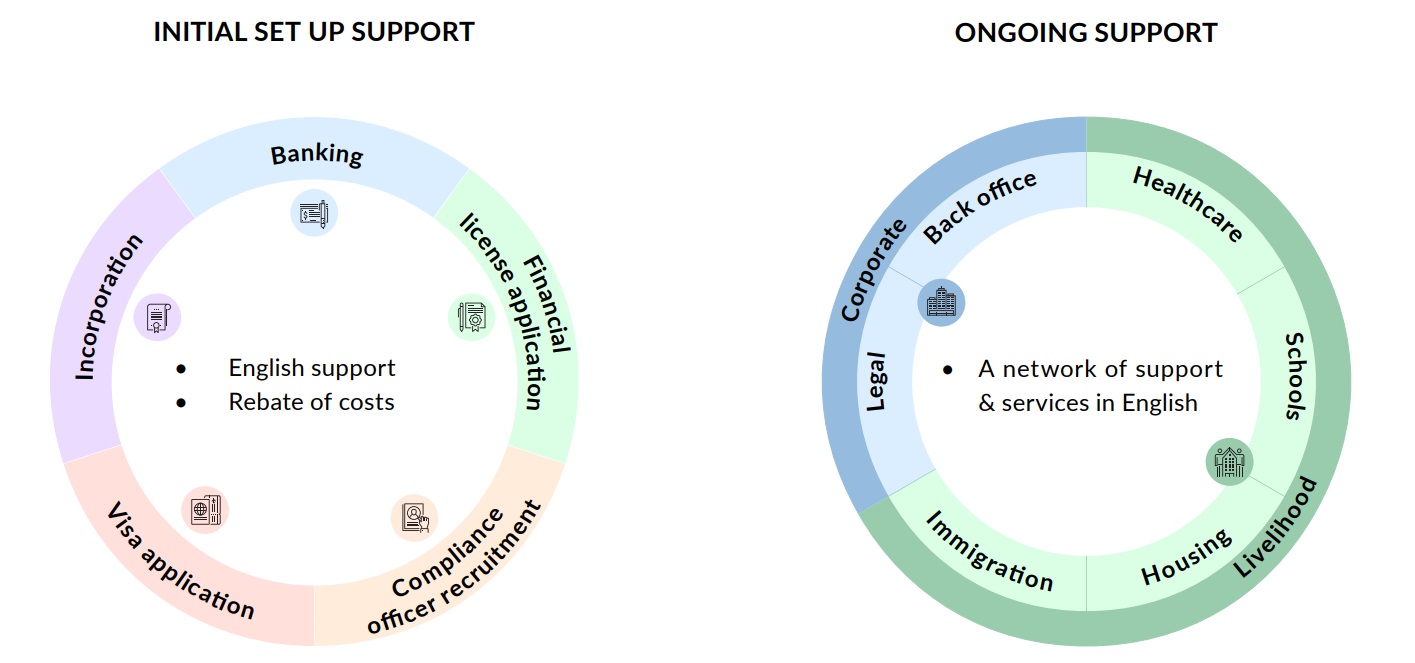

The goal of the program is to elevate Japan’s global financial center status and attract more foreign direct investment (FDI) from overseas financial companies by easing market entry processes including financial license application support, compliance personnel recruitment, and providing relocation assistance.

As the exclusive private operator of the program, Tricor will provide overseas financial companies with English-language incorporation and financial business license registration solutions. Furthermore, the program extends to acclimating executives of financial companies to living and working in Japan, offering relocation services including visa administration, real estate, healthcare and education.

ONE-STOP SOLUTIONS FOR FOREIGN ASSET MANAGERS

WHO CAN APPLY

Individuals or entities who currently have no operation or presence in Japan, and intend to be at least one of the following in Japan. (Both Japanese and foreign nationals are eligible.)

• Individuals or entities who engage in at least one of the following business categories in Japan, and who or whose parent companies, subsidiaries or affiliated companies, etc. conduct business in overseas jurisdictions, equivalent to Investment Advisory and Agency Business or Investment Management Business under the FIEA, in accordance with the laws and regulations of such jurisdictions.

1. Investment Management Business (Article 28(4) of FIEA)

2. Investment Advisory and Agency Business (Article 28(3) of FIEA)

3. Type-II Financial Instruments Business relevant to asset management business in either of the following cases:

i. where selling a beneficial certificate of an investment trust or a fund established by itself (Article 28(2)(i) of FIEA)

ii. where conducting a so-called Deemed Type-II Financial Instruments Business operated by Asset Management Company of an Investment Corporation or an operator of Investment Management Business for Qualified Investors (Article 196(2) of the Act on Investment Trusts and Investment Corporations and Article 29-5(2) of FIEA)

• Foreign securities companies who newly enter Japan and apply for Type-I Financial Instruments Business that is conducted for professional investors and in which the securities handled are certain securities such as beneficiary certificates of foreign investment trusts and foreign investment securities.

• Those who conduct business via notification (not registration) in either of the following categories:

1. Business related to asset managers with overseas qualified clients (foreign corporations and individuals residing in foreign countries with certain assets) (Article 63-9 of FIEA).

2. Business related to asset managers who are authorized by regulatory bodies and a proven track record in specified foreign jurisdictions (Article 3-3 of the Supplementary Provisions of FIEA).

Applicants must fulfill all the following requirements:

• No violation of laws and regulations.

• No delinquent tax payments.

• No violations of contracts with public institutions, etc.

• No threats to public safety and welfare.

• Do not engage in political, religious, or electoral activities as a business purpose.

• The applicant does not fall under the category of a crime syndicate, nor does any representative, officer, employee, or other member of a corporation fall under the category of a crime syndicate member.

• There are no facts in the past business or other circumstances that make the applicant unsuitable for the program.

WHAT THE PROGRAM OFFERS

Tricor Japan and its affiliate partners will provide a range of services. All support services are available in English.

CORPORATE SUPPORT

• Incorporation

• Financial license application

• Other services required for financial business start-up

○ Office brokerage and contract support

○ HR, accounting, tax, legal and business consulting

LIVELIHOOD SUPPORT

• Visa applications (including acquisition of residency status for family members)

• Introducing housing agency

• Introducing schools and hospitals

• Other support (e.g. bank account opening, mobile phone contracts)

SERVICE COSTS SUPPORT PROCESS

The support services outlined in “What the Program Offers” section will be provided at no cost to the applicant.

• The maximum service fees of support per company is approximately JPY 20 million. For any amount exceeding the maximum, applicant may be required to cover the cost.

• The following items are eligible for reimbursement:

○ Incorporation

○ Visa Application

○ Opening a Corporate Bank Account

○ Agent fees for Compliance Officer Recruitment

○ Advisory fees for Financial License Application

○ Others

• Applicant will settle service provider costs and provide proof of payment (e.g. receipts) to Tricor Japan.

• After completion of all steps outlined in the “Application Procedure” below, Tricor Japan and JFSA will confirm and rebate the full payment amount to the applicant.

• Upon completion, JFSA and Tricor may request an interview and/or feedback from the applicant with regard to any challenges faced when establishing an office in Japan, and various support services needed.

• Please contact Tricor Japan for details.

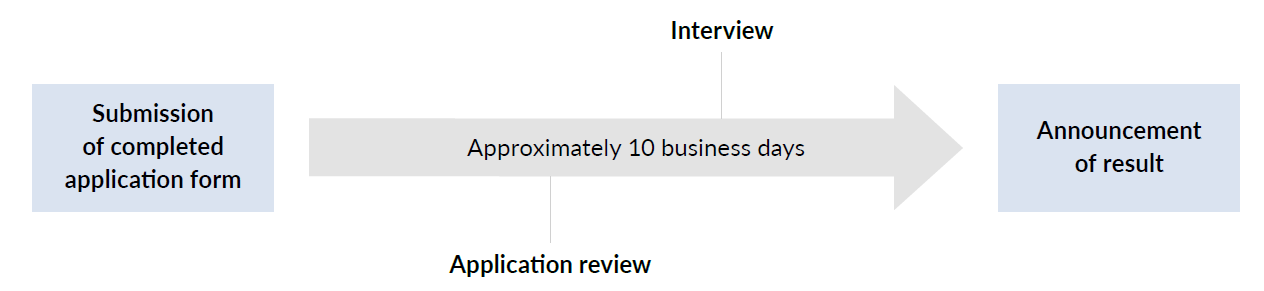

APPLICATION PROCEDURE

• Download and fill in the application form.

• E-mail completed form to JFSA subcontractor, Tricor Japan: financialsupport@jp.tricorglobal.com.

• Upon receipt of the application form, Tricor Japan with schedule an interview with the applicant. An option to conduct the interview virtually is available.

• Application will be based on the following criteria:

○ Individual or entity must satisfy the requirements in the above “Who Can Apply” section.

○ The financial instrument’s business registration is expected to be completed within the program implementation period (see “Program Implementation Period”).

○ The selected service must not be subjected to any other public subsidies or grants.

PROGRAM IMPLEMENTATION PERIOD

• Deadline: March 31, 2023

• The program may be terminated before the deadline depending on the status of budget execution.

• If the applicant wishes to continue receiving support from Tricor Japan or Tricor Japan’s partners after the deadline, the applicant will be required to bear the service fees.

○ For example, if, as of March 31, 2023, the establishment of a corporation has been completed, but registration as a financial instruments business operator has not yet been completed (and notification of registration has not yet been submitted), only support costs related to the establishment of the corporation will be covered by JFSA.

○ In such cases, it is optional to continue to receive support for the registration of the financial instruments business from Tricor Japan or Tricor Japan’s affiliated companies, but the applicant will be responsible for the full cost.

About Tricor Group

Tricor Group (Tricor) is Asia’s leading business expansion specialist, with global knowledge and local expertise in business, corporate, investor, human resources & payroll, corporate trust & debt services, and governance advisory. Tricor provides the building blocks for, and catalyzes every stage of your business growth, from incorporation to IPO.

We were founded through the acquisition of the accounting, company secretarial, share registration and related services from major international accounting firms and other leading professional firms.

Tricor’s advantage comes from deep industry experience, committed staff, technology-driven processes, standardized methodologies, constant attention to changes in laws and regulations, and wide industry contacts.

Financial Support Team – Tricor Japan

financialsupport@jp.tricorglobal.com

www.tricorglobal.com

Financial Services Agency

marketentry@fsa.go.jp

www.fsa.go.jp

LinkedIn: JFSA

Related links